Trending Technology

Fintech Alliance Assessment

Ethan Wang

Product Manager, Infosys Finacle

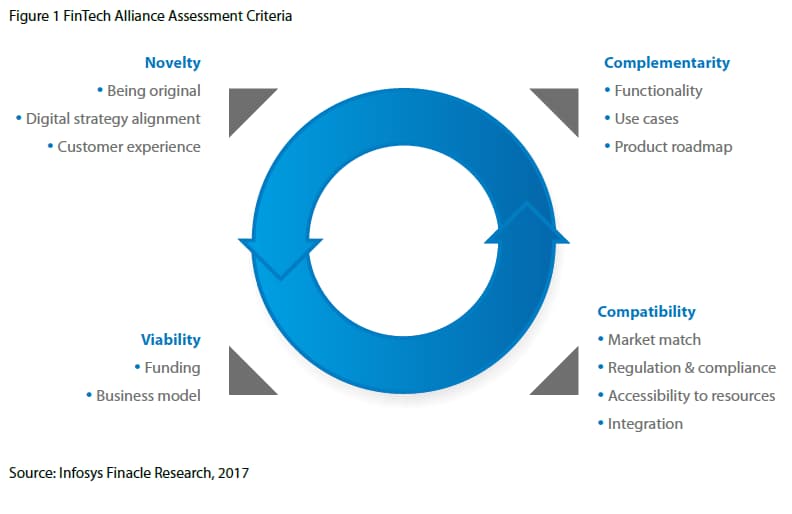

The success of a fintech partnership traces back to a very early stage of the alliance, namely at the assessment and selection phase. Infosys Finacle has identified four key assessment criteria that matter: novelty, complementarity, compatibility and viability. A combination of these 4 criteria gives banks a balanced view of “fintech alliance value”.

We have long recommended that banks must partner with the fintech ecosystem. Fintech can bring the value of new technologies to traditional banking firms. Apart from that, it also has an impact on corporate culture in the areas of innovation, talent, and process. Recognizing these benefits of the fintech ecosystem, banks have started to collaborate, rather than compete with fintechs.

Massive investments of time, resources and capital are injected into the processes related to fintech alliance programs. One of the major challenges for banks is selecting the right fintechs to partner with. Banks are usually lacking in the manpower and experience required to assess fintechs’ readiness in the context of the banks’ infrastructure and demands. On the other hand, there are potentially hundreds of fintech candidates even for a niche market in a specific business domain, in stages ranging from incubation to post-series-C funding. Banks need to be clear about their criteria for filtering these candidates and make the best assessment in line with their digital strategy.

Key Assessment Criteria

A fintech alliance plays a significant role in a bank’s digitalization strategy. Digital banking, combined together with fintechs’ complementary capabilities, results in a digital ecosystem that can give a bank an edge over rivals. However, bank executives usually don’t have the same insights and visibility of a fintech solution as bank’s internal systems. The success of a fintech partnership traces back to a very early stage of the alliance: the Know-Your-Fintech stage. As is the case when selecting a technology vendor, selecting the best-fit fintech requires a bank to carefully consider a set of different rules and criteria, in the absence of a one-size-fits-all formula.

Some elements are common to all fintech assessments, such as functional fitment to a bank’s existing business, business model, and client references. In this article, we have identified 4 key fintech assessment criteria: novelty, complementarity, compatibility, and viability (refer to Figure 1). A combination of these 4 should give a bank a balanced view of the fintech alliance value contained in a particular partnership. That being said, a greenfield digital-only bank that aims to be an innovation leader should value novelty over compatibility, and a classical regional bank may want to prioritize local regulatory compliance ahead of novelty and uniqueness. Therefore, a bank should calibrate these criteria according to its own business context and digital strategy.

Four criteria that matter

Criteria 1: Novelty

Novelty is the quality of being new or following from that, of being striking, original or unusual.

Being original

Fintech, by definition, is an industry composed of companies that use new technology and innovation with available resources to compete in or complement the marketplace of traditional financial institutions. Therefore, novelty, a word quite relevant to new and innovative, is the primary reason that banks are seeking partnership with fintechs. By doing so, banks hope to have more access to new ideas and strengthen their capacity to implement the same.

