Perspective

Laying the foundation

Rajashekara V. Maiya

Head of Product Strategy, Infosys Finacle (Moderator)

A good way to begin any discussion on what banks should do with Artificial Intelligence is to look at what the four tech-biggies are up to. On the infrastructure side, there’s Amazon Web Services and data center, Google Cloud, Apple SIM, and now, a solar-powered Internet spreading drone called Aquila from Facebook. In the world of mobile communications and instant messaging, there’s Plus, Duo and Allo from Google, FaceTime from Apple and Facebook Messenger. Connected technologies are also inviting interest from Google (Google Auto), Amazon (Alexa driven-integration), and Apple (AirPlay/ Car). Besides this, the GAFA set have their own smart assistants namely, Google Assistant, Amazon Alexa, Facebook Jarvis and Apple Siri.

A recent report estimated that globally, the tech giants (GAFA, Baidu and others) spent between US$ 20 billion and US$ 30 billion on AI in 20165. All these companies are betting on an AI opportunity that is expected to contribute US$ 15.7 trillion to world GDP by 2030, of which US$ 6.6 trillion will result from productivity gains and the remaining from consumption effects6. 2017 marked the beginning of the 4th digital wave sweeping through 25 countries around the world, and driven by robotics and AI. As AI overlaps with the Internet of Things, there’s no telling how many devices and people it will connect together in the next few years, but one thing is certain, which is that the future will witness massive collaboration between human and machine intelligence.

Where do banks figure in all of this?

Traditionally a laggard in technology adoption, in AI the banking industry has a chance to right that record. This is because industries that have already gone digital in a big way – and financial services is one of them – are also best placed to adopt AI. But when we commissioned a survey of 1,600 business and IT leaders from 10 vertical groups to understand what their organizations were doing in this space, half the respondents said that not knowing where AI could help was one of the biggest barriers to adoption.

One way of finding out is to use a framework proposed by the McKinsey Global Institute to assess where AI fits into the value chain of any business. Does it help projection processes by improving R&D and forecasting?5 Does it optimize production and maintenance? In what ways does AI benefit sales and marketing? And above all, can the enterprise provide better user experiences using the technology?

Applied to banking, this framework says that AI could project things like new consumer demands, changes to the regulatory landscape, competitor activity and the extent of customer churn. More importantly, the data and analytics layer of AI would be able to analyze the root cause of various events and recommend the best response to each. Currently, most banks are sitting on 10 to 15 years of mostly idle data. AI would enable them to extract its insights to project future events and optimize their impact on the organization.

Moving further down the value chain, AI technologies, such as robotic process automation and machine learning, would eliminate the manual effort going into routine, repetitive banking processes to deliver enormous efficiency and productivity gains. For example, at JP Morgan Chase, a program called COIN interprets loan documents in seconds, with a high degree of accuracy. Previously, the bank employed a very large number of loan officers and lawyers who spent 360,000 hours every year on this task7.

Similarly, the framework can locate a number of use cases where AI can add value by identifying the right targets for product promotions, or by improving the delivery of services to provide superior customer experience.

Now it is up to each bank to decide which use cases to lead with, based on core competence, objectives, resources and readiness. (It is important to be aware that there is no single formula that will work for all banks). After identifying their top use cases and enabling AI technologies, banks should lay the groundwork by provisioning the required IT infrastructure, ensuring connectivity and mobility, and making the necessary investments without delay. AI is still evolving, which means that there is significant advantage to be had by early adopters. On the flip side, fence sitters and slow movers risk falling behind to a point of no comeback.

X

Download case study

You can debate the how, but the time is now

Puneet Chhahira

Head of Marketing & FinTech Engagements, Infosys Finacle

So, recently, Musk and Zuck were at it again, trading arguments on whether AI will kill, or redeem, us all. Unfortunately, this enjoyable debate, instead of clearing the fog around artificial intelligence, is only polarizing public opinion further.

