Contents

Voice from the editor’s desk

Note from the editor

Voice from the editor’s desk

Note from the editor

Cover story

A Bankable Platform

Cover story

A Bankable Platform

Feature

Unlocking the Embedded Finance Opportunity…

Feature

Unlocking the Embedded Finance Opportunity…

Perspective

Making the Most of Banking as a Service

Perspective

Making the Most of Banking as a Service

Perspective

Next Level Cloud-Led Transformation with APIs…

Perspective

Next Level Cloud-Led Transformation with APIs…

Perspective

Real-Time Payments reach Corporates

Perspective

Real-Time Payments reach Corporates

Perspective

Transforming culture to embrace cloud – a necessity…

Perspective

Transforming culture to embrace cloud – a necessity…

Case Study

How LINE BK is Revolutionizing Banking in Thailand with Social App

Fintech Perspective

Would neobanks disintermediate traditional banking?

Fintech Perspective

Would neobanks disintermediate traditional banking?

Kaleidoscope

The future of digital identity in Europe – Lessons from Asia

Kaleidoscope

The future of digital identity in Europe – Lessons from Asia

Inside Talk

Voice from the editor’s desk

Note from the editor

Puneet Chhahira

Head of Marketing and Platform Strategy at Infosys Finacle

As Winston Churchill popularly said – To improve is to change; to be perfect is to change often. Keeping pace with change to remain relevant is indeed the biggest endeavour of banking leaders today. Irrespective of whether we look from the viewpoint of the consumers, investors, or competitiveness, the traditional banking model looks unsustainable, while innovative digital models are going from strength to strength.

Today, there is near-universal acceptance of the need for rewriting the banking business model, and most banks have programs well underway. In this issue, some of the leading banks share their experiences. CBA’s Jesse Arundell talks about how a variety of technologies, including cryptocurrency, cloud and blockchain, are helping innovation in the Australian market. Pierre Ruhlmann of BNP Paribas says embedded finance and digital first are the future of banking. In his interview, Faisal Ameen shares how challenges – pandemic, regulatory environment, talent shortage – are driving innovation at Bank of America. Deepak Sharma of Kotak Mahindra Bank talks about the catalysts for change driving business model innovation. And, Kaspar Situmorang of BRI shares the biggest opportunities for business model innovation in banking.

We are also delighted to share our perspective on various trends and technologies influencing banking business model innovation. Mohit Joshi, President, Infosys underlines opportunities banks can unlock by adopting platform business models. For instance, banks can co-create products with ecosystem partners, or tie up with third parties to acquire customers, on their behalf. In his article “Unlocking the Embedded Finance Opportunity”, Sanat Rao, Chief Business Officer, Global Head, Infosys Finacle, makes a compelling case for licensed institutions to monetize their advantage and expand their reach by leveraging Embedded Finance opportunities.

There is only one way to do this, and that is by accelerating business model innovation. And we hope the articles in this edition offer insight and inspiration to help accelerate the journey.

As always, we are eager to hear from you.

Happy reading!

Cover story

A Bankable Platform

Mohit Joshi

President, Infosys

In the traditional “pipeline” model, banks typically did the following on their own: develop proprietary products; acquire customers; match customer needs with the right products; and deliver offerings through various (owned) channels. The platform model gave banks the opportunity to collaborate in all of these areas, from manufacturing and customer onboarding to need fulfilment and delivery. In other words, by adopting a platform model, a bank can co-create products with a partner, sell third-party products on its own channels, or tie-up with a third-party who will acquire and onboard customers, match needs and products, and even distribute, on its behalf.

These scenarios can give rise to a very large number of options, which could overwhelm a bank that is just starting out on its platform journey. This article simplifies the platform opportunity landscape by dividing it into three main categories, to help banks understand what is most relevant to their individual contexts.

Partnering with demand aggregators/ distributors who find the best way to onboard customers and serve them with personalized products and services

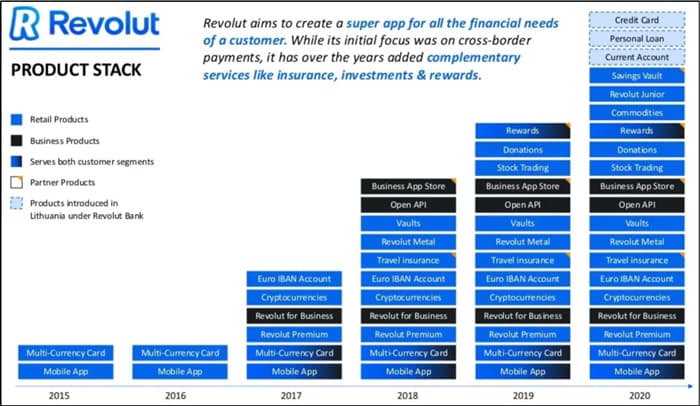

An opportunity for players with a huge customer base or solid distribution muscle, it is dominated by companies that are unparalleled in marketing, such as Amazon, Alibaba, Google, and Apple. This particular platform model derives from the fact that every transaction, regardless of industry, has always involved a financial value stream. Accordingly, it blurs the line between banks and other businesses by enabling the latter to act as de facto distributors of financial services. Think of Apple Pay, a payment service in partnership with Goldman Sachs and Mastercard; or Amazon which lends to the small businesses in its ecosystem; or Shopify, which offers banking, payment, and lending facilities to those building their websites with it. Even Starbucks has amassed assets larger than those of many community banks, through the Starbucks Wallet. Heavyweight brands like WeChat and Alibaba, or Google Pay, are aiming even higher, trying to become super apps that provide not just payments, but even deposits and loans.

But it’s not just established (non-bank) brands with a consumer base that are acting as demand aggregators and distributors. Even new players with the capacity to reach and onboard customers are entering the fray by setting up financial marketplaces. For instance, BankBazaar, a marketplace platform connecting borrowers to prospective lenders, and Raisin, a savings and investment marketplace for finding the best bank deposits. A number of neo banks are targeting specific niches – for example, a specialized product (green banking), or customer segment (gig workers/ migrants) – through demand aggregation and distribution.

Acting as intermediaries facilitating interactions between demand and supply-side players

Platform-based demand aggregators and distributors need products from manufacturers. This is the opportunity tapped by platform-based intermediaries, who use APIs and webhooks to enable interactions at scale between product creators and distributors. The value of the intermediary proposition is that it allows a super app such as Google Pay to aggregate products from dozens of banks without having to manage integrations with them all. Instead, Google Pay interacts with just a handful of banking as a service providers who gather the offerings of all those banks.

Like distributors, intermediaries also come in many shades of Banking as a Service (BaaS) provider. Marqueta is a specialist platform that allows any provider to launch a card-based product very easily. RailsBank wants to offer just one API for payment processing. Galileo, M2P, and Plaid are just a few of several BaaS players that are making it possible for any brand to find banking products and services to expand their own propositions.

Interestingly, even banks are stepping into the intermediary model by building API exchanges, which feature third-party APIs besides their own. ICICI Bank’s API marketplace, for instance, has APIs from several partners.

Then there are specialists, such as data aggregators and distributors – Envestnest Yodlee is one such – that aggregate customer data from several accounts through open banking or screen scraping mechanisms to showcase it in one location; “focused” intermediaries like Stripe and Razorpay that embed payment functionality within customer journeys with a single API; and utility-intermediaries, such as IBBIC which offers specific processes for domestic trade finance.

Manufacturing products and services that demand aggregators and intermediaries take to clients

Progressive banks, both incumbent and challenger, are at the forefront here. These entities are transitioning to the platform business model by building extensive API marketplaces. This model is also attracting smaller banks who are leveraging the BaaS opportunity to build their business without investing enormous capital for distribution and servicing.

