Puneet Chhahira

Puneet Chhahira

Head of Marketing & FinTech Engagements, Infosys Finacle

So, recently, Musk and Zuck were at it again, trading arguments on whether AI will kill, or redeem, us all. Unfortunately, this enjoyable debate, instead of clearing the fog around artificial intelligence, is only polarizing public opinion further.

The truth about AI lies somewhere in between these two extreme viewpoints. Another truth about AI is that adoption is no longer optional for any business that hopes to survive into the future.

For banks, which are struggling to reduce costs, maintain margins, and meet customer expectations of personalized experience, the need to implement AI is particularly urgent. All parameters, whether pertaining to economics, risk, or customer satisfaction, reinforce this need. Take for instance online fraud, which is on the rise as businesses digitize on scale. There is no way that enterprises can manage this risk manually or using legacy information systems; the only solution is to deploy machine/ deep learning and predictive analytics to examine every transaction in real-time.

Banks who are slow to adopt AI will end up conceding an unassailable lead to the early movers, and also forego the opportunity to give their AI systems a head start at learning. The industry can no longer afford the luxury of watching and waiting for the technology to mature. The time to begin the AI journey is now.

With that resolve, banks must proceed to firm up their understanding of AI technologies before taking the plunge. It is important to recognize that a major reason behind the recent spectacular rise of AI is the coming together of several component technologies, such as machine learning, predictive analytics, natural language processing, robotic process automation and smart virtual assistants. Banks should also be aware of the layers in the AI stack to take full advantage of its potential.

The AI stack consists of building blocks and applied solutions, which are commonly used across a variety of use cases. The foundational layer is Data and Analytics. Next come the building blocks of machine learning, deep learning, natural language processing, natural language generation and visual perception. These building block technologies combine into applied solutions such as virtual assistants, robots and expert advisors, which may then be deployed into hundreds, even thousands, of use cases in banking functions ranging from customer service to risk management.

Another way to understand AI is by type of action or role: is the intelligence merely observing and sensing, or does it interpret and evaluate, or better still, interact and take action? In the first instance, the solution, typically based on natural language processing, speech recognition and/or visual perception, acts as an observer, sensing things around it just like human beings do. In the second case, the organization leverages AI to emulate the human thinking process, including creating and evaluating various hypotheses. In the third case, AI takes action, based on its interaction with both man and machine.

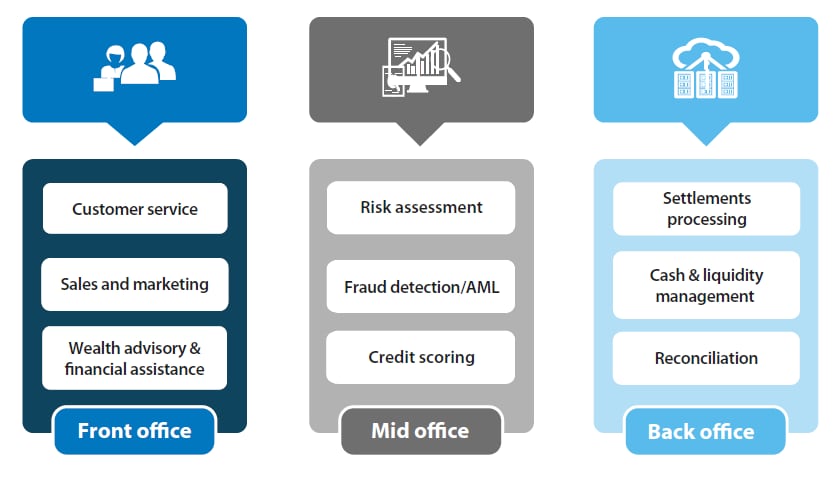

However, most banks are likely to “get” AI by where it fits into the banking function. Today, AI has the potential to reimagine a number of banking processes in the front, middle and back office. Here, a few illustrations may be useful.

In the front office, AI can improve the effectiveness of a marketing campaign by identifying the most likely adopters. Virtual advisors, such as Luvo from RBS, can empower relationship managers with all the information they need for client meetings. And bots can handle a majority of routine queries addressed to the service desk. For instance, Swedbank’s Nina takes more than 40,000 calls from customers every month.

In the bank’s middle office, machine learning can play a huge role in mitigating fraud by scanning transactions for suspicious patterns in real-time, assessing clients for worthiness, and helping risk analysts with timely recommendations for curtailing risk.

Opportunities for deploying AI in the banking back office abound. In securities settlement, robotic process automation may be applied to validate trades and reconcile the information in back office systems with trades made in the front office. AI can also facilitate trade enrichment, confirmation and settlement. Banks may leverage AI for reconciliations in the case of Nostro accounts, OTC derivatives and Forex transactions, and for target balancing and notional pooling in the area of cash and liquidity management.

In a recent Infosys-commissioned study that spoke to 1,600 business and IT leaders across 10 verticals, half the respondents from financial services felt that AI solutions would only be effective if their cost came down. While the benefits of implementation will pay for its cost over the long term, it is also possible to minimize the upfront cost of AI by consuming it off the cloud as a service. Other deployment options are platforms and applications, which confer their own advantages. The commonly held view is that a combination of all three is best.

That being said, there is no set formula or strategy for embracing AI. Each bank must determine its own path, pace and destination based on its business circumstances, readiness and resources. For a bank seeking to build everything in-house, the precondition is that it must have the necessary business vision, skill sets, technology readiness and time. Most banks would probably consider taking some help from the outside, especially from young Fintech companies and startups who have the technical savvy and innovativeness to create AI solutions that they can offer on top of their services to provide real value to customers. When choosing an external partner, certain things to consider are breadth and depth of the AI stack, alignment with the bank’s thinking, domain expertise and track record.

While the approach may differ from bank to bank, the one thing common to all is the need to get going. AI may not have matured to its fullest potential, but it is evolving so fast that anyone who isn’t on board yet is already left behind.