Reduce delinquency rates and charge-offs

Enable clients to create proactive outreach plans and prevent delinquencies through CollectEdge’s accurate early delinquency prediction models

Enhance Customer Experience

Personalized recommendations for time, channel and tone of communication with the borrowers along with recommendations into right resolution strategy ensure the most desired outcomes for both borrower and lender

Improve operational efficiencies

Improve process efficiencies, productivity and compliance based on intelligent segmentation and prioritization of accounts along with prime time recommendation.

Collect Effectively Without Affecting Customer Experience

While financial enterprises have been in the digital race lately, the industry hasn’t been able to efficiently leverage technologies in default management and subsequently improve efficiency and customer experience.

This whitepaper explains how AI can bridge this gap by effectively mapping customer segments, helping collection agencies and lenders gain some traction on data and get insight as to what motivates individuals to pay or default their outstanding debt.

Key Features

API-based

Integration

Simple integration with your servicing and collection systems using our API services

Servicing

Risk Bucket Prediction

AI-based Prioritized Queue

Suggestion on Corrective Measures

Collection

Predict Channel and Time

AI-based Personalized Communication

Roll Rate Prediction

Recovery

AI-based Prioritization

AI-based Resolution Strategies

Account Level Personality Insights

Customer Insights Engine

Prediction Engine

Visualization

Engine

Out-of-the-box insightful charts and provisions to create on-demand views

Make your debt collection processes intelligent by embracing AI

With a low success rate of debt-collections, are the current ways of operating at their optimum best? Is Artificial Intelligence the answer to make the existing debt collection processes more effective? And is it really possible to make current systems intelligent to avoid an excessive rip and replace cost? Download this whitepaper to know more.

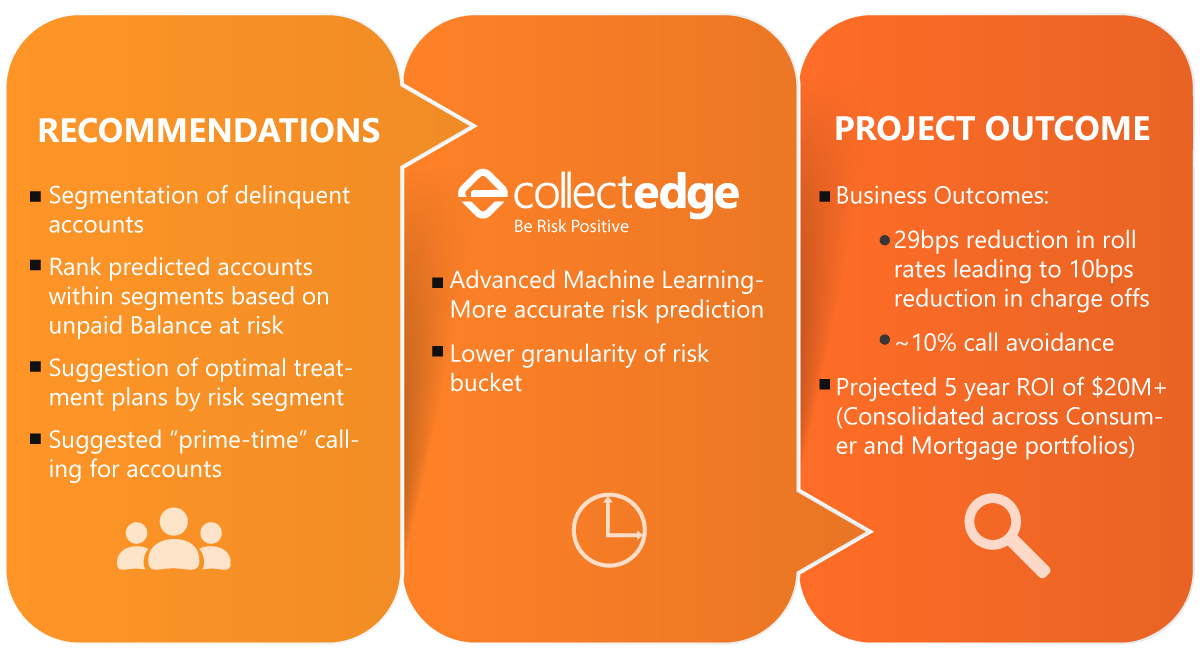

Success Story

A Large Bank in US is looking to reduce losses and increase the efficiency of the collection process through accurate segmentation and rank-ordering of delinquent accounts.

Their objective: To reduce delinquency by 25 basis points (0.25%) across 0-30 day and 30-60 day roll rate risk buckets

The client implemented 85% or more of our recommendations and currently have a delinquency reduction of 29 basis points.

Outstanding consumer debt in some stage of delinquency out of $12.07 trillion of total debt

Industry average collection rate on delinquent debt, a decrease from 30% a few decades ago

debt collection in 2016, falling from 13.3 million in 2012

Percentage of customer

complaints received by CFPB* in the area of debt collection (highest among all areas)

Lending capacity of

a bank that is reduced for every $100 million of loan loss provisions

Debt that collection agencies collected

out of the $150 billion portfolio transferred to them

Right party contact rates for in-house and first-party collections