The manufacturing platform model is also seeing banks group together to create offerings that distributors and intermediaries take to market. India’s NPCI is an outstanding example whose universally embraced UPI is clocking in excess of 5.4 billion monthly transactions.

As the platform model continues to evolve, the opportunities to compose new business models will get bigger. With technology also playing its part, there is no limit to the possibilities of innovation. Personally, I am very excited to see the opportunities awaiting banks that are beginning their platform journeys. Speaking for the organization, the Infosys group has made sizable investments to help clients benefit from these opportunities.

Among our business process platforms are retirement services, mortgage processing from Stater, and insurance services from McCamish. We look forward to extending our partnerships with clients by strengthening existing ones and introducing more such platform offerings.

Feature

Unlocking the Embedded Finance Opportunity: The four things every bank must do

Sanat Rao

Chief Business Officer, Global Head, Infosys Finacle

Embedded finance: what and why now

Embedded finance is not new, but it has been reborn in the digital age. Today, it is among the most-watched opportunities, with market size expected to triple in the ongoing decade.

In its simplest form, embedded finance means integrating banking products and services into non-banking offerings, with the primary goal of removing friction from the banking consumption experience. Decades ago, when a bank stationed a loan officer in an automobile dealership, that was embedded finance in action. Today, thanks to digitization, embedded finance has not only evolved spectacularly in scale, scope and impact, but even the cost of its integrations has come down. After digital technology, growing maturity for open banking has played a key role in accelerating embedded finance implementation. Another favourable factor is that as a secondary service that underlies virtually every transaction, banking is extremely well-suited for embedding. For evidence, look at the relentless growth of UPI-based embedded digital payments in India. Now, encouraged by the success of embedded payments, the digital giants that dominate this space are even offering other embedded services, such as savings accounts and loans.

Good for all

In this article, we discuss the four things that licensed banks need to do to succeed in their embedded finance initiatives.

Modernize technology infrastructure to participate effectively

As a first step, banks need to build adequate API (Application Programming Interface) infrastructure to expose their services and data to third-parties for a variety of use cases. To the extent it is possible, they should create these APIs in a standards-based format – such as that recommended by BIAN – for easy integration. There needs to be an API management platform to offer secure access to approved partners who may use the APIs for approved purposes. A sandbox and accompanying documentation will enable developers to easily plug into the APIs. However, all of this will only come together when the underlying digital stack is sufficiently mature, not least because embedded finance transactions, though low in value, occur at enormous scale. There are other reasons as well, such as high system performance expectations – a balance enquiry must receive a response in under 10 milliseconds, for example – and very little allowance for technical failures.

Apply a product management mindset to API banking

Generally, progressive organizations view APIs as products that will reach their services to a vast number of third parties. This is why they dedicate a product management team tasked with prioritizing, developing, deploying, upgrading, and even retiring APIs. These teams also partner with clients and industry participants in co-creating new use cases. Apart from the product management, there are typically supporting teams offering services to clients, partners, and developers.

Nurture digital sales and fintech teams

Merely creating the infrastructure is not enough; banks must have dedicated business teams for promoting API-based banking, and for building partnerships and use cases with corporate/SME clients, digital giants, fintech firms, ecommerce players, etc. Like they would do in any other line of business, banks should explore relationship-based pricing and discounting models to popularize API-based banking.

Build a mature data and analytics practice

The steps in the preceding section will help to get the business off the ground; however, for differentiation and growth banks must learn to make good use of the data that is generated. The scale of embedded finance is such that it produces massive quantities of data. Take the example of embedded payments, which yields granular spending data by way of several billion transactions every month. So now, banks (also customers) know exactly how the money was spent, an insight they can deploy to improve products and experiences, manage risks better, or provide further insights to their product managers, partners, customers, and merchants. For instance, banks can share aggregated insights about customer profiles and their buying behaviours to enable merchants to plan their merchandising mix better.

As one of the most exciting spaces in banking, embedded finance is attracting the interest of several players. Apart from Banking as a Service providers at the forefront, there are various non-bank intermediaries in the game. This is a great opportunity for licensed institutions to monetize their advantage, and quickly expand their reach to include the customers of other businesses. The sooner, the better.

Inside Talk I

In conversation with Deepak Sharma, Kotak Mahindra Bank

Over the years, the way that financial services are rendered has evolved. At the same time, big tech and fintechs are getting into and disrupting parts of financial services, resulting in a game of the speed of the insurgents versus the scale of incumbents. Deepak Sharma, President and Chief Digital Officer, Kotak Mahindra Bank spoke to us about his thoughts and experiences around driving banking innovation and the future of banking. Below are the excerpts of the conversation:

What are the drivers for opportunities in business model innovation?

The catalysts for change are many, but it starts with the customer. Today, across categories, customers have enough and more choices. Traditionally, when customers wanted a loan or a card, they had to come to a bank branch. Today, that’s available at any touchpoint where the customer is. The way that financial services are getting rendered and consumed across the ecosystem has changed. The old business models are probably not relevant in a lot of categories. The cost and efficiency of rendering financial services have also gone through several changes. In turn, this will drive a change in the whole risk and security framework. That again is a big catalyst to change because if your revenue streams or margins are not sustainable, you need to find a more lean and efficient manner to do the business and find a new way to scale up.

The other one is probably the classic battle between incumbents and insurgents.

The option of building a new platform, designing for scale, and looking at the Cloud is open to everyone. The question now is, how do you leverage technology to build the future of financial services?

What are your thoughts on competition from insurgents?

I think insurgents must be regulated to come in and compete in categories that have regulations. Typically, we see insurgents get into categories that do not need to be regulated or do not require high-risk tolerance. These are typically new business models, such as buy now pay later for credit, which is a new form of credit. Some insurgents are chipping at the core, through a neo-banking model or a new platform architecture. Banks do see that each of those is going to impact some part of the bank or financial service. Either you keep watching them and wonder what happened, or you step in and make things happen. We as a firm decided that the latter holds because this space is going to find more important players. Those who are efficient at bringing in products that customers need and building a better ecosystem to give customers value will succeed.

Where do you see the biggest opportunity in business model innovation in banking, either in general or for your firm specifically?

Opportunities are largely around consumer segments because financial services are still under-penetrated, at least in the Indian context. Access to credit is still a significant opportunity, be it on the small business side or short-term credit. There are opportunities across small and medium businesses to individuals. Wealth-tech is also a large opportunity. Payment has now become an essential part of any ecosystem, rather than a differentiator.

There is a battle of eyeballs – how much time do you get with the customer and how often? If somebody can make my life more seamless, and integrated, I would like to think less and less about more time-consuming things. And that means the banking must be more embedded and seamless too, into whatever we do daily.

Any successful examples of embedded finance that you can share?

Both embedded finance and ecosystems are working. For example, we launched K-Mall, where our idea was to bring all categories that our customers use more frequently into a single app and make it a super app. We brought in top e-commerce stores, cab aggregators, Indian railways, and even categories such as cosmetics and pharmacy, health and wellness, and food delivery. The idea was that this app does more than just your payments and investments but also become your lifestyle app. It’s been a very successful play for us. We continue to expand, add more categories, and bring embedded finance within that. The question now is, how do we expand beyond the obvious categories. That’s where we have seen success in our ecosystem play.

Do you see technology or skills or culture as being big barriers?

Culture is transient, but it can be solved with the right leadership, right intent, and communication. The other part of it is technology. The old way of CAPEX and OPEX is now out, because services or SAAS, cloud etc. need a different operating model and a different set of skills and competence. The demand versus supply equilibrium means you struggle to find a good, qualified engineer. That is the single biggest challenge that we have right now. The other challenges are security and risk.

