FINACLE CORPORATE

BANKING SUITE

Banks in over 100 countries rely on Finacle’s industry-leading solution suite to fast-forward their digital transformation agenda.

ACCELERATE TRULY DIGITAL

CORPORATE BANKING

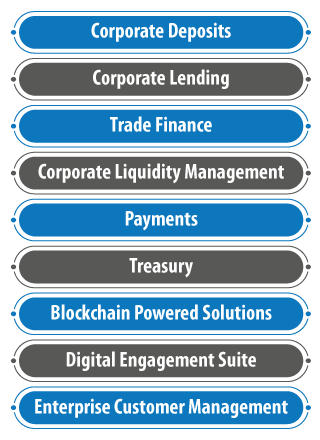

Finacle Corporate Banking is a comprehensive solution suite built on an advanced architecture. The solution addresses the trade finance, lending, syndication, payments, origination, limits, collaterals, treasury, deposits, liquidity management, online banking and mobile banking requirements of corporate banks worldwide and enables them to deliver customized offerings to enterprise clients of all sizes.

Finacle has helped corporate banks around the world reimagine their business with digital technologies to drive new revenue streams. The solution leverages emerging technologies such as blockchain and advanced analytics to offer impressive benefits to banks and their clients.

GET END-TO-END CORPORATE BANKING

CAPABILITIES WITH FINACLE CORPORATE

BANKING SOLUTION SUITE

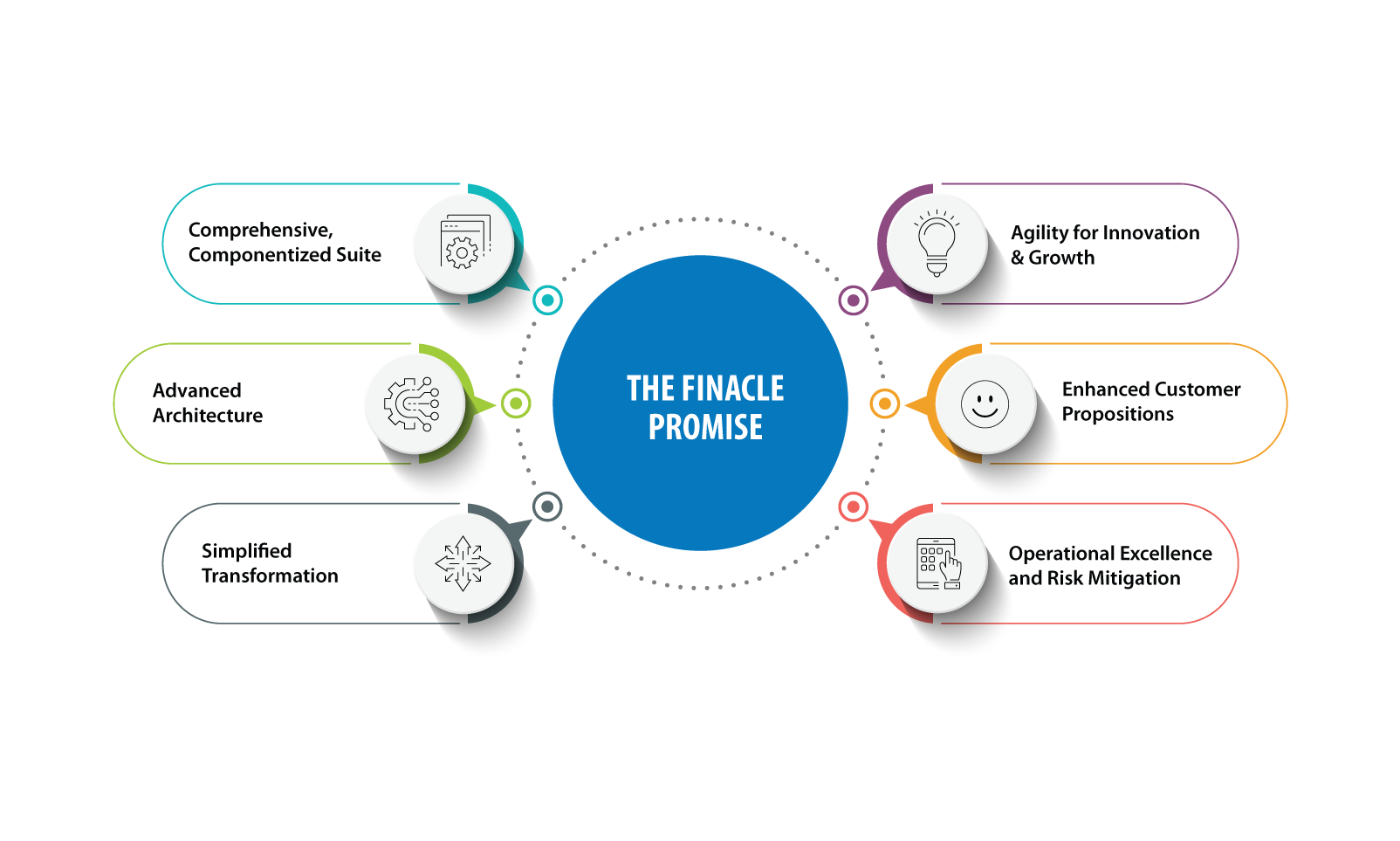

COMPREHENSIVE, COMPONENTIZED SUITE

MODERNIZE AT YOUR PACE

- A comprehensive, componentized platform of corporate banking solutions

- Freedom to choose products that match the bank’s business priorities, and flexibility to decide when to deploy or upgrade a particular component

