In late 2018, Netflix, as part of its Black Mirror franchise released “Bandersnatch”. Set in the 90s, this movie narrates the story of the protagonist Stefan Butler who goes through an intriguing maze of experiences while coding a video game. There is something very unique about this movie. The viewers are in control of the storyline! At each decision point in Stefan’s life it is the viewer who takes a call (two options crawl up and user has to make a choice). Personally it took me a while to appreciate the novelty of the concept, then I ended up spending quite some time figuring out alternate endings by going back and changing my decisions. Wish life itself offered this level of gamification!

Take Away

So what can be the possible take away from this borderline audacious experiment of a movie?

Note: I wish to make this blog interactive, where you would make choices while reading through and I could narrate as per your taste/preference/ “choice”. As a quintessential product person I will proceed and keep the above interactive-blog idea in my backlog or save it for the next hackathon!).

In the world of products, we often face the dilemma of offering choices to the end user. Offer too many options and it will add to the cognitive friction, make it too little and users star feeling a general lack of autonomy. (a negative bias sets in).

Bandersnatch did offer some clues in offering choices the right way.

The Bandersnatch paradigm

User gets to choose

Users of your product, like the viewers of the movie should always have different options to shape up their journey. Choices should be made evident and there should be abundance of options.

There are different possibilities

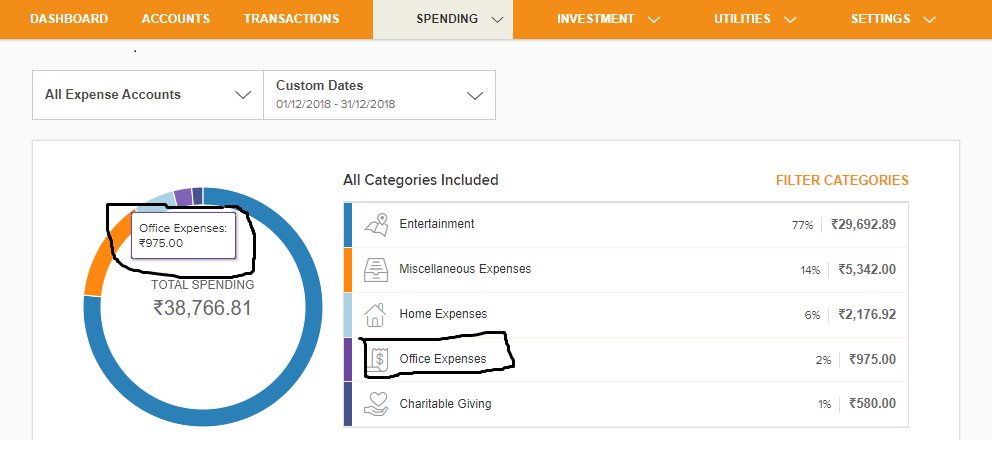

There should be different possibilities/stories for the same product. Based on the user’s decision, usage patterns and choices made on the UI, a unique product-user identity should emerge in time. Once this phase arrives, for the sake of the time spent, and the choice made, the user has higher chances of continuing to use the product. This is the “investment” (Recommended reading “Hooked” by Nir Eyal) phase in user’s journey.

Some products provide this differentiation by “Progressive Reduction” where the UI adapts and simplifies itself as per the usage pattern of the end user i.e. positioning of most used features, dropping of labels, etc.

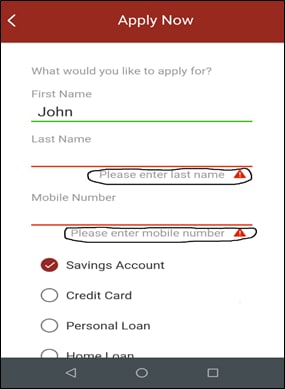

Choices have visible consequences

I remember how the background track in the movie changed the moment I selected the track for Stefan! Similarly, each touch/click/interaction in your UI should have visible, tangible feedback. Not getting a feedback on UI is comparable to not getting a response from a smart speaker despite saying the magic word (and it has happened to most of us).

Choices are limited

The movie provided binary options to the viewer. In real life we can have many options. Limited choices keep the narrative smooth and barrage of options can easily disillusion any user.

However, we can take a conscious call (keep reading… it’s cocktail vs. Lego Block)

Nothing breaks / You can start again

Irrespective of the path taken by the viewer, the movie did not lose the plot. It admittedly reached certain points of no return, however at that instant there always was an option to correct and walk a different path.

It’s ok not to make any choice

The movie showed the options on screen for a limited duration. Failing to make a choice was not a show stopper. The movie proceeded with a “default” narrative. So the default experience does matter. Some of the users would love the default theme in an app and never look beyond it. Therefore, it makes a lot of sense to refine the out-of-the-box experience for any product.

Cocktail Makers and Lego Blocks

While making product decisions we often face the dilemma of extremes. At one end of the spectrum is a simple product with limited options (remember in Bandersnatch we were given only two options for each question). These are the Lego Blocks. Limited options make our life predictable as the system works (behaves!) the way “we” want it to.

Then there are cocktail makers. We package the product with all the ingredients and expect the user to be shrewd enough to arrive at a perfect mix. Perfect! Except for the fact that our user can spoil the cocktail, and blame us too! Imagine several users making quick and disgusting cocktails.

At this point you might just be saying, “let’s get real, above paradigms look great in UX books and blogs.” Let’s have some examples from the real world. So here they are:

Tasker

Offers extreme customization experiences on your android device. You get a sense of “I am the owner of my device”. However, some users have faced consequences like getting into loops and softbricking their devices. Cocktail!

i-OS/ Android

i-OS is a Lego Block fixed by extreme expertise and artistry. Don’t try to move the blocks. Ever.

Android is also a Lego Block out-of-the-box, but it keeps the blocks flexible. Want a cocktail? Root it. It takes you to another world or leaves you with a learning of handling a softbricked device!

IFTTT

You get to choose from a finite list of “if” conditions and resultant “then” occurrences. Infinite possibilities for a creative user. Classic Lego Block.

After Effects and Spark

Both are Adobe products. While After Effects offers extreme customization Spark is about beautiful presets which can be used to create visual experiences. Both are winners! (Which one is the Lego Block?)

An IDE can go with a cocktail while a bank teller app should have a Lego Block. If the target persona is an expert, we should progressively reduce the pre-built blocks. For most users offering a feeling of DIY by the Lego Block approach works to impress them. E.g. giving the bank user an option to create personalized inquiry options. It’s the user who gets to choose.

Just like the interactive movie, users in the digital future will increasingly expect more interactivity and configurability in each product. As the makers of these products, these are our real life Bandersnatch moments. It’s up to us to offer fixed/movable Lego Blocks or offer a cocktail maker based on the user needs.

Wish I had multiple and configurable endings for this blog. Can we create interactive-blogging experiences? Perhaps use a chatbot for it? Let’s work on it. Drop your views in the comment box below.