Stay ahead during these disruptive times with an AI-first automation platform powered by a suite of fut...

Our purpose

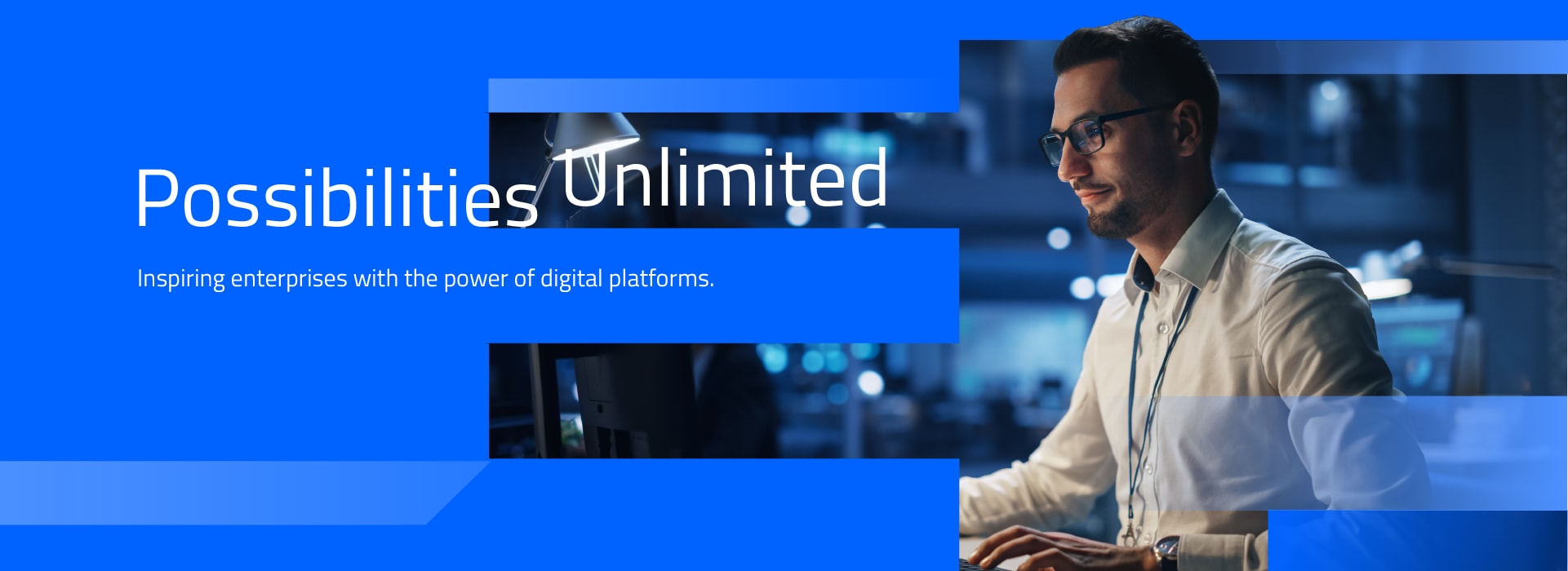

We reimagine the way enterprises work for the better. Enabling our clients to innovate on business models and drive game-changing efficiency with best-of-breed digital platforms.

