Home > Blogs > An Amazon-Inspired Wish List for Banks

An Amazon-Inspired Wish List for Banks

“We need banking. We don’t need banks anymore” Bill Gates, 1997

Amazon may or may not enter the banking industry anytime soon. But with a vision statement which reads “Our vision is to be earth’s most customer-centric company” and Jeff Bezos’s well-known customer obsession, which ensures that Amazon really walks the talk, there are many including me who ardently wish that it would.

As a regular user of multiple Amazon products and services, such as Kindle, Amazon Fire TV Stick, Amazon.com and Amazon Prime, I love many things about that company. I have also wished many times that my bank too would conduct its business like Amazon.

Drawing on my personal experiences, here is an Amazon inspired “Wish List” for banks, one that I hope will resonate with many readers and also provide some actionable insights for banks to consider.

My Wish List

Wide choice with “Platformification”

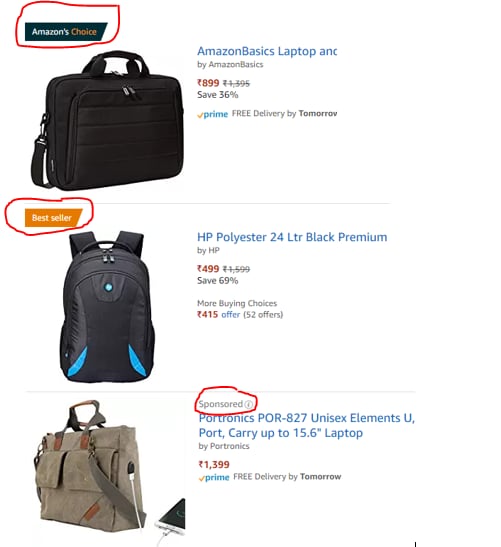

When you shop on Amazon, you are assured of a wide selection of products. The below image is a search for a laptop bag.

Other than the selection, what really strikes you is the clear and transparent manner in which Amazon’s own product, the actual best seller and the advertising money backed “sponsored” products are shown to the user so he or she can make an informed decision.

Contrast this with a typical banking experience. Let us say I am looking to buy car insurance or invest in a mutual fund. I am fairly certain that the priority of the bank and its personnel is to sell their own products.

If at all third party products are offered, it is quite likely that they would be displayed lower down the list. This is the exact space that the financial aggregators and comparison sites are targeting.

How I wish I could buy any financial product offered by any financial institution from my bank itself. What stops banks from selling products from other banks? Is it a fear of losing customers? Is it the possibility of lower margins and reduced profits? Maybe.

But there is definitely a need for a bank, which acts as a one-stop shop for fulfilling all customer banking needs, offering competitor products alongside its own.

Personalization

“You know you’re not anonymous on our site. We’re greeting you by name, showing you past purchases, to the degree that you can arrange to have transparency combined with an explanation of what the consumer benefit is.” – Jeff Bezos

It is one thing to aspire to offer wonderful personalized experiences based on insight to customers, and quite another to actually deliver them.

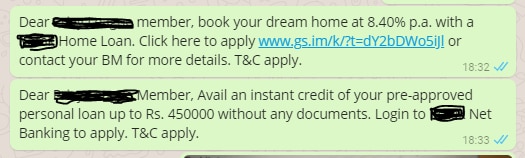

I have never availed a personal loan all my life. However, my bank somehow seems to think that I need one desperately or at the very least, would be interested in taking one. My bank regularly sends me messages like the one below.

The bank has so much of my financial data, including income sources and regular expenses, that it could make me offers that I would actually be interested in. Unfortunately, it has chosen to offer me loans that I have no need for.

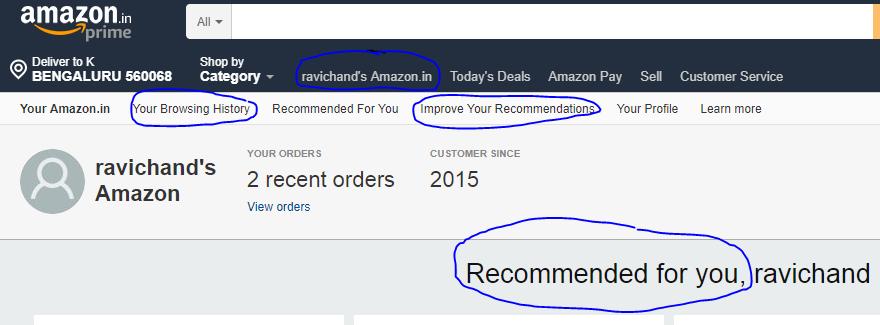

Contrast this to my Amazon account. The below picture speaks a thousand words.

