Perspective

Reimagine the banking customer journey

Sajit Vijayakumar

Chief Operating Officer, Infosys FinacleIntroduction

A bank in New Zealand allows customers to park their savings in customized buckets named after goals, such as a “Machu Pichu”, “Prada Bag” or “Rainy Day”. In the United States, USAA provides not just housing loans, but also third-party assistance to help military families find homes and related services catering to their unique needs.

These are examples of banks that are beginning to view their relationship with customers from the latter’s point of view. Customers rarely view banking as an end in itself; to them it is a means that serves a larger purpose, a process embedded within daily activities or life events. The bank is simply a transit point for customers on different journeys.

Mapping the customer journey is therefore an essential (and rewarding) part of experience transformation. Recent research shows that 85 percent of those who practice it have experienced a positive or very positive impact. Benefits include higher customer satisfaction, fewer customer complaints and lower churn. New-age organizations, and especially big-tech firms like Google, Amazon and Apple, are living examples of businesses that owe much of their success to their beautiful customer journeys. Banks seeking to reimagine their journeys and customer experiences to big-tech standards should look at doing the following:

Given that banks are awash in information today, it is very important to identify the data sets of relevance.

Do more with data: Most banks already use their data to personalize the customer journey by customer segment. (For instance, a high net worth customer is ushered quickly past the queue to the branch manager). The next step is to personalize the journey (or communication or experience) to the individual customer, much like Netflix or Amazon does through targeted recommendations. Once a bank is past this stage, it can look at exploiting data further for things such as improving its pricing model. Here, the dynamic pricing model of companies such as Uber could provide food for thought.

A word of caution. Given that banks are awash in information today, it is very important to identify the data sets of relevance. For instance, Amazon’s personalization engine considers a customer’s purchase history, reviewed products, and other purchases made by buyers who bought the same item as this customer, ahead of other information. In the case of a retail bank, point of sale data or purchases made by customers who behave the same way, enjoy a similar lifestyle or are at the same life-stage must inform customer journey personalization.

Think tech: A bank might have the right ideas and data for improving the customer journey but the wrong technology could let it down. It must therefore choose its platform judiciously – in terms of technology, scalability, reliability and support – and also employ the right algorithms. Spanish bank BBVA is doing it right with an algorithm that uses a customer’s product portfolio, geographic location and other factors to personalize in-app experiences.

Chinese insurer, Ping An, has gone a step ahead to recast itself as a technology company with a license to conduct a financial service business. It is using technology to insert its presence into customers’ everyday journeys.

A better approach is to think about technology the way the best technology companies do – as something that is embedded within every process, application, innovation, idea or customer journey. It is not enough to merely onboard the best-known customer journey mapping vendor or use the most suitable digital banking solution; the bank must think about its impact and integration with surrounding processes and applications.

Chinese insurer, Ping An, has gone a step ahead to recast itself as a technology company with a license to conduct a financial service business. It is using technology to insert its presence into customers’ everyday journeys. Whether it is a quest for better health, better transport, or even better entertainment, Ping An has a platform business and ecosystem connections (and of course an insurance product!) to facilitate the journey.

Journey by design: Onboarding, transaction, service and resolution are all parts of banking journeys. However, customers view banking as a part of the broader life journeys they take to fulfill various needs. Banks must reciprocate that thinking by participating in these larger journeys by being present right from the time the customer acts on a primary need (need for wellness rather than medical insurance; need for vacation rather than travel card etc.). Banks like DBS are already doing this by setting up a marketplace platform for buying and selling pre-owned cars.

As is clear from above, primary needs and significant life-stage events – marriage, parenthood, home buying – make for the most obvious customer journeys. However, by employing techniques, such as Design Thinking, a bank can become more empathetic to customers and discover new journeys. The presence of ecosystem partnerships is key to this, of course, but so is a well-timed intervention.

For instance, when a bank is already facilitating a customer’s house purchase through partnerships, it can initiate more journeys with recommendations for legal services, packers and movers, utility companies and interior decorators at the precise time they are needed.

Reimagining a customer journey is not a one-time activity. It calls for constant innovation and several iterations. When there are competing ideas, it is wise to test them in parallel (using A/B testing etc.) before choosing one. Amazon is one example of a company that tests its shopping experience processes constantly to eliminate friction.

Open up to opportunities: The move towards open banking is forcing the universal bank – one that manufactures, owns and distributes products and services through its own channels – to adopt a platform business model where it sources, aggregates and distributes a variety of financial and non-financial offerings using a network of partners from an ecosystem that it might even help to build.

Banks must embrace this trend by working with partners to innovate and expand their range of offerings, and by leveraging those tie-ups to expand, fulfill and enhance their customers’ life journeys.

The last word

As the customer journey becomes more crucial in the banking relationship, non-banking players, especially bigtech companies and FinTech challengers, might seem to have an edge. But while these new-age entities may have mastered the customer journey, banking incumbents must draw comfort from their own inherent strengths, including but not limited to, vast financial resources, loyal user base, expertise in regulatory compliance, reputation, and customer trust. By reimagining their customer journeys, banks can mitigate both friction in customer experience and the advantage of their young rivals to reclaim their supremacy in the market.