How are you working to overcome some of these challenges?

The first phase is to recognize the challenge. There’s no silver bullet. It’s a combination of things – from grooming the workforce within the firm to identifying and retaining the talent. We also need to find ways to make interested vendors and partners a part of the journey. Articulating our story is a very powerful thing since the younger workforce wants to connect with a purpose. As we create more success stories out of Kotak, we find that word goes out into the market that we are doing something good, even if BFSI as an industry is not very appealing. We must find the right mix between how much we can build in-house versus how much we rely on partners.

Also, we are looking at platform-based architecture, which means giving customers a product or an experience of their choice in a seamless manner. We see three models:

There’s a lot of focus on building those journeys, which are end-to-end digital, and looking at customer access and technology access to define these business models, what technology can deliver, and what value it creates for customers.

How do you think customer expectations are changing?

I think we are all learning every moment. Take Zoom Meetings for example. Probably, two years back, one wouldn’t be very comfortable if someone sends a Zoom link. Now, the experience of Zoom is that I just click and I’m in a meeting room. That’s the experience I’ve gotten used to in a digital world. If I compare it with a meeting in the physical world where you probably must go through five or eight steps before you get into a meeting, you may think hey, wasn’t Zoom better? It’s similar with shopping. If I am getting some groceries delivered, why would I go up and queue in a store and spend two hours, if I can just place that from my cart online? People are always comparing their experiences in one format or with one industry to another. So, it is not about how banks are changing. It’s about how other industries are changing. And that is what customers expect when they look at it.

If I can do something in one click, why would I do two clicks? My banking app can be great, but it needs to deliver in one click. It needs to personalize stuff because Netflix tells me what’s the next content I should be watching. That’s where ‘consumer and tech’ come in. These are the two things that define digital in my mind. Knowing tech and what it can deliver is easy. What consumers want and what they are thinking is extremely difficult. There are many personas, profile biases, and preferences. As a universal bank, how do you keep understanding each of them? Finding the right experiences to deliver to them is a tough task.

What do you think will happen to those banks or those providers that don’t evolve, and don’t keep up?

Like any industry, there will be mortality, for sure. How fast and how much is difficult to predict. It’s also possible that some banks may change their business model. While some will be universal banks, others will be more sector-focused banks or operate more as balance sheet providers. Some may just choose to be tech banks, where they just keep the backend and allow fintechs or partners to just plug and play. Not all banks may end up doing all things. I won’t get into partnerships, just because it’s a cool thing to do. I know that my customers expect me to deliver similar or better experiences than some of the insurgents. There will be a few who will continue to do well as large universal banks, but they will also evolve more into tech companies or more consumer-centric forms. Because without doing all of that, one won’t really be right there for consumers when they think of anything to do with money.

Inside Talk I

In conversation with Deepak Sharma, Kotak Mahindra Bank

With the pandemic unleashing the rise of the gig economy, there is greater pressure on banks to digitize and serve newer customer segments such as freelancers and gig workers. We had the fortune to speak to Kaspar Situmorang, CEO Bank Raya Indonesia, on the changing business models and innovations such as advanced underwriting techniques that are helping the bank create value in the new normal. Here are a few excerpts of the conversation:

Can you share anything interesting that you have around business model and innovation, either in your bank and in your region, or more broadly?

In Indonesia to be specific, when we talk about banking, it will be around three pillars. The first pillar is hybrid banks. Hybrid banks have a massive number of offices and branch offices. But at the same time, they’ve already optimized their business process with digitalization and digitization, which is how they get to reduce their cost of funds.

The second pillar is Sharia Banking, which is almost similar to hybrid banking, but they play in the segment of Sharia.

And the third pillar is the digital bank, which has very few branch offices but has already fully digitized operations starting from the front-end up to the back-end. They employ a minimum number of people— right from opening a bank account, savings account, lending account, or paying transactions using QR etc.

The Asia banking landscape has also been amplified by the mature industries of fintech. For the past few years, we’ve seen that a massive influx to the Indonesian start-up ecosystems was coming from the fintechs.

Where do you see the biggest opportunities for business model innovation in banking?

We are the largest bank in Indonesia and the largest network in Southeast Asia. With digital transformations over the last four years, our goal is to eventually have a digital bank on our own. Back in April, I was appointed as the CEO of this bank. Previously, the bank was focused on agriculture, specifically, lending to palm oil plantations. I was appointed to focus on pivoting this bank to become a digital bank on its own. We have optimized and digitized all of the manual processes, which makes us one of the best in originating loans, and the quality of the credit is awesome.

And at the same time, we’ve seen for the past few years that we also need to implement a digital bank on its own, which is why we bought one of our subsidiary companies, BRI Agro.

We are trying to focus on becoming a digital bank. We use business models and focus on making them leaner. So, we implement all the digitalization in the existing business processes, removing some of the toxic processes out of it, and make it leaner. And at the same time, we need to have a new kind of business model. So previously, when people wanted to borrow money at the holding bank, we still used and deployed 28,000 people, right across Indonesia.

Also, we need to serve some of the segments that we’ve seen for the past few years. They are already savvy enough to play on their smartphone. So, when they borrow money, open savings accounts, and do transactions, they don’t have to go to the tellers in the branch offices. This is the kind of segment that we want to serve. Because it’s very difficult to serve that kind of customer, we decided, group-wide, to create a digital bank on our own and BRI Agro has been designed to do so.

So, this shifting to the digital economy is massively distributed right now, especially in the productive economy in Indonesia.

You’re clearly adapting your business model based on the needs of the customer. How do you think those customer expectations are changing?

There are three things. First, customer habits have been changing. At the same time, they were also forced to make money from the gig economy, when some of them lost their jobs in 2020. None of the banks have been creating a digital infrastructure for informal sectors – for freelancers, for example, writers, influencers, etc. because it has to have a specific model of underwriting. The credit scoring of a freelancer is different from the credit scoring of established businesses for example. How do you manage their cash flow? How do you manage the repayment capacity? How do you predict the default rate? This has been a challenge.

For the past few years, I’ve been working at the holding company at BRI to establish the Big Data organization over there. So, we have “BRI brain” as the artificial intelligence function owned by BRI Holdings to be able to predict default rate, cash flow, repayment capacity, based on specific and regulated data. That’s why we are very firm that we are able to do underwriting based on that.

What do you think are the biggest barriers to business model innovation, for the industry as a whole?

I think one of the biggest problems and the biggest threat is underwriting. Banking is very highly regulated, and normally, you have to use Basel III on the compliance side. However, to be able to underwrite this kind of freelancer economy or gig economy, you need alternative underwriting models. This is one of the key strengths that we have as a firm because of the kind of technology and expertise in our banks, to be able to underwrite that kind of alternative loan using alternative basis data.

The second part is about the customer experience. For the freelancer economy, whether they’re in ride-hailing, ecommerce, agritech, edutech, healthtech or part of the influencer economy; every time they want to make content or provide in the supply chain, it requires a specific solution. A lot of banks just provide saving accounts, lending accounts, payments, and transactions. But we must go further back into providing a specific solution for that.

For example, in a supply chain, especially for those freelancers playing in the gig economy, they want to create content. Normally, they have some sort of a purchase order from a principal. So, when you have that kind of purchase order, you can do some sort of underwriting based on that, we call it supply chain financing. Supply chain financing is one of the solutions that we provide in our digital bank, right now, in order to be able to provide a specific and tailored solution for this kind of freelancer. At the end of the day, most of them have this kind of supply chain financing, in terms of landing sites or sailing sites or deposit sites. We also coupled the platforms on their own, because we know that every digital bank will need to survive. They need to play along with the specific ecosystems.

