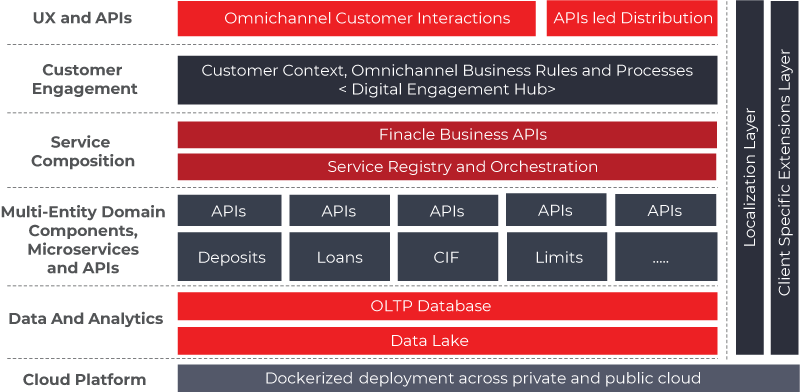

Layered and composable architecture

Finacle offers a componentized solution suite that can be composed flexibly to power truly digital transformation for financial institutions of all types – established or emerging, global or regional, omnichannel or digital-only. Highlights include –

- Optimum mix of componentization granularity

- Clear decoupling and separation of concerns between layers and components

- Full-stack organic design resulting in coherent architectural choices

- Polyglot by design – Fit for purpose technologies at each layer

- Open-source components supported across the stack

- Proven extensibility framework to support region-specific localizations & bank-specific extensions across all the application layers without any source code change

- Containerized deployment across on-premise or on-cloud infrastructure

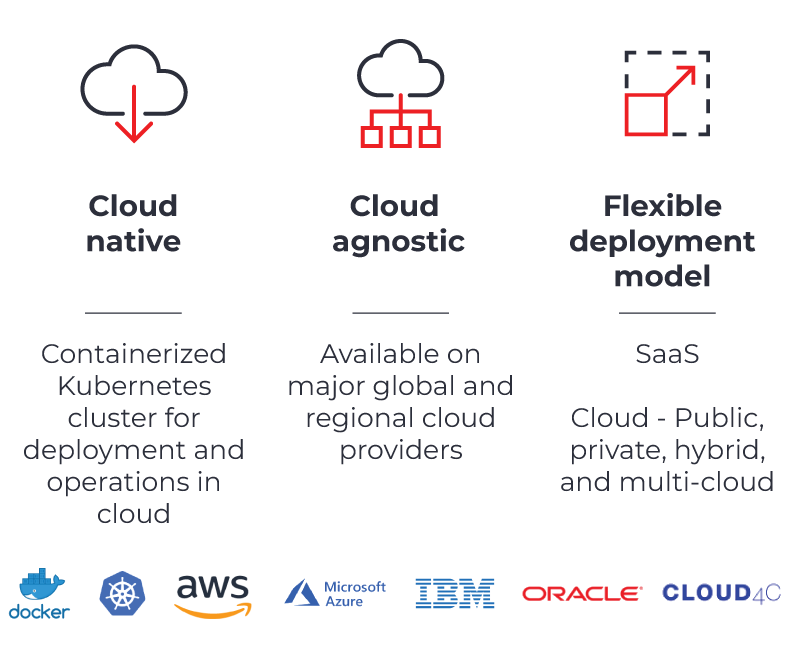

Cloud-native suite

Finacle offers a cloud-native, cloud-agnostic digital banking suite that can be deployed flexibly. The solution components run in a containerized environment orchestrated by Kubernetes. They can be deployed on a private, public, or hybrid cloud or accessed in a software-as-a-service model.

We have partnerships with all major global and regional cloud providers, including AWS, Microsoft Azure, Google Cloud, IBM, Redhat, and Oracle. Whether a bank is looking to transition entirely to the cloud or do it progressively in phases, Finacle provides the necessary flexibility and support. Finacle’s componentized structure allows banks to choose any combination of solutions matching their specific business priorities and modernization strategy.

As a Cloud Native Computing Foundation (CNCF) member, we are working with a global community to build and shape the cloud-native ecosystem. Finacle applications are developed using the cloud-native Twelve-factor App Methodology. This approach prevents vendor lock-in and allows applications to be ported to any Kubernetes-based environment on any cloud.