Download FinacleConnect

FinTech innovation in banking

The case for greater collaboration

Ravishankar

Chief Executive Officer, Active.aiIt wasn’t that long ago when banks viewed FinTechs, as competitors. Those days are behind us now, with FinTechs and banks becoming collaborators, partners and even customers, leveraging each other’s skills and strengths to achieve common goals.

Banking has significantly evolved over the years from a state of technology experimentation to adoption, with banks in the current era having moved through two major phases of digital evolution.

First phase is the evolution from paper-based banking services and transactions to online banking, reducing the need of customers to visit banks. Then was the advent of mobile banking platform which was the second phase, allowing even easier access to banking services to consumers anywhere anytime.

There would be countless examples of collaboration between FinTech and Banks during this phase however a classic example of perfect partnership comes to mind between IDnow and Commerzbank in Europe. Commerzbank wanted to launch a mobile based app for its banking services. Unfortunately, EU laws require that bank customers verify their identity to the bank in person, which would mean that signups outside a bank branch are impossible. However, IDnow came into the picture and gave them a solution that allows them to verify their customers’ identity via video on their smartphone or computer.

This resulted in drastic increase in their mobile app downloads and 50% increase in conversions. Such and many more untold stories of collaboration is what has propelled the change in narrative of “Fintech vs Banks” to “Fintech and Banks”.

As a bank in today’s day and age, one of the greatest challenges is the war for customers. According to research from Accenture, around 7 percent of Canadians and 11 percent of Americans switch banks every year. What statistics like these suggest is that to succeed, today’s banks not only need to win new customers, they also have to figure out how to retain as well.

Essentially, it means that banks need to become far more customer-centric than they ever have been. Rather than talking to customers using industry jargon and product names, they need to put their customers in the driver’s seat so that they can access information and complete transactions on their own, whenever they want, using natural language to do so. And while that was virtually impossible until recently, advances in technology have changed the rules of the game.

Hence the next phase of digital banking will be powered by AI-enabled services leveraging API/Open Banking capabilities, reducing the friction even further where AI will drive the interaction between banks or FinTechs riding on banks’ Open APIs and their customers. Thus removing the last layer friction of UI/UX and usher in the era of true Conversational Banking allied by backend processes powered by AI/ML for faster and accurate processing.

It is projected that chatbots will save banks billions of dollars in the coming decade. According to a report released by Juniper, chatbots will be responsible for over $8 billion annual cost savings by 2022. According to Gartner, by 2020 chatbots will be handling no less than 85% of all customer service interactions.

When embarking on the Conversational AI journey, some of the key points that banks need to focus upon when engaging with FinTechs are:

- It’s a platform game: It is critical to look at FinTechs who are a platform or product players as opposed to siloed solutions or else scaling will become a challenge. Also going omni channel will become much easier when working with a platform.

- Focus: AI as of today works well only if narrow, so you need to look at players who are focused on specific domains or else quality and low level of business understanding will create a poor customer experience. In short, look at players who are focused solely in BFSI space to give a rich and powerful customer experience.

- Leadership: For a long term and strategic relationship, it is critical for FinTechs to have a strong leadership team with domain expertise to enable rich inputs both from business and technological aspects.

This is just the beginning of the third wave in digital banking powered by AI and Open Banking. However, if the rapid advancements and adoption of AI based solutions and Open Banking is anything to go by, it’s imperative for banks to start their AI journey ASAP and secure their futures through deep collaboration with FinTechs.

Some new paradigms of collaboration frameworks which I believe can help Banks to navigate the future with FinTechs are:

- Joint Ventures: Co-create digital brands by leveraging the technology of Internet companies and their capital. Newer digital applicants in Asia are seeking such partnerships between Banks, Internet companies and Telecom providers. Case in point are applicants in HK and Korea.

- Become a tech company: Acquire technology companies in part or full, is becoming a transformation process for leading global players. Seen as a competitive advantage in areas of payments, AI and Digital capabilities. Leading bank in Canada acquired a leading AI company for building out its strategy. Some banks in Asia have over 10,000 technologists working in AI and cutting edge technology.

- Create the Ecosystem: Incumbents have moved on from innovation labs to directly control outcomes by taking greater risks in creating newer digital experiences. This is via their corporate venturing arms or talent partnerships to encourage and incentivise innovators to take risks for banks to become digital leaders. This talent chase is happening in AI hubs and Universities across the world.

The future for traditional banks clearly lies in transforming to technology companies as they compete in a Hyper Digital Era. I would think more tech fin will help incumbents while fintech is where the challengers will look to drive their customers to.

Creating new experiences in banking: A transformation journey

Puneet Chhahira

Head of Marketing & FinTech Engagements, Infosys FinacleExploring the relationship between customer satisfaction and financial performance has consistently been a pursuit of interest for researchers. And their findings have consistently revealed a clear correlation – businesses that report higher customer satisfaction also report stronger financial performance. Recent research by the Institute of Customer Service states that organizations that maintain a customer satisfaction score above their sector average achieve 9.1% revenue growth year-on-year while those with a lower-than-average customer satisfaction score achieve just about 0.4% growth year-on-year. The positive top-line growth is a function of favorable customer retention, customer acquisition and cross-sell/up-sell outcomes. The right customer experience keeps the existing customers returning for more, as they also double up as advocates positively influencing the rate of new customer acquisition. What’s more, great CX directly translates into benefits of lower total cost-to-serve. For one, expanding the existing share of customers’ wallet is a more cost-efficient means of meeting revenue goals than putting all weight behind chasing new customers. A proven fact, industry regardless. Secondly, one of the key enablers of great digital customer experience is the use of technology and automation, which if done right, can help save millions in the cost-to-serve.