Although it is difficult to make a quantitative measurement of novelty – which may be the shared experience of an organization or the subjective perception of an individual – one way to score novelty is in terms of its originality: be it technology, use case, or business model. This is particularly important to banks that target to become innovation leaders. A bank that aims to be a digital pioneer looks for fintechs equipped with innovative use cases backed by technology, for instance, eye-print enabled authentication, machine learning based product recommendation, or shared-ledger based record management. These kinds of alliances will enable it to access emerging technologies, rebuild a robust artificial intelligence based infrastructure, and implement new digital offerings for consumers.

Digital strategy alignment

Some financial institutions may err on the side of being too original. There are other factors to calibrate novelty. In circumstances where a bank is taking a progressive approach to digitalization. For a major multinational bank, the alignment of the fintech with the potential bank spend is critical to ensure a proper business potential. The less aligned the fintech is with a bank’s overall digital strategy, the greater the chances of the partnership creating undesirable outcomes.

Our research indicates that only 31% of organizations believe they had a systematic digital strategy at the end of 20161. A digital strategy is designed to help a bank to understand its position in its journey of digital evolution, be it classical, adaptive, or shaping2. Digital strategy is a guide for bank executives to decide what kind of digital ecosystem to create, and what kinds of fintechs to include in it. Without a digital strategy, a fintech alliance could end up as a short-term tactic – like a one-off program – rather than a long-term effort to build the bank’s digital competitive edge.

A bank should ensure its digital strategy is ready before taking any strategic fintech alliance decisions and ensure its overall fintech program is aligned with the digital journey. For instance, a digital lending platform for small and medium enterprises could play a value add to the bank’s financial inclusion strategy.

Customer experience

Novelty should be evaluated not only from a technology perspective but also from a customer experience standpoint. Customers are the lifeblood of an organization, and a unique customer experience is probably the most important way by which a business can truly differentiate itself from competitors. We are already seeing many exciting innovations to realize the value of exceptional customer experiences, using mature technologies. On the other hand, technologically new and original doesn’t necessarily translate into a positive customer experience. We have seen customers contorting their hands into awkward positions to make their wearables work, or being put off by the number of details they had to supply to set up PFM goals.

The evaluation of novelty has to be set in the context of customer experience and digital strategy. For instance, the novel idea of using only facial recognition technology for authentication may come a cropper in a dark environment. But bank could still offer a better customer experience by making facial recognition a complementary authentication approach in specific customer journeys. For example, facial recognition could add on extra security for a large-value mobile payment. It could also provide additional support for two-factor authentication when customers are accessing banking with Wi-Fi only tablets.

Criteria 2 Complementarity

Complementarity is a relationship in which the fintech company and the bank can improve each other’s qualities in digitalization.

Functionality

The future of fintech and banking is more digitally reimagined than disrupted. A collaboration between fintech and financial services is a joint endeavor of complementary strengths.

Many fintechs are creating separate constructs of traditional banking services, for instance, PFM in retail banking, and robo-advisors in wealth management. Other fintechs are enabling banks with better digital experience and optimized efficiency, by using machine learning in trade fraud detection for example. Indeed, fintech functions that could complement their own legacy capacity are exactly what banks are looking for in a fintech alliance.

In any review of a fintech product, a visible and simple metric is the presence of complementary functions. Nevertheless, bank executives should assess the startup’s functional fitness within the broader context of a digital ecosystem, rather than solely based on the bank’s existing business capacity. A cloud-based SME accounting software company might be a good partner to provide cross-sell prospects for a bank to finance small-medium enterprises. A wearable device solution might be a nice add-on to mobile banking features – imagine a Fitbit Charge 2 paired with a mobile phone that can switch to a snapshot of the customer’s account balance by simply rotating the wrist.

Use case

A use case is a list of actions or event steps, where interactions are defined and functions are performed. Some fintechs are use case neutral, for instance, a sound-wave communication technology could potentially be used in many scenarios, starting with proximity payments. Some fintechs could be tightly coupled with use cases, such as those specializing in AI-based trading fraud detection.

To make an effective partnership assessment, the bank should define a priority list of use cases where a fintech can add value based on the bank’s needs and the fintech’s capabilities. This is particularly important for fintechs that are use case neutral. Lacking focus and a sense of priority in use cases – and this happens often – may waste both effort and investment. A typical example here is partnering with a fintech that is strong in advanced analytics and AI technology but does not know which business problems the bank should address. In this case, the fintech alliance may not be able to fulfill the bank’s biggest business needs and will end up disappointing it.

Product roadmap

It is also worth pointing out the importance of understanding the roadmap of both banking and fintech products. Banks and fintechs are both organic organizations that change constantly. An outline of future plans is a guideline to examine any overlap of mid-to-long-term goals between a fintech and a bank.

