Investment in innovation is on the rise, and the results are starting to show. Banks are changing the customer experience far more systemically than in the past and the race for customer excellence is hotting up. Winners and Losers are on the horizon.

SitenYonet by Deniz Bank in Turkey is a holistic residential property management solution that has replaced multiple standalone web applications for communication, online monthly payment and residential debt follow-up in the apartment and site management realm. It has brought all of these services together in a single offering.

Intesa Sanpolo in Italy has launched its ‘Customer Journey’ project to create a differentiated digital experience, offering multi-channel communication and service delivery opportunities. Communication supported by big data analytics and a customer-centric CRM infrastructure that operates in real time, allows Intesa to provide significant customization based on a customer’s interest, use of bank’s products and information on life events.

With the integration of digital technology in the front, middle an back office of the bank, day-to-day operations have undergone a seismic shift in some Financial Institutions and the long term strategic vision for the future is beginning to take shape. Large technology organizations such as Google, Amazon, Facebook and Apple (GAFA) are emerging as strong service delivery options that champion customer experience. Threats from these organizations combined with those from nimble fintech companies are compelling banks to invent ways to engage deeper with the customer, exemplified by initiatives such as Deniz Bank, Intesa and many others.

Banks and Financial Institutions are adopting a three pronged approach to ensure their long term viability. These are – evaluating all the possible disruptions; how these disruptions impact their revenue, positioning, and operating model, and how they can create options and hedges against any negative shifts while taking advantage of new opportunities.

To navigate and deliver the future state model for the Financial institution requires dedicated efforts and significant systemic investments. A recent survey by Infosys and EFMA on digital banking examined how banks are investing in innovation. A chief innovation officer or executive to spearhead the innovation process is key for any organization’s innovation strategy to succeed. Research findings reveal that the presence of such an executive has a direct correlation with the size of the organization. About 67% of the large financial institutions (>$50 Bn) surveyed had a chief innovation officer as opposed to only 9% firms in the <$1Bn bracket.

Banks have been progressively increasing their innovation investment over the years, but in the past 12 months this has accelerated. About 79% of the respondents surveyed increased this investment this year. The areas that saw the maximum increase were channels and customer experience. Large organizations (>$50 Bn) reported the greatest increase in innovation investment in the area of customer experience, followed by channels and processes. Amongst the biggest challenges cited in pursuing the innovation strategies were legacy technology, system integration and the resources of time and cost.

With an increasing threat from new players, banks are being pushed to change. As their traditional services get commoditized, those that will survive and thrive will be those that successfully move from catering to the pure transactional financial needs of a customer to purposefully integrating services to engage customers’ holistic requirements around a topic or life stage. An example of this is a home loan provider partnering with a property dealer to become the one-stop-solution for a customer’s housing needs.

Banks and Financial Institutions are suitably investing in their innovation strategies to get there, as seen in various cases across the globe and as corroborated by research findings.

