3 Lessons Banks Can Learn From the Singapore Fintech Ecosystem

By Amit Dua, VP and Regional Head, Advanced Markets and Global Accounts, Global Head – Alliances, Infosys Finacle

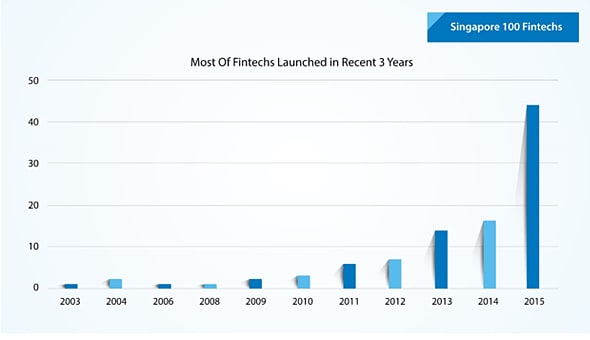

The Fintech movement continued to grow in both pace and scale in 2015. In the first three quarters of the year, global Fintech investments were already double that of the total investments made in 2014. Another indicator of the growing Fintech phenomenon is the increasing interest among major cities across the globe to become the Fintech capital of the world. We start this series on Fintech ecosystem with a look at Singapore, a major financial center in the Asia Pacific region that is also rapidly becoming a key hub for Fintech investments and innovations. Other country’s ecosystems and banks could learn from Singapore to design an integrated regulatory framework to foster a culture of innovation.

Why Singapore?

Figure 1 Fintech Demographics – Singapore and Global

*Source: open database and google. Data only for sampling purpose.

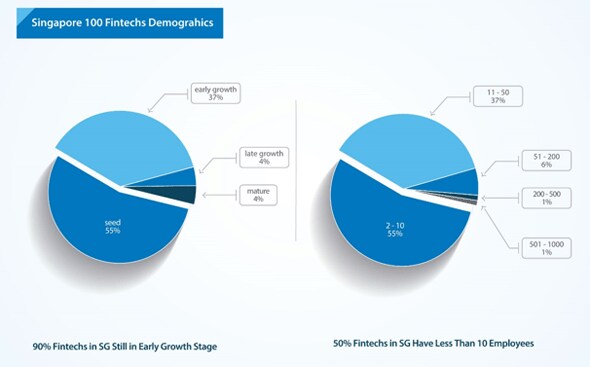

Singapore is a relatively nascent Fintech market with over 90% Fintechs still in the seed or early growth stage (Figure 1), however, Singapore is a vibrant financial services center with headquarters of around 200 banks. The country made it to the top 10 in the Global Startup Ecosystem rankings in 2015. Moreover, the Monetary Authority of Singapore (MAS) has taken an extra step to became the first central bank to fund the Fintech sector with a $167 million scheme to promote innovation.

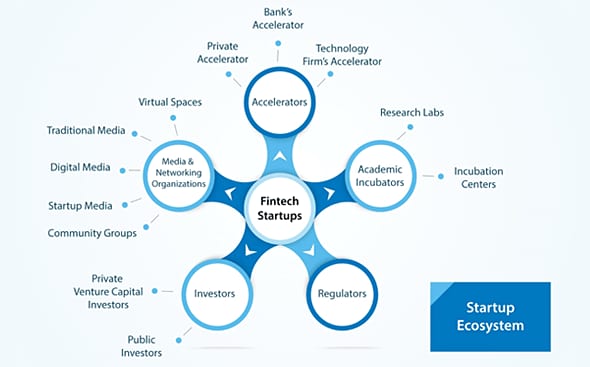

Apart from being a leading financial center and technology hub, Singapore also boasts of one of the widest telecommunications and ICT networks in the world. Besides, it is ideally positioned to serve as a gateway to other much larger markets in the region including ASEAN, India, China, Japan and Australia. Taken together, all these broad strokes paint a picture of a country that seems to be primed to evolve into a global Fintech hub. But there are many more factors that have to come together to create a perfect Fintech ecosystem. In this article, we assess Singapore as a potential Fintech leader from the perspective of five foundational pillars (Figure 2).

Figure 2 Five Foundational Pillars of Fintech Ecosystem

A Closer Look at Singapore Fintech Ecosystem

Accelerators play a critical role among the five foundational pillars, not only in the development phase of startups but also in providing the funding for growth and expansion in the ecosystem. Singapore has a robust and representative accelerator network that includes a full range of profiles:

- Private Accelerators, for instance, Startupbootcamp Fintech Singapore, Singapore Fintech Consortium, Singapore Fintech Startups, and Plug and Play Singapore.

- Banking and Technology Industry Accelerators, for instance, the newly setup DBS Innovation Group and DBS Accelerator. Recently, UOB launched a new accelerator in a joint venture with Infocomm Investments, a wholly owned subsidiary of the Infocomm Development Authority of Singapore. OCBC Bank is also starting a fintech unit, joining its peers in trying to crack the fintech space.