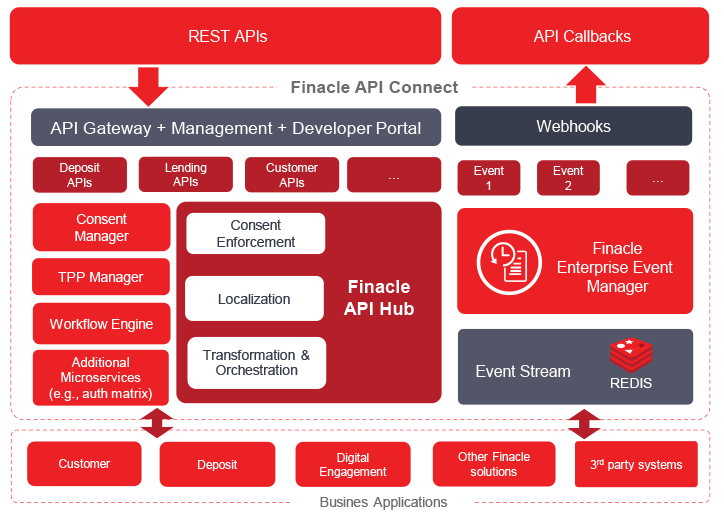

API-first suite

Finacle provides a comprehensive suite of open APIs and webhooks. All solution capabilities are exposed through APIs to enable banks to connect and co-innovate within the organization and with customers, partners, and the extended developer ecosystem.

- Business API Suite – A vast catalog of BIAN-inspired pre-pack aged business APIs powering various banking functions, bundled into domain packages

- API Hub – A unified platform to design, develop, and orchestrate API interactions with multiple enterprise applications; offers a GUI-based API Flow Builder and an API Workflow Manager

- Event Hub – A dedicated hub to define, detect and publish business events from across any of the digital banking applications. The Kafka-based event streaming platform is capable of handling millions of events a day

- API Management – A pre-configured set of tools to manage the end-to-end API lifecycle; offers an API gateway to facilitate exchange of API calls at scale

- Developer Portal – A portal to register and manage clients, prospects, and developers with a sandbox environment and self-service account management tools

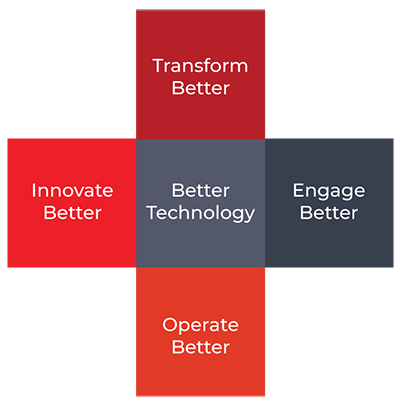

Technology that powers our promise

At the heart of our mission of inspiring better banking is the continuous journey of improvement in our technology and solutions. Our technology is the foundation on which we deliver our promises –

- To help banks Engage Better with their customers, employees, and partners, so that they can drive purposeful growth

- To empower banks to Innovate Better, to create new value, and be more competitive

- To unlock ways to Operate Better, so that banks can reduce costs and be more sustainable

- To help banks Transform Better, so that they can stay relevant to evolving market dynamics