It say’s “ravichand’s Amazon” and it actually feels like one. The recommendations are based on things I have searched for or those that I am really interested in. Also, I have complete control over improving those recommendations by deleting things I don’t want to be alerted about.

Then there is this wonderful “Wish List” in Amazon where I can list as well as track things I find interesting. What makes it even better is that if there is a deal or offer on any item on my wish list, Amazon proactively notifies me so I don’t miss out.

How I wish my bank too kept a close watch on my browsing history on its website, applied insightful analytical data models to my banking transactions and provided me with actionable insights into things that I want to buy, as opposed to things that it wants to sell. How I wish there was a “wish list” I could use to inform my bank about my requirements.

Trust and Transparency

“I am a big fan of all-you-can-eat plans, because they are simpler for customers”- Jeff Bezos

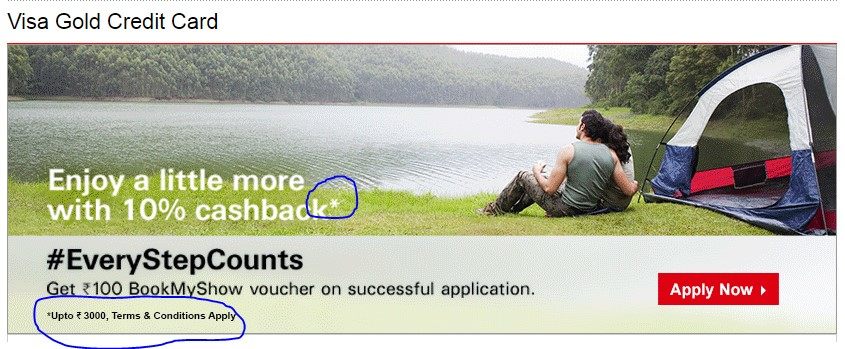

The below image is a random offer based on an internet search for credit cards in India. Technically, there is nothing wrong with the credit card offer.

It is just that the principle of caveat emptor (buyer beware) applies here too. The prospective customer here is shown a 10% cashback but with a rider with various terms and conditions and a ceiling, all in fine print!

Also, the exact offer is not clearly articulated and the onus is on the prospect to actually “dig out” the relevant information as well as to scrutinize the fine print to check if there are any clauses, which are against his or her personal interests.

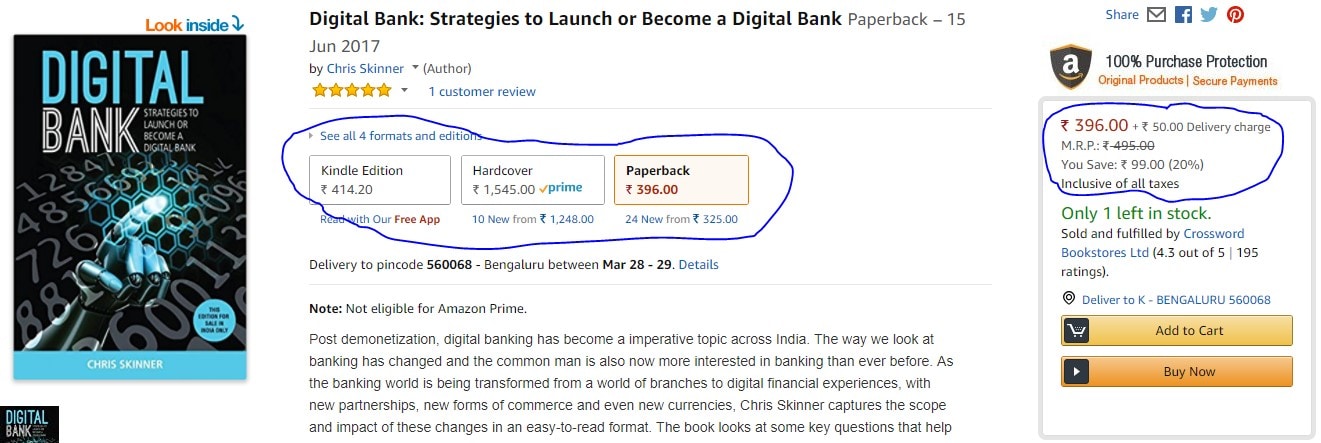

Contrast this with a search on Amazon for Chris Skinner’s book, “Digital Bank”.

