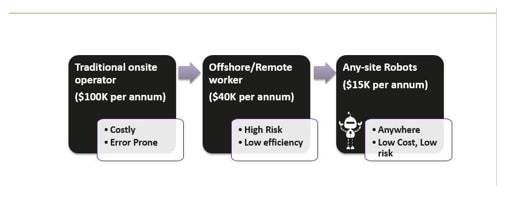

Automation is helping industries transform – directly in some businesses and indirectly for many others. A look at running cost of banks gives a totally different picture. Today, ‘run the bank’ systems take 70-80% of the overall IT budget… and it has to change.

How has it evolved?

Core banking adoption across banks took almost 20 years (1980-2000), Internet banking another 10 years (2001-2010) and mobile/wallets took shortest time. Despite technology adoption and increased use of channels it didn’t have much impact on cost although increased the customer convenience. (Should it really cost this much to run a bank?) Gains through off shoring, captives and outsourcing are slowly disappearing with added cost of security, compliance and risk.

What next?

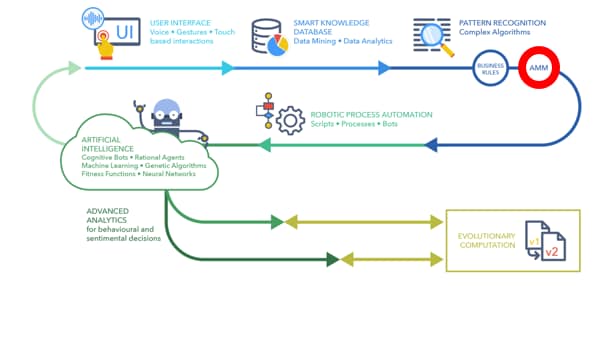

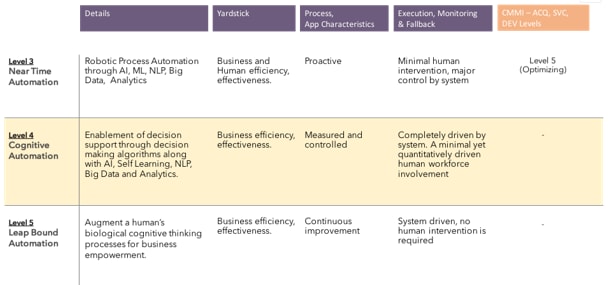

The next frontier for banks without any doubt is digitization (2017-Strategic Priorities) – and automation (RPA) is at forefront of this…. it reduces cost, improves customer experience, helps in compliance, mitigates risk of human errors and most importantly enable digitization.

Since banks have a very high degree of IT usage in operations, it makes them an ideal candidate for automation (RPA).

Certain very apparent advantages –

Efficiency improvement – Augment staff capability and capacity by 40-60%

Reduction in error rate – Reduce human errors and dependencies.

And some not so apparent benefits –

- Happier Customers – Turnaround time for customer requests come down drastically with lesser errors… whether it is loan processing, service requests, payments or any other area which needs attention.

- Reduced cost of compliance – Ever increasing compliance costs (including cost of auditing, monitoring staff, reporting, checks and balances) can be reined in with many of these activities handled by Bots.

- Insurance cost optimization – Banks spend huge some of money on insurance against frauds, malpractice, errors etc. With automation of processes and reduction in errors, insurance costs will see a huge drop.

- Staff can do more – Bank staff can do much more than perform tasks. They are the ones best suited to automate the tasks they handle and can focus more on be moved to increase sale, service customer directly and improve the processes run by Bots.

And nothing can stop banks – No more excuses

- I don’t have budget/funds to run another initiative – Automation of tasks can save you enough to fund the initiative on its own. Simple Automate -> Save -> Invest -> Automate -> Save. This is a journey and not an end state in itself.

- I am already working with xyz vendor and can’t/don’t want to replace – There is no replacement of any of existing vendor systems. Automation bots sit on top and help your staff execute faster, automated.

- I can’t wait for a year to show results – ROI for RPA programs is 3-6 months and once on the journey, it only becomes faster.

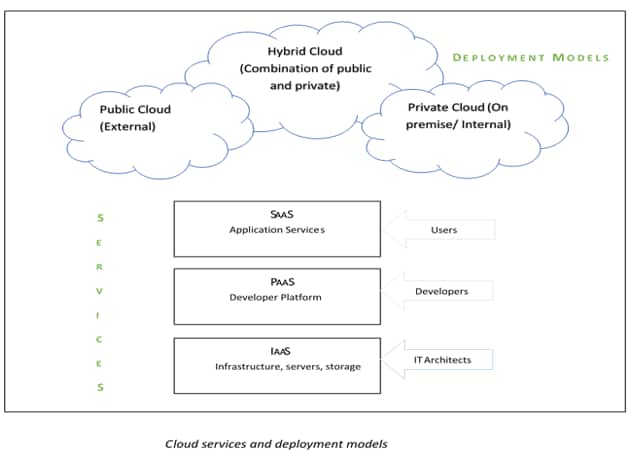

- My bank and systems are unique – And so is everyone else. RPA solutions have evolved far more than scripting. It can help integrate disparate systems – open, mainframe, text, images, xls.

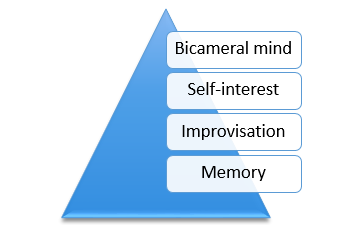

And to the tough question – Will my folks lose jobs..

Yes and No. This is not first time machines will be helping amplifying human capability to achieve more. But it has only changed the way work is done and who does what. There will be a redistribution of work and skills. A set of people, who might move to something better and more challenging and with the existing know how of processes, products and customers, it might be a better utilization of the resources.

With banks increasingly adopting automation, there is little to choose from. Either, Automate and be the more efficient bank to survive OR competition will make you redundant sooner than later.

I am keen to hear your views on the topic. Comments are welcome and you can reach me for discussion on how automation can help your bank. It may not be as simple as it sounds and one needs to be aware of pitfalls in adoption of automation technologies and various modes of deployment.

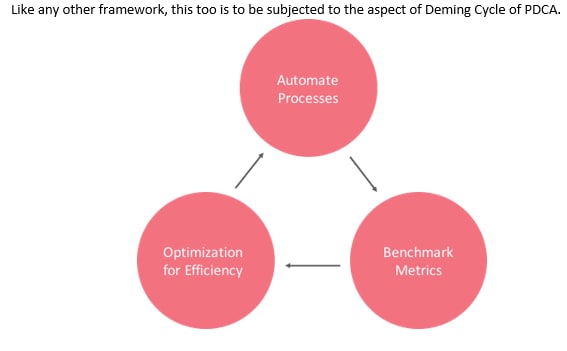

In embracing the automation journey, there will be quick wins followed by next level of challenges. (Do Bots have their own Ids)? How to handle underlying system changes? What to do if assembly line gets stuck? And so on…). Nonetheless, it’s an interesting and rewarding journey for the organizations.