Academic Incubators constitute a vital cog in Fintech ecosystem in driving research, developing skills and fostering entrepreneurship.

- The Institute of Innovation and Entrepreneurship, from the Singapore Management University (SMU), offers a range of training and networking events and a full-fledged incubation program that helps entrepreneurs take their ideas to market.

- Sim Kee Boon Institute for Financial Economics (SKBI) from SMU also plays a key role in networking Fintech ecsosystems, by connecting local Fintechs with the financial industry, the Singapore government, and networking with oversea ecosystems.

- NTUitive, the innovation and enterprise company from NTU has already established four technology accelerators to help startups commercialize their offerings.

- NUS Enterprise, from the National University of Singapore, offers a comprehensive incubator cum accelerator program called NUS Start-Up Runway apart from running a variety of entrepreneurship outreach and development programs.

Media and Event Organizer is a healthy and vibrant media and events industry to promote thought leadership and serve as a link between all ecosystem stakeholders, for instance, Tech in Asia, FST Media, and especially e27, a publisher and event organizer focusing on technology startups.

Regulator – MAS – in Singapore has also created a new Fintech and Innovation Group (FTIG) in 2015 to work with the financial services and technology communities to develop policies and strategies that will promote Fintech innovation. FTIG comprises of three sub-departments:

- Payments & Technology Solutions Office

- Technology Infrastructure Office, and

- Technology Innovation Lab

Three Unique Lessons Learnt from the Singapore Fintech Ecosystem

Like other mature financial markets, for instance, New York and London, Singapore clearly has the infrastructure in place to become a thriving Fintech ecosystem. However, the Singapore model of development also delivers three unique lessons for other ecosystems seeking to build Fintech credentials.

1. Define a clear regulatory agenda to integrate with the Fintech ecosystem: Together with the setting up of FTIG, the MAS has defined a broad regulatory framework that fosters Fintech innovation. One of the key elements of this framework is the decision to allow startups to take innovative ideas to market without their formal endorsement as long as the risks are diligently assessed and managed. The regulator also allows banks adopt a “sandbox” pilot approach to launch innovations so that risks can be controlled and contained. The most impressive aspect though is the regulator’s emphasis on co-creating rules and guidelines in consultation with industry stakeholders, for instance, joint-hosting hackathon activities with accelerators.

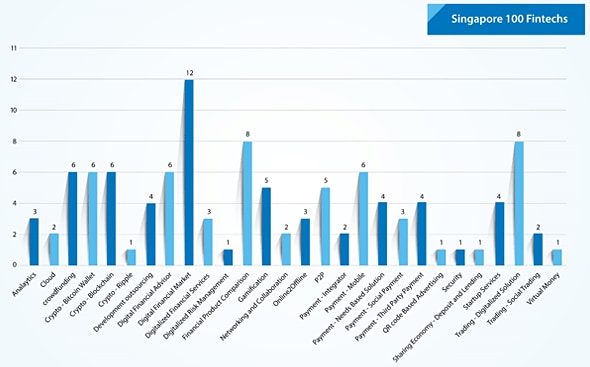

2. Leverage unique local factors to accelerate innovation: Every region has its unique characteristics and it is imperative for the broad innovation agenda to embrace these local nuances. Singapore is renowned as a global wealth management center. The startup ecosystem was quick to capitalize on this by being one of the earliest in the world to create wealth management innovations like Robo Advisors and digital PFM tools (Figure 3).

DBS launched the DBS Home Connect App to redefine the home buying experience, by leveraging well-established e-government database. Local banks and international banks in Singaproe are also keen to further investigate blockchain to achieve better operational efficiency Singapore is positioned as a major banking back-office hub in APAC.

Figure 3 Functional Category (Num) – Singapore 100 Fintechs

*source: public database and google – based on 100 Singapore based Fintechs, only for sampling purpose.

*source: public database and google – based on 100 Singapore based Fintechs, only for sampling purpose.

3. Fostering a culture of innovation: It is important to see innovation as a culture rather than an app or a technology. The key benchmark of DBS Innovation Group is not to develop apps, but to incubate different ideas, integrate with external ecosystems, and importantly, change the corporate culture from inside – so that “everybody from DBS can innovate”. Creating a culture of innovation will help expand the focus of innovation beyond big and disruptive changes to smaller, incremental changes that also make a significant difference.

Conclusion: A combination of economic, demographic and technological factors is shifting the epicenter of financial innovation from the west to the east. Singapore – already home to 10 of the 15 most funded Fintech startups in Southeast Asia – is ideally poised to reshape Fintech innovation in its region. Other Fintech ecosystems could learn from Singapore on how to leverage its traditional position as a major global financial center and its emerging status as a dynamic startup ecosystem to become a serious challenger for the title of global Fintech hub.