Who We Are

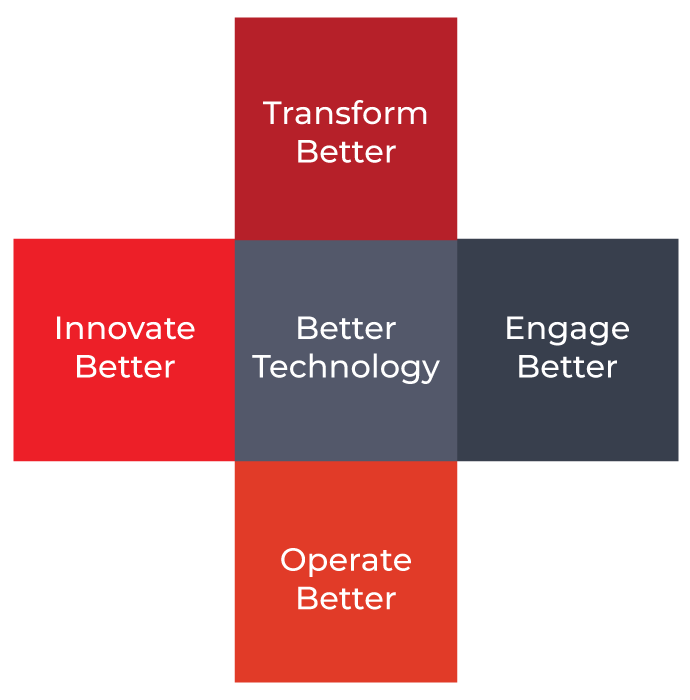

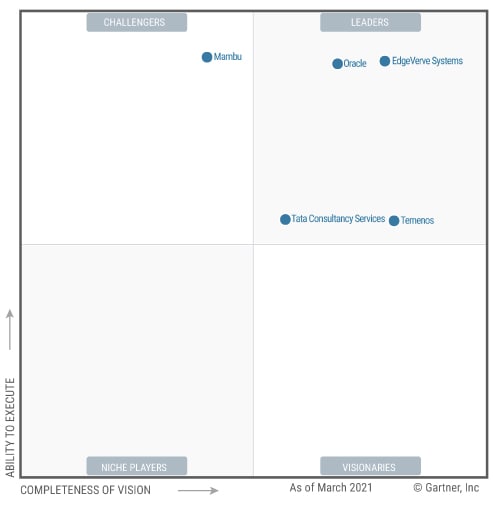

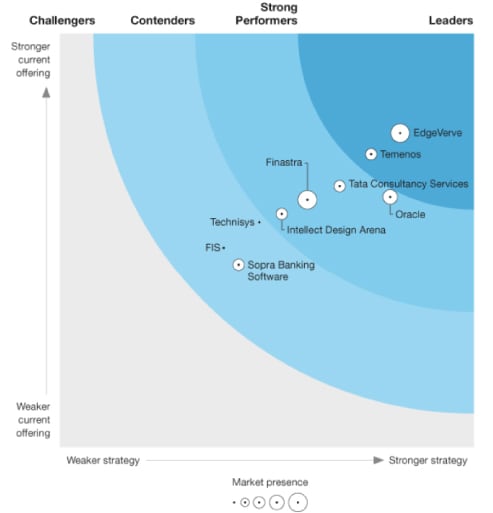

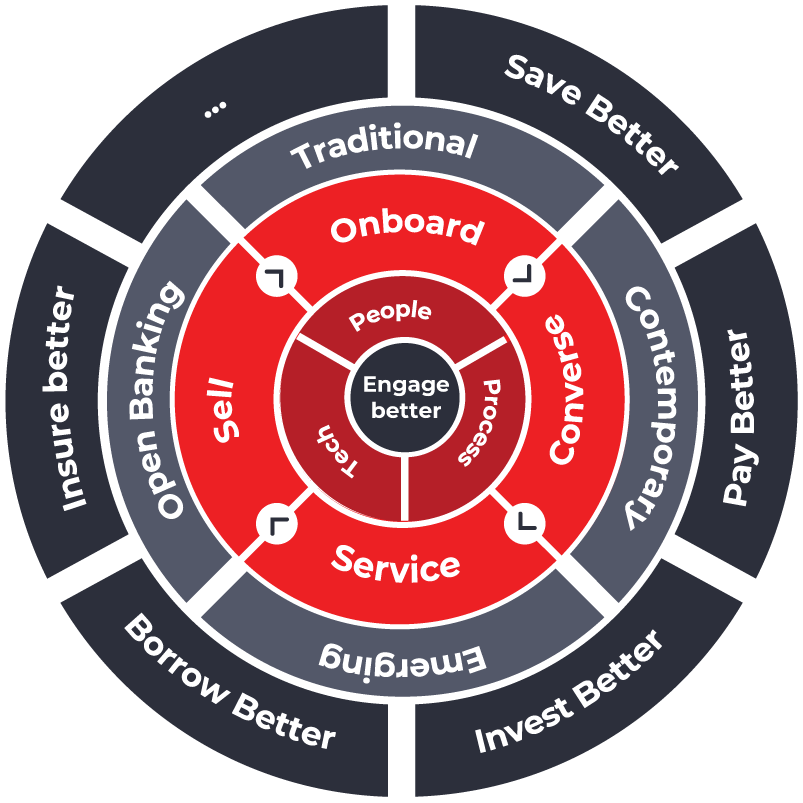

Finacle is an industry leader in digital banking solutions. We partner with emerging and established financial institutions to inspire better banking. Our cloud-native solution suite and SaaS services help banks to engage, innovate, operate, and transform better.

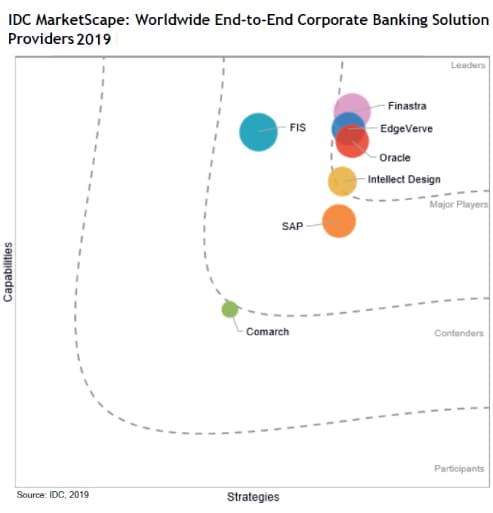

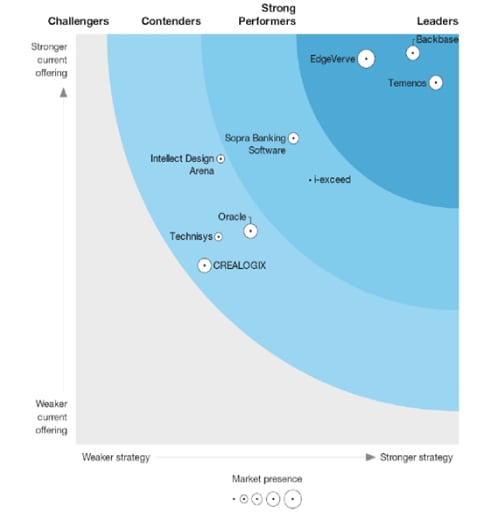

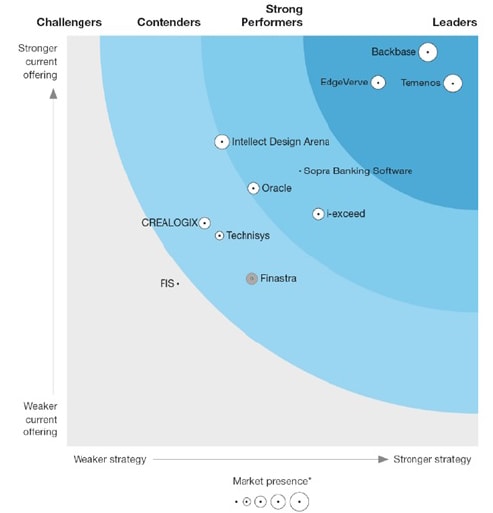

We are a business unit of EdgeVerve Systems, a wholly-owned product subsidiary of Infosys – a global technology leader with over USD 15 billion in annual revenues.

We are differentiated by our functionally-rich solution suite, composable architecture, culture, and entrepreneurial spirit of a start-up. We are also known for an impeccable track record of helping financial institutions of all sizes drive digital transformation at speed and scale.

Today, financial institutions in more than 100 countries rely on Finacle to help more than a billion people and millions of businesses to save, pay, borrow, and invest better.