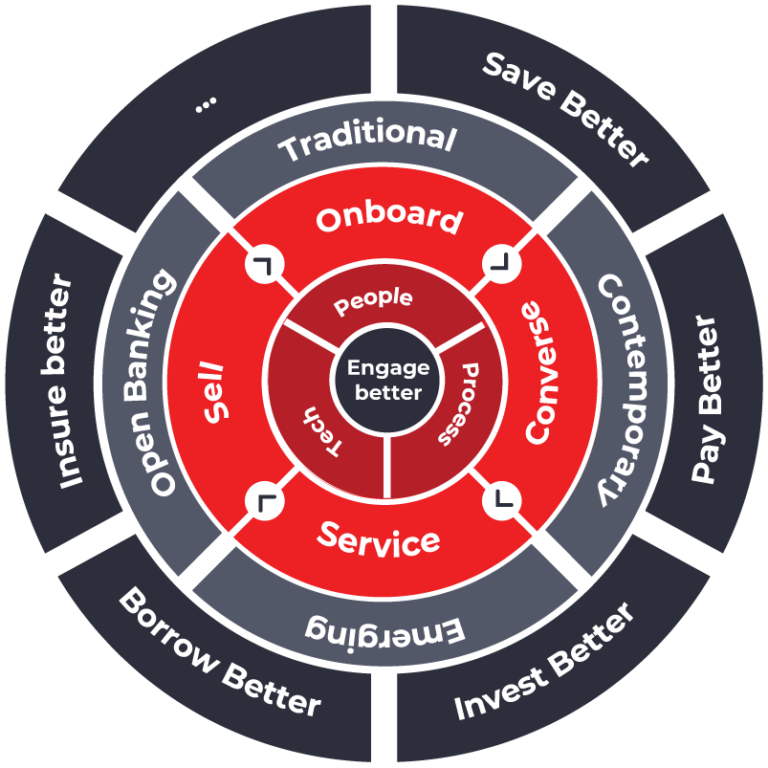

Engage Better

Finacle help banks engage better with their customers, employees, and partners, so that they can drive purposeful growth. Built on a unique engagement hub, our suite helps banks onboard, sell, service, and converse better with customers. Highlights include –

- Customer-led engagement architecture supporting contextual experiences, robust cross-sales, and nudges for financial well-being

- Unified channel administration centralizes process design for assisted and self-service channels.

- Context manager enabling seamless cross-channel customer journeys and experiences across channels, applications, and devices.

- Customer preferences and entitlements management enabling personalized channel experiences across devices and channels

- Flexible experience design – Decoupled UX architecture empowers banks to flexibly design user experience basis brand preferences

- Unified digital innovation factory – The extensive parameterization enables centralized services and transaction design to dramatically shorten time to market.

On average, banks running on Finacle have realized a 19% improvement in their NPS scores.

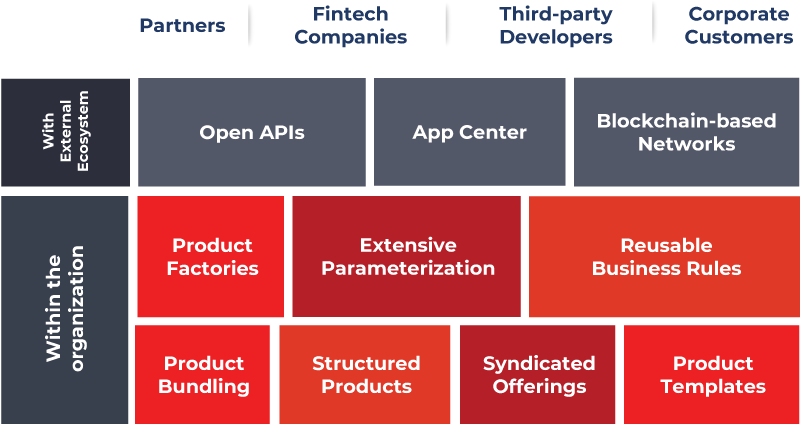

Innovate Better

Finacle helps banks differentiate with unique value propositions through continuous innovation. Banks can go-to-market faster with our flexible product factories that bring global innovations to life with simple configurations.

Banks can also compose contemporary, future-ready digital business models with ease, using our open APIs, webhooks, and App Centre. Highlights include –

- Product capabilities such as extensive parameterization, product bundling, and product templates drive speed to market and power innovation-led growth

- The architectural construct of an immutable global product codebase, localization layer, and customization components enable access to global innovations while enabling the agility to extend the solution independently

- A full suite of Open APIs, eventing infrastructure, and webhooks for ease of collaboration with partners, FinTech companies, corporate clients, and the extended

developer ecosystem - DevOps toolchain helps banks to build, test, deploy, and monitor new capabilities with speed

The industry-leading performance of our clients reflects our promise of inspiring better. Banks running on Finacle have experienced an average 20% improvement in ecosystem innovation and 16% uplift in digital sales.