Clearly, good customer experience is good business. And technology and business executives recognize this. The ripple effects of CX improvement across customer acquisition, retention, sales and cost-to-serve metrics have been widely acknowledged in business and technology circles. However, many an executive seem to be losing the plot somewhere between “recognizing the importance” and “translating it into the required action”. In financial services, all senior industry professionals admit to a willingness to radically improve customer experience, but few seem to have charted a definite approach or demonstrate the sense of urgency essential to drive the transformation efforts.

When it comes to customer experience transformation, few things are more important than understanding what a great customer experience means to a business, in its unique business context and environment. That is to say, defining the right vision to know where one wants to go is paramount. Next, it is equally crucial to determine the level of competency required to deliver on that vision. The total competency quotient (TCQ) is not limited to financial or technology considerations but cuts across people, processes, operations and technology. An unbiased and honest assessment of the existing level of competency uncovers the gaps and sets out the direction for a roadmap that is realistic and pragmatic, yet aligned to the long-term vision.

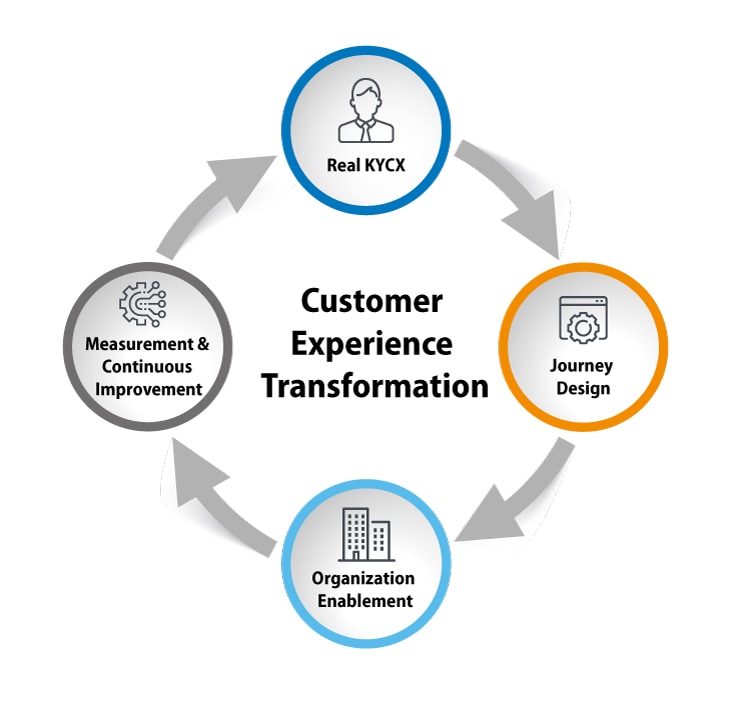

In our view, they are four fundamental rungs to this transformation ladder:

1. Real KYCX (Know your customer’s experience)

A customer experience transformation initiative is highly likely to come a cropper if it begins with an inaccurate understanding of the current customer experience, no matter how clear and bold the vision. This crucial first step in the process is what we call the “Real KYCX” stage. And doing this right requires banks to perform a comprehensive analysis and assessment that takes into consideration insights from quantitative as well as qualitative methods. Techniques that provide a fresh stream of real-time data inputs such as recording journeys for web and mobile analytics can be particularly instrumental in discovering where customers abort a journey, take longer than the average estimated time or diverge from the expected path. Qualitative inputs such as customer interviews often serve to correct any false positives and reveal the deviation between the perceived and the actual level of customer satisfaction. Real KYCX is not about “more data” but about “the right data” gathered through a combination of quantitative and qualitative techniques.

Leading banks are restructuring their CX organization around customer journeys. The practice prevents handshakes across various functions, since each journey team comprises a diverse set of experts across product development, business development, channel strategy, and more.

2. Customer journey design

The Design phase spans several sequential steps such as persona building, workflow and data flow design, and design thinking-led journey map design. While the importance of flawless planning and execution across all these stages cannot be overstated, the journeys a bank prioritizes can go a long way in demonstrating immediate value of change to the customers.

A customer’s experience with a bank is the sum total of all the experiences and interactions the customer has with the bank. However, not all customer journeys are equally critical or important. Prioritizing some over others can hold banks in good stead. In fact, a rewarding practice many banks seem to be adopting now, is aligning and driving multidisciplinary effort towards re-imagination of identified customer journeys. Instead of organizing talent in functional units, leading banks are restructuring their CX organization around customer journeys. The practice prevents handshakes across various functions, since each journey team comprises a diverse set of experts across product development, business development, channel strategy, and more. Prioritizing journeys helps drive dedicated cohesive effort towards re-imagining the identified customer journeys.

