FINACLE OFFERINGS FOR

DIGITAL – ONLY PROPOSITIONS

FINACLE OFFERINGS FOR DIGITAL – ONLY PROPOSITIONS

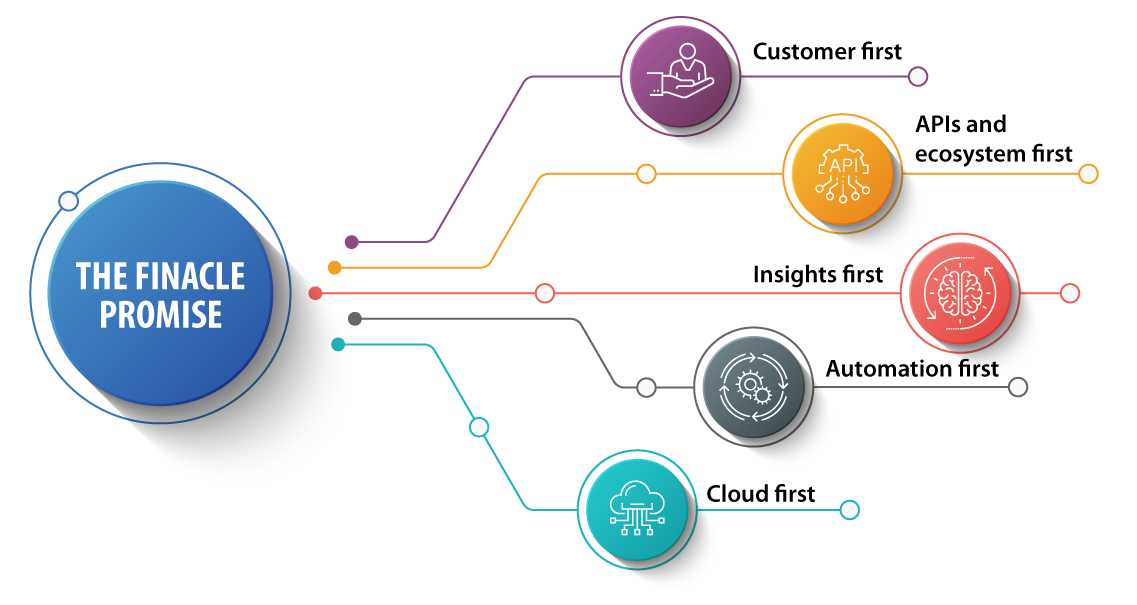

Leading banks with digital-only business model rely on Finacle to take their value proposition to the market

BUILDING A DIGITAL- ONLY BANK

BUILDING A DIGITAL- ONLY BANK

Finacle for digital-only banks is a comprehensive, front to back digital banking solution suite built on advanced architecture. The solution helps address all the business banking application requirements of digital-only propositions – across core banking, customer onboarding, product origination, payments, digital engagement, and omnichannel digital experiences. The solution enables banks onboard, sell, service and engage – retail, small business and corporate customers on a range of digital channels – mobile, online, or RESTful APIs.

Over a dozen digital-only banks globally rely on Finacle to drive their innovation and

growth aspirations.

LEADING DIGITAL-ONLY BANKS RELY ON FINACLE

LEARN WHY FORRESTER NAMED FINACLE A LEADER

LEARN WHY FORRESTER NAMED FINACLE A LEADER

FORRESTER WAVE™ DIGITAL BANKING ENGAGEMENT HUBS, Q3 2021

“EdgeVerve excels with engagement infrastructure on a well-designed architecture… The solution comes with strong API management, offers broad and rich retail, business, and corporate banking services, and excels with its top-tier engagement infrastructure… EdgeVerve is a good fit for banks with a preference for custom-built apps seeking an advanced solution that can be melted into their existing infrastructure” – Jost Hoppermann, VP and Principal Analyst – Referring to Finacle Digital Engagement Hub in The Forrester Wave™: Digital Banking Engagement Hubs, Q3 2021 report

DRIVING ENGAGEMENT ACROSS THE CUSTOMER RELATIONSHIP LIFECYCLE

DRIVING ENGAGEMENT ACROSS THE CUSTOMER RELATIONSHIP LIFECYCLE

Finacle Digital Engagement Suite provides a strong digital banking platform that caters to the needs banks in the digital economy and supports the delivery of next-generation services, while providing broad omnichannel capabilities. Ovum recommends that banks shortlist the solution when considering a digital banking platform.

– Daniel Mayo, Chief Analyst, Ovum and Matthew Heaslip, Associate Consultant, Ovum

digibank by DBS acquires 2 million customers within 18 months with frictionless customer on-boarding

ENHANCING CUSTOMER ENGAGEMENT WITH ECOSYSTEM PROPOSITIONS

ENHANCING CUSTOMER ENGAGEMENT WITH ECOSYSTEM PROPOSITIONS

We, at Paytm Payments Bank, provide various facilities to our customers like savings account, current account, automatic fixed deposits through sweep out, digital debit cards etc. We have ensured that these banking services are available to customer at any time, any place, in consumer’s language and on their mobile phones itself. All our initiatives have been taken to fulfill our vision of financial inclusion.

Our core banking system is provided by Infosys Finacle and we are happy that the jury at Client Innovation Awards have selected us as finalists in various award categories. We continue to work towards our endeavor of bringing half a billion Indians to mainstream economy and we are looking forward to the journey ahead to achieve this goal.

– Satish Kumar Gupta, Managing Director and Chief Executive Officer, Paytm Payments Bank

DEEPENING CUSTOMER ENGAGEMENT ACROSS INTERACTIONS

DEEPENING CUSTOMER ENGAGEMENT ACROSS INTERACTIONS

With the presence of Pinang, Bank BRI Group is able to reach more volumes of customers in Indonesia at high speed (from application to disbursement in less than 10 minutes without a face to face meeting). Pinang is BRI’s radical innovation catering to ultra-micro customers creating a seamless and economical on-boarding process.

The reimagined process provides a faster, cheaper and safer digital lending in Indonesia. With the persistent support of the Infosys management and the robust Infosys Finacle digital banking suite, BRI’s vision of accelerating Indonesia financial inclusion is one step closer.

– Kaspar Situmorang, Executive Vice President, Digital Center of Excellence, Bank Rakyat Indonesia

DRIVING OPERATIONAL EXCELLENCE THROUGH INTELLIGENT AUTOMATION

DRIVING OPERATIONAL EXCELLENCE THROUGH INTELLIGENT AUTOMATION

Discover’s adoption of the Finacle solution is part of our continuous commitment to improve our customer experience. As our direct banking business grows, the Finacle platform will help us scale and optimize internal processes so that they keep pace with evolving consumer demands and market trends.

Carlos Minetti, President of Consumer Banking at Discover Financial Services

LEVERAGING CLOUD TO ACCELERATE SPEED OF BUSINESS INNOVATION

LEVERAGING CLOUD TO ACCELERATE SPEED OF BUSINESS INNOVATION

Ask for a Meeting

Thanks for your interest!

Our team will get in touch with you soon.