The truth about AI lies somewhere in between these two extreme viewpoints. Another truth about AI is that adoption is no longer optional for any business that hopes to survive into the future.

For banks, which are struggling to reduce costs, maintain margins, and meet customer expectations of personalized experience, the need to implement AI is particularly urgent. All parameters, whether pertaining to economics, risk, or customer satisfaction, reinforce this need. Take for instance online fraud, which is on the rise as businesses digitize on scale. There is no way that enterprises can manage this risk manually or using legacy information systems; the only solution is to deploy machine/ deep learning and predictive analytics to examine every transaction in real-time.

Banks who are slow to adopt AI will end up conceding an unassailable lead to the early movers, and also forego the opportunity to give their AI systems a head start at learning. The industry can no longer afford the luxury of watching and waiting for the technology to mature. The time to begin the AI journey is now.

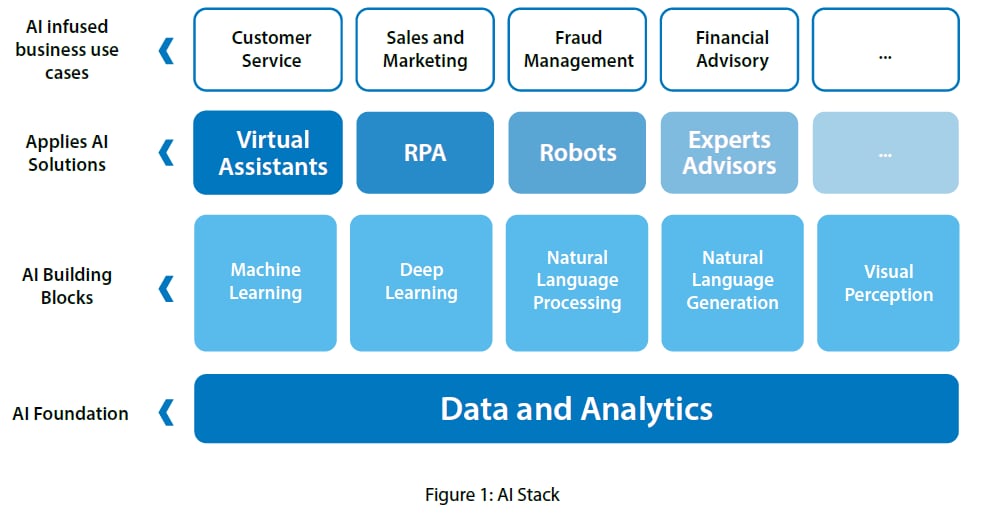

With that resolve, banks must proceed to firm up their understanding of AI technologies before taking the plunge. It is important to recognize that a major reason behind the recent spectacular rise of AI is the coming together of several component technologies, such as machine learning, predictive analytics, natural language processing, robotic process automation and smart virtual assistants. Banks should also be aware of the layers in the AI stack to take full advantage of its potential.

The AI stack consists of building blocks and applied solutions, which are commonly used across a variety of use cases. The foundational layer is Data and Analytics. Next come the building blocks of machine learning, deep learning, natural language processing, natural language generation and visual perception. These building block technologies combine into applied solutions such as virtual assistants, robots and expert advisors, which may then be deployed into hundreds, even thousands, of use cases in banking functions ranging from customer service to risk management.

Another way to understand AI is by type of action or role: is the intelligence merely observing and sensing, or does it interpret and evaluate, or better still, interact and take action? In the first instance, the solution, typically based on natural language processing, speech recognition and/or visual perception, acts as an observer, sensing things around it just like human beings do. In the second case, the organization leverages AI to emulate the human thinking process, including creating and evaluating various hypotheses. In the third case, AI takes action, based on its interaction with both man and machine.

