WEBINAR: BECOMING AN INNOVATION LEADER IN 2020

New research indicates that organizations that consider themselves to be ‘innovation leaders’ are more digitally mature, leverage AI and other new technologies more effectively to differentiate themselves in the market, and are more committed to measure results than other organizations. Most importantly, there is a very very strong correlation between ‘innovation pioneers’ and those firms where transformation was ‘deployed at scale’. Consecutively, these are more sustainably profitable. Unfortunately, innovation leaders only comprise 14% of the financial institutions globally. Watch this webinar to explore:

- What differentiates an innovation leader

- How has digital transformation impacted organizational objectives?

- What is the correlations between innovation and digital transformation maturity

- How is innovation managed at the best financial institutions

- How can organizations improve their innovation maturity

SPEAKERS

Krzysztof Nawelski,

Director of Innovation

Santander Consumer Bank Poland

Gurhan Cam,

SVP & Deputy CDO, DenizBank

Jim Marous,

Owner and Publisher of Digital Banking Report, Co-Publisher of The Financial Brand

Rajashekara V. Maiya,

VP, Global Head of Business Consulting & Product Strategy, Infosys Finacle

INNOVATION LEADERS ARE

ALSO MORE SUCCESSFUL

IN THEIR DIGITAL

TRANSFORMATION EFFORTS

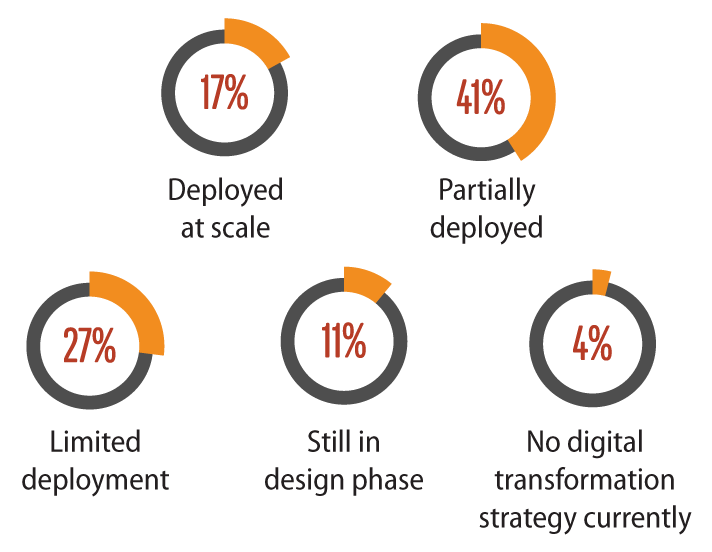

Our findings suggest that most banks have not deployed digital transformation at scale. However, organizations where innovation is a priority are further ahead of their peers in the desire to become a ‘digital bank’. These leader organizations have top management support, are more committed to investing in customer experience and advanced analytics, and are more likely to measure results of their efforts. Not surprisingly, these firms have more positive financial results than firms where digital transformation is only partially deployed.

Some of the most progressive banks are innovating with Finacle to empower their customers. Know how these innovation leaders are unlocking new value.

Progress of Deployment of Digital Banking Transformation Globally

43% of the banks that consider themselves to be innovation pioneers report to have deployed digital transformation at scale. 14% of the pioneers have only partially deployed digital transformation at their organization.

