Jeff Bezos founded Amazon in the year 1995, when the Internet was still in its dial-up days. The company is the largest ecommerce giant today.

Following a serendipitous series of developments including toying with the idea of Amazon infrastructure and storage, AWS came into being in the year 2006. It is today one of the top cloud vendors and the largest public cloud services provider in the world. Every day the company adds server capacity equivalent to what it had at the end of 2005, when Amazon (not AWS) was nearly 5% its current size.

Amazon Cash for deposits, and Amazon Lending for short-term business loans are already part of Amazon’s value proposition for sellers on its platform. The retail giant is now officially looking to encroach on banks’ turf with services like checking account.

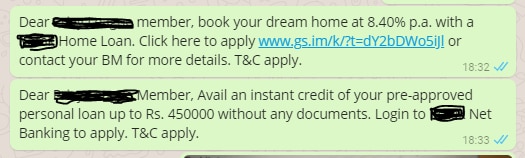

An industry struggling to keep profits afloat clearly needs to prepare and reinvent itself to take on players such as Amazon. And Amazon is not the only giant eyeing the space. Tech giants Google and Facebook have already forayed into the financial services space. Both the companies have launched their digital payment service in the Indian market taking advantage of the country’s instant real-time payment system UPI. Facebook, with its chat service Whatsapp has a ready user base of more than 250 million. Google’s payment service Google Tez is a convenient payment option while searching the Internet using the Google search engine. Users can send money over Whatsapp’s chat interface while chatting with friends, or search, select and pay for a service without leaving Gmail with Tez.

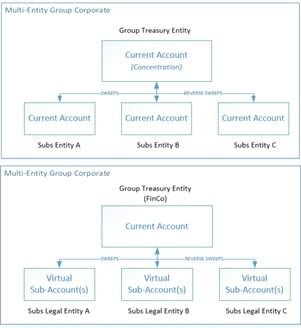

Banks are left with no choice but to self-disrupt their business. They have to discard the go-it-alone approach in favor of platform banking to be more – be more open, more collaborative, more diversified (into non-financial products) and more invisible.

However, the platform business is an altogether different ball game for banks that have relied on pipeline business for all these years. Banks need to understand what makes a successful platform business and what the perils are. In their book “Platform Revolution”, Geoffrey G. Parker, Marshall Van Alstyne, and Sangeet Paul Choudary elucidate the key factors to create a successful platform business. Here we look at these in the context of banking.

Achieve demand economies of scale

The success of a platform business hinges on network effects. The more the number of users of a platform, the greater the value it creates. It’s a no brainer then that a platform that doesn’t make it easy for its users to use it, is only setting itself up for failure.

Thus the first step towards building a platform bank is to ensure a frictionless experience for their customers and partners. For customers, the process of on-boarding, transacting or service enquiries should match the experience they get in prevalent platforms like Uber or Facebook. The customer’s experience should be seamless whether they access the bank’s own or partner products / service offerings offered on the platform. Only then can banks hope to build the economies of scale that attracts new customers and partners.

Make the right matches

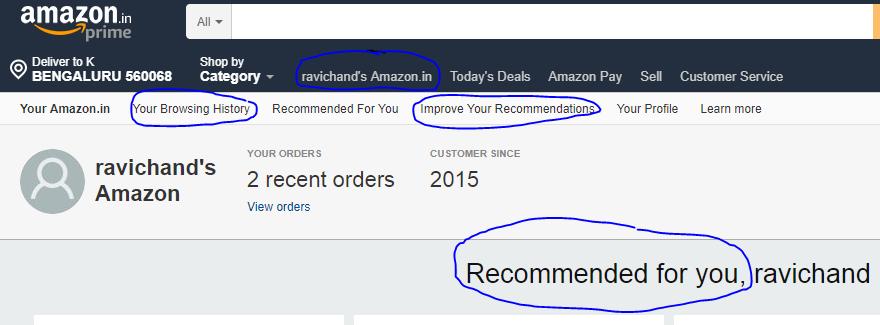

A platform creates value by “consummating matches among users”. Flawless logic and a well-defined algorithm that can perform pairing immaculately are pivotal for a successful platform business.