However, some of the digital banks in China like WeBank, MYbank, and in South Korea, like KakaoBank, are very deeply integrated with the specific ecosystems. Therefore, the customer acquisition costs are lower than the customer lifetime value.

Eventually, because you’re part of those super app platforms, it’s easier for you to, get the daily active users, monthly active users, weekly active users, because it’s already embedded in their apps. So, the keyword, I think is embedded finance.

How are you measuring your progress with business model innovation?

So, we already create some value in terms of the valuations out of the stock exchange.

The second part is the financials. In the normal banking sector, you need to have a profit, and then you’ll be evaluated highly. But these days to become a digital bank, you need to be able to clean up your bad banks, before you are evaluated. We were in the phase of cleaning up the banks. Now, we are preparing products such as digital savings, which are much leaner. Digital lending is specifically tailored for the gig economy. We’ve already got the digital lending products on the consumer side. Now we’re releasing some of those additional digital lending products for those freelancers, for the digital economy. We have market value as one of the promising digital banks in Indonesia.

Inside Talk I

In conversation with Deepak Sharma, Kotak Mahindra Bank

How do we stay close to not only a client’s current needs but also their needs as they evolve?

While banks are seeing greater competition from non-traditional competitors such as fintechs and big tech, they often find themselves bogged down by legacy technology, architecture, infrastructure and the costs associated with transformation. Faisal Ameen – Managing Director, Head, Asia Pacific Global Transaction Services at Bank of America – spoke to us on the changing competitive landscape, barriers to change, and new business model innovations that banks must embrace. Here are some excerpts from the conversation.

What do you see as the real catalyst for change that is driving the opportunity for business model innovation?

First of all, I think we all agree that the recent pandemic has accelerated the digitalization process at so many levels, starting at the lowest common denominator, which is the individual human being. The tech-savvy generation was always utilized digitalization, but now the generations that were not as used to technology have adapted to it as well. This is a simplistic example but there’s more online shopping among the population than there’s ever been in any period of history. And many people doing it because they are being forced to. Sometimes, necessity, not just innovation, is the driving force behind adoption.

The second factor is the regulatory environment. Over the next five to ten years, we expect our landscape to evolve into a real digital sort of scenario where central banks replace the physical currencies that they’ve been issuing since the beginning. This lowers the frictional cost of money, and the cost of money itself because there is a cost of physically printing money and putting it into circulation.

The final critically important factor includes skill set, talent and mindset. It’s not just about the infrastructure and how the landscape is evolving, but it’s also about your willingness and your ability to drive the kind of talent, capabilities and teams that are needed, and having the mindset to adapt to the changes that are going to be taking place.

How do you think customer needs are changing? What is driving business model innovation for you and the wider industry?

Clients want real-time payments, real-time information, and real-time liquidity. They are heading towards much, much greater digitalization, not just within their treasury operations, but in their entire interface with their banking partners. They want a consolidated view across all of those banking partners. And that’s a big difference – how clients’ needs have changed. It’s no longer a luxury or a leading sort of initiative, it is now the norm.

Are there any competitors that stand out for you, either existing ones or relatively new to the market that is affecting your business?

Rather than financial institutions, the real big challenge is going to be from big tech – the Facebooks, Amazons, and Apples of the world. They have deep pockets and are tech-enabled, and they’ve got massive consumer bases. The regulatory framework is encouraging and facilitating this as well.

Looking specifically at big tech companies, how are you responding to the threat that they pose?

The most important thing is that we have to remain close to our clients. There is a big difference between the experiences that financial institutions have in the different spaces that we play in. It’s much easier to disrupt the consumer or retail spaces because there is a desire among individuals to make distinct and disassociated decisions on specific services. But it’s much harder for a large corporation to just pick a service or provider to replace another, without potential disruption to its entire treasury management process or working capital cycle. This is true not just for non-financial institutions, but even within financial institutions.

At the corporate level, certain products and services offer better rates, better speed to market, and are slightly more efficient. Buy Now Pay Later, in the corporate construct, is called supply chain financing. You see a reluctance among companies to solely rely on that. Credit is important. Ongoing viability is important. So, companies can’t just risk putting all their eggs in one basket, which has not the type of proven track record and familiarity built over decades.

What do you think are the biggest barriers?

For any large financial institution, it is going to be the legacy technology, architecture, infrastructure and the costs associated with transformation. And another area would be mindset. To remain relevant, you need to listen closely to your customers. Then everything you do will revolve around meeting those existing and future needs.

And then there is the question of skill. The most important thing is figuring out what job needs to get done. It is about having a balanced approach in terms of leveraging the skill sets you already have, and hiring in the skill sets that you require to complete that job.

The cost of compliance is also rising. With more transparency, data and information will be more accessible even to regulators. Therefore, the need to manually create reports is going to be minimized as well. So, there are benefits in terms of the entire automation digitalization journey that is taking place in the industry.

Security issues are also a concern. It’s not just about pure automation, it is about how much data you are digitizing and shifting onto the cloud. That ultimately creates more risk because that data is susceptible to exposure at some point, whether it’s through cyberattacks or phishing scams. How do you fight against these challenges? It’s a matter of corporate vigilance and educating your people. In our organization, we test regularly, which is not easy to do when you have over 200,000 people, but it is imperative that we do so.

What do you think will happen to banks that don’t evolve?

Rather than speculating about the future, we can learn from the past, and the key lesson is that consolidation has taken place. It’s not by chance that you have, in a country like Singapore, four main local banks that currently exist. It wasn’t always like that. There is only so much economic value that can be distributed among the players in the marketplace. It is not feasible to support an unlimited number of participants. It’s also about understanding which base you want to serve, and what your unique selling propositions are. If you are very diversified, but you don’t have the financial wherewithal, or the talent or the teams to be able to focus and be number one, two, or three in your respective spaces, it may be difficult to sustain yourself over the longer term.

The other thing is that as the market consolidates, there is a difference in the cost of capital for the larger institutions vis-a-vis small institutions. You start seeing smaller players that are all in the same space consolidating to become a much more focused rival to others.

Is there anything else about business model innovation that you particularly want to highlight?

One thing is that business models are becoming much more integrated. For example, if you walk into a store and like a particular sweater, you order it and you pay for it. The first part of it is the digital transaction and it happens at a fairly quick clip. But then, the store would want that payment to trigger an update to stock and an update to procurement and also trigger an order for that particular size and unit of that sweater that you have bought. It’s no longer the traditional method that would have been to order 500 sweaters of different sizes based on average sales. The stockroom was disconnected from the sales department, which was separated from the accounts department, which was separated from the procurement department. There could be weeks between orders passing from one area to the other. Now it’s happening on a real-time basis.

Inside Talk I

In conversation with Deepak Sharma, Kotak Mahindra Bank

With responses from over 1165 banking executives globally, the 13th edition of Innovation in Retail Banking proved to be an extremely crucial edition, as it covered the growth in digital transformation initiatives in retail banking and consequently banking innovation since the pandemic disrupted banking. One of the noticeable trends in this year’s findings was a higher acceptance among bankers of the dramatic changes that are overtaking their business such as business model innovation, modern technology adoption etc.

We spoke with some top executives at the biggest global banks to get their take on the biggest trends shaping the industry retail banking landscape. Below is our interview with Pierre Ruhlmann, Chief Operating Officer and Chief Transformation Officer of Retail Banking France at BNP Paribas.

Embedded finance is growing in prominence. What role do you think embedded journeys and products will play in banking of the future?

Embedded finance is the integration of a financial service within both non-financial or financial services, products or technologies, anytime and anywhere.

Customers don’t necessarily have a favorite app or product. They have a preferred ecosystem, a preferred destination through which they are ready to interact, experience, and transact with brands that make themselves readily available.