A bank with its own artificial intelligence center with a dozen AI scientists may hesitate to partner with a third party AI startup with a similar use case roadmap. On the one hand, bank executives want to avoid wasting their research investment; the decision not to partner may cost the bank an opportunity to absorb the latest machine learning ideas. In this circumstance, a combined approach – a short-term fintech alliance effort together with a long-term plan to build in-house capabilities – might be an option worth considering.

Criteria 3 Compatibility

Compatibility is the state of being compatible in which fintech and bank are able to work together in combination without conflict.

Market match

Compatibility with the fintech firm is a significant factor in leveraging the business potential of the alliance. Market segmentation is a starting point for evaluating compatibility. Typically, fintechs don’t have a conflict with banks in terms of targeted markets because they usually focus on a slender niche in the broader retail or business banking market. Nevertheless, bank executives need to have a clear idea of what customer segmentation the fintech targets. For instance, a robo-advisor with powerful algorithms to utilize ETF – which is targeted to mostly private banking – may not fulfil the needs of a retail premier banking business. Instead, a digital portfolio tool that can easily allocate customers’ assets to mutual funds and structured projects may be a better fit to retail wealth management in this case.

Things get more complicated when, for instance, a regional bank is searching for best-of-breed fintechs across the world. A best-in-class banking-vertical chatbot based in the U.S. may have limited market penetration in Germany, and also not know the local language. If this is a problem, the bank should explore another option, such as a local chatbot.

Fortunately, in many cases, fintech solutions are region, culture and language independent.

It is also important not to overvalue the importance of the market match. Bank executives should bear in mind that in most circumstances, a bank’s marketing and sales team plays a leading role in the alliance when it comes to marketing and re-selling to supplement the fintech’s limited capacity in these areas. It is up to the bank to integrate with the fintech’s solution and explore new markets and opportunities.

Regulation and compliance

Innovation comes together with risks.

Banking is probably the most regulated industry in the world. Although regulation usually does not subject banks to certain technology requirements or restrictions – it focuses more on business guidelines – they need to make adoption of any new technology transparent, especially when there is an impact on customers.

Fintechs are often consumers of emerging technologies. Therefore, bank executives should assess their compatibility, together with their situation with respect to data privacy, digital security, outsourcing, and cloud adoption. In circumstances where it is less clear whether a particular fintech solution complies with regulatory requirements or poses unacceptable risks, it may be wise to experiment with it in a “sandbox” environment. Bank executives should also conduct due diligence as per corporate IT policy, for instance, in the use of open source tools and public cloud.

Access to resources

A partnership is nothing but to access each other’s knowledge and resources, in terms of communication, discussion, engagement, and implementation.

The accessibility issue is often due to the constraints of resources, not location. Some, if not many, fintech alliances have been made remotely – that is to say, between a bank in one country and a fintech in another one. A bank in Singapore may decide to work with a fintech headquartered in London. Bank executives may be less concerned about this, given that high-speed internet and VPN technologies can support remote integration, and that local resources can also be arranged.

However, fintechs, especially good ones, are often constrained by very limited resources. A startup may have only few staff to answer proposals and run projects. Bank executives need to assess the fintech’s capacity before signing an alliance deal: For instance, how many projects are they running? How many banks are they working with? What are their available resources? And what is their human resources plan? A delayed response from the fintech firm in the early negotiation stage could be a sign that it may not be able to commit its efforts to the future relationship.

Generally, accessibility is a concern mainly for established fintechs, but not for incubation startups such as those selected from accelerator programs or hackathons. These early-stage fintechs usually take an all-in attitude in a relationship with a bank, given that if it were to fail, they may not have a second chance at survival.

Integration architecture

Fintechs are often designed based on the latest architecture, for instance, service-oriented architecture (SOA), RESTful API, and micro-services. The flexibility enabled by these modern, componentized architectures explains why integration with fintechs is usually less of a concern for bank executives. This is important in particular for fintechs that have tightly embedded their use cases into banks’ infrastructure. For instance, a PFM tool with many exposed services to be built tightly with a bank’s existing digital offerings will need a flexible integration framework such as open APIs that the bank could work with.

Bank executives should assess integration not only from the organization’s point of view but also from the ecosystem’s perspective. A chatbot fintech that work perfectly well together with the bank’s digital banking platform and a Fintech’s PFM tool creates the synergy needed to make a frictionless customer experience.