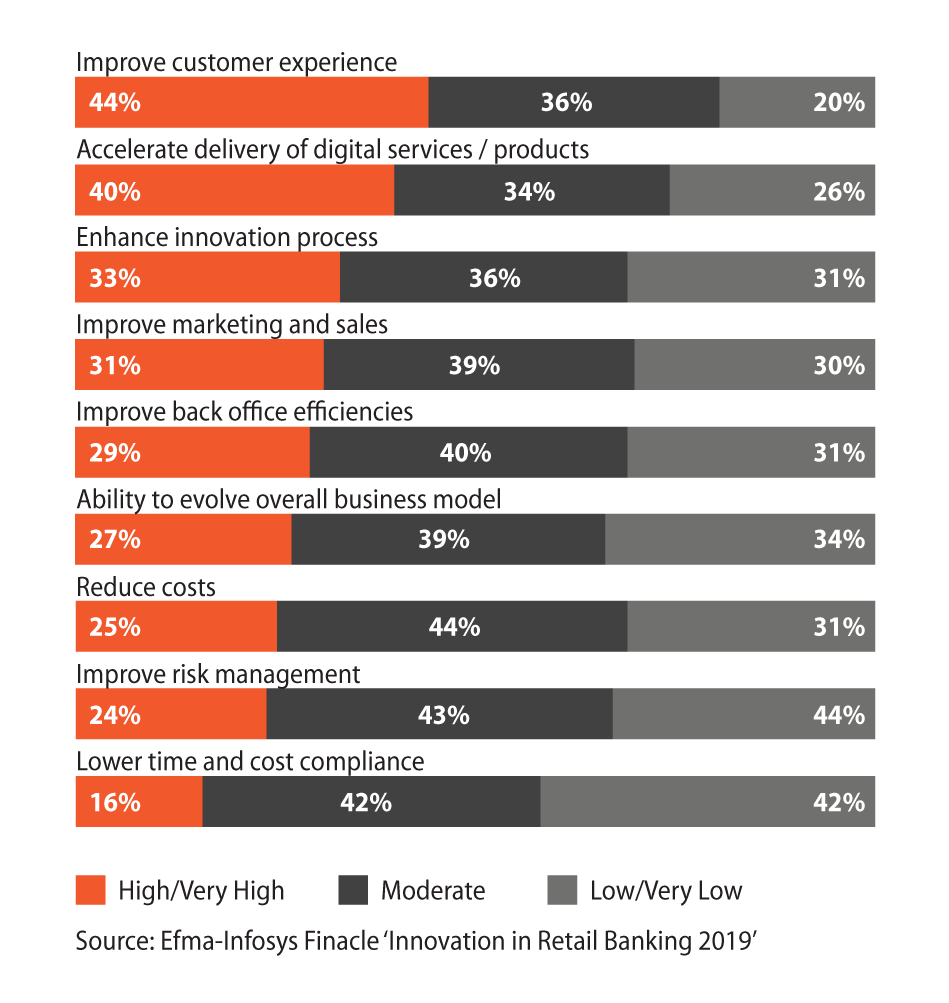

Digital Banking Transformation Impact on Strategic Objectives

DIGITAL TRANSFORMATION

AND CX ENHANCEMENT:

THE CORRELATION

Digital transformation seems to be having the greatest impact in the areas of customer experience and the delivery of digital solutions, with most other objectives not being impacted nearly as much. Not many organizations believe digital transformation impacts one of the most critical elements of digital success – the ability to change existing business models.

Top 5 technologies in which most banks will increase investment over the next two years:

- Customer experience technologies

- Mobility

- New products and services

- Advanced analytics / AI / machine learning

- Open banking APIs

Top 5 strategic objectives most banks are meeting successfully through their digital transformation efforts:

- Improving customer experience

- Accelerating delivery of digital products / services

- Enhancing innovation process

- Improving marketing and sales

- Improving back office efficiencies

Learn how you can drive deeper customer engagement across traditional, modern and emerging channels with Infosys Finacle’s Digital Engagement Suite.