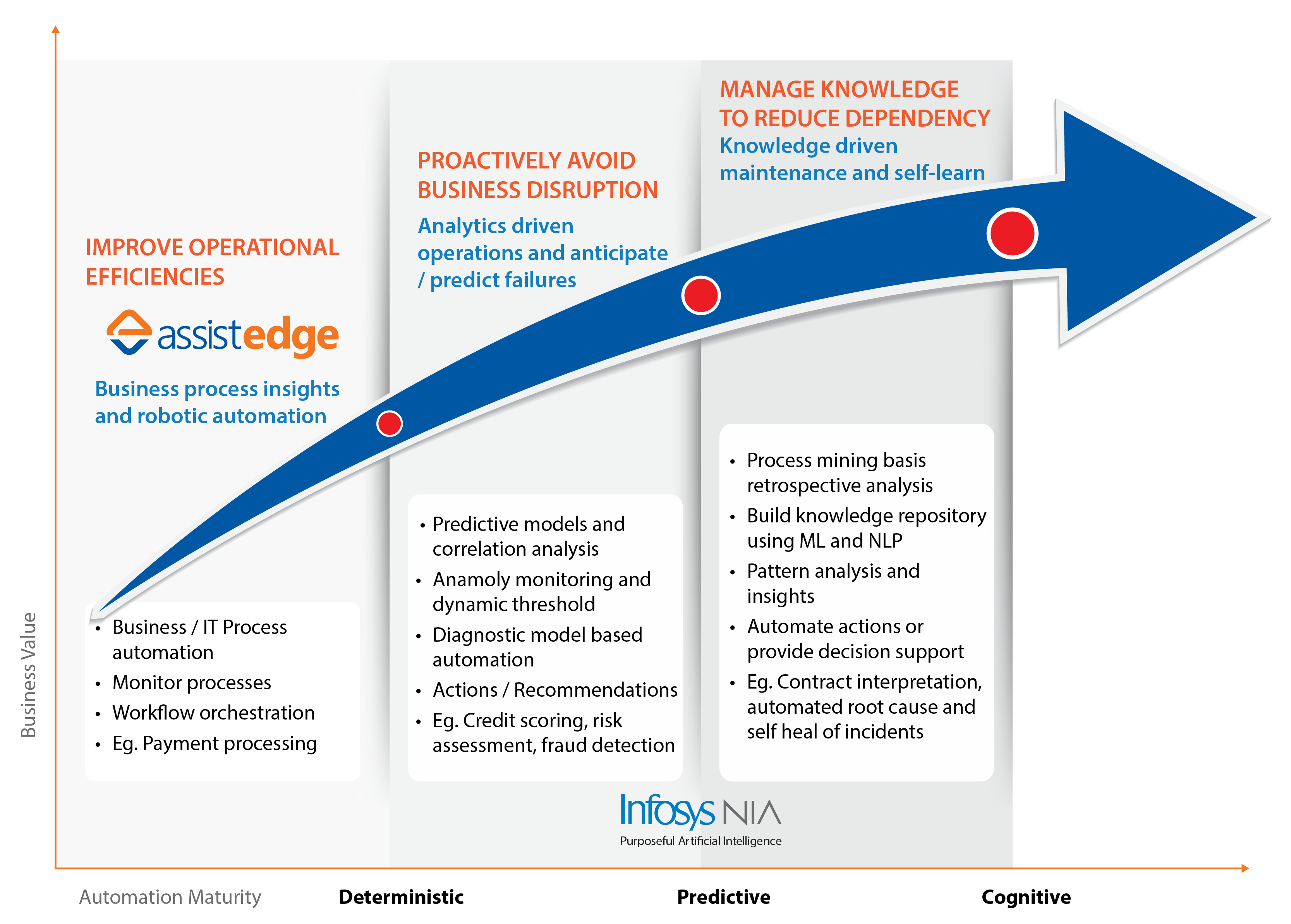

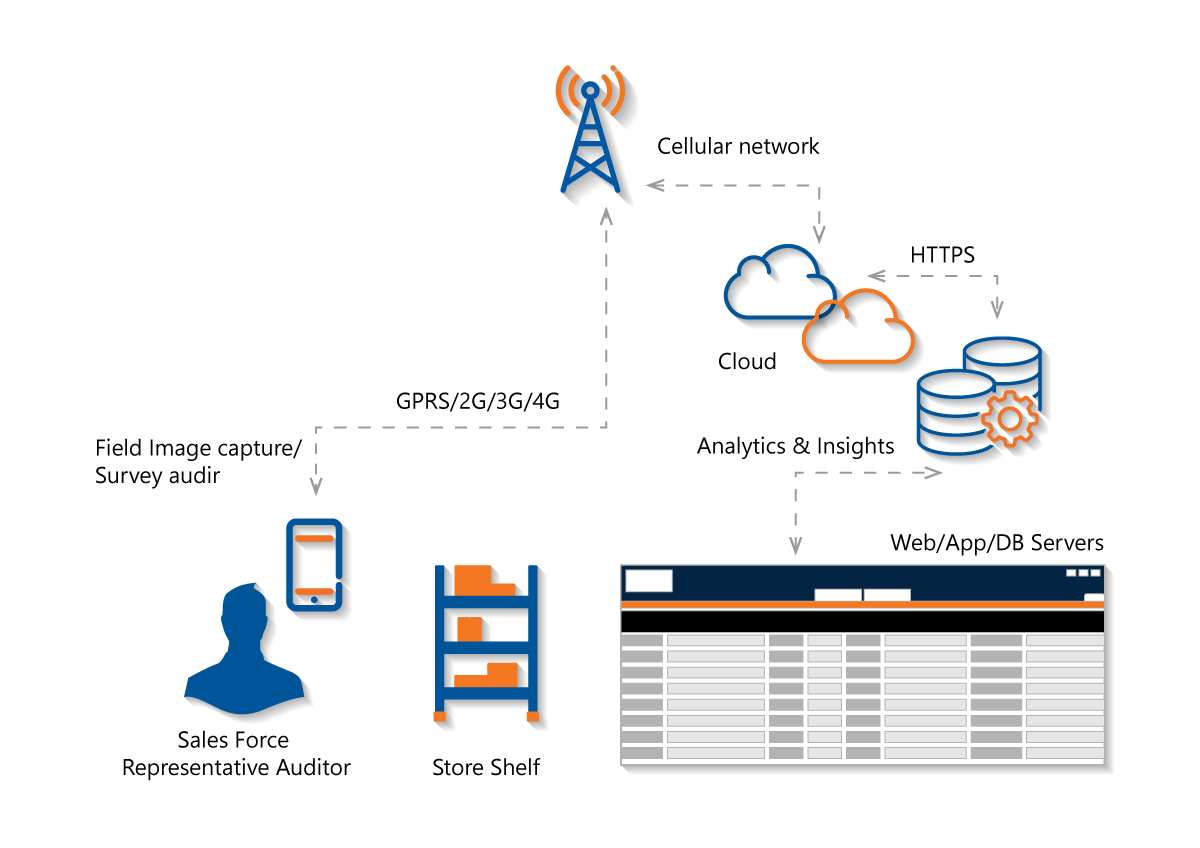

To power this innovation, investment in emerging technologies has also seen a significant upturn. According to the Infosys and EFMA research, traditional technologies such as Security, Data Analytics, and Cloud currently score higher on the investment priority of organizations when compared with disruptive technologies such as Blockchain, Artificial Intelligence, Robotics, and the Internet of Things. However organizations are also investing in these, testing them in specific but varied scenarios across the industry.

These technologies are expected to further augment change. In the race to provide greater personalization, banks of the future will continue to harness the potential of ever-increasing data assets through advanced analytics. At the same time these organizations will need greater cybersecurity expertise to safeguard data assets and lastly, the importance of cloud technology is key, supporting the storage needs of real-time access and analysis of data. This group of technologies provides the backbone for the disruptive times to come.