Leading with AI: The role is cut out for banks’ top management

Sanat Rao

Chief Business Officer and Global Head, Infosys Finacle

Artificial Intelligence is expected to be one of the most prevalent technologies of our times that is slowly getting integrated into every aspect of our daily life.

That includes everything from a Coca Cola vending machine, where an embedded virtual assistant1 will allow you to personalize your drink, to a robot called “Nigel” who will someday recommend whom you should vote for based on an understanding of your political leanings.

Thus today, no CEO can escape the fact that AI will deeply alter the way their business is run. Or that the pace of change will be dramatic given the confluence of forces – explosion of data, increase in accessible computing power, and the rise of open AI – at play.

Let us turn our attention to the banking industry, whose situation hangs in the balance, as economic factors remain soft, new competitors continue to attack, and consumers persist with their demands. Amidst shrinking margins, banks’ leaders are under severe pressure from shareholders to shore up revenue and profit. For them, the AI revolution couldn’t have come at a better time.

In one of its recent reports, the European Financial Management Association said that AI presented a huge opportunity for financial service companies to use their data to improve profit, customer experience, and regulatory compliance, among other things2. Other industries, such as ecommerce, have already turned that potential into proof. Amazon, for example, claims that its ability to use AI to propose contextual, personalized recommendations is contributing an astounding 35 percent of its total cross-sales.

Banks can also reap similar benefits by taking their pick from a selection of established AI use cases. They can improve sales by employing a combination of AI technologies, such as machine learning and predictive analytics, to recommend personalized, contextual products and services to individual customers. Besides generating revenue, banks could also leverage AI to price their products, such as mortgages and personal loans, more effectively and fairly by personalizing interest rates based on a customer’s credit score and risk profile.

In the middle office, AI has shown its prowess in areas such as fraud management, risk assessment and credit scoring. AI-based solutions for KYC/AML adherence, fraud detection and regulatory compliance can analyze transaction data in real-time, (and not after the event has passed) to identify suspicious patterns of activity. Machines can learn continuously from past performance to reduce false positives and negatives. During risk assessment, banks can leverage artificial intelligence to analyze historical transactions and calculate risk exposure at a transaction level. Here it is worth mentioning Feedzai, Kenzo and ZestFinance – lenders who use AI to assess risk before extending credit.

Today, Robotic Process Automation is saving financial service organizations significant sums of money by automating value chains across the front, middle and back office. For example, at ICICI Bank, India’s largest private sector bank, software robots operate more than 200 business processes, and a million transactions everyday. Response time has come down by 60 percent, and both efficiency and productivity have improved.

But beyond doubt, AI’s impact on banking is most visible in customer experience. Natural Language Processing and Generation capabilities have brought inanimate devices to life as they engage banking customers in contextual interactions, all the while conversing like human beings. By taking over the bulk of routine customer service queries, chatbots, such as Swedbank’s Nina, are allowing banks to serve many more customers with the same number of staff. What’s more, the chatbots are smart enough to know when to hand over an interaction that is not going well to a human agent. The result is a hybrid (machine-human) helpdesk that can render superior service to customers, at a lower cost to the bank.

These are only a handful of hundreds of use cases for AI in financial services, which, if implemented right, can make a noticeable impact on banks’ financial performance. Now it is up to each bank to chart its own path to adoption based on business strategy, context, and resources. While spearheading this effort, banks’ leaders must also consider technology readiness, both from an organizational and evolutionary point of view, before making a decision. For instance, do they have the solid data and analytics foundation that is necessary for any AI initiative to succeed?

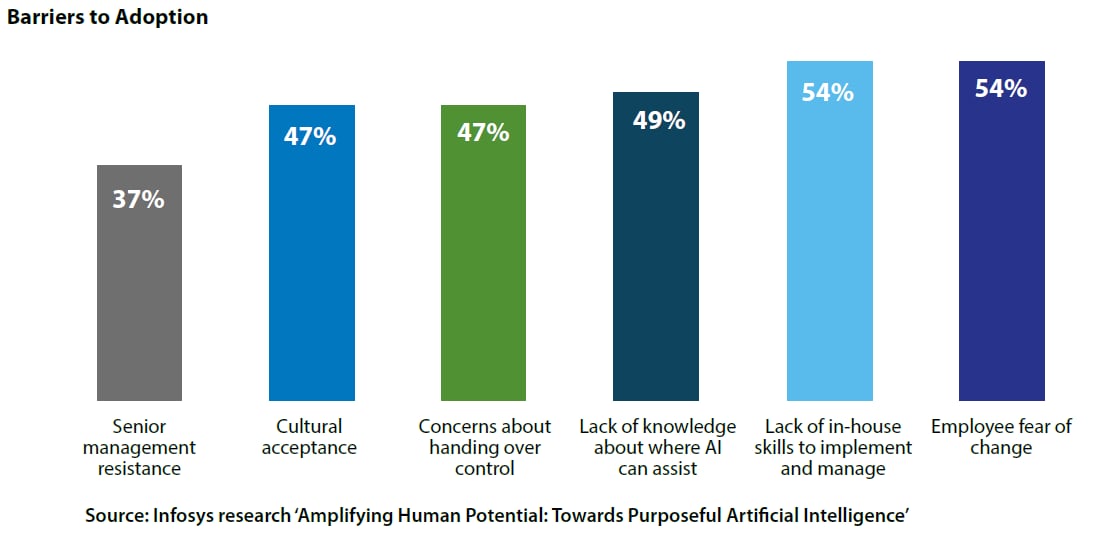

However, the most important issue facing top management is the ethical implications of using AI – the impact on employees and customers, encroachment on data privacy and security, and the risk of ceding control to intelligent, but empathy-lacking machines. An Infosys-commissioned survey of 1,600 business and IT leaders from 10 vertical groups (including financial services) found that fear of change among employees, concerns about handing over control, and cultural issues were among the top barriers to adopting AI. It is the responsibility of business leaders to bring down these barriers and secure employee buy-in. The survey revealed that most were already on this, with 80 percent of those planning to replace manpower with AI, intending to retrain or redeploy those workers to take up new roles.

And the fact of the matter is that organizations have no choice when it comes to AI. 71 percent of survey respondents agreed it was inevitable, but were also optimistic that it would not only contribute to their organizations’ success but to societal and economic well-being as well. Therefore the best option for organizations, banks included, is to make plans and forge ahead towards AI adoption, fully aware that despite the technology not being fully mature, even in its current state it can confer significant benefits and an invaluable head start to the early movers.

Download case study