Characterized by the spread of business and operations across geographies, a large number of employees and partners, complex management hierarchy, legacy systems and a huge volume of data, large-scale enterprises are a complex beast. Large and complex IT systems are but inevitable, and with it come problems of improving workflows, aligning systems and processes to serve customer journeys, optimal allocation of tasks, and driving dynamic business operations.

Large enterprises today are looking to scale up their operations, streamline business processes, accelerate growth, and make data-driven decisions more than ever. This calls for an enterprise-grade software platform with a new set of capabilities that can drive a new wave of transformation. The advent of RPA (Robotic Process Automation) and convergence of that with AI have assured a new set of possibilities. Can RPA open up opportunities for a large scale enterprise to become agile? Can it take the large enterprise to the next level of optimization?

In a short time, RPA has proved to be a game-changing asset, moving beyond its obvious benefits of eliminating human errors and taking over repetitive rule-based tasks to enabling enterprises to make data-driven decisions, amplifying human capabilities more than ever. It has demonstrated the necessary ingredients needed to affect enterprise-wide transformation. As a matter of fact, a recent survey by Forrester states that 43% of organizations globally consider RPA initiatives a strategic priority.

The primary drivers of increasing RPA adoption

To understand the current state of RPA adoption and the future needs of large scale enterprises, we recently co-conducted a survey with Forrester, where we surveyed around 300 professionals from large enterprises across Australia, France, Germany, Japan, US, and UK markets who were responsible for their organization RPA strategies. The study highlighted that large enterprises globally are serious about expanding and scaling their automation efforts for the multitude of benefits it can provide for their human workforces and their business outcomes. As RPA expands, enterprises will require enhanced systems and capabilities to govern, manage, and optimize its value.

From our experience of working with over 360 customers across the globe, we have found companies broadly approaching this in two ways. Looking at RPA for simple task automation, i.e. automating rule-based, repetitive tasks that extract low-value human labor; or leverage RPA as a change agent to drive end-to-end automation with a broader objective of achieving scale and efficiency. The latter would be combining RPA with futuristic capabilities such as Machine Learning, Computer Vision and text analytics that help redefine operations.

There is also an ever-increasing need for large enterprises to augment their existing workforce capabilities to gear up for an AI-driven future. With RPA becoming disruptive as a force, we will see the human and digital worker collaborating closely than ever before — where the aspect of creativity and empathy from the human and predictability and consistency from the bot will bring about a paradigm shift in the way enterprises think and work, transforming how enterprises deliver their services to the stakeholders. This will compel enterprises to relook at their overall workforce management strategy, starting from what the future workforce looks like to what role the human workers play.

So, what is it that large enterprises need?

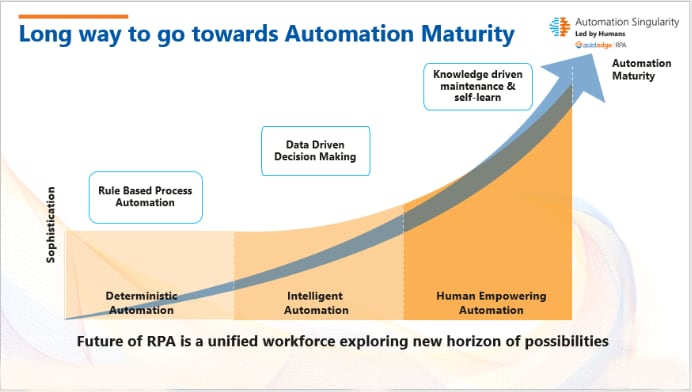

With the enterprises’ growing demands for an end-to-end automation solution, having an enterprise grade scalable automation platform along with a robust framework helps enterprises map themselves in the whole Automation maturity curve, starting from basic automation going all the way to autonomous operations.

Just recently, we’ve elaborated on the concept of Automation Singularity, that refers to a highly customer-centric and agile oriented state of constant improvement and optimization through the future workforce of humans and bots. It is a journey that has fundamentally three stages — Deterministic Automation, Intelligent Automation and Human-empowered Automation. As companies traverse through this evolution of Automation Singularity, they will move from:

Enterprise Grade Software Platform and Automation Framework — The way forward

Large enterprises need a cohesive and scalable platform that will successfully cater to their complex requirements and enable them to move forward in the journey towards Automation Singularity. To bring upon this change, they need to focus on building capabilities across three dimensions — governance and risk, people, and technology.

That’s where an end-to-end platform like AssistEdge comes in. With a robust framework, AssistEdge empowers large-scale enterprises to reach the next level of optimization. As mentioned before, a successful RPA implementation requires scalability and agility — the key drivers that bring about a disruptive transformation across the enterprise. Having deployed over 49,000 attended bots for one of our enterprise customers, we have realized that scalability is an aspect that large enterprises cannot overlook.

AssistEdge is a cohesive, enterprise-grade platform with offerings in the discovery space, catering to attended and unattended automation along with its ability to traverse the intelligent automation journey, bringing about orchestration and accelerating the onset of the future workforce. This, combined with the AssistEdge Marketplace and AssistEdge Academy enables large enterprises to make intelligent automation pervasive in their environment.

Join us as we enable and empower large enterprises to navigate their automation journey with a holistic, enterprise-grade software platform that is second to none.

References:

[1] “Evolution of The Enterprise Workforce in The Age of Automation,” EdgeVerve,

https://www.edgeverve.com/assistedge/forrester-evolution-enterprise-workforce/