- Overview

- Voice from Editor’s Desk

- Cover Story – On the Platform We Bank

- Features

Platform for Banking and Beyond – In conversation with Sangeet Paul Choudary - Inside Talk

- Perspective

- Opinion – Platform Banking Not Why, But How

- Technology

- Case Study

- FinTech Future and Forward

- Kaleidoscope – United Kingdom: Data Protection Decreed

- References

India Trade Connect- Blockchain Based Network for Trade Finance

The India Trade Connect network won the Celent 2018 Model Bank award for Trade Finance & Supply Chain. This case study was written by Alenka Grealish, Senior Analyst at Celent, as part of the Celent Model Bank awards for 2018. Ms. Grealish has over 20 years of consulting and research experience in the banking industry with deep expertise in payments, transaction banking, and commercial banking. Her research focus is on innovation in treasury management services, trade finance, working capital finance, and the implications for customer journeys across segments, including small business.

| FINANCIAL INSTITUTIONS | ICICI Bank, Axis Bank, IndusInd Bank, RBL Bank, Yes Bank, Kotak Bank, South Indian Bank |

| INITIATIVE | India Trade Connect |

| SYNOPSIS | Domestic trade finance blockchain based network, enabling automation and transparency, and improving risk mitigation in domestic trade and supply chain finance operations. |

| TIMELINES |

|

| KEY BENEFITS |

|

| KEY VENDORS | Infosys Finacle |

CELENT PERSPECTIVE

- The bank consortium along with their technology partner, Infosys Finacle, recognized the opportunity that blockchain-based technology presented to digitize trade finance, which is mired in inefficiencies and is subject to fraud.

- They also knew that to be successful they needed to build an ecosystem of the entities involved in the trade finance supply chain.

- The seven founding banks (listed above) were able to run successful proofs of concept with Finacle Trade Connect and hence moved forward to form a consortium to pilot India Trade Connect.

- The group wisely chose a well-honed use case, raising the odds of success. The resounding success of the consortium’s inland letter of credit pilot (cycle time reduced from 8–9 days to 2–3 days) was due to a winning combination of technology, willingness to embrace paradigm shifts, and strong collaboration.

- While the business side drove the initiative, ensuring that the customer experience remained at the center of the project, it engaged effectively with other stakeholders through working groups.

Detailed Description

ICICI Bank, Axis Bank, IndusInd Bank, RBL Bank, Yes Bank, Kotak Bank, and South Indian Bank form a critical mass of participants to support India Trade Connect. They all were exploring the potential of blockchain technology to solve various operational pain points and generate new services. Similar to banks in other regions, the use cases being examined included not only trade finance but also remittances (cross-border payments) and other payments. The use case that stood out was domestic trade finance, which is a huge market in India (likely around $2.45 trillion in trade). In addition, this use case would be welcomed by the government since it would contribute to its broader “Digital India” campaign.

| ASSETS | ~$250 billion in sum |

| GEOGRAPHICAL PRESENCE | India |

| OTHER KEY METRICS |

|

Source: Consortium banks.

ICICI and Axis met in February 2017 and agreed that the domestic trade finance use case merited taking to the next level, a pilot with a bank consortium. In March, they met with five other banks, including relevant business and technology heads, and Infosys demonstrated Trade Connect. Consensus was to move forward and develop a letter of credit module. After a successful pilot between ICICI and Axis bank in October 2017, Trade Connect is slated to go into production this March.

Opportunity

While trade finance provides banks with an attractive annuity revenue stream and has relatively low default rates, it is a tough business to run. Trade finance (both open account and documentary) is plagued by slow, opaque, paper-heavy processes involving multiple entities. Because these entities interact with each other through siloed channels, there is no common view of the status of a trade instrument (e.g., purchase order, invoice, and letter of credit). In addition, the processes are vulnerable to document fraud (e.g., fraudulent invoices) and duplicate invoice financing. Cumulatively, these inefficiencies result in hidden costs of up to 15% of the value of traded goods (Organisation de Coopération et de Development Économiques). For banks, they drive up labor, transaction costs (in particular, messaging costs), and reconciliation costs. Blockchain-based technology could eradicate these inefficiencies as well as mitigate risk (Figure 1). It brings numerous advantages: digital, persistent data, immutable ledger (a single common truth), traceability, and auditability. Invoices and purchase orders received on the platform are uniquely identified and stored on the blockchain platform. Cumulatively, it can dramatically lower processing costs and time and push fraud to zero. While cost savings was a key driver for bank participants, revenue generation potential was a greater driver. Banks are losing material revenues as a result of paper-based trade finance processes and attendant fraud exposure. Each document on the blockchain represents a new financing opportunity for a bank.

