ACCELERATE YOUR JOURNEY TOWARDS A TRULY

DIGITAL PAYMENTS PLATFORM

Finacle Payments Suite, which includes an advanced real-time payment services hub, a blockchain-based payments solution, and an enterprise-class message transformation engine, is designed to help banks successfully transform and modernize their payments landscape.

![]()

Finacle Payments

A real-time enterprise payments services hub for emergent payment rails – Real-time, instant, or faster payments

![]()

Finacle Payments Connect

A blockchain based enterprise solution to simplify global payments processes and provides frictionless experience

![]()

Finacle Message Hub

An enterprise class message transformation engine built leveraging ISO 20022 standards to simplify messages management

THE FINACLE PROMISE

COMPREHENSIVE, COMPONENTIZED PAYMENTS SUITE

A real-time payments platform, with proven scalability to meet emergent business needs and the agility to respond swiftly to emerging market trends. The SWIFT certified payments hub is designed leveraging ISO 20022 standards to deliver seamless interoperability across various global and local payment

networks – be it real-time, instant, or faster.

Finacle Payments Suite

Provides real-time, frictionless payments experiences anytime, anywhere

Own channels

Branch, Online, Mobile, Wallet,

Social, Wearables…

APIs led distribution

3rd party apps, FinTechs, Partners,

Clients, Other Financial Institutions

Finacle Payments | Finacle Message Hub | Finacle Payments Connect

ADVANCED ARCHITECTURE

Experience a modern real-time payments platform

The real-time Payments platform from Finacle, which is built on the most advanced architecture in the industry, empowers banks to transform their

payments business with scale and speed.

Industry’s most advanced architecture, empowering you to do more

Cloud-native

Componentization and micro-services

Declarative and RESTful APIs

Enterprise-class capabilities

Event-driven architecture

Technology platform choice

Scalability, performance and resilience

Configurability, localization and extensibility

Data and insights driven

Contextual workflows for different schemes

Truly 24*7 & real-time processing

Multi* capabilities

SIMPLIFIED TRANSFORMATION

Experience agile, risk-mitigated modernization

Whether it is a big-bang switchover, progressive deployment or complete overhaul, Finacle helps banks transform payments business with agility, and in risk-mitigated fashion.

Simplified and risk-mitigated transformations

![]()

Reference bank

Global best practices + innovations + localized solution

Coverage for local products – parameterization for geo-specifc innovations

Interface configuration for local payments systems, third party agencies

![]()

Phased transformation

Progressive modernization

A phase-wise approach

Business priority mapping and value realization

![]()

Agile delivery

SAFe Agile Practice

CI-CD, end to end release automation

Progressive launches

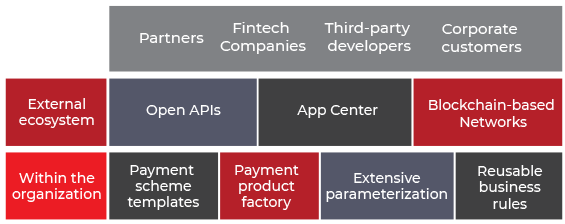

AGILITY FOR INNOVATION AND GROWTH

Making the payments business ready for the digital, real-time world

- Extensive product capabilities provide the flexibility to offer tailored payments and value-added services

- Open APIs for ease of collaboration with partners, Fintech companies, corporate clients, and the extended developer ecosystem

- Blockchain-based networks to digitize cross-border payments

Simplified and risk-mitigated transformations

ICICI BANK REMITTANCE-AS-A-SERVICE NETWORK

ICICI Bank, a leading private sector bank in India, has enabled remittance-as a-service among its partner banks in global strategic corridors.

ENHANCED CUSTOMER PROPOSITIONS

Enabling customer centricity in payment solutions

- Seamless access to payment services across channels and devices with Finacle Digital Engagement Suite

- Open APIs to support multiple open payments initiatives, accelerate innovation with external ecosystems and deeply embed payment solutions into corporate systems

- Innovations built on a real-time foundation – smart payment solutions, including host card emulation-based and sound wave-based contactless payments

Powering Santander UK’s International Cash Management System

Finacle’s digital offering will help Santander UK to strengthen its multi-channel cash Management, cash forcasting and payment services to better serve its corporate customers.

Alberto Gonzalez, Head of Product Development UK Global Transaction Banking, Santander UK

(Referring to Finacle solution for Cash Management Transformation)

Extensive automation opportunities to significantly boost efficiency, reliability and operational excellence

![]()

Rules based STP

Open APIs driven automation

Business process management and Workflow capabilities

![]()

Automate repetitive and rule based human processes

Cognitive automation through Infosys Edge products

![]()

Blockchain powered private, permissioned networks for payments and trade finance

OPERATIONAL EXCELLENCE AND RISK MITIGATION

Managing operational indexes and risks in the agile, open payments era

- Rule-based STP and open APIs to automate integration and enable seamless information flows

- Multi-tenancy on a single instance of application, infrastructure and database, to centralize operations or create regional hubs

- Navigation based UI and simplified user experience with workflow-based task work-trays for multiple scenarios

QATAR NATIONAL BANK

Payments transformation to power its digital banking strategy

With Finacle’s enterprise class Payments Hub, the bank is able to deliver seamless interoperability across various global and local payment networks, providing clearing services, and comprehensively supporting multiple payment types and instruments.

AN INDUSTRY LEADING SOLUTION

Finacle Payments solution is chosen as a leader in independent industry assessments by major analyst firms.

![]()

Positioned as a Leader in Integrated Payment Platforms in IDC MarketScape: Worldwide Integrated Payment Platforms 2019-2020 Vendor Assessment

![]()

Recognized as the best-selling Payment solution provider in the IBS Intelligence Sales League Table 2021

![]()

Rated as a leader in The Forrester Wave™: Digital Banking Processing Platforms (Corporate Banking), Q3 2021

Rated as a leader in The Forrester Wave™: Digital Banking Engagement Platforms, Q3 2021

RELATED RESOURCES

CORE BANKING BROCHURE

The Finacle Core Banking solution provides banks a comprehensive set of capabilities, including flexible product factories, extensive parameterization, and product bundling…

12 TRENDS RESHAPING BANKING

It took ten years for customers to shift from branches to digital channels. In 2022 and beyond, banks need to capitalize on the big trends…

UNLOCK NEW BUSINESS MODEL OPPORTUNITIES

Discover new business model archetypes – Banking as a Service, Marketplace Banking, Banking Utilities, Digital Finance advisor, and more…