> Events > Infosys Finacle at CLAB 2023

Infosys Finacle at CLAB 2023 (Congreso de Tecnología e Innovación Financiera) | Miami, FL, USA

Date: 13 – 15 September, 2023

Time: 7:30 AM – 05:00 PM

Location: Hotel Trump National Doral, 4400 NW 87th Ave, Miami, FL 33178

Booth: L9

RSVP: Karthik Shetty | E: karthik_shetty@infosys.com

Request a meetingFeatured SolutionsOur Session Thought Leadership MEET OUR LEADERS EVENT HIGHLIGHTS

About the event

Leading banks in Latin America and the Caribbean have chosen Infosys Finacle to accelerate their digital transformation outcomes and drive their business model innovation.

Meet us at the upcoming CLAB 2023 to learn how your bank can :

Catch our latest insights live at the event – Hear from our leaders

Webinar

RECOMPOSING BANKING: ACCELERATE YOUR BAAS JOURNEY

Thursday, Sep 7 | 11:00 AM – 12:00 PM ET |

The narrative about rapid change in banking landscapes and customer journeys isn’t new to bankers. What needs more discussion though, is how banks can Recompose their business model using composable technology, to create Banking-as-a-Service (BaaS) propositions that not only allow banks to participate in primary customer journeys, but also co-create platforms that can host the entire journey end-to-end.

At Finacle, we enable banks to launch, scale, and differentiate BaaS propositions with ease and speed. Based on our extensive experience in enabling successful BaaS operations for several global clients, we recommend the following steps to build your BaaS proposition, This is what you can take away from this webinar:

Speaker:

Session | Thursday, Sep 14 | 8:45 AM – 9:00 AM EDT

BANKING ON CLOUD – IT’S NO LONGER ABOUT ADOPTION, BUT ABOUT ACCELERATION

In the race to digital transformation. cloud has been a critical enabler. In the early years, the conversation around cloud in the banking community centered on reducing costs and increasing storage and computational capabilities. The concerns around the security, compliance, or skilling, which while valid, slowed banks down and distracted them from the urgency of adoption. However, things have changed dramatically since then. The discussion about ‘Why cloud’ is no longer on the table. Banks have realized the need to shift gears and are fully convinced about the need for cloud in their digital transformation journey; what they need to do is to switch to the fast lane to unlock the best path to migration and tangible business value. There is no universal formula for adoption; every bank must devise a cloud migration strategy based on its particular context and circumstances. That being said, there are some foundational guideposts which every bank must consider on its cloud transformation journey.

In this session we discuss, Six compelling reasons to accelerate your cloud journey

Speaker:

Panel | Thursday, Sep 14 | 9:00 AM – 10:00 AM EDT

BUILDING THE BANK OF THE FUTURE – HOW TO GET AHEAD OF THE DIGITAL DISRUPTIONS

Panelists:

Featured Solutions

Meet our subject matter experts to learn more about our industry leading solutions :

Attend our Session

Scaling Digital Transformation for Corporate Banking – Learn from Global Banking Leaders

Date & Time: Monday, 10th Oct 2022, 1415-1445 hrs. (CET)

Location: Exhibitor Theatre

Corporate banking industry is going through a deep digital reset. Consequently, banks are in a state of continual digital transformation. However, a recent market research study showed that only 26 percent of corporate bankers said they had been able to deploy digital transformation at scale and reap the desired results. What does it take to scale digital success? How can banks scale digital maturity to unlock new-age business models? Join this session to hear from executives of leading global banks on the storied transformational journeys of these global digital pioneers.

FIRESIDE CHAT: Digital for the next normal – Hear from Barclays on Corporate Banking Modernization

Date & Time: Wednesday, 12th Oct 2022, 1700 to 1720 CET

Location: Stand C85

Speakers:

The Corporate Banking business is facing multiple headwinds today, accentuated by the macroeconomic challenges and strained international relations. For banks to effectively manage a dynamic credit environment, sustain fee based incomes, reduce ongoing costs and strengthen innovation to drive growth, a truly digital foundation is increasingly inevitable. But what does this mean in the corporate banking context? What are the essential contours of an impactful digital transformation? How will this play out with regard to business models, channels, processes and customers experience? Join this session to understand how some of the world’s most progressive banks such as Barclays, have designed their digital strategy and how they plan to execute this strategy to better position them for the coming years.

Thought Leadership

Banking on Cloud: The Next Lap

Hari Moorthy, Global Head of Transaction Banking at Goldman Sachs in conversation with Sanat Rao, Chief Business Officer, Infosys Finacle, sharing the inside-story of building the Goldman Sachs transaction banking business from scratch, the vision for the future, the challenges overcome and the lessons learnt along the way.