An excellent transformation strategy that does not figure a plan to enable all stakeholders in the value chain to adapt to new ways of working is like attempting to steer pods designed for a steam-powered carriage at hyperloop speed.

3. Organization culture and workforce enablement

An excellent transformation strategy that does not figure a plan to enable all stakeholders in the value chain to adapt to new ways of working is like attempting to steer pods designed for a steam-powered carriage at hyperloop speed. A business or organization transformation is not about how progressive, agile, and efficient its innovation engine or innovation team is, but how quickly and effectively employees in the organization can understand what change means for them at an individual level, and then create value in their respective roles, responsibilities, and circles of influence. The business has a large and critical role to play in this transformation. When Singapore’s leading bank DBS embarked on its transformation strategy in 2015, people and culture transformation was not an afterthought but a project run concurrently with technology transformation. The bank’s three-part approach to workforce and culture transformation called “Think Digital” encompassed learning through education, learning through experience, and learning through exposure. The bank educated its employees on digital business models, human-centered design principles and journey thinking using the 4D framework (discover, define, develop, deliver) and agile methodology; implemented the squad model for experience-led learning; and, chose a select group of employees to act as Digi Ninjas to expedite adoption and eliminate barriers. Continuous learning forms the core of workforce upskilling and transformation efforts of Infosys. Wingspan, a next-gen enterprise learning solution, is not only used widely within the organization but has also been adopted by a few leading banks in the U.S. for talent transformation.

4. Periodic measurement

KPIs such as customer satisfaction index (CSI) and net promoter score (NPS) are evidentiary indicators of customer experience success. But what can significantly enhance these final indicators is a regular measurement of performance against the key parameters identified and measured during the “Real KYCX” stage. Employing qualitative and quantitative techniques comprehensively to measure performance across the identified metrics helps track and benchmark improvement. What’s more, a rigorous performance improvement discipline informs decisions in the event an identified pursuit warrants course correction.

Conclusion

The industry is in the midst of multi-dimensional change. With the rise of new collaborative models, the unbundling and re-bundling of products and propositions is dramatically changing the supply-side dynamics. On the demand side, the empowered and digitally-savvy customer is interacting with financial service providers in new ways and on a variety of new digital channels. Re-imagining customer journeys for this change begins with an accurate understanding of the current level of satisfaction of a bank’s customers. As stated, a combination of qualitative and quantitative techniques to arrive at the true picture sets out the direction for transformation. Translating these insights into action requires the right priority matrix and the introduction of related organizational changes to drive swift execution. Next, true customer-centricity requires every employee in the organization to understand how they can drive positive customer outcomes within the context of their roles and responsibilities. A customer-centric organization is one that relentlessly focuses on organization-wide learning and development to keep pace with the rapidly changing customer expectations. And finally, defining the right yardstick and measuring performance regularly provides the benchmark and impetus to drive continuous improvement.

Banks may choose to prioritize different journeys based on their unique realities. However, an accurate understanding of these realities is the first step towards successful CX transformation.

Four key essentials of sustainable CX transformation in banking

Rajashekara V. Maiya

Vice President, Business Consulting and Product Strategy, Infosys FinacleApple has always been a shining example of customer-centricity, the secret behind brand Apple’s cult status.

Back in 1989, when the company launched the first portable iMac, people were skeptical of using personal computers. Apple launched the Mac with great fanfare; something customers have come to expect and look forward to now. But in the design and development phases of the machine, the bigger challenge before the company was not about how to market the product, but to try to get people to use it. Apple focused on making it more personal, and designed it to elicit the feeling of familiarity. With a briefcase-like handle on top, the design inspired and encouraged people to try and use it. Such nuanced understanding of the consumer psyche typifies the company’s razor-sharp focus on customer-centricity that has been documented widely and has earned the brand good press time and again.

Today, all modern SaaS-based companies, on-demand services, and billion-dollar unicorns are pushing the boundaries of customer-centricity, each debuting unique ways to delight the customer with cohesive experiences and contextual journeys.

In this article, we look at four key tenets for success in modern banking.

The 4Ds of development

The foremost part of a successful business or customer strategy is creating products that customers want. And while there may be no definite rulebook or formula for creating successful products, integrating customer insights throughout the product development life cycle – design, develop, deliver, distribute-invariably goes a long way. Product development experts in industries such as consumer goods often begin the process with proven practices such as focus group research that help them chalk out the broad guidelines for designing a product with potentially great desirability and demand. In banking too, studying consumer behavior across different customer segments and age groups can set out the primary foundation for creating a customer-centric product.

However, research findings gathered in the pre-design stage are at best useful for academic purposes if they do not translate into actionable insights for the design and development phases. Creating accurate specifications and ensuring immaculate execution are the most crucial steps in product development. But even that’s not all! The secret lies in putting the product prototype to test, discovering new unlikely scenarios, and eliminating the potential false-positives and false-negatives before the product hits the market. Best practices such as setting up a user experience cell to allow a set of users – preferably one that’s different from the sample considered for the initial research exercise – have proven particularly instrumental in achieving positive customer outcomes upon product rollout, and after. Prototyping is best done in alternating design-deliver cycles.

