- Overview

- Voice from Editor’s Desk

- Cover Story – On the Platform We Bank

- Features

Platform for Banking and Beyond – In conversation with Sangeet Paul Choudary - Inside Talk

- Perspective

- Opinion – Platform Banking Not Why, But How

- Technology

- Case Study

- FinTech Future and Forward

- Kaleidoscope – United Kingdom: Data Protection Decreed

- References

FinTech Future and Forward

Fintech Alliance Assessment

Sunil Mishra

Senior Industry Principal, Infosys Finacle

In a few short years, the narrative around FinTech in banking has softened noticeably from competition to collaboration.

Anthony Jenkins, ex-CEO, Barclays, warns that banks will be dealt a “Kodak moment” by FinTech companies if they are not careful. His is a minority opinion amidst a growing belief that FinTech is more friend than foe of banking institutions, a source of complementary strengths that incumbent banks would do well to leverage.

In a few short years, the narrative around FinTech in banking has softened noticeably from competition to collaboration. The 2017 edition of an annual global retail banking study reported that more than 90 percent of bankers were keen on collaborating with FinTech firms, while 75 percent of FinTech companies said they would work with banks. But collaboration is only one among several factors shaping the FinTech landscape. This article briefly explores the evolution in this space.

Banks and FinTechs collaborate for mutual gain their respective (complementary) capabilities make banks and FinTech firms natural allies. Banks, whose ability to respond to market needs is severely hampered by legacy, can tap the agility and innovativeness of FinTech to overcome those limitations. Likewise, their FinTech partners can benefit from their (banks’) knowledge of regulatory compliance besides piggybacking on their distribution network to compensate for their own lack of scale. Also, synergies emerge when banks join their huge resources of data with FinTech’s expertise in analytics.

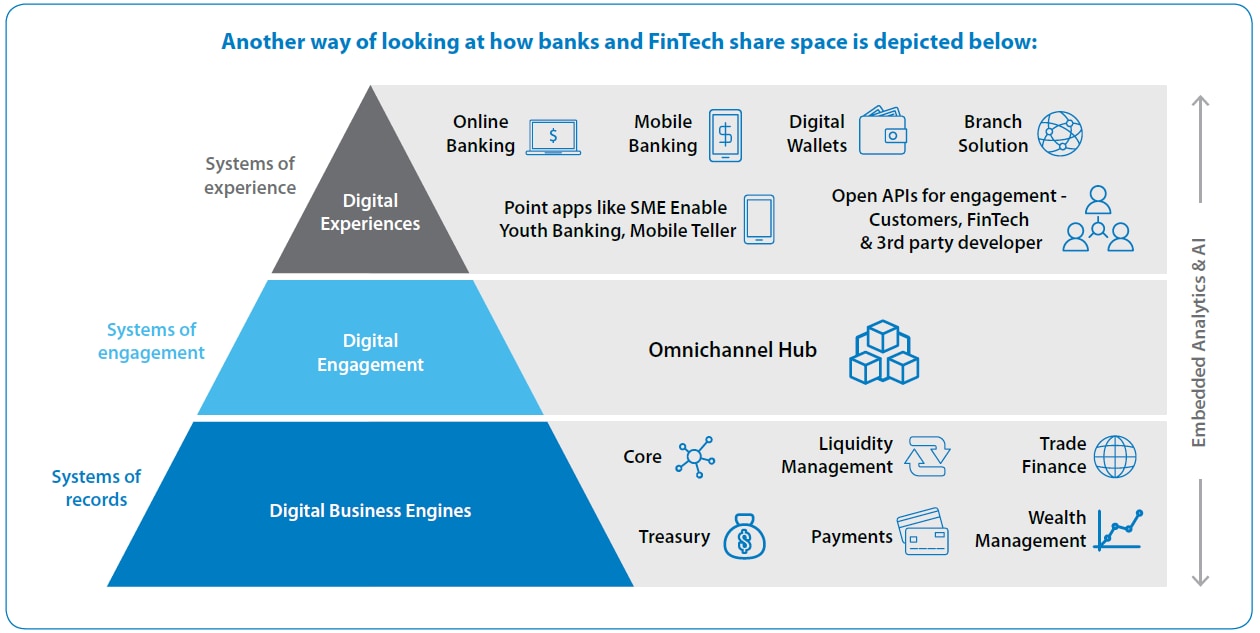

Banks have very strong systems of record that are responsible for basic banking operations such as core banking, treasury, payments, trade finance, wealth management, etc. Banks also possess strong systems of engagement. However, when it comes to systems of experience, FinTech firms clearly have the edge.