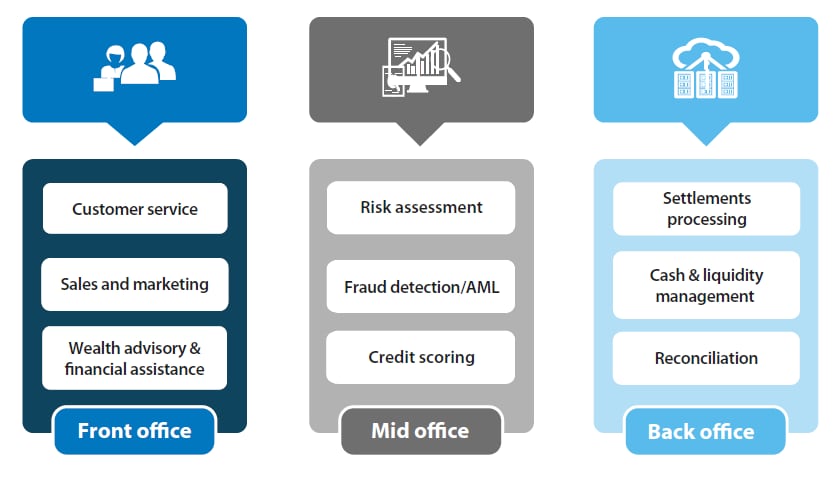

However, most banks are likely to “get” AI by where it fits into the banking function. Today, AI has the potential to reimagine a number of banking processes in the front, middle and back office. Here, a few illustrations may be useful.

In the front office, AI can improve the effectiveness of a marketing campaign by identifying the most likely adopters. Virtual advisors, such as Luvo from RBS, can empower relationship managers with all the information they need for client meetings. And bots can handle a majority of routine queries addressed to the service desk. For instance, Swedbank’s Nina takes more than 40,000 calls from customers every month.

In the bank’s middle office, machine learning can play a huge role in mitigating fraud by scanning transactions for suspicious patterns in real-time, assessing clients for worthiness, and helping risk analysts with timely recommendations for curtailing risk.

Opportunities for deploying AI in the banking back office abound. In securities settlement, robotic process automation may be applied to validate trades and reconcile the information in back office systems with trades made in the front office. AI can also facilitate trade enrichment, confirmation and settlement. Banks may leverage AI for reconciliations in the case of Nostro accounts, OTC derivatives and Forex transactions, and for target balancing and notional pooling in the area of cash and liquidity management.

In a recent Infosys-commissioned study that spoke to 1,600 business and IT leaders across 10 verticals, half the respondents from financial services felt that AI solutions would only be effective if their cost came down. While the benefits of implementation will pay for its cost over the long term, it is also possible to minimize the upfront cost of AI by consuming it off the cloud as a service. Other deployment options are platforms and applications, which confer their own advantages. The commonly held view is that a combination of all three is best.

That being said, there is no set formula or strategy for embracing AI. Each bank must determine its own path, pace and destination based on its business circumstances, readiness and resources. For a bank seeking to build everything in-house, the precondition is that it must have the necessary business vision, skill sets, technology readiness and time. Most banks would probably consider taking some help from the outside, especially from young Fintech companies and startups who have the technical savvy and innovativeness to create AI solutions that they can offer on top of their services to provide real value to customers. When choosing an external partner, certain things to consider are breadth and depth of the AI stack, alignment with the bank’s thinking, domain expertise and track record.

While the approach may differ from bank to bank, the one thing common to all is the need to get going. AI may not have matured to its fullest potential, but it is evolving so fast that anyone who isn’t on board yet is already left behind.

Download case study

The first step towards AI

Sudhir Jha

Senior Vice President, Head of Product Management and Strategy, Infosys

An increasing number of banks are beginning to consider using software tools to automate repetitive, rule-based processes consuming massive manual effort. One estimate says that the robotic automation market for Banking, Financial Services and Insurance companies will grow 75 percent every year to touch US$ 835 million by 20208. Many industry watchers believe this could be the year that Robotic Process Automation (RPA), also known as the digital workforce, comes into its own.