Widely recognized as the 4D model for product development, the methodology described above has been hailed as the hallmark of successful product development by many a business, not only because it increases RFT (right-first-time) phenomenally but also prevents frequent radical changes later on.

In this age of instant gratification where Google returns a battery of relevant search results in milliseconds and the threshold for wait-time – whether for purchases on a digital channel or in a queue physically – is as low as 60 seconds, banks that expect their customers to wait at a branch can easily be said to be living under a rock.

The need for speed

Over the years, commercial enterprises have firmly come to believe – and rightly so – that any business that does not have the customer at the heart of all it does is setting itself up for failure. But the belief has never been more reflective of the times than now. Cheaper networks, affordable technology, smarter devices, and unprecedented competition for innovation, are all culminating in the rapid rise of models that transfer power to the customer. Amazon’s one-click proposition embodies one of the foundational principles of the customer-obsessed brand’s philosophy. The wildly successful strategy that compelled the company to file a patent back in 1997, focused on eliminating a significant hassle in online shopping at the time. That of shopping cart abandonment. It gave online shoppers a reason to provide their details to the retailer, and save time and fees for multiple purchases. Even though Amazon’s patent for this breakthrough expired in 2017, the trademark will be Amazon’s in the history of retail.

In this age of instant gratification where Google returns a battery of relevant search results in milliseconds and the threshold for wait-time – whether for purchases on a digital channel or in a queue physically – is as low as 60 seconds, banks that expect their customers to wait at a branch can easily be said to be living under a rock. The increasingly impatient and significantly less loyal customers expect retail-like experiences from their banking relationships, and banks must pull out all stops to provide these experiences.

The moving target – Technology

The good news amid all the pressures of customers’ evolving expectations and increasing bargaining power is that emerging technologies such as AI, ML, and embedded analytics, that until a few years back only technology companies reaped the benefits of, are now commercially available and seeing wide enterprise adoption.

World’s leading ride-sharing app Uber, that services over 75 million customers across the globe, records about a thousand rides every minute. Not surprisingly, the cost of every minute of downtime runs into thousands of dollars. Not only that, the sheer volume of data about car locations, traffic conditions, and routes to destinations would typically never have made Uber the profitable company it is today if it were to build its own infrastructure. Add to that the cost of building its own texting system, mapping technology, and gateway. What eliminates all this cost is the easy availability of the technology components that power Uber’s operations, namely AWS for cloud, Google map APIs for navigation, and PayPal’s Braintree as the payment gateway.

In financial services, banks have been investing in their own compute resources, and some progressive banks are even moving substantial mission-critical core banking workloads to the public cloud for benefits of innovation and agility. Banks are driving the adoption of emerging and rapidly evolving technologies such as AI in the form of chatbots, RPA, and ML, in a variety of more and more sophisticated use-cases. And, there is a visible shift in the processes and practices in banking – from batch processing to real-time processing, from economies of scale to economies of data-at-scale, from mass production to tailored experiences, and from the pipeline business model to the platform business model.

As banks continue to undergo a holistic transformation of their business and organization, how they do it with least disruption to business and consumer will have a lasting impact on their success in the times to come.

Customer-first culture in the organization’s DNA

The shift from product-centric approaches to customer-centric ones has been perceptible in businesses across industries. And the top-line gains have been equally evident. Riding the next wave of customer-centricity would require businesses to enrich the lives of their customers by offering products and services that create value in ways that empower their customers to do more. Harnessing structured and unstructured data across customers’ digital footprints is something all progressive banks have invested in. As they transform their core for higher agility and responsiveness to realize the full potential of and returns from their investments in analytics, they must drive customer-first thinking and analytics-for-all within the organization to create services and experiences that go beyond the realm of financial services and engage customers across demographics. This would mean different things for different target customers, and banks will need to understand the specific context of each customer. For instance, a bank may need to educate a customer approaching the age of retirement about a relevant assured savings plan, and approach a salaried customer who strives to save every dollar possible by offering the best deals through a marketplace.

Banks have no time to lose to align their strategic priorities around a single or hybrid specialist role across the banking value-chain. And then, execute them swiftly.

CX and customer onboarding A reality check for banks

James Buckley

Regional Director, Europe, Infosys FinacleBanks are now way past the embryonic stage of their CX transformation programs. Most financial service institutions began their transformation journey about five years back when they moved beyond basic Internet banking to create seamless omnichannel banking experiences. Over the course of the years, banks have strived to iron out issues in customer onboarding, and have steadily navigated the challenges around KYC verification, a step that was a key point of friction in the onboarding experience.

However, the key challenge for banks has not been so much about eliminating friction from the onboarding process for a new customer as it has been about onboarding or migrating existing customers to new channels and applications. Banks have wrestled with the challenge of containing their cost-to-income ratios ever since the 2008 recession and new low-cost channels have proven to be a crucial lever.

The key challenge for banks has not been so much about eliminating friction from the onboarding process for a new customer as it has been about onboarding or migrating existing customers to new channels and applications.

