Possibilities Unlimited

Possibilities Unlimited

XtractEdge, so you can harness Insights Unlimited

XtractEdge delivers insights from enterprise documents to make better decisions. As organizations shift from simply surviving in a digital era to thriving in a digital world, the business opportunities for enterprises that can extract value from their data have never been greater.

XtractEdge, the Document AI platform, provides you a powerful tool to gain insight from documents; legal contracts, commercial insurance papers, SOPs, images, handwritten notes, PDFs, emails, or any other document. Enterprises can now unlock unlimited possibilities by gleaning insights from myriad unstructured data to deliver measurable business value.

XtractEdge helps clients capitalize on the inherent power of a connected enterprise by amplifying human potential, crafting connected customer journeys, and exploiting the power of value networks.

10x

Productivity improvement for an American Bank

98%

Clause extraction accuracy for a Telecom Major

90%

Cost reduction for a Fortune 500 Conglomerate

$90M

Revenue leakage opportunity identified for a Telecom Major

Solving Enterprise

Document Problems

Solving Enterprise Document Problems

Extract intelligence from structured or unstructured enterprise documents, regardless of template or layout complexity or domain specificity.

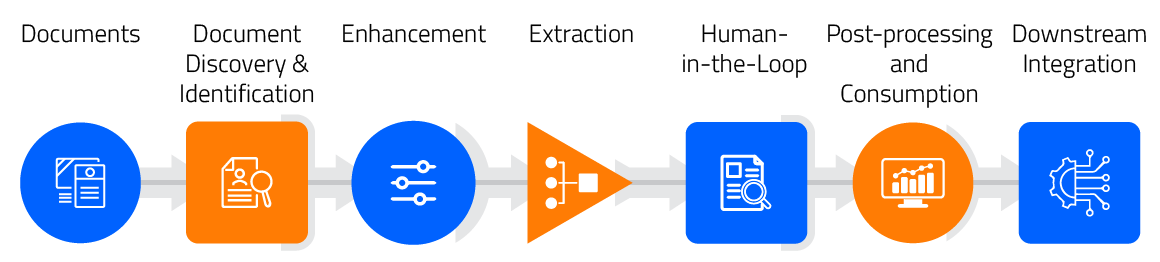

End-to-End Document Processing with XtractEdge Platform

End-to-End Document Processing with XtractEdge Platform

Business Value Unlocked

Business Value Unlocked

XtractEdge Platform optimizes the document extraction, processing, and comprehension pipeline to help enterprises unlock business value faster.

Improve Productivity

Improve Time to Value

Improve Decision Making

The XtractEdge Platform Difference

The XtractEdge Platform Difference

Auto-discovery of documents

Fast onboarding of new layouts,

variants

Integrated measurement and quality benchmarking

Platform and Products

Platform and Products

XtractEdge Platform

Extract intelligence from enterprise documents, regardless of complexity or domain specificity

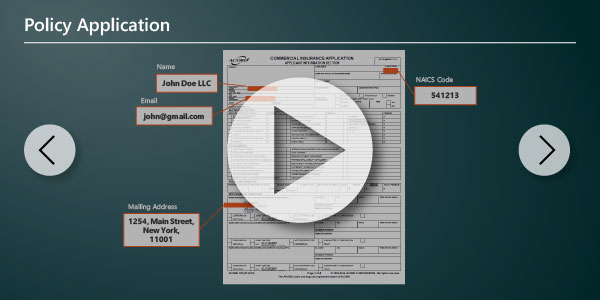

XtractEdge Commercial Insurance

Accelerate new business intake/processing with domain focused out-of-the-box capabilities

XtractEdge Contract Analysis

Derive insights from contracts and legal documents across industries

Solutions

Solutions

KYC and Customer

Onboarding

LIBOR

Transition

Claims and EoB

Processing

Invoice

Processing

Recognition

Recognition

Gold Award in the Artificial Intelligence category in the 13th Annual 2021 Golden Bridge Business and Innovation Awards

According to IDC survey respondents, EdgeVerve is among the top document AI software/ technologies in use*

Everest Group Intelligent Document Processing (IDP) Products Peak Matrix Assessment 2021

Contender in The Forrester New Wave™, Computer Vision Platforms, Q4 2019

Finalist in AIconics 2020 as Enterprise Solution of the year

Gold Award in the Artificial Intelligence category in the 13th Annual 2021 Golden Bridge Business and Innovation Awards

According to IDC survey respondents, EdgeVerve is among the top document AI software/ technologies in use*

Everest Group Intelligent Document Processing (IDP) Products Peak Matrix Assessment 2021

Contender in The Forrester New Wave™, Computer Vision Platforms, Q4 2019

Finalist in AIconics 2020 as Enterprise Solution of the year

*Source: IDC, What Is the Landscape of the Emerging Document Artificial Intelligence Market?, Doc # US47701421, July 2021

Request a demo

Thanks for your interest!

Our team will get in touch with you soon.