In addition to this notion, there is bank-as-a-platform, which revolves around the beyond banking services provided in our channels. In France, as a bank, we appear to be a trusted third party serving our customers. The challenge now is to capitalize on this trust to move beyond financial services and to support our clients in all their projects at every moment of life, such as mobility and health. What is striking is what our clients expect from us, as a trusted companion. Most of our clients say they are willing to work more and strengthen their relationship with their bank.

We must therefore respond to this by developing new and more embedded services, as we are doing for example with Papernest, a start-up which helps everyone in the daily management of contracts and subscriptions. Deepening and valuing our customer journeys will help us become the trusted beyond banking companion for our customers.

The cost-to-income ratios of banks looks set to continue declining from current levels. Can reduced costs be largely attributed to digitization and automation or are there other factors at play?

Yes, digitization and automation are major factors in cost reduction. But there are other factors. Firstly, the issue is not so much to digitize the past, but to digitize the future! We are constantly creating new customer journeys, for new products and services. They are necessarily digital and end-to-end to meet customer needs (e.g. immediacy) and to provide a great customer experience.

Another major source of cost reduction is reached by increasingly relying on infrastructure or service mutualization with other banks or partners. It’s not a new trend, but it is an increasing one and the topics on which we are currently working, like ATM pooling, are ideas that in the past we wouldn’t have thought possible.

Finally, even while we continue to insource our most sophisticated and secure items, we are increasingly buying standard services from service providers.

The payments space is increasingly competitive, with the growth of non-bank owned channels such as Apple Pay and Google Pay. How do banks ensure they stay relevant in the payments space going forward?

The European Payment Initiative (EPI) sets the European ambitions: to counter the supremacy of Visa, Mastercard and GAFAM giants in the field of payments. While consumers and merchants will have a unified pan-European payment solution in 2022, many advances have already improved their digital lives.

The notion of immediacy guides innovations in the service of consumer experiences. Transfers between bank accounts were one of the first beneficiaries. Instant transfers are increasingly used by BNP Paribas customers – almost one in ten today. For credit card payments, the contactless limit was raised from 30 to 50 euros, before the biometric card removed the limit completely (up to each customer’s personal limit). This card, offered on the market for the first time by BNP Paribas in 2021, enables payments of over 50 euros in shops with one’s fingerprint.

Payment-related innovations are also being made for smartphones. From Apple Pay for iPhones to PayLibfor Android, BNP Paribas’ credit cards are being dematerialized in mobile phones. Dedicated applications such as Lyf Pay also allow payments in certain stores, click & collect, as well as associated services such as loyalty cards, vouchers or online kitties. For wearers of connected watches, Fitbit Pay or Garmin Pay enables payments using the watch’s pin code up to the payment limit of the registered bank card.

The service Paylib between friends enables you to send money to your friends, relatives, family, etc. very simply, thanks to a telephone number, instantly, irrespective of the recipient’s bank, directly into his or her bank account.

For merchants, the instant payment solution Instanea also offers instant payment using the aggregation technology of open banking specialist Token. This is proof that the Second Payment Services Directive (PSD2) and the SEPA instant transfer are being implemented by European banks. Immediacy is also a matter for suppliers, especially for large companies who need visibility on the payment of their invoices. The international dimension complicates this need in some cases, given the number of actors involved and the local regulations.

Another market trend, split payments – enabling consumers to pay in several installments – has taken off phenomenally. They quadrupled between 2018 and 2020, to reach 80 billion dollars worldwide (source: Kaleido Intelligence). In response to this market transformation, particularly in e-commerce, BNP Paribas signed an exclusive agreement in July 2021, to acquire the French leader in split payments, FLOA.

Finally, innovation is not just about technology. The partnership signed by BNP Paribas with Accor Group to operate the ALL-Accor Live Limitless Visa credit card opens up new horizons. For the first time, BNP Paribas is managing transactions that do not necessarily originate from its own customers. Points earned when paying entitle you to benefits offered by the Accor Group.

Some of these innovations are not exclusive to BNP Paribas. Fintechs are bringing innovation and disruption to this ecosystem. Detecting their innovative solutions remains a challenge to affirm and strengthen BNP Paribas’ leadership in payments.

Most banks are in the midst of reducing their branch footprint. Do you see this trend continuing? Or will we see more creative repurposing and redesigns of branches as well?

French and European players have turned the Covid crisis into an opportunity to speed up the emergence of new ways of working. What seemed unthinkable for advisors in branches only months ago is now a reality: video-advising or distance working.

The trend will undoubtedly continue for some years, even if the easiest closures have already been made. On the other side, banks will need to open new branches to better cover evolving movements of populations.

To answer your last question: yes, repurposing and redesigns of branches is a subject, a challenging one because of the cost implications. In BNP Paribas French Retail Banking, we want to become the trusted companion for and beyond banking of our customers; this implies that we will need to adapt -and to some extent reinvent- our stores by being more welcoming and by providing diversified services tightly linked to the local ecosystems.

Will the transition of enterprise banking applications such as core banking and payments continue its transition to the public cloud? What potential obstacles are there to this transition?

As a trusted third party, we forbid the placing of customer data in the public cloud for matters of security, sovereignty and risk.

Instead, we are developing a specific solution with IBM, which is a secure cloud in which we want to deposit banking systems or applications that are essential to security. Its implementation phase has just started with a service center application. It will continue at a steady pace until the end of the year (before the freeze period).

The aim is to enable our customers to master their data through storage in a controlled and highly secure environment.

Blockchain-based business applications are highly touted for their potential business impact. Will blockchain use cases continue to grow or is the technology over hyped?

It’s a good question, and to tell you the truth, it isn’t an easy one. It isn’t totally clear for us the full cost/benefit of using blockchain technology nor the full array of use cases where it makes perfect sense. What seems obvious is that blockchain technology has become a standard for certification and for traceability, and most of the times they come together. It does provide a very secure way to collaborate between partners and institutions. When used on such use cases, we witness a real potential to enable transformations, mainly on multi-entity work flows. There, we imagine it could be an important enabler to many innovations. Moreover, the growing usage of smart contracts and the developing field of tokenization and cryptocurrencies, all based on the blockchain technology, will most certainly fuel the dynamic and bring new possibilities and applications.

To go deeper in the world of retail banking, download your copy of this year’s Innovation in retail banking report: Beyond the pandemic.

Inside Talk I

In conversation with Deepak Sharma, Kotak Mahindra Bank

Infosys Finacle and EFMA have once again teamed up with the Financial Brand’s Jim Marous for the 13th edition of the Innovation in Retail Banking report. Further to the report publication, EFMA spoke with some top executives at the biggest global banks to get their take on the retail banking landscape.

Jesse Arundell is a technology leader at Australia’s largest financial services institution. Who better placed to speak on the trends that occupy the minds of bankers the world over?

On crypto:

“Cryptocurrency is a broad, complex, and fascinating space that is exponentially growing. It is driving unique financial product innovation and the development of new business models that are merging traditional and decentralized finance.”

“Based on our analysis of how our customers are investing in cryptocurrency and interacting with exchanges, the prevalence of cryptocurrency is growing week-by-week, which poses both opportunities and risks to traditional financial services institutions.”

On core banking & the Cloud:

“At the Commonwealth Bank, we have an ambition to be a global leader in digital and technology. A key component of our strategy is to build our applications using cloud-native functionality. As part of this journey, we are actively working on migrating our core product manufacturing systems and payments capabilities to public cloud. While this migration won’t happen overnight and will be meticulously executed, it will happen and will unlock newfound levels of pace, agility, and product innovation for the bank.”