The price, delivery charges, and taxes for each format are displayed in a transparent manner, with no scope for ambiguity. I don’t need to worry about reading the fine print or trying to understand legalese.

How I wish that banks would stop putting out catchy captions and teaser campaigns just to attract the customers’ attention. It would be significantly better to focus efforts on presenting the terms and conditions of the offer in a clear and transparent manner, so it could be understood even by a lay person. Things presented in a clear, simple and transparent manner inspire trust, a huge factor in building customer loyalty and advocacy.

Best Offer

“There are two kinds of companies, those that work to try to charge more and those that work to charge less. We will be the second” – Jeff Bezos

The above statement by Bezos highlights a key part of Amazon’s business model, which is to ensure that there is relentless focus on lowering the cost structure. The thing to note is that cost savings are actually passed on to the customer.

Contrast this with the way banks work. Most of the banks are seen working hard to increase or maintain their “spread”. There is a continual focus on increasing Net Interest Margins (NIM) by garnering low cost deposits, generating fee based income etc., all with an objective of profit and margin maximization.

A few years back when I was looking for a housing loan, I found that my bank was charging a whopping 1% more for a 20-year term. I am sure a similar story also plays out in deposits as well as other areas.

How I wish I could be confident that my bank will not overcharge me. How I wish I could take the bank’s offer at face value without having to read the fine print. How I wish I could be sure that my bank will strive relentlessly to provide me the best offer possible. Presently this remains just a wish.

Customer Experience

“The best customer service is if the customer doesn’t need to call you, doesn’t need to talk to you”. It just works.” – Jeff Bezos

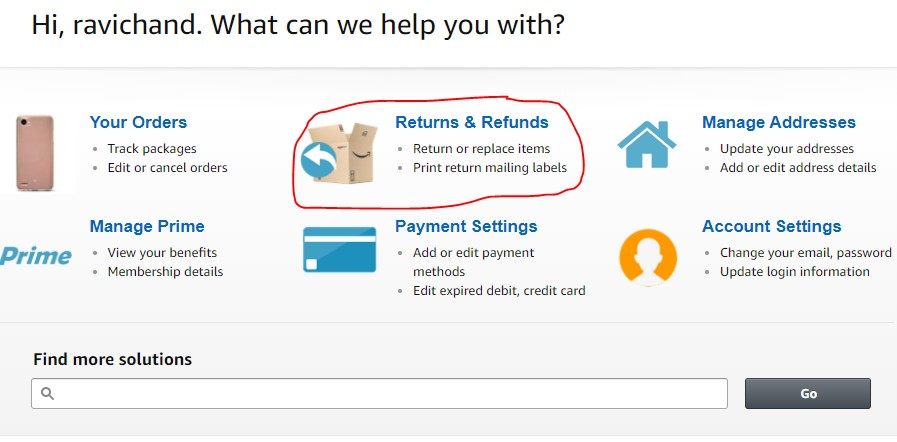

Personally, I find the handling of returns and refunds a good barometer for judging the customer service / customer-centricity of a business. In Amazon’s case I was very impressed with the whole process.

Among many things, I had ordered a bottle of shampoo which was promptly delivered the same evening. When I opened the package, I found a dent in the bottle that was leaking shampoo. Returning the product was as easy as purchasing it.

The same night I used the customer service option shown above to lodge my complaint, including a photograph of the spillage. I woke up the next morning to a message saying that the refund process had already been initiated!

Let me contrast this with the experience I had when an excess charge was debited erroneously to my account. To get it reversed, I needed to visit the branch, submit a written application and then wait a few days for the internal approvals for processing the refund to come through.

Comparing the near frictionless and seamless return process of Amazon and the not so smooth refund process at the bank, it is clear as daylight that the former’s relentless focus on customer experience has permeated through and through.

How I wish that banks designed every possible banking interaction with customer experience in mind. As of now, they have a lot of catching up to do.

Final thoughts

For a long time now the “what” of banking has remained fairly stable. It’s in the “how” of banking that we are seeing tremendous action and innovation. Technology savvy, customer-centric companies like Amazon have a lot of lessons to offer to banks, such as providing wide choice, useful insight and delightful customer experience against a backdrop of trust and transparency.

Ravichand Kanoor

More blogs from Ravichand Kanoor >