Bancolombia takes a digital leap with its Nequi platform

Profile

With assets exceeding US$60 billion as at 2015, and more than 1070 branches, Bancolombia is not only the largest commercial bank in Colombia but also one of the biggest in Latin America. The Bank is part of Grupo-BANCOLOMBIA, a financial services conglomerate with a footprint in eleven countries across its region. Apart from retail and corporate banking, Bancolombia’s suite of services includes trust and asset management, investment banking, leasing, and brokerage.

Overview

In November 2014, Bancolombia decided to create a digital bank called Nequi to meet the emerging needs of the mobile oriented generation in Latin America.

Nequi would leverage Bancolombia’s know-how in the market while maintaining operational, technological and commercial independence.

With Nequi, Bancolombia wanted to inculcate the culture of a start-up, supporting the bank’s efforts in becoming an innovative and humane bank that would appeal to the new generation of digital consumers. Bancolombia aspired to get a head start in digitalization and reimagining of personalized financial solutions using innovative methodologies and new ways of working. In March 2016, Bancolombia went live with Nequi having Finacle Core Banking Solution as the technology platform.

Key Business Drivers

In 2014, Colombia’s Financial Superintendence estimated that at 334 percent, the country was the fastest growing mobile banking market in the world.

A young population, with 40 percent below the age of 24 and another 40 percent aged 25-54, was creating strong demand for digital financial products and services. The Bank realized it was imperative to build a sound digital platform to power its digitization agenda. Thus, in November 2014, Bancolombia commenced the implementation of its digital platform, “Nequi”.

Earlier, the Bank had deployed Finacle in its project titled ‘Innova’, for transforming key operations across Latin America. Hence Finacle Core Banking was a natural choice for supporting Nequi

Implementation Highlights

Nequi was setting up a service design for the bank using a human centric approach and adopting agile methodologies. The new organization model focuses on user journeys through the use of personas. Based on the incremental development principle for Agile delivery, the overall delivery requirements for implementing Finacle Core Banking solution were broken down into sets of work items that would be completed in sprint cycles in a few weeks.

The project involved implementation of CRM, Transaction, CASA and ACH functionalities by way of 3 Transaction modules, namely, Intra-bank Transfers, Payments and ATM Withdrawals and one module each for the other functionalities, namely Customer Data Maintenance (CRM module), Customer Accounts Maintenance (CASA) and Inter-bank Transfers (ACH module).

A core team from Finacle with 4 members on average was deployed on-site throughout the project, supported by a larger team offshore. Bancolombia was keen to have a team that was equipped with both functional and technical expertise of Finacle Core, CRM, infrastructure and interfaces. Given that over 30 interfaces were involved in the development and execution, selecting resources with the right skillset was critical. Bancolombia’s team comprised of 23 experts from 4 divisions viz. digital, IT, marketing and operations. In all, about 75 people were involved at the technology transformation at Nequi. Other vendors – of biometrics/ identity assurance and fraud protection solutions, for instance – also contributed their particular expertise to the implementation.

Bancolombia faced a few challenges in developing the Nequi digital platform. One of the biggest was technology-related, and had to do with forging connections between multiple solutions, each from a different supplier. It was also a challenge to personalize the platform to Colombian requirements. Nequi faced many business challenges that included creating a digital financial platform without branches, securing digital money transfer and building services which connected to physical channels.

Infosys Finacle overcame these challenges with a structured, collaborative approach. The implementation followed an incremental development principle of Agile delivery, and broke down the overall delivery into work streams, which were completed in short sprint cycles, in a matter of weeks.

Leveraging Finacle services via MQ, the team managed to get a range of functions across applications to interact seamlessly without interruption with Finacle across several channels.

In November 2015, exactly one year after the project began, Bancolombia did a pilot run with a small set of users, and a few months later in March 2016, finally went live with Nequi.

Business Benefits

Nequi is a user-centric platform, designed after carefully understanding customers’ need for convenience, speed and personalization.

The Bank hopes to build on that in the future to create new solutions that continue to respect customer-centricity. Clearly, technology, and banking solution suites like Finacle, will play a key role in this.

In the meantime, however, Bancolombia customers have already reaped several benefits from Nequi. Customers may open a bank account using their smartphone in under 5 minutes. They can also send money via mobile, even to recipients not using Nequi. It is possible to withdraw money from 4,000 ATMs without a debit card, and make digital payments at 9,000 outlets using QR codes.

With the success of Nequi, Bancolombia hopes to launch many other innovations in the future. The Bank has opened more than 20,000 accounts since going live on Nequi and aims to take the client base exponentially in the next couple of years.

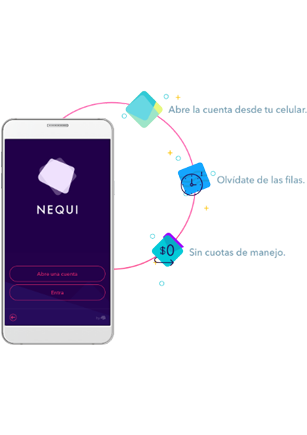

Services offered by Nequi:

- Open a bank account with a smartphone in less than 5 minutes

- Send money to mobile contacts, even if they don’t have Nequi. Receive and send money as if one is chatting

- Organize money with sophisticated but simple tools

- Withdraw money from more than 3000 ATMs without a debit card

- Digital payments in more than 9000 places using QR codes

- First Colombian financial institution to use mobile biometric authentication

Download case study