On blockchain:

“Within the financial services industry, we have been early adopters, advocates and believers of the potential for blockchain to radically modernize and transform products, services, systems and processes within the global financial services industry. We were early investors in R3, have delivered multiple world-first experiments with blockchain (e.g. Bondi – the world’s first bond issued on a blockchain) and continue to explore opportunities to develop, or use, applications on both public and private blockchains across the bank.”

To go deeper in the world of retail banking, download your copy of this year’s Infosys / Finacle Innovation in retail banking report: Beyond the pandemic.

Perspective

Making the Most of Banking as a Service

Puneet Chhahira

Head of Marketing and Platform Strategy at Infosys Finacle

”Banking as a Service” (BaaS), a model where banks publish APIs to allow third-parties to access their services and data securely, is a key enabler of open banking and embedded finance. With the majority of banks showing interest, the BaaS market, is expected to grow multi-fold in the next decade.

This growth seems like a given because as a secondary service underlying almost every transaction, banking naturally lends itself to embedding. Another factor supporting the growth of BaaS is that embedded finance, which it is part of, enjoys the favour of all parties: customers, because they get a banking experience that is seamless with their primary transaction such as buying a phone or vacation package; merchants, because they can acquire new customers and revenues with options like Buy Now Pay Later; and banks, because they can grow their business by embedding their offerings within the consumption journeys of other brands.

Let me explain –

Launch

Based on our experience, we believe that incumbent banks should launch their BaaS journeys in partnership with a select set of fintech companies, neo banks, or digital giants that are already active in this space. At first, the goal should be to introduce basic services, such as checking accounts, debit card payments, and unsecured lending, through these partners to build a foundation for API banking as briefly described below:

The starting point is to develop the APIs for the shortlisted use cases. As far as possible, banks should standardize their APIs in alignment with their partners’ requirements, so it becomes easier to work with, and also add, partners in the future. Good discipline, by way of robust documentation and adherence to product management principles, accelerates API maturity. There needs to be a strong focus on performance, because even a slender technical failure rate impacts experience disproportionately. As an illustration, consider a digital payment that doesn’t go through instantly. Even though this happens very rarely, both payer and receiver are anxious until the transaction is completed.

A dedicated API banking team is required to support the bank’s partners in innovating further use cases. In fact, the most progressive banks even have API sales teams for business development. Finally, a modern core banking platform – with RESTful APIs, and event architecture – is a big asset, since it enables the bank to set up its BaaS proposition quickly, at low cost and effort. In contrast, while a bank running on legacy technology can also create APIs, it will have to spend a lot more effort to do.

Scale

Banks with an adequate API foundation should then scale their BaaS offering on both demand-side and supply-side ecosystems. On the demand side, this involves expanding the number and types of partners to include – in addition to fintech and digital giants – ERP software, TMS providers, human resource management solutions, etc. Accordingly, a bank which allied with a limited number of high impact partners at launch, will scale by working with large, and also niche, players. Importantly, it will have already standardized and exposed the relevant APIs and webhooks for the use cases being explored with each of these partners. Basically, the bank, which used the launch stage to learn from its biggest partners, will now leverage its new partnerships to scale the business. This is what India’s ICICI Bank is doing by working with more than 100 partners just for building SME banking use cases.

Equally, banks need to develop the supply-side ecosystem, particularly because their clients may want services other than what they (the bank) provide. Sometimes these services may be something the banks use internally, such as the taxation database or SME registry in the country of operation, access to which they could offer to clients via APIs for a fee. The addition of adjacent capabilities like these will make banks’ API channels more attractive to customers. Some progressive banks are going further to offer even competing services through their channels.

Differentiate

That being said, the vast majority of banks are still in the early stages of launching a BaaS offering. Nonetheless, they should start thinking about a roadmap for scaling, and following that, differentiating, their proposition. Although BaaS is currently in a hype cycle, it is likely to start maturing shortly. However, it will not eclipse the other channels anytime soon. In that case, a BaaS offering’s differentiation will depend on the breadth and depth of its (bank’s) APIs and webhooks, and ease of partner onboarding. Today, even the most advanced banks take six to eight months to onboard a partner, instead of the ideal two weeks. There is also a need to standardize and streamline information security requirements, so partners don’t spend excessive time and effort in conforming to those expectations. While they are not there yet, it is expected that the progressive banks will achieve these goals in the near future.

The first is an outcome of broader supply-side and demand-side ecosystems; the more numerous the supply-side participants in a marketplace, the more valuable it is to the customers in the demand-side ecosystem, who are able to meet multiple needs through a single partnership (and way of working). Basically, the bank differentiates its BaaS offering by expanding its services to include a variety of adjacent non-banking services such as wealth management and insurance.

The learning effect comes into play when banks expand their supply-side networks and leverage the deeper understanding of partner needs to curate services more effectively. For instance, a bank working with several HR management systems may find that payroll processing APIs should be curated differently than general payment processing APIs. Since the learning effect depends on a bank’s unique ability to use insights, it can set a bank distinctly apart from the competition.

But all of that is still in the future. Banks, which are expressing keen interest in the BaaS model, must implement and scale it with alacrity. Customers want it, merchants are asking for it, and if the incumbent banks don’t respond, there are plenty of next-gen players who will be more than happy to provide it.

To learn more about framework to scale BaaS, download our report Developing Innovative Digital Banking Business Models

Perspective

Next Level CloudLed Transformation with APIs, EventDriven Architecture, & Data Analytics

K. R. Venkatraman

VP, Head Technical Architecture, Infosys Finacle

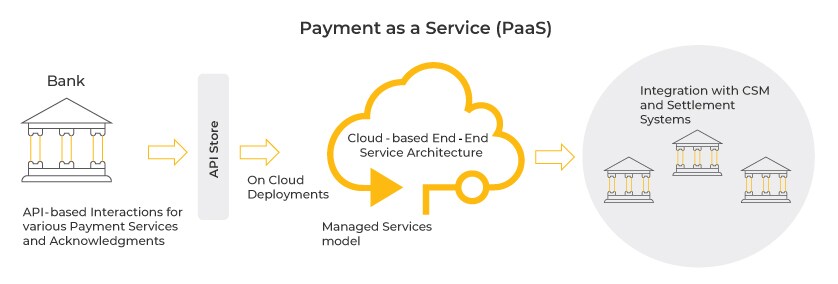

Cloud is one of, if not the, most important tools of transformation in the digital world. Its significance as a game changer has progressed far beyond dynamic infrastructure provisioning or IT modernization, to the stage of business transformation. It is no longer just a technology lever of efficiency, resilience, and scale but a catalyst of ecosystem innovation, time-to-market, and business value creation.

Over the years, Cloud has proven its worth by enabling agile delivery, providing compute on demand, transitioning infrastructure costs from Capex to OpEx, and in the specific context of banking, enabling financial institutions to evolve from consuming infrastructure-as-a-service to providing banking-as-a-service. Also, from a technology standpoint, platform-as-a-service models have been influential in changing the technology-cum-business focus of banking IT to a pure play digital and domain focus by relieving banks of the responsibility of managing their IT infrastructure.

Meanwhile digital technologies have unleashed waves of innovation in banking, driving rapid improvements in the quality of services delivered to customers, increasing competition, and raising customer expectations. On the other hands, customers are becoming more informed and connected and are increasingly demanding more than generic, one-size-fits-all banking services. As a result, innovations powered by these technologies have shown rapid progresses to achieve unprecedented levels of adoption.

A great example is how these technologies have supported the proliferation of UPI payments in India, which crossed 4.6 billion transactions in January 20221. In another example, Alibaba processed over 580,000 transactions per second in the latest singles day sale2.