Banks are clearly the engines of the digital business. They have very strong systems of record that are responsible for basic banking operations such as core banking, treasury, payments, trade finance, wealth management, etc. Banks also possess strong systems of engagement, an example of which is the omni-channel hub, which enables them to add new channels with ease, as well as provide the same information, products and experiences to customers on all channels.

However, when it comes to systems of experience, FinTech firms clearly have the edge. They offer a variety of solutions based on artificial intelligence, biometrics, user experience technologies, etc. that connect with consumers at the last mile. Systems of experience are witnessing a lot more innovation and growth than systems of record and engagement, because of FinTech firms’ expansion into areas ranging from AI and deep learning to Blockchain and from ecosystem components to digital sales and marketing. A leading consulting firm observes that FinTech offerings in favorite niches such as payments and lending are maturing, and firms are now looking at innovating in other areas and even at offering full stack solutions.

Along with FinTech capabilities, the modes of bank – FinTech collaboration are also expanding. Popular models include:

Sandbox environment: Open Banking is exposing banks to a new level of competition where they have to pitch not only their own products but also those from other providers because their customers demand it. Regulations, such as Europe’s Payment Services Directive 2 (PSD2) mandate that banks must allow qualified third parties to access customer transaction data and initiate payments on their (the customers’) behalf. It goes without saying that a number of those qualified third parties will be FinTech companies.

To comply with Open Banking, banks are publishing open APIs (Application Programming Interfaces) and building an ecosystem of external partners. They are testing the waters by providing a cloud-based sandbox environment where developers, application providers, FinTech innovators and other parties can use “test” or dummy data to create innovations on top of the banks’ services.

Close integration: Some alliances have outgrown the sandbox and entered the real world. A great example is the tie-up between India’s RBL Bank and a FinTech firm called MoneyTap where the latter uses the Bank’s APIs to provide loans to young, urban, middle-income Indians who can’t get a bank loan for want of a credit history. MoneyTap assesses the creditworthiness and loan eligibility of prospective borrowers in a few minutes, based on which they can choose an EMI plan that suits them. Borrowers are charged a nominal fee upon approval besides the usual interest and processing charges.

Monetization opportunities: The opportunity to generate new business is an important motivator in bank-FinTech collaboration. By allowing third parties, including FinTech, to build applications on top of their APIs, banks can earn additional income. DBS Bank’s cross-referral alliance with a couple of peer-to-peer lending platforms, namely, MoolahSense and Funding Societies, is a good example. The Bank sends small business customers that it cannot service to its partners, who return the favor by referring their successful borrowers now in need of larger loans or more sophisticated financial solutions to DBS.

FinTech thrives globally on the back of regulatory support

There is a vibrant FinTech scene around the world. While the United States is still the leader, with 57 percent of the worldwide FinTech market, Asia (31 percent) is clearly more progressive. Singapore is one of the top FinTech hubs in the world, while Chinese FinTech is among the most innovative as well as a top destination for VC investment.

Everywhere, the support of regulators has been a key factor in FinTech success. Recently, the innovation units of regulatory bodies in the United States and the United Kingdom – LabCFTC and FCA Innovate – said they would collaborate to support FinTech by sharing information with each other, and referring FinTech companies trying to enter the others’ market.

After a phase of explosive growth, China’s FinTech sector is now benefiting from a tight regulatory framework that curbs fraud even as it drives consumption. 10 Singapore, where the Monetary Authority of Singapore launched the FinTech and Innovation Group as early as August 2015, is probably the benchmark when it comes to providing regulatory support for financial innovation.

With venture funding and customer share of wallet ending up with a select few, a large number of firms are up for grabs, mainly by large organizations.

And in India, a quasi-regulatory body called the National Payments Corporation of India has revolutionized the nation’s payments infrastructure with its Unified Payments Interface to set the stage for financial innovation.

The market consolidates as FinTech firms are acquired

Low entry barriers have allowed FinTech firms to proliferate, with the result that now there are too many players with similar propositions. With venture funding and customer share of wallet ending up with a select few, a large number of firms are up for grabs, mainly by large organizations. In 2017, global venture capital in FinTech saw many sell-offs – 59 strategic acquisitions and 11 buyouts valued at US$ 2.38 billion. Notable deals included Trayport’s acquisition by TMX Group for US$ 727 million and the US$ 150 million PlayTech paid for TradeTech Alpha. On 12th May 2018, Softbank, which already holds a US$ 400 million stake in India-born PayTM Mall, indicated it could increase its investment to a massive US$ 3 billion.

This, then, seems to be the way forward for global FinTech – to draw strength from collaboration and partnership with large financial institutions and to merge with them when the time comes.