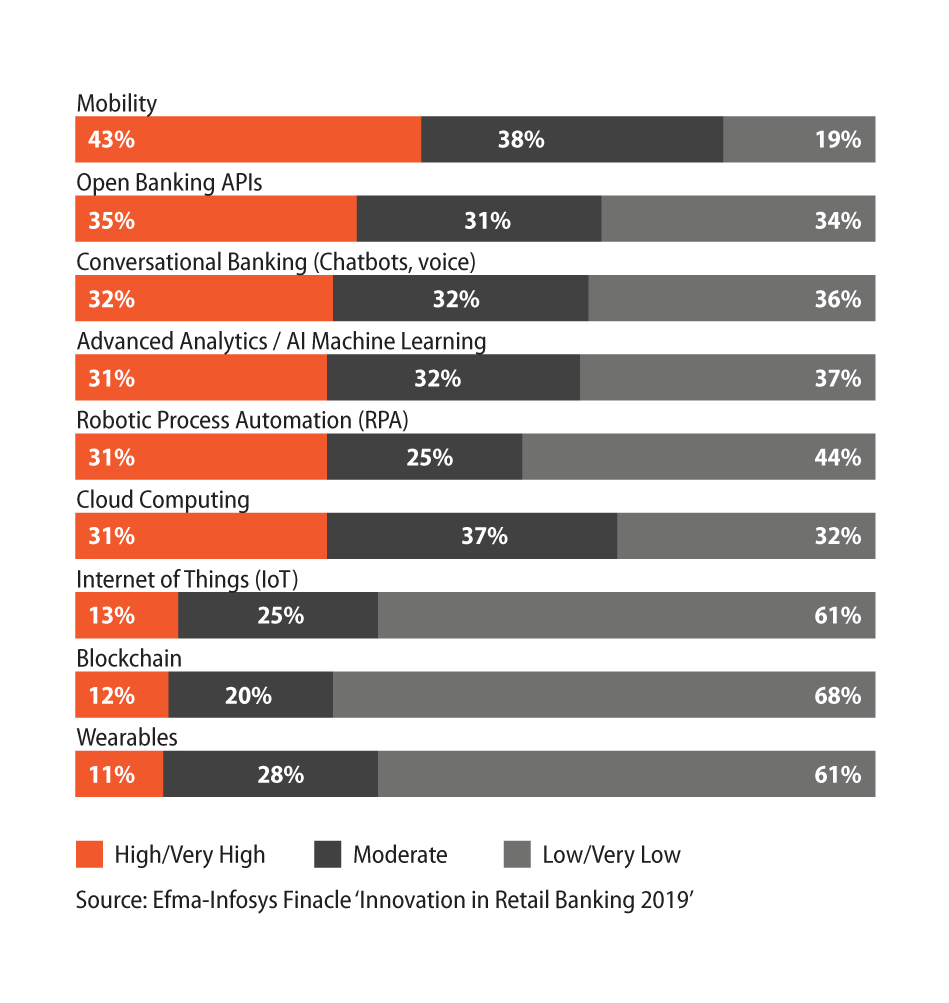

HOW READY ARE BANKS FOR

EMERGING TECHNOLOGIES?

There is a variance between what organizations know is important and their stated ‘readiness’. Mobile technologies topped the charts for technologies to have the greatest impact on banking in the near future, followed by advanced analytics and open banking APIs. However, readiness for AI and analytics continues to be lower than expected.

Top 5 technologies that banks expect will make the greatest impact in banking:

- Mobility

- Advanced analytics / AI / Machine learning

- Open banking APIs

- Cloud computing

- Robotic process automation (RPA)

Readiness of Financial Institution to Leverage Digital Technologies

Less than 50% of the banks surveyed consider themselves ready to leverage the technologies they think will make the most impact

Learn from the success stories of leading banks using Finacle’s blockchain solutions to power their trade and remittance transactions.

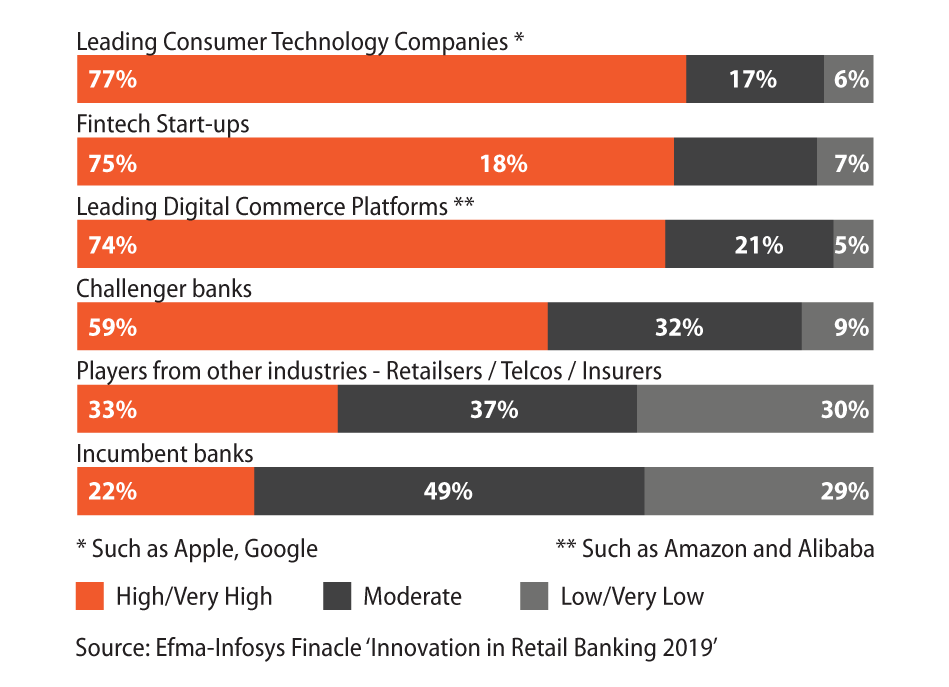

Biggest Threats to the Banking Industry over the next five years

ARE BANKS THE INNOVATION

LEADERS IN THE INDUSTRY?

By combining modern technology with a laser focus on improving consumer experiences, fintech and technology firms have brought unprecedented innovation to the banking industry.

One of the primary benefits traditional banks and credit unions had over their competition in the past was trust. Nobody wants to put their life savings at risk or to partner with an organization that wouldn’t protect their identity and privacy. However, this advantage seems to be diminishing. It does not appear as though trust is a big problem for big techs such as GAFA (Google, Amazon, Facebook, Alibaba), who along with digital upstarts and FinTechs have emerged as the new innovation leaders in banking.

India’s leading payments bank drives 30% of open banking transactions in the country today. Read the full story.