Banks have an advantage here due to their access to customer data and insights that can be drawn to match consumer preferences with complementary offerings from their partner ecosystem. Banks that have already embarked on an API strategy stand to gain since they can consummate matches among developers, fintechs and other partners, to create new digital experiences for their consumers. BBVA has made eight of its APIs commercially available to companies, startups and developers. The Citi Developer Community offers APIs in 3 countries, in categories ranging from account management and peer-to-peer payments to Citi rewards and investment purchases.

Enjoy positive network effects

An example of this is accurately penned down by Eric Jorgenson of Evergreen Business Fortnightly:

“More number of riders does not necessarily improve my Uber experience but it does attract more drivers, which will improve Uber for me.”

Similarly, a platform bank must look to cultivate large and diverse ecosystems. The greater the choice, the better is the platform for its customers. The success of tomorrow’s banks will be measured by the size of their ecosystem in addition to their asset base.

Be easy to consume

A platform that causes friction in use is a non-starter. A successful banking platform must ensure easy integration of APIs into other applications to encourage adoption.

In our study of offerings of 6 banks that have formed API marketplaces, Citibank led the pack with 49 APIs to its name, closely followed by Oversea-Chinese Banking Corporation (45), Fidor (40+) and Ratnakar Bank Limited (40).

Moving beyond the tactical approach to APIs, more banking APIs are now allowing digital firms and developer ecosystems to build applications with production data. Banks need a definite strategy to steadily increase the breadth and depth of their APIs.

Have a strong community feedback loop

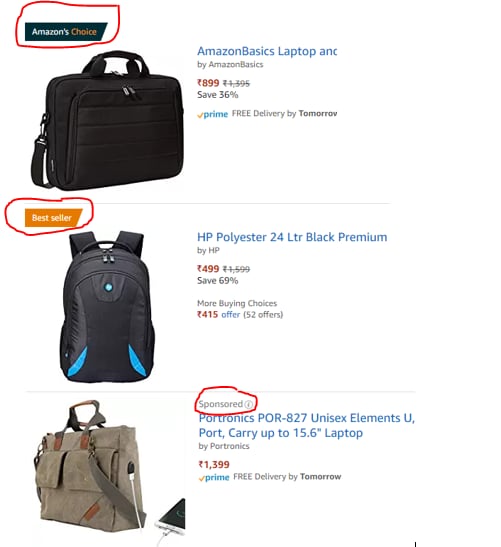

The digital world has made users accustomed to receiving instant feedback. The simplest examples are platforms such as Facebook or Instagram where users get reactions to their content within minutes of sharing it. Amazon’s feedback system that allows users to review products is a way to control quality and keep vendors in check. It also helps consumers make informed purchasing decisions increasing their confidence in the platform.

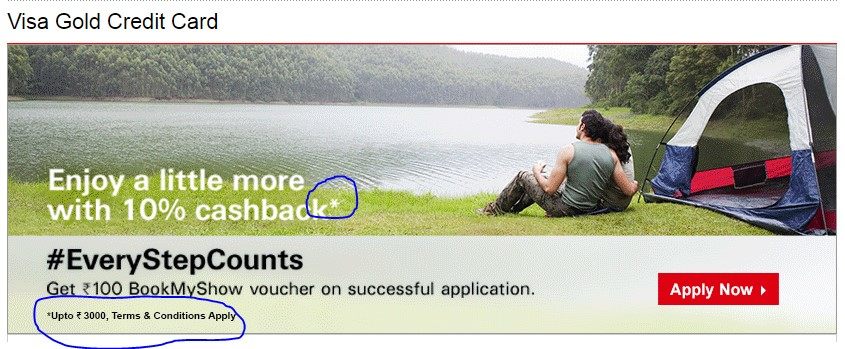

In a platform model banks will not only sell their own products and services but will become aggregators of products and services to integrate banking in the lives of consumers. Banks must borrow this concept of a simple feedback mechanism to not only offer customers the best products and services, but also build trust.

Lastly, a successful platform evolves the value exchanged among users. Facebook evolved from making connections to sharing content. Amazon continues to advance into adjacent industries to become the quintessential ‘Everything Store’. Banks should move forward in their platform journeys with a scalable interaction model that constantly strives to evolve the value exchanged.

If you liked this post, you might find our paper on ‘Platform Business Model for Banking‘ interesting. You can access it here.

References: