Who We Are

Finacle is an industry leader in digital banking solutions. We partner with emerging and established financial institutions to inspire better banking. Our cloud-native solution suite and SaaS services help banks to engage, innovate, operate, and transform better.

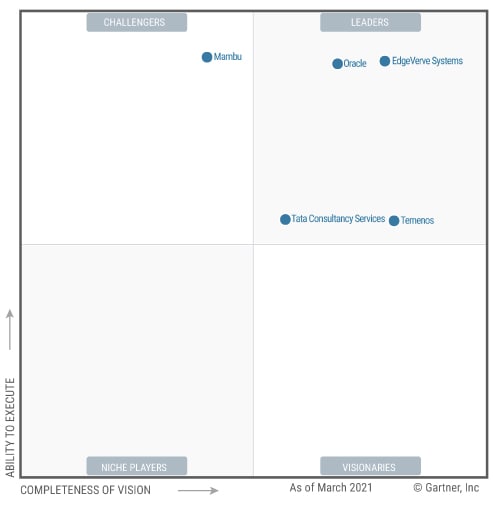

We are a business unit of EdgeVerve Systems, a wholly-owned product subsidiary of Infosys – a global technology leader with over USD 15 billion in annual revenues.

We are differentiated by our functionally-rich solution suite, composable architecture, culture, and entrepreneurial spirit of a start-up. We are also known for an impeccable track record of helping financial institutions of all sizes drive digital transformation at speed and scale.

Today, financial institutions in more than 100 countries rely on Finacle to help more than a billion people and millions of businesses to save, pay, borrow, and invest better.

Inspiring Better Banking Across

- 100+ countries

- 110,000+ branches

- Over a billion people

- Millions of businesses

- 1.7 billion accounts

What We Offer

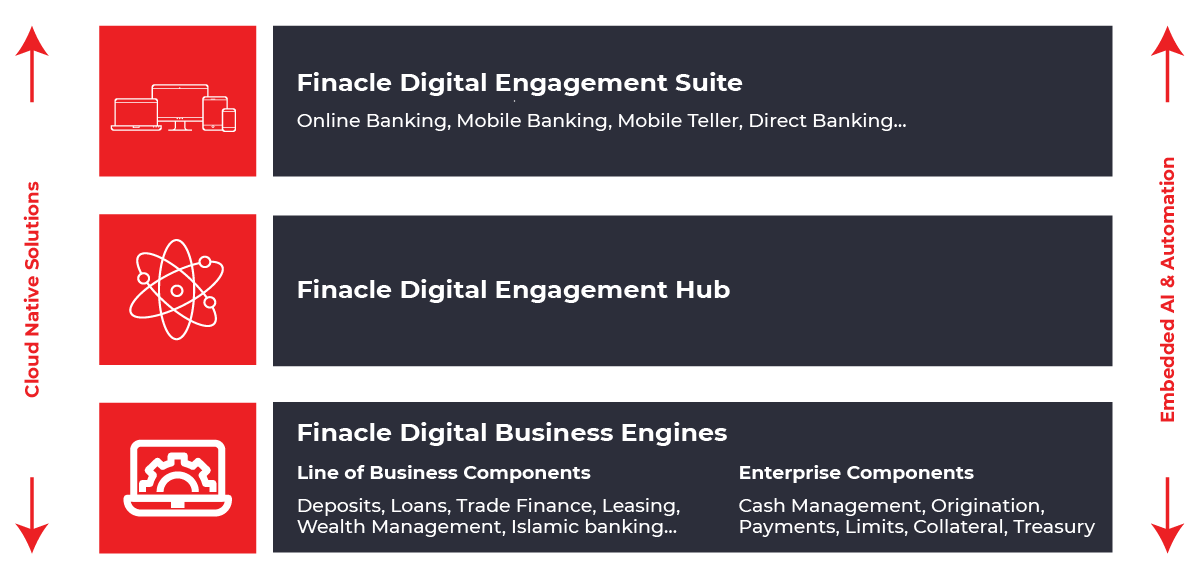

Finacle solutions address the core banking, lending, digital engagement, payments, cash management, wealth management, treasury, analytics, AI and blockchain requirements of financial institutions

Finacle solutions support various modern and traditional customer engagement channels, enterprise capabilities, line of business components, and business segments, such as Retail, Wealth, Islamic, Business, and Corporate banking.

Finacle’s componentized structure allows banks to deploy and upgrade solutions flexibly as per their business priorities. Our comprehensive and versatile suite powers truly digital transformation for financial institutions of all types – traditional or emerging, global or regional, omnichannel or digital-only.

What can banks expect from Finacle?

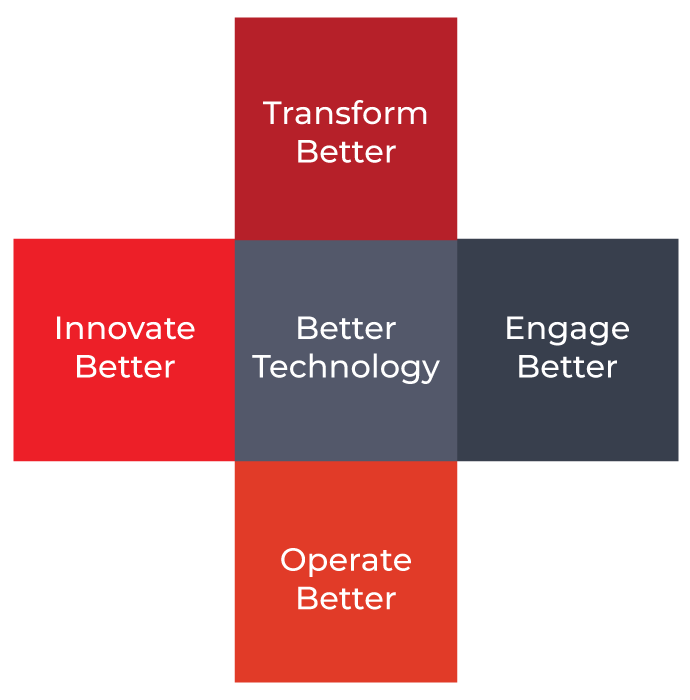

At the heart of our mission of inspiring better banking are five promises –

- To deliver solutions built on Better Technology, so that banks can unlock new possibilities and enrich the financial lives of their customers

- To help banks Engage Better with their customers, employees, and partners so that they can drive purposeful growth

- To empower banks to Innovate Better, to create new value, and be more competitive

- To unlock ways to Operate Better, so that banks can reduce costs and be more sustainable

- To help banks Transform Better so that they can stay relevant to evolving market dynamics

Solutions powered by Better Technology

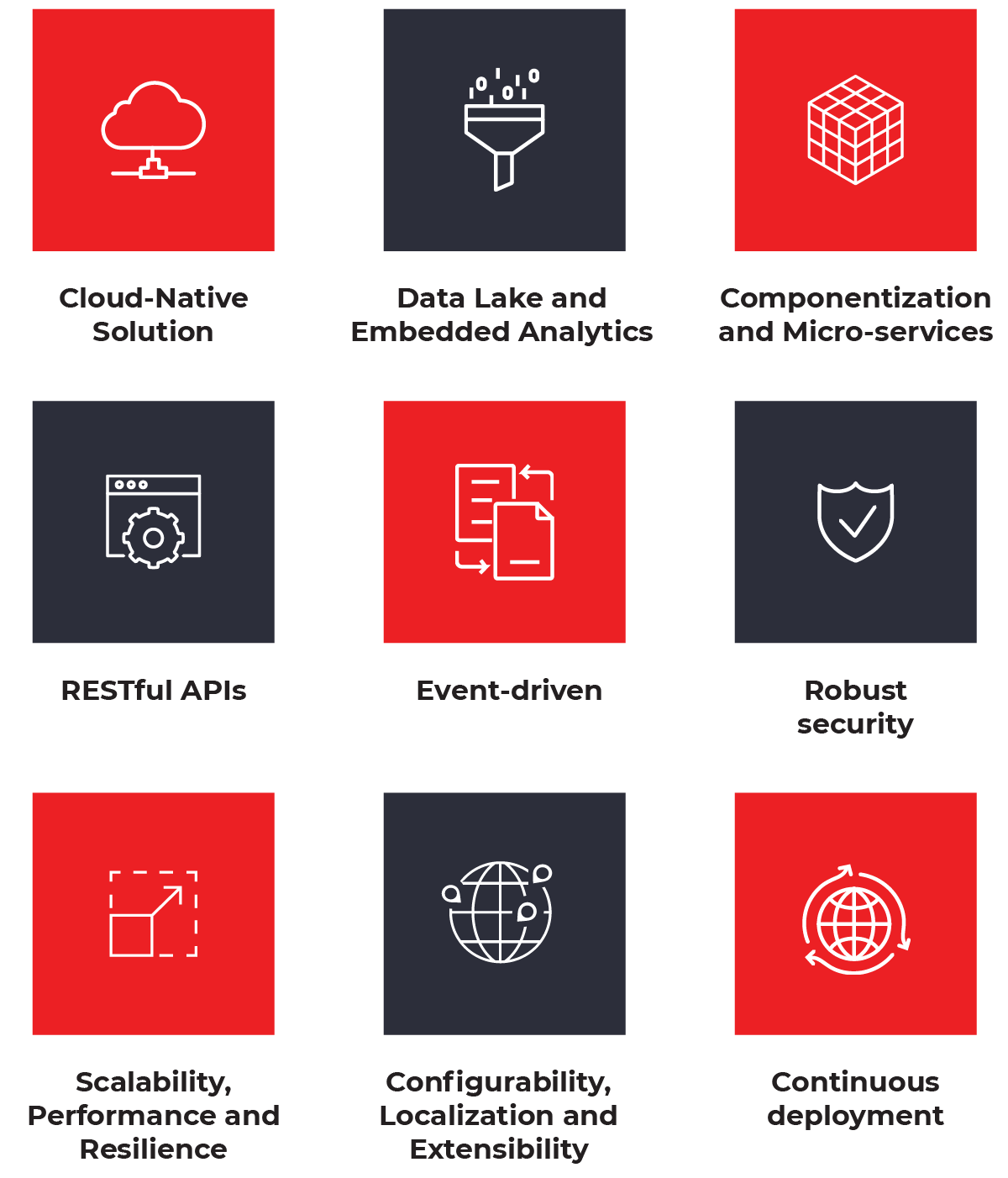

Finacle solutions enable banks to unlock benefits of modern technology and accelerate digital transformation at scale.

Our solution suite is cloud-native, componentized and open APIs driven, to help banks transform into an agile, scalable and open enterprises, ready to benefit from new-age possibilities.

Finacle solutions run in a containerized environment orchestrated by Kubernetes. They can be deployed on a private, public or hybrid cloud or accessed in a software-as-a-service model.

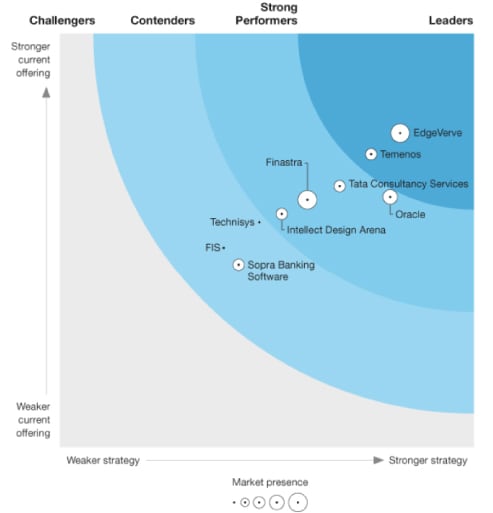

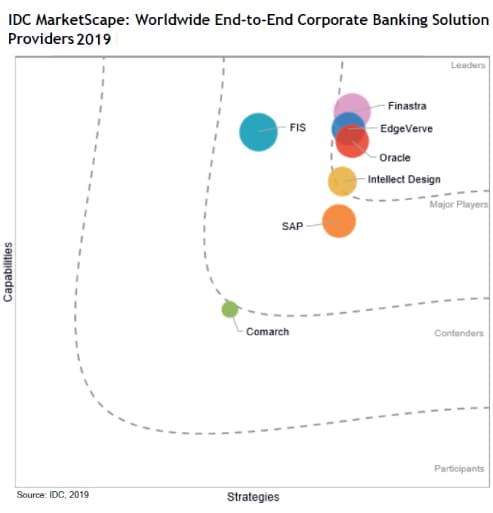

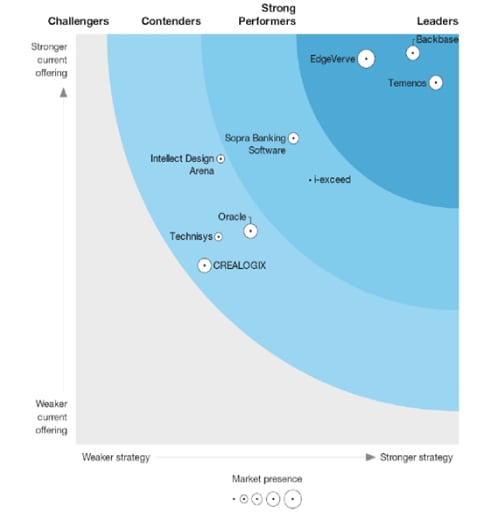

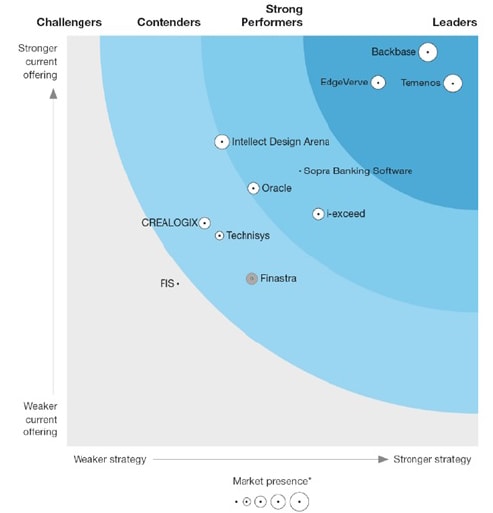

Our modern architecture has enabled Finacle to be consistently rated as a leader across core banking, digital engagement, corporate banking, and payments space by major industry analysts

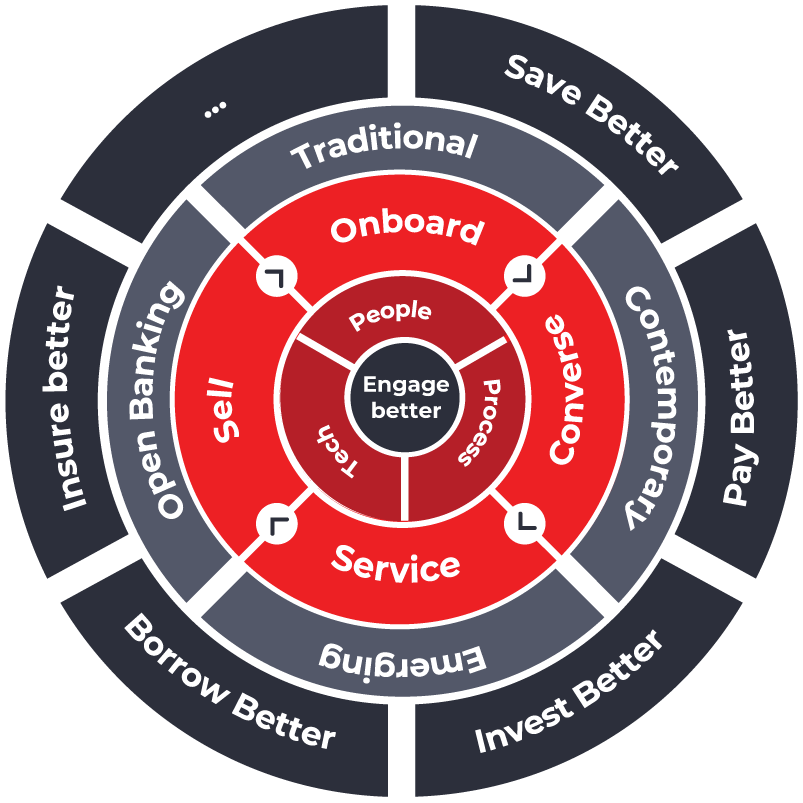

Engage Better

to drive growth

Finacle help banks engage better with their customers, employees, and partners. We do this by helping banks design and deliver truly personalized products and services. Built on a unique engagement hub, our suite helps banks onboard, sell, service, and converse better with customers. In fact, banks running on Finacle have realized an average 19% improvement in their NPS scores.

Onboard better

- Mobile first omnichannel journeys

- OCR based document capture

- Biometrics and liveliness test for safe and secure access

Converse better

- Enterprise customer data platform

- Personalized insights – descriptive, diagnostic, predictive

Service better

- Full suite of services on traditional, modern and emerging channels for every type of user – end customer, bank staff and trusted third parties

Sell better

- Effective customer segmentation

- Personalized campaigns

Finacle is the Platform of Choice for:

Well-established financial institutions that seek comprehensive digitization across front to back enterprise systems, such as DBS, Emirates NBD, ICICI Bank, ING, Santander, Standard Bank and State Bank of India

Digital-only banks, branch-less banks that seek to integrate into their customers’ digital lives, such as Digibank by DBS, Discover Financial Services, Liv. by Emirates NBD, Marcus by Goldman Sachs, and Nequi by Bancolombia

Financial technology organizations (FinTech) transforming financial services through emerging technology, such as Paytm and Resimac

Non-financial companies such as telcos, insurers, and retailers, who are leveraging connectivity to help customers manage their finances such as India Post and Manulife

Innovate Better

to stay competitive

We help banks differentiate with unique value propositions through continuous innovation. Banks can go-to-market faster with our flexible product factories that bring global innovations to life with simple configurations. Banks can compose contemporary, future-ready digital business models with ease, using our open APIs, webhooks, and App Centre. In fact, Banks running on Finacle have experienced an average 20% improvement in ecosystem innovation and 16% uplift in digital sales.

