Much like any other industry, the oil industry faces numerous challenges in transporting oil from its sources to the refineries, processing crude oil to gasoline and its by-products, and finally transporting the finished product to the end markets. Throughout this process, the condition of the oil and equipment needs to be carefully controlled. Failure to do so could lead to costly accidents that could be extremely damaging to the environment such as the catastrophic failure of Deepwater Horizon.

However, it is almost impossible for human operators to monitor all the various sensors along the pipeline or pay attention to every alert when most are not serious. There is a tendency to be complacent about multiple alerts that are constantly going off. Such was the case with Deepwater Horizon, where the constantly sounding – mostly false – alarms were turned off to allow workers to sleep.

Today, with advances in Machine Learning and Artificial Intelligence technologies it is possible to leverage data across the various sensors and predict when an adverse event is about to occur. Hopefully, going forward we should be able to avoid tragedies such as the Deepwater Horizon.

Leverage Technology to Avoid Costly Asset Downtime

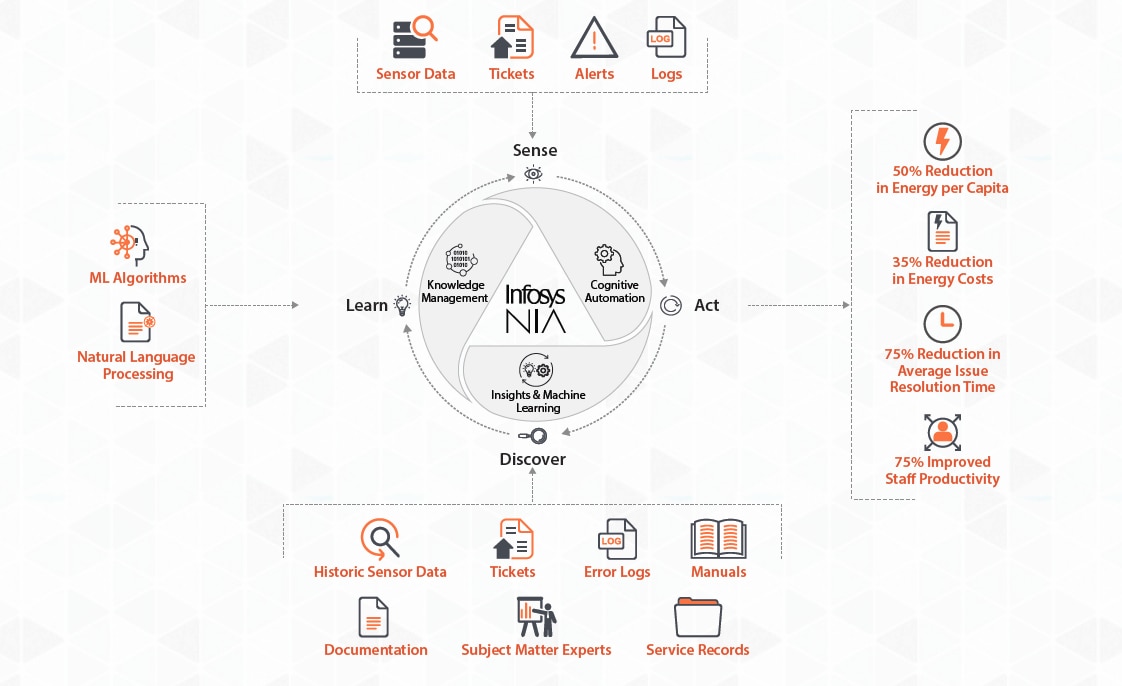

XtractEdge’s Asset Efficiency Solution would save millions of dollars for enterprises that operate large assets and machinery. XtractEdge’s Asset Efficiency Solution works by learning from all relevant data assets – including sensor data, maintenance logs, design specs, etc. – it builds a knowledge base for the asset and then monitors sensor data in real time to predict potential issues, extrapolate remaining useful life, and predict maintenance requirements. Thus ensuring that when an alert is raised the human operators have all the information necessary to take appropriate action. With it, managers can schedule maintenance service, mobilize field technicians, and avoid costly asset downtime.