It provides the much-needed computing power for implementation of technologies such as AI and blockchain. It also democratizes the access to the most advanced AI tools available today in form of cloud-native, subscription-based pay-per-use applications. What’s more, cloud can mitigate the cost, scalability and performance issues of blockchain – as indicated by the emergence of blockchain-as-a-service.

These digital technologies are at the forefront of the seismic shift which the global banking industry is undertaking. Vertically integrated banking monoliths are being displaced by digital ecosystems built around customers. The banking value chain is being reshaped and new business model archetypes are emerging.

Most banks, in varied stages of their transformation journeys, know that cloud is critical to succeeding in the new banking business realities. However, they are yet to embrace it fully; more than a quarter are yet to evolve definitive cloud strategies3. Now, it is time for them to take cloud (and cloud-led transformation) to the next level. From a technology perspective, three cloud-complementary technologies, namely APIs, event-driven architecture, and data analytics, are crucial to this agenda.

APIs

The availability of standardized frameworks around the API model is a crucial factor in delivering data at scale and driving innovation on cloud.

The best way to understand this is by looking at successful implementations. Emirates NBD was the first bank in the U.A.E. to launch an API sandbox, so it could capitalize on the open banking opportunity. With the help of more than 70 Finacle-powered APIs, ENBD’s Fintech partners were able to create several proofs of concept on the Bank’s platform4.

Nigeria’s pan-African financial services group, United Bank for Africa (UBA), leveraged RESTful APIs to integrate Finacle core banking with a customer’s ERP and reconcile branch transactions with its database. This enabled transactions in more than 700 branches to flow into the customer’s database and facilitated tracking by printing details, such as the transaction number, on depositors’ acknowledgement slips. It also made it easier for customers to reconcile sales and inventory online5.

Goldman Sachs took a cloud-based approach to disrupt the retail banking segment when they launched Marcus. Marcus offers extensive self-service capabilities on digital channels to design truly personalized products, giving end-consumers the flexibility to choose lending terms such as repayment amount and tenor. Marcus has designed and built modern technology operations by ensuring straight-through-processing across digital channels to its core banking solution, which leveraged the technical architecture of Marcus, along with its RESTful APIs and process orchestration capabilities to optimize operations6.

Event-driven design

A contemporary event-driven architecture uses business events to trigger API calls. The advantage of event-driven design is that the architecture is decoupled, with clear separation of concerns between systems that create events/data and those that ingest the events/data for further actions. It ensures that data produced in a certain format in a certain location can be easily consumed in an entirely different format somewhere else.

For example, transaction data generated in a bank’s legacy system on-premise may be consumed by a cloud-based analytics system to deliver insights via an API-driven ecosystem provided by a Fintech innovator.

Let us look at an example. One of Australia’s leading digital bank built a mobile application on the principles of event-driven design. With this, the bank was able to offer industry-leading customer experience with personalized real-time interactions, while achieving faster time-to-market for new products. Furthermore, the decoupled architecture reduced interdependencies and increased integration flexibilities, thus driving efficiency gains for the banks on multiple fronts7.

Data analytics

For decades, banks have sat on a mountain of underutilized customer data, but they have never been able to make the best use of it. In fact,

In this digital age, newer banking business models, built around collection, consumption and sharing of data between systems, continue to gain prominence. Consequently, the role of cloud as an intrinsic enabler, with its capability to store, process and exchange a large volume of data in real-time, becomes even more critical from a data analytics standpoint.

The opportunity is ripe for banks to derive insights from this data using the modern analytics technologies and generate incremental business value.

Sohar International partnered with Finacle to enhance customer-centricity with insights-driven banking. The bank leveraged big data and advanced analytics to deliver right insights at the right time, thereby enabling superior CX and efficient internal operations. With this, the bank was able to achieve 60% reduction in time taken across processes and increase alternative revenues and fees from up-sell/ cross-sell opportunities8.

Conclusion

The potential of cloud as a catalyst for the digital banking transformation is limitless. What’s important is the approach banks take to shape up their cloud strategies and roadmap. The initial phases of cloud transformation were centered around the promises of cost efficiency, infrastructure agility and flexibility. But now, it needs to step up to deliver data at scale and the enormous on-demand processing needs that come with it.

The confluence of these technologies, along with data analytics, will drive the next wave of cloud advancement and make for a compelling technological foundation to enable business model innovation.

Source:

- https://www.npci.org.in/what-we-do/upi/product-statistics

- https://www.moneycontrol.com/news/business/alibaba-singles-day-sales-hit-record-56-billion-at-583000-orders-per-second-6101481.html

- https://www.edgeverve.com/finacle/research-reports/efma-innovation-in-retail-banking/

- https://www.edgeverve.com/finacle/wp-content/uploads/2020/08/Driving_Open_Banking_Emirates.pdf

- https://www.edgeverve.com/finacle/casestudy/united-bank-africa/

- https://www.edgeverve.com/finacle/news/marcus-goldman-sachs-deploys-finacle-cloud/

- https://www.equalexperts.com/wp-content/uploads/2021/06/A_New_Benchmark_in_Banking_Experience_Case_Study.pdf

- https://www.intelligentcio.com/me/2022/04/27/bank-sohar-enhances-customer-centricity-with-insight-driven-banking/

Perspective

Real-Time Payments reach Corporates

Saurabh Garg

Principal Consultant, Infosys

As financial ecosystems evolve rapidly, corporate and government customers are demanding real-time payment options that are aligned with their emerging payment use cases. Corporates today do not see payments as just a credit transfer service, but rather as an ecosystem that can manage payments end-to-end. Companies are also looking beyond “normal” business requirements at better operational efficiencies, shorter time to realization of money, and quality end-to-end payment experiences. For banks, providing an effective real-time payments architecture is an opportunity to offer greater value to corporate customers.

Corporate payment systems have traditionally run on conventional batch processes. With real-time payments, banks can support new business use cases for corporates and at the same time, drive efficiencies for their clients through accurate working capital management and visibility of funds. As a result, corporates can assess cash positions and liquidity risks and make decisions instantly, instead of waiting for the day’s transactions to close. Accordingly, they are looking for new payment solutions that can offer the below-mentioned benefits:

Efficient Treasury Operations

Distribution and Supply Chain Management

Lean Payment Operations

Next-Gen Payment Solutions

Gearing Up for Real-Time Payments

Choosing a Transformation Strategy

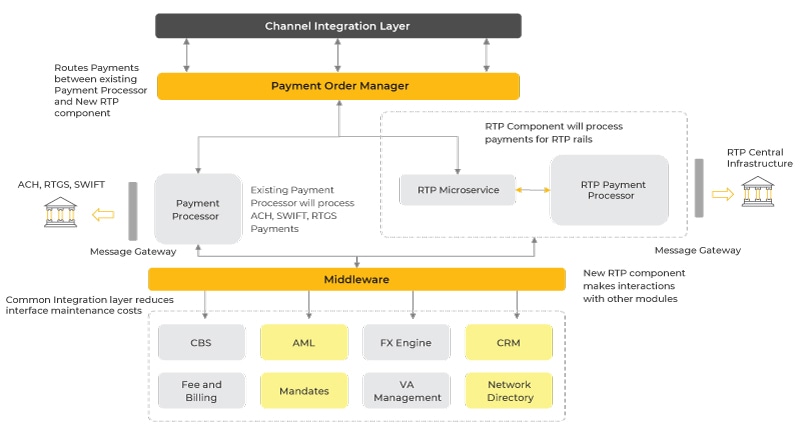

Banks must meticulously choose an approach that works best after evaluating their customer segments, business areas, and technology landscape, especially the integration capabilities and underlying architecture. While they may want to choose a single platform that provides the best for both traditional and modern payment rails and offers scalability for real-time payments processing, it may not work out that way. A single platform would still leave the bank with a monolith which can scale horizontally and vertically, but at a significant cost. This approach would be similar to a big bang migration with lengthy deployment cycles and slower business benefits flowing from real-time payments. This means banks will only be ready tomorrow, rather than today.