Addressing the right problem

Undoubtedly, banks are not undervaluing the importance of driving customers to new digital channels. But they seem to be enjoying little success.

Most incumbent financial institutions are relying on the rather traditional contact-center-led approach of calls and e-mails to drive customers to new digital channels. Most customers, on the other hand, are reported to abandon the download process less than three minutes into the conversation with a call-center bot or human agent.

A deeper analysis of these results often points to the fact that contact center inefficiencies are far from a part of the problem statement. The low adoption of new channels stems from an inherent inertia. And the solution, therefore, lies in finding ways to make customers want to adopt new applications and new channels rather than forcing them to do so. It entails embedding newer and easier ways of using banking services in journeys that naturally become a customer’s preferred way to interact, not improving the effectiveness of contact-center calls. Not many large incumbent banks, however, are adopting approaches that change consumer behavior.

Bringing about this shift in consumer behavior requires a strategically planned process executed over a period of time. When a large retail bank in a low-interest market was recently asked about its channel-distribution, the bank reported that about 60 percent of its customers still use a mix of brick-and-mortar and digital channels. So when customers are not abandoning the traditional channels but continue to adopt new channels, the traditional channels cannot be shut down. This should encourage a bank to enrich journeys across digital channels, nevertheless. The good news is that banks are not devoid of this impending change. The investment profile of banks is reflective of it. As opposed to large investments in physical infrastructure assets, the current investment profile of banks indicates a more practical shift towards data and technology enablers for enhanced customer outcomes.

The data imperative

Banks have long believed that they have the most comprehensive reserve of intelligence about their customers. Is there a compelling need for banks to take cognizance of a divergent view?

Primary banking relationships apart, a bank’s strategies and approaches are primarily dictated by market trends. Now, market trend in a debit card economy such as Germany could be strikingly different from that in a credit card economy such as the UK or the US. So, when it comes to really knowing a customer, retailers have a more thorough insight into customer buying behaviors and purchase patterns. For instance, Amazon can run deep analytics and arrive at a truer picture of customer preferences and risk profiles with its large data sets that comprise information not only about an individual’s choices but also an individual’s family and influencers.

Design to build

With increasing emphasis on customer journey design, another spreading realization taking hold among banks is the gap between the attractive design on paper and the realities of the implementation process in the delivery value-chain. And this recognition is driving a shift towards iterative agile delivery models which allow a path of continuous improvement that translates into immediate tangible enhancements for the customer. Representative consumer behavior studies have repeatedly stated that experiences that get better over time and demonstrate clear value to customers by allowing them to do more are perceived to have a greater impact on customer satisfaction than static experiences where a single instance of failure can quickly snowball into bludgeoning attrition. As banks bridge the gap between the sophistication in design and the maturity of tech delivery they are already beginning to save millions of dollars they have invested over the years but reaped meager returns on, due to lofty designs amounting to huge implementation challenges.

With increasing emphasis on customer journey design, another spreading realization taking hold among banks is the gap between the attractive design on paper and the realities of the implementation process in the delivery value-chain.

Digital Davids: The dichotomy and the dividend!

It’s no secret that the incumbent Goliaths in financial services are grappling with the mounting challenge of customer-churn as the newer digital-born Davids continue to attract a growing customer base with sophisticated digital solutions and offers. However, the real threat is that these agile start-ups are not just hollowing the incumbents with customer churn but high-value customer churn, a number that runs into the millions. Even if customers do not discontinue their banking relationships, in a growing number of cases, their accounts remain idle as they continue to turn to innovative solutions from new agile service providers. Ironically, the answer to this urgent need to salvage wealthy customer relationships from FinTechs and agile upstarts lies in partnering with these FinTechs and upstarts; an approach banks came to terms with after quite a few years of initial pushback. If there are mounting challenges, there are umpteen opportunities as well. Collaborating with the new crop of banking technology specialists is one such opportunity. Accessible, flexible, and scalable solutions from banking specialists such as Finacle and Mambu can help banks accelerate and augment business value in the digital-first world.

A tale of two journeys

Abhishek Verma

Senior Director and Digital Evangelist, Infosys FinacleIntroduction to the customer journey

Open Banking, and its key enabler, the platform business model, are ushering unprecedented possibilities for customer experience and engagement in banking. With banking services integrating further with daily life activities in the open era, the banking customer experience is also expanding from a one-off event to a journey of connected, not isolated episodes.