- Transform at one go, or in a progressive, phased manner

Learn how Emirates NBD leveraged Finacle liquidity management solution to significantly enhance corporate customer propositions, resulting in a remarkable seven times return on technology investments.

ADVANCED ARCHITECTURE

Future proof your business with a modern platform which is agile, flexible and scalable

– Jost Hoppermann, VP and Principal Analyst, Forrester [As mentioned in The Forrester Wave™: Digital Banking Processing Platforms, Corporate Banking, Q3 2020]

SIMPLIFIED TRANSFORMATION

EXPERIENCE AGILE, RISK-MITIGATED MODERNIZATION

Whether it is a big bang switchover, progressive deployment or complete overhaul, Finacle helps your bank transform at its own pace by simplifying transformation and minimizing risks.

- Finacle reference bank models for cutting complexity and time

- Phased transformation for maximizing business outcomes

- Agile delivery for progressive launches

Learn how State Bank of India (SBI), India’s largest bank leveraged Finacle corporate banking solutions to power progressive multi country transformation across 27 countries in record 24 months, resulting in time-to-market reduction for new products introduction drop from 3-6 months to less than 30 days.

AGILITY FOR INNOVATION AND GROWTH

MAKING CORPORATE BANKS READY FOR DIGITAL ECOSYSTEMS

- Build a platform business by tapping new and diverse partner

networks within a larger ecosystem - Become marketplace operator for financial and non-financial

offerings recommending contextual offerings to corporates - Leverage third party channels on par with the banks own channels

RBL bank has implemented an API based trade finance innovation, enabling corporate clients make enquiries directly from their respective ERP solutions/applications and receiving responses from the trade finance and core banking system directly. The highly secure, open APIs have automated the manual process, ensuring shorter turn around, risk minimization, and deeper integrations with corporate workflows.

Talk to us to know how Finacle is driving API based trade finance innovation at RBL, one of India’s fastest growing banks.

ENHANCED CUSTOMER PROPOSITIONS

CONSUMER BANKING LIKE DIGITAL EXPERIENCES FOR YOUR CORPORATES

- Finacle digital engagement hub gives clients seamless access to corporate services across channels and devices

- The enterprise level dashboards provide graphical views of liquidity positions on-the-go, cash flow forecasting and liquidity management structuring options

- Build new operating models to deliver products and services across channels in a cost effective way and fulfill new customer needs through innovation

- Leverage data-led insights to understand your corporate customers better, identify business opportunities, reduce costs and craft tailored solutions

“Using Finacle solutions, Santander will provide our corporate customers a single point of access to better manage their interbank global commercial cash flow conveniently and securely…”

– Bart Timmermans, Head of Global Transaction Banking (GTB), Santander UK

OPERATIONAL EXCELLENCE AND RISK MITIGATION

REDEFINING OPERATIONAL INDEXES FOR THE DIGITAL WORLD

- Adopt new business models built on the latest digital tools, such as robotics, big data, AI, and blockchain

- Leverage a host of automation enablers to help you transform with agile processes, higher effciencies, leading to better customer experiences

- Build comprehensive risk management capabilities across the core for unified real-time view of exposures, enabling effective risk mitigation strategies

Learn how ICICI Bank on-boarded over 250 leading corporates for domestic / international trade finance transactions, enabling inter organization automation leveraging blockchain.

![]() Traditional Automation Levers

Traditional Automation Levers

- Rules based STP

- Open APIs driven automation

- Business process management and workow capabilities

![]() Robotic Process Automation

Robotic Process Automation

- Automate repetitive and rule based human processes

- Cognitive automation through Infosys Nia

![]() Inter Organization Automation

Inter Organization Automation

- Blockchain powered private, permissioned networks for payments and trade finance

RESOURCES

Corporate Banking Brochure

Finacle Corporate Banking is a comprehensive suite of solutions built on an advanced architecture to address the trade finance, lending, syndication, payments.

Thought Paper

Success in the digital economy is a function of scale. Ecosystems are the new assets for a business and the value created or exchanged in these ecosystems their return.

Case Study

Commercial Banking is one of the most ambitious programs at The ING Group. In early 2013, ING in partnership with Infosys Finacle embarked on a massive exercise to transform its commercial b

Know us better

Ask for a Meeting

Thanks for your interest!

Our team will get in touch with you soon.