Therefore, it is imperative to think of options that bring immediate benefits, faster time to market, future-readiness and the possibility of systematically upgrading traditional rails without impacting them. Two strategic approaches to choose and deploy a real-time payments platform are:

Approach 1: Standalone Real-Time Platform (Cloud/ On-Premise)

Approach 2: Real-Time Payments as a Service through a Third-Party Service Provider

Looking Ahead: Implications of Real-Time Payments

As the payment ecosystem evolves, real-time payments will emerge as an important differentiator in corporate banking. With “digital” becoming pervasive, banks need to step up to support corporate payment use cases. Real-time payments allow banks to offer corporate clients greater value, and acquire new customers by offering value added services, thereby enhancing both customer loyalty and scale.

However, the question remains whether banks are ready to capitalize on the opportunity that real-time payment rails offer. What is beyond doubt is that regardless of the approach they take to offer real-time payments to corporate customers, banks must get to the task right now.

Perspective

Transforming culture to embrace cloud – a necessity for successful business model innovation

Rajashekhara V. Maiya

Vice President and Head, Business Consulting Group, Infosys Finacle

Through 2020-21, organizations in every industry, and in every country, sped up their digitization plans to cope with the unprecedented situation. Enterprises took to cloud in droves to support the sudden switch to work-from-home.

Banks had been experimenting with cloud computing – especially the infrastructure as a service option – for about a decade before Covid-19 happened. At that time, they were mainly looking to save costs, gain agility, and scale up their infrastructure on demand.

When the pandemic broke out, banks also advanced their transformation agendas by at least a couple of years to manage the spurt in digital transactions as well as the shift to remote working. Today, these organizations have even more reason to embrace cloud – think trends such as open banking, embedded finance, and platform business models, which are all powered by (mostly) public cloud.

It is projected that the global finance cloud market will grow at a CAGR of 22.3 percent between 2021 and 2026. This kind of large-scale cloud adoption, or full-fledged cloud transformation, is not just a technology play; just think about what it means to a highly regulated and risk-averse industry to let go of their data centers and entrust their data and applications to a third-party who could host it anywhere in the world. Cloud transformation is as much about changing the traditional culture of the bank as it is about modernizing its technology assets. Hence before going on cloud, banks should make sure four elements are in place:

Develop a cloud strategy, with all its details

This will shape the banks’ strategic objectives, goals and major milestones. Since the huge majority of vision and mission statements do not articulate their banks’ position on technology, the leadership may need to devote some thought and time to detailing their strategic intent with respect to cloud transformation. The strategy should see at least five to ten years into the future and consider the cloud evolution of other sectors, such as fintech, retailing, or manufacturing, which have all embraced cloud and associated technologies (APIs, AI, IoT) to remain relevant amid disruptive change.

Institutions without sufficient cloud expertise should seek the help of specialists to chart their strategies to make sure their goals, be it improving competitiveness, becoming agile, or something else, are served. However, explaining to employees, partners and investors why their banks are migrating to cloud after relying on captive data centers for decades, is something that the leaders have to do on their own. Leaders need to consider their responses carefully, making sure they convey the reasons for the decision, including the long-term vision, so that the message is understood down the ranks.

To secure widespread support for the transformation, there needs to be regular communication between the strategy team and peer groups that are not part of the strategy discussion, and also with customers, partners, investors and employees.

Curate the partnerships for implementing the strategy

Several actors play a role in implementing the cloud transformation agenda of an organization. Therefore, after a bank creates its strategy, it needs to find the right partners who will help implement it. The first people to call are the cloud service providers – either hyperscalers, such as Google Cloud, AWS, MS Azure or IBM Cloud, or regional players like Huawei or Cloud4C – who have rich knowledge and experience in implementing cloud for different purposes, industries and types of organizations. A bank may also like to talk to its peers about their alliances, to understand what is the best way to proceed. Banks, which already have some cloud experience, may wish to build on that by entering into a transformational alliance, enabling them to adopt cloud enterprise-wide, in multiple countries, and committed for the long-term. Other banks may be convinced that cloud is the way forward, but wish to experiment with it in a limited way before going all out. For them, the right starting point is a transitional partner alliance that takes a few solutions in a limited region to cloud, giving them a first-hand feel. But there will be a large number of banks that are still testing the waters, who would like to assess how well a system performs on cloud, before making any kind of commitment. They can form a transactional alliance, with a cloud-native fintech company, for example, to run just one type of transaction on cloud.

The same approach – transformational, transitional or transactional – should also be applied to all the other digital initiatives of the bank, from API to mobility implementations. There may even be a need for some cultural adaptation to support the chosen alliance – for example, a transformational alliance will demand that the bank commit itself fully, in terms of time, material, money, human resources and senior leadership support; a transitional alliance will need to be driven by a dedicated “cloud-oriented” group; but a transactional alliance only needs the partner organization to have the right cloud culture.

Strengthen the execution engine

The execution engine has to be involved throughout, starting from setting up policy and standard operating procedures; it is their role to ensure that partners are aligned with the bank in principle, and that there are contracts, clear timelines, project guidelines and reporting requirements to take that alignment through to implementation. A sponsor from the strategy team should support the execution team from above to keep things on track and within budget.

Quality of execution should be measured and monitored both qualitatively and quantitatively, under senior management supervision. The involvement of the leadership is especially important to ensure things are running according to plan and that new recruits are able to seamlessly slip into their responsibility of executing the company’s long-term cloud vision.

Carry the organization along

Since cloud transformation impacts the extended enterprise, it is essential to take all the stakeholders along on this journey. First of all, data center staff – the most affected by the change – should be rebadged and reskilled to take up new responsibilities.

Also, customer-facing staff should be educated in advance on the need for transformation, so they are ready with the right answers if there is some disruption of service during migration; this will enable them to enlist the support and confidence of customers through the transition.

Last but not least, there must be clear communication guidelines and standard procedures for dealing with the queries of suppliers, partners, and investors.

Summing up

Cloud was already an influential technology that became essential once the pandemic happened. It is the single largest factor in accelerating the digital transformation of enterprises, including banks. However, cloud migration is more than a simple technology implementation; to succeed fully, cloud must transform the enterprise, and especially its culture. There are four important steps in creating a cloud culture in an organization – evolving strategy, securing partnerships, executing with excellence, and taking everyone along on this very important journey.

Perspective

Transforming culture to embrace cloud – a necessity for successful business model innovation

Launched in 2020, LINE BK is Thailand’s first truly social bank. The Bank was launched with a mission to transform traditional consumer financing and revolutionize banking in Thailand, by providing accessible credit. In particular, one of the objectives was to provide Thai consumers better access to essential financial products and support them in navigating through the tough time during the COVID-19 pandemic outbreak. LINE BK is a joint venture between Kasikornbank, the leading retail bank in Thailand and LINE Corporation, the provider of the top messaging application with over 49 million active users in Thailand. The range of LINE BK services includes deposit accounts, debit cards, special interest rate savings account and unsecured loan.

Unlike conventional banking services that focus on pushing the available financial products to consumers, LINE BK decided to integrate itself into customers’ everyday life. LINE BK allows users of LINE App to easily open new deposit accounts and apply for other financial products all within the LINE app.

Meeting Credit Needs of Unpenetrated Segments

Since LINE BK is the result of user-first service design, the service is embedded into consumers’ everyday life as much as possible. Some of the advantages include:

A Scalable and Reliable System for Unsecured Loans