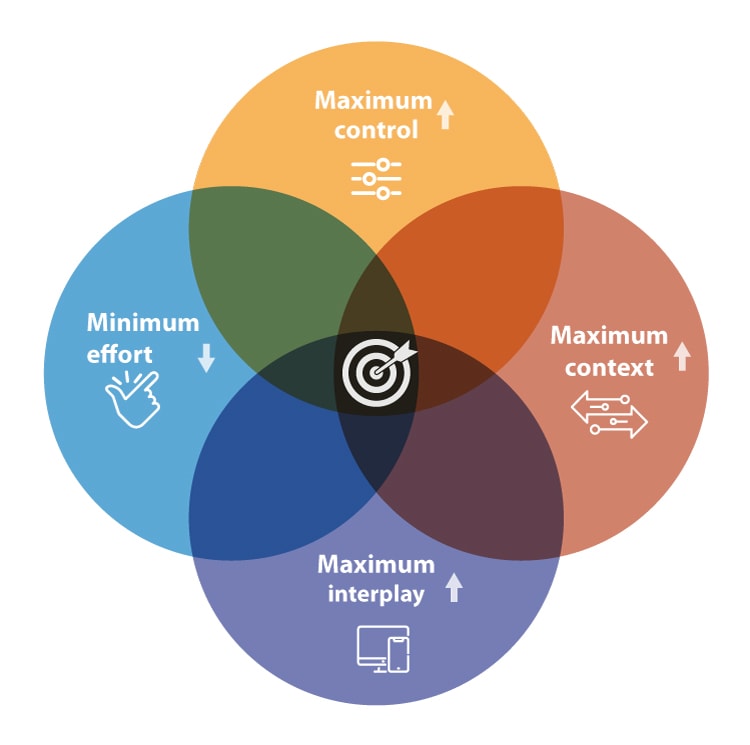

Research by a leading market research and advisory firm says that customer journey analysis is a top priority for the customer analytics initiatives of enterprises. Designing the right journey for an open banking environment is therefore of utmost importance. An effective customer journey has the following attributes:

- It is effortless, which means the customer encounters no (or minimal) friction throughout the journey.

- It allows the customer to be in control at all times, and especially of what he seeks and receives.

- It supports interplay between channels, devices, touch points and services, so that the customer can hop seamlessly from one to the other.

- It is immersive because it only proposes personalized and contextual offers, and engages customers based on journey principles and not processes.

Two journey scenarios

The customer journey in an open banking era is superior to the banking experience of the past in every way; it is more convenient, more engaging and has infinite possibilities. The following two scenarios clearly illustrate the difference.

In the first scenario, Christian, a financial controller at a medical devices company, travels from California to New York for a business conference that he has registered for on BusyConf, which is integrated with his savings bank account at Lloyds Bank, and paid for via Zelle, Bank of America’s P2P payments app. At New York airport, he calls for an Uber car to reach his hotel; on the way, he checks on booking.com whether the hotel has agreed to allow him early check-in.

The next day, an important Dutch client asks for a meeting on the coming Friday, a day after the conference in New York ends. Christian scrambles to reschedule his British Airways flight through the bank’s mobile app, and is lucky to find a seat in the busy weekend traffic.

On Friday evening after the meeting, he shops for some specialty cheese and stocks up on Stroopwafel at Albert Heijn. Realizing that he does not have enough diabetic medication, he orders some through the bank’s iphone app, thanks to its integration with a pharmacy app.

Just for fun, he checks a BBVA app called Bconomy to see if he bought these items at a good price; it’s the same app he will use later to reconcile his travel expenses, some of which he paid from his own pocket.

The second scenario features Kathy, a communications manager, who is looking to buy her first house. She asks the smart assistant on the Rightmove app on her iPhone to find a suitable flat costing about GBP 500,000 close to Canary Wharf. Her spoken command launches a search that throws up several housing options; when she likes something, the app proactively triggers a search for a mortgage at a comparison site, based on her financial status and loan eligibility. All this is possible because the mobile app of Kathy’s primary bank is integrated with the apps of a number of service providers in the home buying value chain. (Should Kathy accept one of the mortgage options, a loan application will be triggered automatically and the chosen mortgage provider, which is linked via APIs to Kathy’s bank and also to various credit rating agencies, will give a decision within 48 hours.) Then her banking app triggers the next stage of her journey, where legal advisers, real estate solicitors, relevant government bodies, etc. come in to facilitate the purchase. Other triggers are sent out to providers such as movers and packers, home stores like IKEA, and also to utility companies informing them of the impending move. Kathy starts to receive offers on her mobile phone, and when the time comes, she can simply choose the best ones. Job done.

While this seems like a customer journey from the future, a number of digital innovators are already working on it. If a bank were to integrate APIs from companies such as niki.ai, it would be able to cater to every need in the home buying customer journey through its own (single) app. That’s one app for everything, from buying insurance and comparing rates to dealing with legal service providers, packers and movers, furnishing retailers and utility companies.

Compare this amazing customer journey in an open banking environment to the traditional home buying experience where Kathy would have had to find and deal with each of these agencies separately. Open banking not only simplifies and accelerates the entire process, but also amplifies the value derived by the customers and the members of the provider ecosystem.

Closing comment

As is clear from the scenarios, both Christian and Kathy manage to access a variety of apps and perform the diverse transactions in their journeys using a single mobile banking app from their primary bank. This is already becoming possible in the open banking world where the different mobile apps of different providers offering different services can be integrated via APIs with a single banking app. And thanks to the geo-location capabilities of the underlying software, any customer journey can run smoothly in parallel with the customers’ physical journeys, even when they are crossing countries and continents.

Corporate banking Seeking new journeys, new destinations

Sudhindra Murthy

Global Product Marketing Manager, Infosys FinacleChange is finally setting in in corporate banking. Corporate customers are taking to digital technology and like their retail counterparts before them, are making sophisticated demands on banks. In particular, they are asking for the same kind of experiences that ecommerce companies, telecom operators, travel websites, etc. offer today; experiences that are always on, extremely convenient, efficient and enjoyable. The traditional corporate banking relationship – characterized by personal contact and old world communication channels, and highly dependent on the relationship manager – is being transformed by selfservice and digital engagement.