Solution

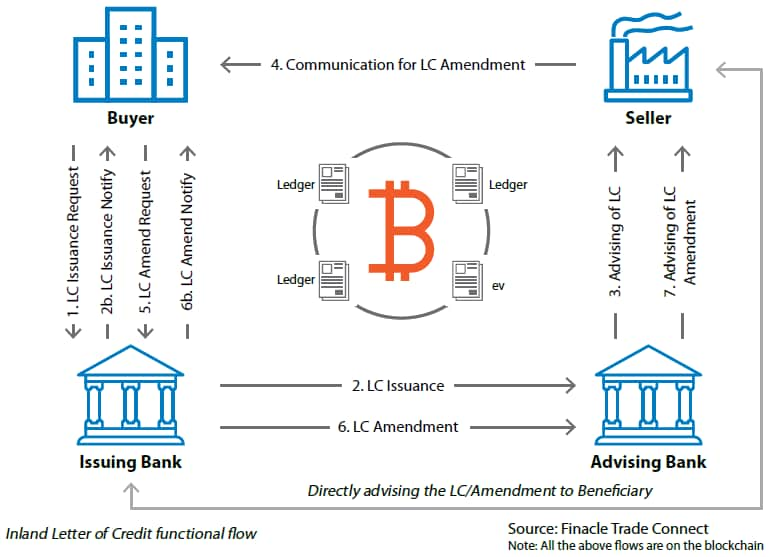

India Trade Connect’s success rests on technology, effective governance, and strong business-IT collaboration. Technology Infosys Finacle began examining the potential for blockchain to solve inefficiencies and mitigate risk in banking four years ago. It found that trade finance in particular could greatly benefit from a blockchain-based solution, not only to improve efficiency, but also to generate new revenue streams. As a result, it developed Trade Connect specifically to address the trade finance process requirements of banks. India Trade Connect’s goal is to digitize trade finance workflows within a distributed, trusted, and shared network (as illustrated in Figure 2 for a letter of credit). It is agnostic to which blockchain infrastructure is used (e.g., Hyperledger, Corda, Ethereum, and Bitcoin). Workflows include validation of ownership, certification of documents, and payments. It covers a wide scope of transaction types: purchase order, invoice, bill lodgment request, bill acceptance request, documentary credit request, documentary credit, advance payment, bill payment transaction, customer-to-customer (both use same bank), and open account. All documents received on the platform are uniquely identified and stored. In addition, Finacle Trade Connect provides real-time dashboards, which track trade instruments across lifecycle stages and actors. The biggest tech challenge was using an independent data center in the cloud and establishing security requirements. There were few benchmarks available on how a distributed storage and distributed computing system can be integrated with host systems in a secure way, which was compliant with the security standards at the participating banks. Infosys worked extensively with the participants to explain how an independent data center would work, implement the security they required, and acquire third party certification.

Figure 1: Contrasting the Traditional Trade Finance Process with Finacle Trade Connect

| Existing Trade Finance Process | Trade Finance Process on Finacle Trade Connect | Benefits |

| Buyers and sellers have relationships with each other and separately with their banks. | Banks, buyers and sellers maintain the same direct relationship with each other. | No material change in the relationship process. Engagement with each other is direct and on digital channels, reducing dependency on physical documents. |

| Only the correspondent banks have relationships with each other. | Message and document sharing is done on a real-time basis for all involved parties increasing trust, reducing costs, and time. | This ensures a single source of truth and increases trust between the parties. |

| Each party deals separately with its counterparty through a siloed channel and no one is sure of the status of granular trade. | The flow of goods and information is visible to required parties in the transaction, all at the same time. | This provides a shared picture of granular trades and ensures efficient risk management. |

| Low automation, limited visibility. | Higher automation, increased transparency and immediate availability of data. | This ensures superior awareness for better decision making. The open data picture also helps open up the possibility of new business avenues for both banks and corporates. |

Source: Finacle Trade Connect.