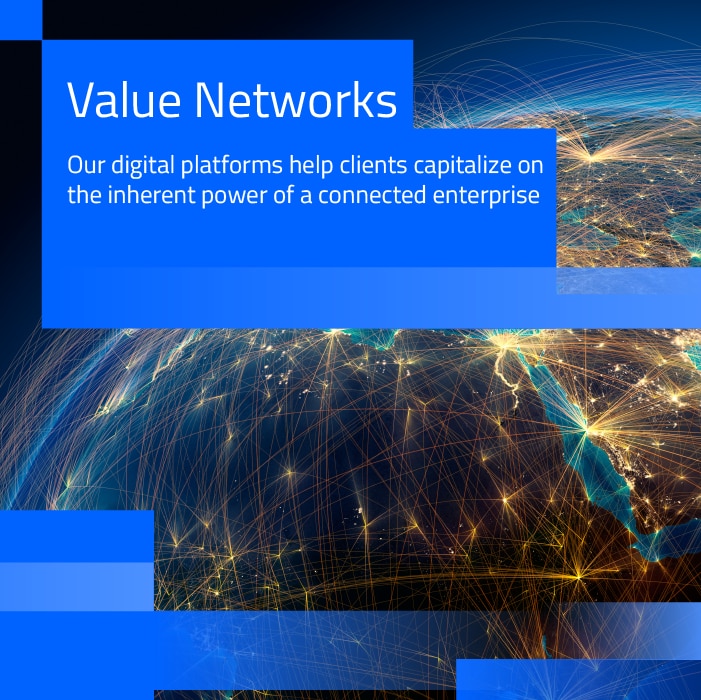

Our digital platforms help clients capitalize on the inherent power of a connected enterprise. We do this by amplifying the human potential, crafting connected customer journeys and exploiting the power of value networks.

Powered by native AI and automation capabilities, with security and scalability at the core, our digital platforms help enterprises discover & automate processes, digitize & structure unstructured data and unlock the power of the network by integrating enterprises.

Unlock hidden business value

EdgeVerve is a global leader in AI, Automation, and Analytics. Our technology empowers enterprises globally to bring life to their digital transformation initiatives.

We are not just building path-breaking products; we are building technology that will unlock hidden business value from your business processes, documents, and supply chain.

Born in

2014

Run by

1400+

technology

enthusiasts

Trusted by

400+

global customers

An Infosys

Company

100% owned

subsidiary

Innovative at

core with

50+ patents

Client retention rate

95%

Known as

EdgeVerve in

140+ countries

Winner of

Stevie Awards

2022

Client Advisory

Board with

10 Global CXOs

Rated as a leader by

top analyst firms

Born in

2014

Run by

1400+

technology

enthusiasts

Trusted by

400+

global customers

An Infosys

Company

100% owned

subsidiary

Innovative at

core with

50+ patents

Client retention rate

95%

Known as

EdgeVerve in

140+ countries

Winner of

Stevie Awards

2022

Client Advisory

Board with

10 Global CXOs

Rated as a leader by

top analyst firms

-

Intelligent Process Automation

-

Document AI

-

Supply Chain

-

Digital Banking Solutions

The Connected Enterprise – Powered by EdgeVerve

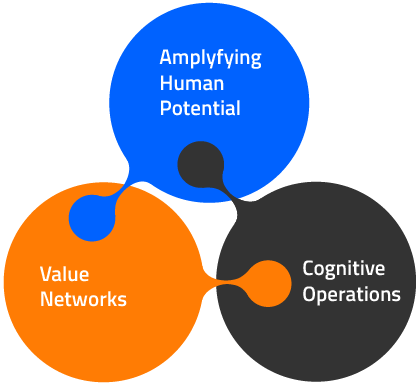

Just as humans sense, analyze, and partner to unlock immense potential, a Connected Enterprise is equally cognitive, responsive, collaborative, and resilient to amplify human potential, drive cognitive operations, and unlock value networks.

Build a truly connected enterprise with EdgeVerve’s digital platforms.

Leveraging our digital platforms, we have transformed 400+ large, global enterprises into Connected Enterprises – by enabling cognitive operations, exploiting the power of value networks and amplifying the human potential.

Our digital platforms help clients capitalize on the inherent power of a connected enterprise

Digitize

Processes and documents

Connect

Parties and customer journey

Exchange

Data and information

Automate

Processes and systems

Augment

Human decision making

![]() Unlock new business models

Unlock new business models

![]() Improved org resilience

Improved org resilience

![]() Enhanced customer experience

Enhanced customer experience

![]() Industry leading process efficiency

Industry leading process efficiency

![]() Increased productivity & predictability

Increased productivity & predictability

Case Studies

News and Events

Latest News

23 Aug 2023

EdgeVerve Positioned as a Leader and a Star Performer in Everest Group’s Task Mining Products PEAK Matrix® Assessment 2023

EdgeVerve Systems Limited, a wholly-owned subsidiary of Infosys, has been positioned ...

30 Jun 2023

EdgeVerve’s AssistEdge Discover Positioned as a Leader in NelsonHall NEAT Vendor Evaluation for Process Understanding 2023

AssistEdge Discover has also demonstrated its effectiveness in real-world applications...

14 Jun 2023

EdgeVerve’s XtractEdge Positioned as a Leader in Everest Group’s PEAK Matrix® Assessment 2023 for Unstructured Document Processing Products

EdgeVerve Systems Limited, a wholly-owned subsidiary of Infosy...