A 2016 study of RPA in the financial services industry revealed that three-fourths of organizations had tried their hand at it with either a proof-of-concept or a more intensive implementation9, seeking benefits ranging from cost efficiency and accuracy to scalability and freeing up of human resources that could be deployed into more value-enhancing roles.

But while RPA has elicited great interest, it still has miles to go to hit meaningful usage: in the above study, only 4 percent of respondent organizations reported widespread implementation, whereas another 13 percent said that they had started, but not finished, the process of adopting RPA throughout the enterprise.

What is the focus of these efforts? Are banks looking to automate any and all processes that are amenable to RPA, or are they operating within a narrow band? And is there a “right” way to adopt the technology?

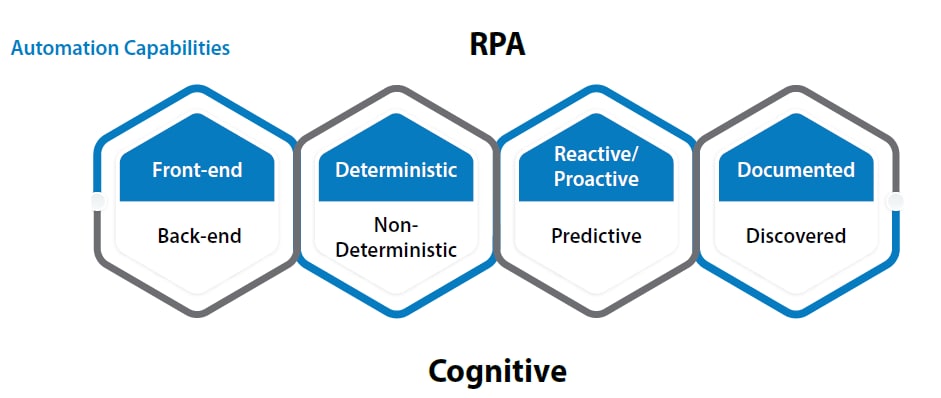

Our experience of working with banks around the world says that the bulk of robotic software automation is targeted at front-end banking processes that are deterministic, either reactive or proactive, and well documented. Let us look at each descriptor briefly.

Front – Back End: Front-end processes are those where interaction between customer and bank happens over a User Interface such as a website/ web form, spreadsheet, or application where data is extracted through the UI itself. The back office processes, however, are yet to take advantages of modern technologies. The processes consisting of functions like clearing, settlement, payments, custody operations, reporting, and compliance can also benefit tremendously from AI technologies.

Deterministic – Non Deterministic: In a deterministic process, all the steps are known and hence easily automated. A request for resetting a password is an example of such a process. A non-deterministic process, on the other hand, is not as clear-cut because it may arise from one of several causes and accordingly, set in motion any one of multiple processes. As illustration, consider a website that is down. The problem might be with the application itself, or the network, or the user’s browser. Clearly, recovery can be automated only after identifying the reason for the outage using a probabilistic decision tree that analyzes the organization’s past history to arrive at the most probable cause. That is actually deeper Artificial Intelligence (AI), or more specifically, Machine Learning territory. This tells us that when banks seek to automate complex or uncertain processes, they might need to use RPA as a first step in deploying a solution involving some form of AI.

Fully – Partially- Not Documented: A process may or may not be fully documented. It is obviously easier to document a deterministic process. But sometimes, even that is not possible for a variety of reasons – people with expertise leave the organization taking their knowledge with them; the organization lacks a holistic view of a certain process; the necessary systems and resources are unavailable, and so forth. Exceptions often go undocumented because while people have a good idea of what a functioning process looks like, they don’t have the same clarity about a broken one. Here, the bank would have to discover the process before it can document and then automate it. Once again, this might call for a more complete AI-based solution to examine all the exception logs from an application, or study the keystrokes at an agent’s desk to understand what is going on.

