Corporate banking is a revenue powerhouse, generating half of the world’s banking income. Yet, a recent report shows that a mere 13% of surveyed banks have leveraged cloud for a majority of their operations.

This lag in digital transformation can be a golden opportunity for your bank to seize the reins, bridge the digital divide, and unlock the full potential of Corporate Banking on Cloud.

Download the Report Ask for a Meeting

5 Compelling Reasons to Shift Cloud Adoption Into the High Gear

![]()

Turbocharging business innovation and agility

![]()

Elevating corporate customer centricity with powerful digital propositions

![]()

Amplifying transformative potential of cutting edge technologies

![]()

Powering resilient banking operations

![]()

Streamlining total cost of ownership of IT infrastructure

5 Best Practices for Seamless Cloud Migration and Sustained Corporate Banking Excellence

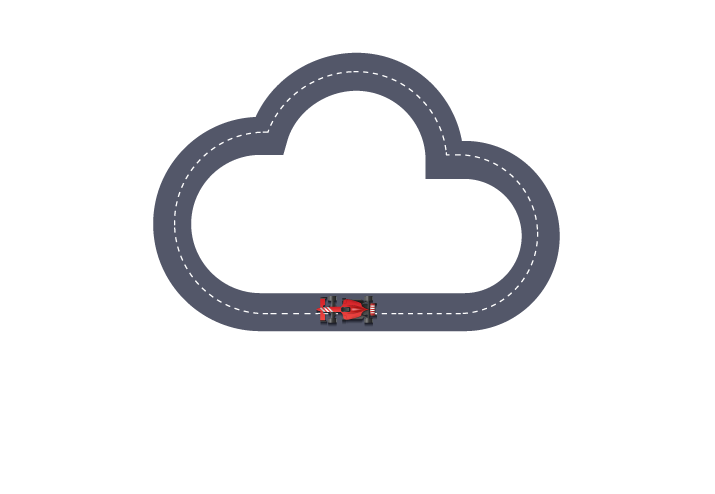

Fast-tracking Cloud journeys with Finacle

Finacle offers a cloud-native and cloud-neutral digital banking suite that can be deployed flexibly – on private, public or hybrid cloud, to suit your bank’s requirements. Our applications are built on a cloud-native framework based on Cloud Native Computing Foundation (CNCF) standards and follow the Twelve-factor App Methodology.

This cloud-native approach prevents vendor lock-in and ensures delivery and support across managed cloud services, for private, public and hybrid cloud. The applications run in a containerized environment orchestrated by Kubernetes, which is supported in all cloud environments.

With Corporate Banking on Cloud powered by Finacle, your bank can accelerate its journey to leveraging growth opportunities and racing ahead of competition.

![]()

Private cloud deployment

Deployment in the client managed private cloud environment

![]()

Client managed public cloud

Deployment in the bank managed public cloud environment

![]()

Software as a service – Single tenant model

Solutions offered as a service by Finacle or partner, full opex model

![]()

Software as a service – Multi-tenancy model

Multi-tenant service offered by Finacle or partner, full opex model

Ask for a Meeting

Thanks for your interest!

Our team will get in touch with you soon.

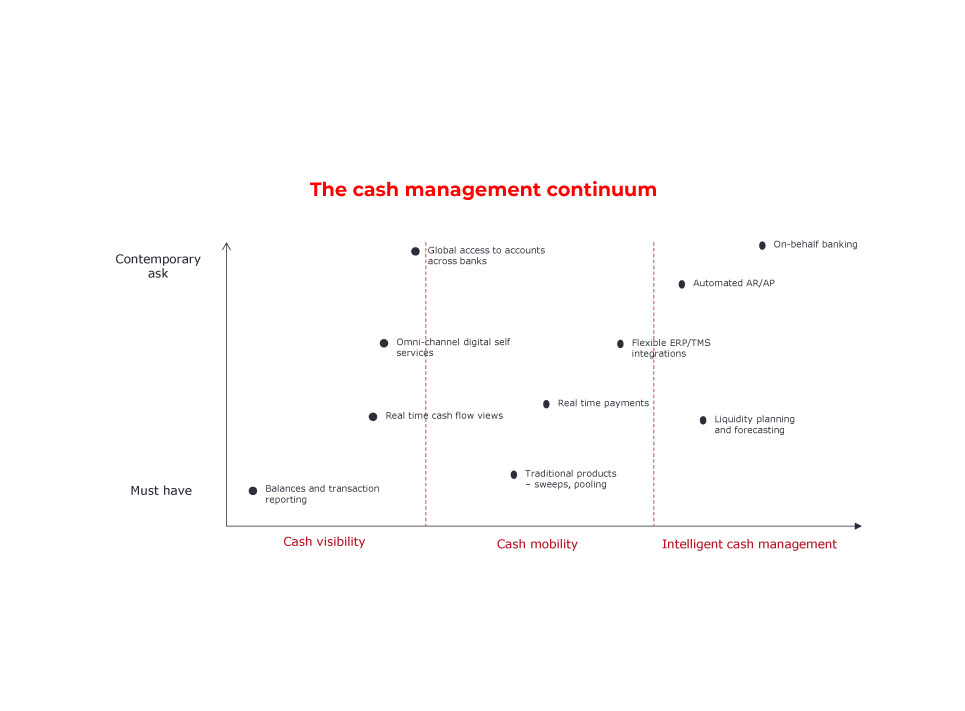

Reimagining Digital Cash Management: Banks' New Approach

To effectively deliver on their promise of comprehensively enabling corporate treasurers, banks need to offer innovative global cash and liquidity management solutions that provide the much-needed flexibility and self-serve capabilities that empower corporates to take control of their financial operations. Achieving this requires banks to fundamentally rethink digital cash management services along the three foundational pillars of cash visibility, mobility, and intelligent cash management. With this continumm-led approach to transforming their cash management offerings, banks will be able to drive continuous maturity and successfully respond to evolving client needs.

Transforming Your Cash Management Offerings with Finacle

Finacle serves as an invaluable business partner for banks, facilitating their journey of scaling the continuum of cash management. With its comprehensive and componentized suite of solutions, Finacle covers the entire gamut of cash management needs, providing banks with a powerful toolkit to meet the diverse requirements of their corporate clients. From liquidity planning and virtual account management to cash flow forecasting and digital engagement, Finacle’s range of offerings ensures that banks can offer holistic and tailored cash management solutions to their customers. This comprehensive suite empowers banks to enhance their value proposition, strengthen client relationships, and drive innovation in the dynamic landscape of cash management services.