XtractEdge 4.0, our Intelligent Document Processing platform, is a game changer when it comes to transforming data into insights.

Powered by Generative AI, the platform takes document processing to a whole new level of speed, accuracy, and efficiency.

XtractEdge 4.0 processes structured, unstructured and semi-structured data, from all kinds of documents, converting it into usable information. Its modular components facilitate fast deployment and empower both business and IT users to transform any document into data.

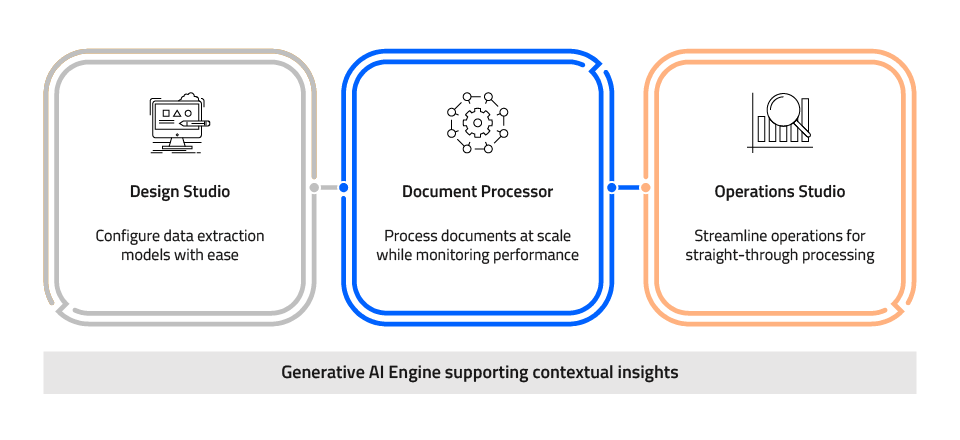

How does XtractEdge 4.0 work?

XtractEdge 4.0 is a modular platform. Its three different modules democratize document digitization and enable accelerated processing for faster value realization. Powered by Generative AI technology, the platform takes document processing to a whole new level of speed, accuracy, and efficiency.

Design Studio

This module provides a unified workbench where business users can configure AI models for document extraction. A generative AI-powered conversational interface provides the ability, to search and summarize information.

Document Processor

This easy to set up module offers an end-to-end document extraction pipeline. It can automate high volumes of documents, from ingestion to completion, catering to varied business use cases.

Operations Studio

This module streamlines operations for straight-through processing. Business users get a single pane view of document, third-party and internal data. The Studio’s case management capability provides a contextualized review experience, with documents being reviewed on a case-by-case basis.

Generative AI engine

The Generative AI engine enhances the data extraction model and expands use cases by increasing dataset diversity. With Generative AI, the platform can adapt to new or unseen document types more easily, and provide contextual and precise insights.

Capabilities that contextualize the experience

Third-party data integration

Conversational interface powered by generative AI

Single pane view of documents, third-party and internal data

Case management for case-by-case review

Low-code enabled customized interfaces

Human-in-the-loop capability for validation and updates

Performance monitoring dashboard to monitor key metrics

Auditability and traceability of all actions and updates

Why XtractEdge 4.0?

Solving any document problem

Highly accurate and effective extractions even while managing multiple and diverse variations

Contextualized experience

A contextualized review experience that enables comprehensive decision-making

Customized user interfaces

User centric interfaces make it easy to adapt and simple to use

Improved compliance

Auditability and traceability provide enhanced compliance and reduce errors

One platform for various needs

Caters to document-intensive processes across multiple industries

Cloud agnostic

It can be deployed on the public or private cloud making it easy to scale

Leading US financial services firm speeds up underwriting

Leading US financial services firm speeds up underwriting

Our client is a financial services company that provides clearing and settlement services. The company regularly determines eligibility and assesses risk for newly issued corporate debt securities before they can be traded in the marketplace. The client’s underwriting process involves reviewing multiple parameters in the issuer prospectus, which spans up to 600 pages, and supplemental documents that usually contain complex operational, financial, legal, and regulatory aspects represented in semi-structured and unstructured formats. It is imperative for our client to have a quick turnaround on determining eligibility and to ensure these securities and offerings meet the legal, regulatory, and operational requirements.

We implemented XtractEdge, our modular intelligent document processing platform, and developed a model to extract key attributes and elements in determining the eligibility of such offering documents. The platform streamlined the eligibility review process, improved operational efficiency, and significantly reduced underwriting turnaround time.

A leading US bank reduced KYC turnaround time from weeks to days

A leading US bank reduced KYC turnaround time from weeks to days

Our client, a leading global bank, wanted to standardize the Know Your Customer (KYC) process to handle growing volumes and bring speed and scale. The client faced many challenges, from a historic load of 25 million KYC documents to 70% of existing customers being due for a periodic refresh.

XtractEdge helped extract, process, and validate data hidden in KYC documents. The platform integrated seamlessly with the client KYC application, helping establish a data pipeline with supervised and unsupervised learning capabilities for document discovery.

Industry Recognition

Its intuitive user interface, advanced unstructured document processing capabilities including intelligent search and document comparison, domain specific pre-built models, and analytics and dashboarding capabilities have played a big role in establishing EdgeVerve as a market leader.

Vaibhav Bansal, Vice President, Everest Group

Resources

Request a demo

Thanks for your interest!

Our team will get in touch with you soon.