Without the XtractEdge Asset Efficiency Solution, equipment operators will be forced to conduct maintenance based on a manufacturer’s specifications. This increases an equipment’s susceptibility to failure, increases the likelihood of false alerts, and decreases asset useful life. However, by leveraging the integrated modules of the XtractEdge Asset Efficiency Solution, conditions-based, preventive maintenance and repairs can be carried out to ensure industrial safety and efficiency.

Artificial Intelligence Will Shape the Fourth Industrial Revolution

It is fitting that the sequel to the global best-seller that coined the term “Fourth Industrial Revolution” was released at the same time that we unveiled the XtractEdge Asset Efficiency Solution. In the new book Shaping the Fourth Industrial Revolution, World Economic Forum (WEF) founder Klaus Schwab calls on corporate leaders to match the nimbleness of their technologies and the private-sector players who create them, to constantly update and rethink rules in collaboration with other sectors.

“For businesses, greater experimentation with new technologies and greater investment in people and skills are required to maximize firms’ ability to develop and bring to market winning innovations” according to the WEF.

Indeed, XtractEdge Asset Efficiency Solution rethinks the rules of asset efficiency, utilization and the collaboration between human employees with AI-powered solutions. Its four modules work together to provide an overview of the health of an enterprise’s assets, thus improving utilization and extending asset lifespan.

XtractEdge M2M Gateway directly connects with equipment sensors to gather data. XtractEdge Data stores real-time data ingested from XtractEdge M2M Gateway and from various enterprise knowledge repositories. This includes everything from design documentation and engineering drawings to operational and maintenance logs.

XtractEdge Knowledge platform captures and represents organizational knowledge related to the assets. It then operationalizes this knowledge and makes it available in real-time at all consumption points. XtractEdge Automation automates tasks that do not require humans. For example, when it senses an anomaly in equipment data, it raises a ticket in enterprise asset management systems.

XtractEdge Asset Efficiency Solution in Action

Real-Time Condition Monitoring: In another case, a refrigeration plant knew it had valuable data related to its asset but was unable to access and leverage the same to improve asset efficiency. We worked with the company to improve operational efficiency and rationalize costs. XtractEdge Asset Efficiency Solution helped reduce energy costs by 35 percent and decrease per capita energy consumption by 50 percent. Maintenance professionals experienced a 75 percent drop in the average time it took to resolve issues, and overall, the enterprise saw a 75 percent improvement in productivity.

AR Assisted Maintenance: All of these modules come together to provide a real-time view of the asset condition. When overlaid on the asset, Augmented Reality it can provide the operator with a real-time view of the asset condition or provide step-by-step maintenance instructions in real time. Thus providing field technicians with all necessary information to conduct their maintenance.

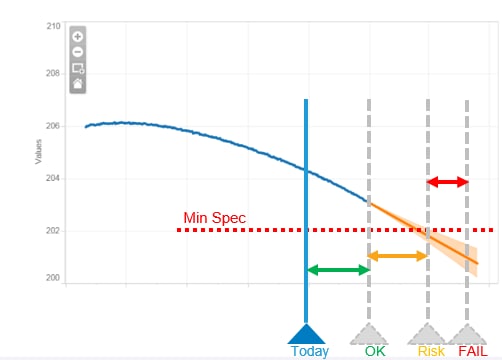

Predictive Maintenance: We worked with a large automobile manufacturer who was following spec-based maintenance on their industrial spindles. They were experiencing frequent downtime when the spindles broke down unexpectedly or were being replaced despite having some more useful life.

The unpredictable downtime was causing delays and the premature replacements were increasing their capital expenditure. With the XtractEdge Asset Efficiency Solution, the automobile manufacturer was able to move to condition-based maintenance predicting the remaining useful life of the devices. The result was a 30 percent reduction in the company’s efforts to detect anomalies and a lower cost of maintenance that was possible due to the elimination of unnecessary spindle replacement.

Leveraging Data Purposefully

XtractEdge empowers all stakeholders on the maintenance team – the manager, engineer, and technician – with the capability to take real-time conditions based preventative actions rather than reactive actions, which can be an expensive move. With the XtractEdge’s Asset Efficiency Solution, the stakeholders will not just be able to leverage insights from data but do so in a purposeful way that allows them to maximize the promise of the next new wave – the Fourth Industrial Revolution – to amplify human potential.