Products and services innovation

- Feature rich product factories with comprehensive parameterization

- Base product enriched with global innovation

- Configure self-developed, co-innovated, thirdparty products

Channel innovation

- Unique digital engagement hub for omnichannel innovation design

- Comprehensive suite of packaged channel solutions

- Open APIs and webhooks for accelerating channel innovation

Ecosystem innovation

- Pre-packaged API store for ease of collaboration with external ecosystem

- Blockchain powered innovation networks

- Finacle App Center – Marketplace of 60+ partner apps

Operate Better

to reduce costs

In a hyper-competitive world, Finacle helps banks to reduce costs and be more sustainable. Finacle enables straight-through processing, driven by rules and APIs, and supported by an in-house RPA platform. It helps banks automate workflows across applications seamlessly, saving precious effort, time and money. Our blockchain-powered solutions open up new levels of efficiencies by automating inter-organization processes. An assessment of the top 1000 banks globally confirms that institutions powered by Finacle enjoy a 3.9% point lower cost-to-income ratio over their peers

Smart processes

- Customer first, APIs and ecosystem first, insights first, and automation first propositions

- Customer-centric journeys with focus on digital self-service

Augmented workforce

- Blended workforce propositions with RPA bot factory, embedded insights and context switching between humans and machine

- Multiple co-innovation platforms for collaborative growth

Technology advantage

- Multi-entity, Multi-CCY capabilities to operate regional and global hubs

- Continuous evolution with DevSecOps enablement

Traditional Automation Levers

Rules based STP

Open APIs driven automation

Business process management and workflow capabilities

Robotic Process Automation

Automates repetitive and rule-based human tasks

Processes Cognitive automation

through Infosys Nia

Inter Organization Automation

Blockchain powered private,

permissioned networks for payments, trade finance and digital identity

Reference Bank

Global best practices and innovations

Parameterization for geo-specific innovations

Interface adapters with local banking infrastructure

Phased Transformation

Progressive modernization

A phase-wise approach

Value realization based prioritization

Agile Delivery

Industry-leading agile practice

Progressive launches

Risk management and strong governance

Transform Better

to stay relevant

Finacle helps banks to transform better so that they can stay relevant to evolving market dynamics. With a componentized digital suite and flexible deployment options, we empower banks to mitigate risk and transform and upgrade in a phased manner. Our DevOps toolchain helps banks to build, test, deploy and monitor new capabilities with speed to stay ahead of the competition.

Our global product suite, local expertise and a team of inhouse and partner experts is helping banks across 100+ countries to scale their digital transformation with confidence.

Simply put, in mission-critical transformations, Finacle and our ecosystem partners ensure banks have access to seasoned experts to help navigate the future.

Better Inspires Better

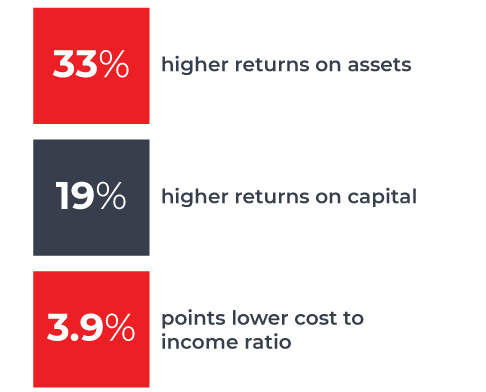

The industry-leading performance of our clients reflects our promise of inspiring better. An assessment of the top 1000 banks globally revealed that institutions powered by Finacle enjoy –

- 33 % higher returns on assets than others, with average returns on assets at 1.2% and top-performing client at 4.7%

- 19 % higher returns on capital than others, with average returns on capital at 15.6% and top-performing client at 33%

- 3.9 % points lesser cost-to-income ratio than others, with the average ratio at 47.2% and top-performing client at 16%

Sources –

1. Independent client value assessment, 2020

2. Assessment of the top 1000 banks in the world by The Banker, 2020