Governance and Collaboration

Close coordination between bank participants and a multi-stakeholder approach have been paramount to optimizing functionality and satisfying information security requirements. Given India Trade Connect’s success rests on consensus across participants, close coordination was undertaken between participating banks and Infosys Finacle. Each bank had two members on the team, a business product owner, and an IT leader whose core responsibility has been trade finance systems. Infosys Finacle had 15 people from its product development and delivery groups.

The business side drove the initiative. As a result, the project had a strong focus on maximizing improvements in customer experience, ranging from what the customer sees to what they do not see but should have visibility into (e.g., timing of a letter of credit). Importantly, the consortium invited corporations (both buyers and suppliers) to test the functionality and received very positive feedback as well as recommendations for enhancements. For example, corporations were concerned about authentication and authorization security and administrative control. While the business side drove the initiative, they recognized that they must have buy-in from other stakeholders. Hence, they formed four working groups: business, operations and process, technology, and information security. The business team engaged heavily with the operations team to reimagine the end-to-end back office processes. Through monthly meetings to review progress, assess the direction, and measure against criteria set up at the beginning of the initiative, these groups kept the process on track. Moreover, they assured that participants addressed and solved any issues as swiftly as possible. Infosys worked in parallel to develop necessary functionality and security.

The consortium’s ability to move relatively fast has been underpinned by efficient communication and agile testing. Infosys established a WhatsApp group and a “testnet.” The WhatsApp group enabled the banks to quickly seek help, clarify points, and provide direction. The “testnet,” a cloud-hosted environment and network, enabled the banks to rapidly explore and test the functionality. Monthly releases with the latest functionality were refreshed into the “testnet.” This enabled the banks to see how their feedback was incorporated and to continue to test and pilot the solution. This approach also allowed the banks to conduct pilots with no direct infrastructure cost.

Results, Lessons Learned, and Future Plans

The benefits to the banks and their customers of India Trade Connect will be significant as indicated by the pilot:

Operational efficiencies: By cutting the cycle time for an inland letter of credit by 75% from 8–9 days to 2–3 days, India Trade Connect proved that blockchainbased technology can solve real world bank operational challenges. It also promises to improve the cycle times on related products. For example, invoice financing, which is plagued by a slow, paper-based process, could be transformed into a swift, digital process.

Cost reduction: The digitization of information is reducing costs in two important areas. First, it allows the bank participants to reduce document courier fees. Second, it eliminates the per transaction cost associated with intermediary messaging systems.

Operational risk mitigation: Invoices and Purchase orders received on the platform are uniquely identified and stored on the blockchain, leading to lower risk associated with duplicate financing. In addition, dashboards enable real-time tracking of trade instruments across lifecycle stages and actors.

New business opportunities: Most importantly, India Trade Connect will likely generate new revenue streams as banks will have ready and trusted access to documents required to underwrite credit.

On its 2018 and 2019 road map, the consortium hopes to onboard other banks as well as nonbank intermediaries involved in trade (e.g., logistics and insurance providers). It is also seeking a network provider partner to facilitate broader bank adoption. The next product that will likely be piloted is open account, which makes sense given the gradual decline of lines of credit. Eventually it wants to move beyond being a banking solution and have a global coverage.

Further on the horizon, Infosys Finacle sees potential to enhance Trade Connect with artificial intelligence (AI) and machine learning. Both could contribute to digitizing the remaining paper documents (e.g., bill of lading, airway bill, packing list, insurance documents), automate manual processes, and tackle fraud and compliance challenges. They could also automate document validation and matching per banks’ rules. In addition, machine learning could enable sophisticated credit decisioning (e.g., for purchase order, invoice, or supply chain financing).

The India Trade Connect initiative overall proved that

critical paradigm shifts are possible (using a cloudhosted

environment and distributed ledger) when all stakeholders are striving for a winwin and the technology provider excels on the security front. It showed that increasing the odds of a successful pilot by tackling a well-honed use case is wise. In terms of the organizational dynamic, it demonstrated how valuable it is to have the business side drive a project with profound customer experience and revenue potential. It also showed that key stakeholders (operations, IT, information security) need to be involved and collaborate effectively. On the tech front, it demonstrated the importance of being agnostic to core banking system and having API services to facilitate integration.