Home > Blogs > Payments in the Open API world

Payments in the Open API world

APIs are not new to the banking universe; they have been in use for a long time now. APIs were traditionally used for integrating the different systems in the bank with each other or for providing services through customer channels like internet and mobile banking.

Evolution of technology and changing regulations, and market changes in line with these developments are now opening up new avenues for API usage. One of the primary differences between traditional and current use of APIs is that now API access is defined more stringently as they are exposed to the external world. By publishing open APIs, banks allow Fintechs or third party developers access to the data and provide innovative services which was impossible earlier. Who consumes the APIs and how they create value using them has become exceedingly crucial. Earlier usage was restricted to within the bank for integrations, but now public APIs have opened up many more interesting avenues.

This trend is global and as per Infosys Finacle Efma Digital Banking Report 2018, 65% of the respondents consider open APIs as the top technology impacting banking. In this blog, we will primarily focus on how the payments space is slated to change with APIs coming into picture.

Current payments landscape:

Currently, most of the payment systems in the world are either file based (Traditional Clearing, ACH, SEPA etc.) or message based (SWIFT, RTGS, IMPS etc.). This is primarily due to the times in which these evolved and the technology/communication infrastructure available to the market players at the time. The emergence of real time rails like SEPA Instant Payments and RTP by TCH have allowed the possibility of back-and-forth message transfers between various constituents in the payment landscape. With the adoption of ISO 20022, there is now a global standard which can be used for each and every payment system. A lot of payment systems have adopted the standard already and others are following suite. The fact that such a standard exists and open API itself is based in part on it helps set the ground for an API revolution in the payments space.

Emerging trends and Future state:

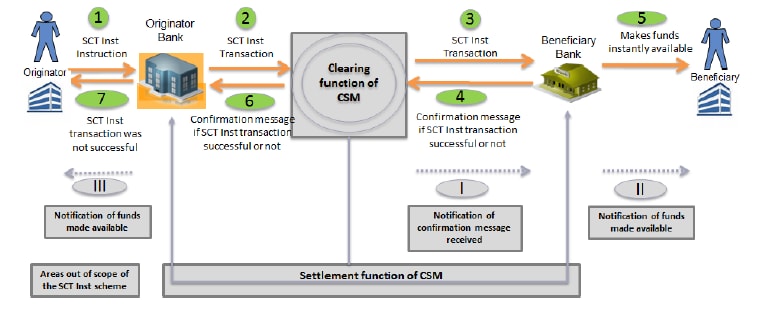

With the advent of real-time payments and its rise around the globe, we are now seeing major technology and retail companies also eying an opportunity to leverage them. Regulations like PSD2 are enabling new services and faster payments. Most of the real-time payment systems are ISO 20022 based and involve back-and-forth messaging. A sample flow is shown below:

Source: SEPA Instant Payment – Credit Transfer Rulebook

Such flows can be better supported using an API-based system. There are already API-enriched traditional message flows like UPI in India which is an overlay on the IMPS payment system. API calls are used to identify the payer account, bank etc. from the virtual payment address. There are other examples as well where the API revolution has already transformed or is transforming domestic payments. Federal Reserve in the US is currently deliberating on launching its own faster payments real time rail and technology giants such as Google, Amazon etc. are asking for an API-based ecosystem which will enable 3rd parties to offer new products and services.

However, this is not limited to domestic payments and the effects are visible in cross-border remittances as well. SWIFT is currently working with banks to launch a “pre-validation” service which allows banks to call a pre-validation API to check for accuracy of information provided before the payment is sent. This will avoid payment failures for conditions like wrong account number, mismatch in name or other such errors which currently cause failure, though all the participants in the chain will incur a cost for it. A few other examples of emerging trends in this space are listed below:

- API Exchange from Joint Electronic Teller Services Ltd: Hong Kong’s JETCO launched an exchange with more than 200 APIs which helps simplify cross-border trade and payments

- UnionPay International launched a developer portal which opens up its cross-border mobile payment product APIs.

- US’s Cross River Bank along with UK’s open banking platform Railsbank Technology Ltd. is providing an API interface based banking-as-a-service (BaaS) platform.

Banks and industry players have been trying to transform cross border remittances and a major shift is on the cards where APIs are expected to play a major role.

Leave a Reply

3 thoughts on “Payments in the Open API world”

-

Like!! I blog quite often and I genuinely thank you for your information. The article has truly peaked my interest.

-

Informative article explained in simple manner on the API.

-

Very good article which explains the necessity of APIs. Would be glad if there is a post which explains the challenges and threats in implementing the open API in solutions like payments and how they can be overcome.

Load more comments...

Radhesh Tharammal

More blogs from Radhesh >