Which Processes to Automate: Reactive – Proactive – Predictive – Cognitive: Every banking process is triggered by something. Robotic Process Automation lends itself easily to processes that are triggered proactively or reactively. An example of a reactively triggered process is a relationship manager being notified as soon as his customer enters the branch. A proactive process is anticipatory; the automatic dispatching of a fresh checkbook when a customer issues the last check in his booklet, is an example of such a process.

A predictively triggered process is set in motion based on a reading of data patterns. For example, if a customer’s transaction activity drops for three months in a row, it might signal that she has moved some business to another bank, and therefore trigger a particularly attractive promotional offer to win her back. This process can be fully automated since it is rule-based.

When the trigger is cognitive in nature – requiring a human skill such as natural language understanding, for instance – it will take a combination of RPA and other elements of AI to automate the related process. Think of a simple service request sent via email. Robotic Process Automation can do nothing until an AI tool with Natural Language capability, such as a chatbot, reads the email and instructs the software.

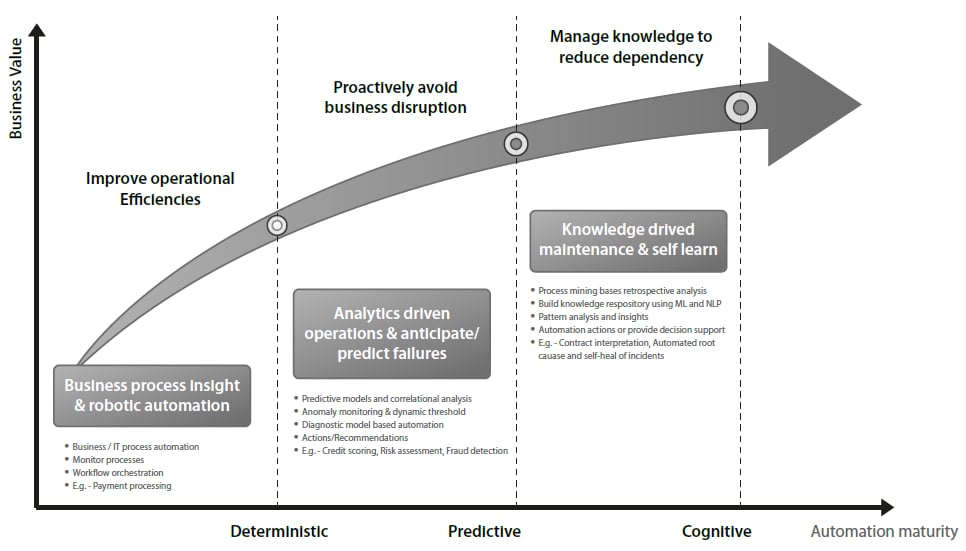

The way forward

From the above discussion it is clear that banks can begin their journey of automation with RPA, but will someday need to step up to solutions that take advantage of other AI capabilities to automate their trickier processes (non-deterministic, not documented, cognitively triggered etc.). A bank’s progress from deterministic to predictive to cognitive processes marks the increasing maturity of its automation capabilities, as well as the increasing business value it generates from automation.

In the early stages of automating deterministic processes, the bank gains operational efficiencies. In the middle stages, when it uses analytics to drive operations and make predictions, the bank becomes more proactive and resistant to business disruption. When it manages to automate cognitive processes, the bank will get to a state where its systems learn on their own. At that point, knowledge management will play a vital role by reducing the bank’s dependence on individuals.

That being said, it is not necessary for a bank to transition sequentially from one stage to the other; it could choose to run multiple initiatives of varying automation maturity levels in parallel. However, before getting into anything the bank would do well to lay out its vision for the future and get the right partner on board. A vendor with full spectrum capability, and a strong track record in financial services automation would be an invaluable ally in this important journey.

Download case study