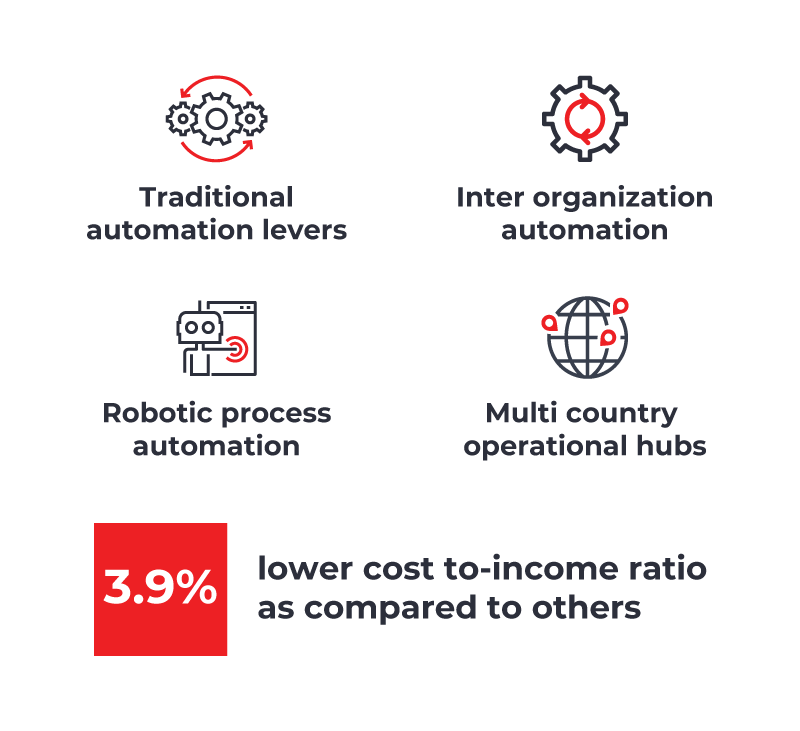

Operate Better

In a hyper-competitive world, Finacle help banks to reduce costs and be more sustainable. Finacle enables straight-through processing, driven by rules and APIs, and supported by an in-house RPA platform. It helps banks automate workflows across applications seamlessly, saving precious effort, time and money. Highlights include –

- Enterprise-wide engines, such as payments hubs and customer data hub, to orchestrate org-wide business processes and enhance automation

- Multi-entity support to create regional operations hubs across multiple countries, time zones, and languages

- Over-the-top AI-based applications to automate processes across the front to back office

- The suite supports horizontal, vertical, and functional scalability. It is proven for high availability and performance. In fact, Finacle’s largest core banking implementation powers over 500 million accounts.

- Unified security framework across application, infrastructure, and data

- Blockchain-powered solutions open up new levels of efficiencies by automating inter-organization processes.

An assessment of the top 1000 banks globally revealed that institutions powered by Finacle enjoy 3.9 % points lower costs to income ratio than others, with an average ratio of 47.2% and top-performing client at 16%.

Transform Better

Finacle helps banks Transform Better, so that they can stay relevant to evolving market dynamics. With a componentized digital suite and flexible deployment options, we empower banks to mitigate risk and transform and upgrade in a phased manner. Our global product suite, local expertise, and a team of in-house and partner experts are helping banks across 100 countries to scale their digital transformation with confidence. The key deployment models available to Finacle clients include:

- Client-specific cloud-based SaaS model: Finacle solutions offered as a service on Infosys managed cloud environment

- Multi-client cloud-based SaaS model: Finacle solutions offered as a service in a multi-tenant model on Infosys managed cloud environment

- Private cloud deployment: Containerized solution deployment in the bank-owned private cloud infrastructure

- Client managed public cloud: Containerized solution deployment in the public cloud platform, leased by the client

- On-premise installation on traditional data centers: Traditional on-prem deployment approach in bank-managed data centers, with a broad range of technology stack option including open-source stack

Our clients have won 21 industry awards for exemplary transformation programs using our solutions in the year 2021, making us the most awarded solution provider in the industry.

Reference bank

Global best practices and innovations

Parameterization for geo-specific

innovations

Interface adapters with local banking infrastructure

Phased transformation

Progressive modernization

A phase-wise approach

value realization based prioritisation

Agile delivery

Industry-leading agile practice

Progressive launches

Risks management and strong governance

Reference bank

Global best practices and innovations

Parameterization for geo-specific

innovations

Interface adapters with local banking infrastructure

Phased transformation

Progressive modernization

A phase-wise approach

value realization based prioritisation

Agile delivery

Industry-leading agile practice

Progressive launches

Risks management and strong governance