Home > Blogs > Corporate Bank Branch of the Future

Corporate Bank Branch of the Future

In the corporate bank branch of the future, the relationship manager will spend more time with corporate customers and less inside the premises of the bank. He will be well informed about the latest developments in the company thanks to the internet. While on the move, he will access the bank’s application to approve transactions requiring his go-ahead, as well as provide recommendations for any renewal of credit facilities.

New Customer: He will update details on potential opportunities in the customer management platform and inform the credit analyst to prepare a credit application based on the details shared by the customer. Meanwhile, he will also inform the deposit team about a cross-selling opportunity. The necessary credit approval request will be sent to the approving authority.

Existing Customer: He can query limit availability and inform the customer accordingly. The customer would also be able to access these details using the banking application. In the case of problem customers, a proposal for debt restructuring would be sent to the credit analyst to help bring repayments back on track. Early warning signs can also be arrived at based on any red flags during discussions with the customer. A report with the key details can be updated in the system after every visit.

The manager, despite spending a productive day with customers, will not feel out of touch with his colleagues and the bank’s operations. This is because he is able to focus on his core competence and take help from other teams wherever required.

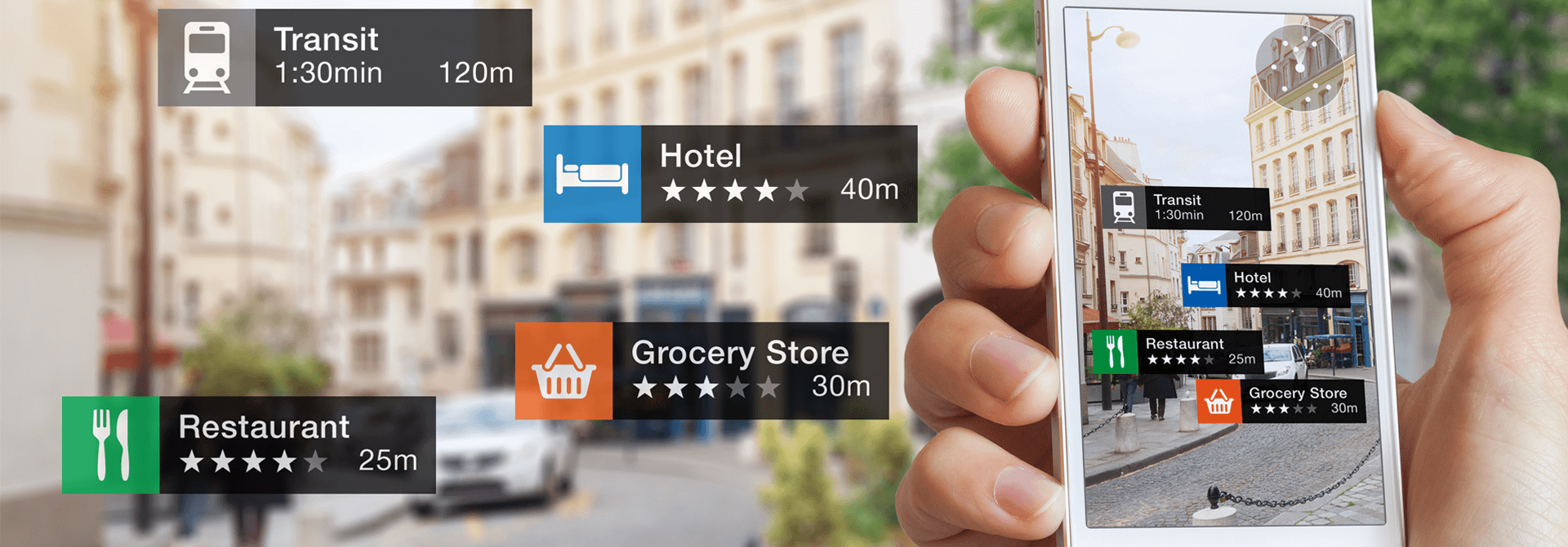

Digitization has helped the relationship manager access the bank’s systems to inquire, collaborate, prepare visit reports, approve transactions and do much more on the move.

Leave a Reply

8 thoughts on “Corporate Bank Branch of the Future”

-

Very Informative

-

Well articulated.

-

Good read . Glad this my time was worth it.

-

nice info

-

Very insightful, Banking System definitely needs these process and technology upgrades.

-

Very helpful read

-

Exactly, bank would aim at blending intrinsically in to the corporate ecosystem, available right in time, just a service call away from their internal enterprise applications.

-

Will be really helpful.

Load more comments...

Sandeep Joseph Mathew

Senior Consultant

Sandeep Joseph Mathew is a product owner in Finacle Loans ART at EdgeVerve Systems Ltd. His areas of interest include product management and credit monitoring. He is a Chartered Associate of Indian Institute of Bankers. He holds Post Graduate Diploma in Management from LIBA, Chennai and BTECH from CUSAT, Kochi.

More blogs from Sandeep Joseph Mathew >