Criteria 4 Viability

Viability is the ability of a fintech to survive or do business successfully.

Funding

Fintech is a diverse industry that includes startups using new technology to facilitate online lending, payments, money transfer, insurance and stock trading. In recent years, it has attracted investor attention for its potential to upend traditional financial systems.

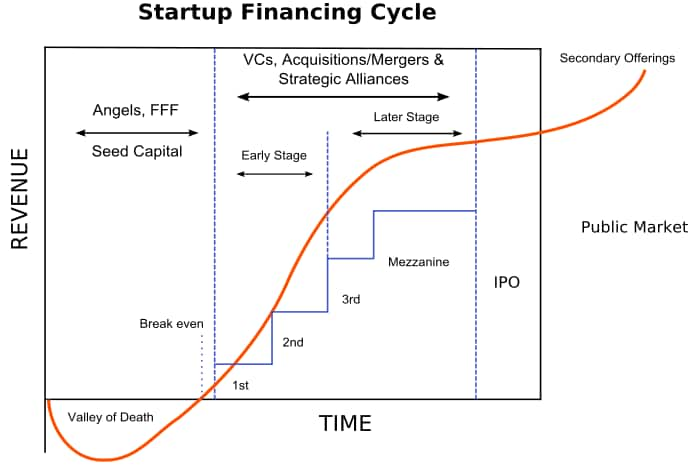

The fintech funding landscape has changed significantly over the past few years. While five to ten years ago the options available to startups were few, lately we’ve witnessed an important surge in VC (Venture Capital) available for startups at all stages (refer to Figure 2) from seed to growth, from Series A to Series C.

Source: Wikipedia

There is certainly no one-size-fits-all rule to select an appropriate fintech based on funding. Fintechs in early incubation stage may be too small to offer a mature and approved solution. Fintechs that have passed Series C or even E funding may be too independent to rely on banks for business expansion. The bottom line is the company should be financially healthy with reasonable cash flow to support its daily business, regardless of whether it is self-funded or funded by VCs.

Business model

A report on revenue and cost is an effective touchstone for understanding a fintech’s “real world” business. In spite of the fact that many fintechs are still in the growth stage with negative net profit, and not able to provide detailed financial reports, understanding the business model properly is an alternative to analyzing business potential. Be it a monthly subscription model based on the number of customers, software license model, or fee generation model, a proper and clearly articulated business model is critical for understanding how the revenue stream is generated and how revenue could be split between the bank and the fintech, and importantly, for assessing any financial impact to customers who use the services: a fintech alliance relationship is fundamentally a commercial contract between two parties.

Reference it

Many times, a bank doesn’t have experience or experts to analyze fintechs based on the above criteria. Using a reference is an alternative approach for evaluating the “real world” potential of fintechs.

A good reference will be a strong backing for the fintech in almost every aspect. A reference can justify its novelty if it is adopted by one of the world’s leading digital banks. A reference can prove the fintech’s functional fitment if it is used by a bank with a similar business landscape. A reference can prove the fintech’s solution is regulation compatible since it has fulfilled to the regulation requirements in another bank. Therefore, bank executives need to collect a full list of fintech customers for easy assessment. Bank executives need to review the list carefully given the fintech may provide a mixed list of solutions running in production environments and also pilots.

It is important to point out that a client story is not the only type of reference that could justify a fintechs’ value. Other forms of reference, for instance, industry awards from a competition or hackathon, and funding from an accredited acceleration program or organization could be also taken as a sort of endorsement of its potential. Bank executives should review all this information to gain a balanced view of the fintechs under consideration.

Using references could be an effective assessment approach. Meanwhile, in order to be a digital leader rather than a follower of other banks, a bank would need to be equipped with fintech experts so that it can do first-hand analysis and be able to select best-of-breed fintechs from hundreds of young candidates.

Recommendation

There has been a strong growth in fintech across the globe, sparking a digital revolution within traditional financial services. Banks have started partnering with fintechs to address these challenges. To select the right fintechs to work with, bank executives should:

- Make sure fintech candidates align with the bank’s digital banking strategy. If they haven’t got one yet, it is time to create it first before forging a fintech alliance.

- Assess the value of fintechs based on the four key criteria discussed: novelty, complementarity, compatibility, and viability in the context of the bank’s business focus.

- Carefully review the customer list of fintechs as a strong reference of the assessment criteria.

Download case study