Business Model Innovation in Corporate Banking

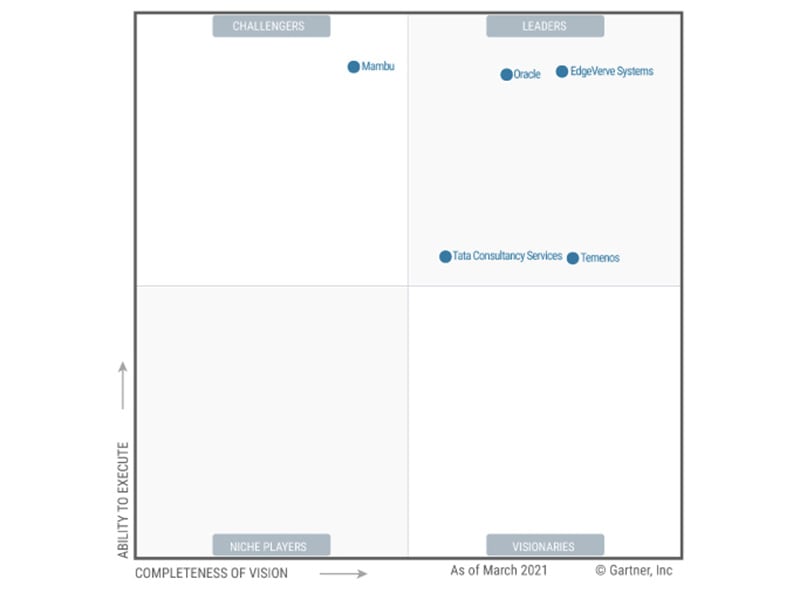

This graphic was published by Gartner, Inc. as part of a larger research document and should be evaluated in the context of the entire document. The Gartner document is available upon request…

Corporate Cash Management Playbook

This graphic was published by Gartner, Inc. as part of a larger research document and should be evaluated in the context of the entire document. The Gartner document is available upon request…

Developing innovative digital banking business models

With responses from over 125 senior corporate banking executives globally, our report Leaping Forward: Scaling Digital Innovation in Corporate Banking’, created in partnership with Strategic Treasurer and…

Ecosystem Innovation Playbook

Virtual accounts are helping businesses drive efficient payables and receivables management, and enhanced controls over their cashflows. So it’s no surprise that every progressive financial institution is investing…

Maximizing Digital Banking Engagement

Virtual accounts are helping businesses drive efficient payables and receivables management, and enhanced controls over their cashflows. So it’s no surprise that every progressive financial institution is investing…

Scaling Digital Innovation in Corporate Banking

At Sibos 2021, Infosys Finacle is pleased to bring you a 30 min Fireside chat with Charlotte Aleblad, Head of Corporate Solutions, Swedbank and Martin Runow, MD and Global Head of Payments, FX and Digital, Barclays Corporate Banking.

Case Studies

API Innovation at the World’s Best Digital Bank

Hari Moorthy, Global Head of Transaction Banking at Goldman Sachs in conversation with Sanat Rao, Chief Business Officer, Infosys Finacle, sharing the inside-story of building the Goldman Sachs transaction banking business from scratch, the vision for the future, the challenges overcome and the lessons learnt along the way.

KASIKORN LINE achieved significant financial inclusion with embedded finance

This graphic was published by Gartner, Inc. as part of a larger research document and should be evaluated in the context of the entire document. The Gartner document is available upon request…

Transforming transaction banking experiences for the new age customers

This graphic was published by Gartner, Inc. as part of a larger research document and should be evaluated in the context of the entire document. The Gartner document is available upon request…

High-tech US based bank reimagines customer journeys with channel implementation

With responses from over 125 senior corporate banking executives globally, our report Leaping Forward: Scaling Digital Innovation in Corporate Banking’, created in partnership with Strategic Treasurer and…

Leading Spanish bank leverages virtual accounts to drive innovation

Virtual accounts are helping businesses drive efficient payables and receivables management, and enhanced controls over their cashflows. So it’s no surprise that every progressive financial institution is investing…

Santander connects cash globally

Virtual accounts are helping businesses drive efficient payables and receivables management, and enhanced controls over their cashflows. So it’s no surprise that every progressive financial institution is investing…

Stepping into the future

At Sibos 2021, Infosys Finacle is pleased to bring you a 30 min Fireside chat with Charlotte Aleblad, Head of Corporate Solutions, Swedbank and Martin Runow, MD and Global Head of Payments, FX and Digital, Barclays Corporate Banking.

Solution Collaterals

Click the button to download the asset.

Thought Leadership

2022 Gartner® Magic Quadrant™ for Global Retail Core Banking

This graphic was published by Gartner, Inc. as part of a larger research document and should be evaluated in the context of the entire document. The Gartner document is available upon request…

Leaping Forward: Scaling Digital Innovation in Corporate Banking

With responses from over 125 senior corporate banking executives globally, our report Leaping Forward: Scaling Digital Innovation in Corporate Banking’, created in partnership with Strategic Treasurer and…

The Scenarios e-Book: Unlock True Power of Virtual Accounts

Virtual accounts are helping businesses drive efficient payables and receivables management, and enhanced controls over their cashflows. So it’s no surprise that every progressive financial institution is investing…

Agenda

Day 2: Tuesday, Oct. 11, 2022

Time: 15:00 – 15:45

Session: Open banking for Treasury: Where will the next wave of opportunities come from?

REQUEST A MEETING

Thanks for your interest!

Our team will get in touch with you soon.

Event highlights

Event highlights