If one had to describe new-age corporate banking in two words, they would be “digital” and “empowering”.

Digitize and empower

If one had to describe new-age corporate banking in two words, they would be “digital” and “empowering”. Corporate clients want banks to go digital all through their journey, starting with onboarding. In place of conventional onboarding, which can take between 4 and 6 weeks, they would like a digital process that is simple, really quick, and free of redundant steps and data inconsistencies. Currently, much of the lag in the corporate banking journey comes from the need to secure approvals, physical signatures, and various mandates; this can be eliminated by adopting digital signatures and mandates. Companies want banking channels to become truly omni-channel and digital, and provide experiences enabling ubiquitous, seamless and integrated access to all products and services they subscribe to.

Cash management, one of the most important activities in corporate banking, is ripe for transformation at the hands of real-time payments initiatives, market infrastructures that reimagine correspondent banking, open banking and other trends. Corporates see the opportunity to increase the mobility and transparency of liquidity, and to improve treasury efficiency and enjoy greater control and visibility into cash.

Indeed, they are seeking greater empowerment in many forms: setting up liquidity structures that best meet enterprise cash flows, creating sweep products on their own, having virtual accounts management to streamline cash flow, and seeing graphical views of liquidity positions at any time, place or device. Corporate banks have no choice but to cede control to their customers and enable them to perform “bank-like” actions on their own. At the same time, they must empower their own relationship managers with the right digital tools and technologies so they can keep pace with the customers they serve.

Corporate banks have no choice but to cede control to their customers and enable them to perform “bank-like” actions on their own.

Slow off the mark

While a few progressive banks have made headway, most corporate banks have been slow to respond. They continue to be saddled with manual processes, paperwork, and people-dependencies. Likewise, their communication is also hampered by legacy channels such as in-person meetings, telephone, and email. The result is inefficiency, delay, and a fairly sub-optimal experience.

And what about the offering itself? Here, it is worth emphasizing that there can be no generic, one-size-fits-all product or service in corporate banking. Every industry has unique needs that can only be fulfilled by a tailored offering. To understand this, simply contrast the context – and hence the financing needs – of a corporate customer from an airline, vis-à-vis, a mining firm that has significantly different business dynamics.

There are two absolutes for enhancing the customer journey in corporate banking, namely, digitization and customization capability. Merely bolting on a new channel does not qualify as digitization; nor does it elevate experience. The customer journey gets amplified only when the experience is tailored to the customer’s need, and both the customer and the relationship manager are empowered to take certain decisions.

Twin imperative

Based on our experience of transforming the customer journeys of clients around the world, we recommend that corporate banks do two things:

- Digitize the journeys for both end-customers and relationship managers by moving away from paper-based processes, and serving the right mix of digitally enabled products (loans, deposits, products for cash & treasury management, accounts payable/receivable management and so on).

- Assess and blueprint their customer journey maps holistically, from client onboarding and servicing to lifetime relationship management. Unlike in retail banking, where it is not feasible to plot a unique journey map for each customer, here it is very much possible to create a separate map for each industry, if not company.

Let us look at each in more detail.

Digitizing the customer journey begins with streamlining corporate banks’ internal processes using fully-integrated digital tools that unify the experience of servicing customers across the relationship. Deep automation and straight through processing play a key role in transforming the service model for a better experience. Enterprise-wide process engines orchestrate business processes, increase automation and allow information to flow seamlessly between core systems. With the need for manual effort reducing dramatically, bank staff are able to focus on higher value adding activities.

A digitized customer journey also requires products to turn fully digital so they can support a platform business model for corporate banking, and channel experiences to be redesigned with facilities such as single sign-on, credit pre-approval, on-the-go access to functionality and anytime access to relationship managers. Relationship managers must be empowered with digital self-service models so they can slip into a larger role where they service client requirements on their own – such as structuring range bound loans, and tailoring prices and products based on client needs.

While blueprinting the customer journey map, it is important to cover all touch points and stages in the customer relationship. A good beginning in the form of smooth onboarding is essential. New-age rivals, such as Fintech firms and challenger banks, are beating incumbents at this with advanced services such as mobile-based onboarding for business checking accounts. Next, product and service designs must enhance the business and operations of clients, which means they must be differentiated based on market segment, industry and even company. Relationship managers must become specialists and strategic advisors. They should possess deep insights into their clients’ business so they can help improve business outcomes.

In the new open world, it is not long before the business becomes hyper connected and corporate banks publish open APIs to collaborate with a wide partner ecosystem. Their model will transform completely from monolithic pipeline to aggregator and operator of a marketplace of diverse offerings, both owned and sourced from third parties. At that time, instead of pushing its own product, a corporate bank will recommend the one that best suits its customer’s need. Last but not least, it will also have the opportunity to advance its entry into the customer journey to the point of primary need by recommending non-financial offerings from partners. Indeed, this should be the destination for a corporate bank as it transforms its customer journeys.