ACCELERATE YOUR TRADE FINANCE TRANSFORMATION JOURNEY

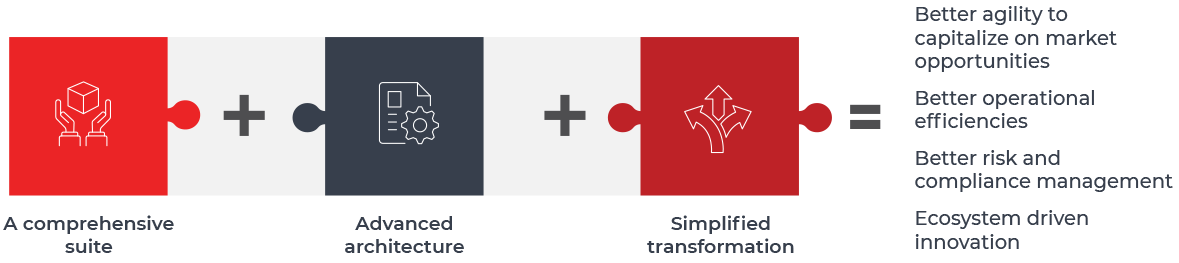

Finacle Trade Finance Solution Suite offers an expansive range of trade and supply chain finance products to enable banks and financial institutions accelerate their digital journeys. Built on an advanced architecture, the comprehensive, multi-entity enabled solution suite is designed to unlock new propositions in trade finance business.

THE FINACLE PROMISE

![]()

A comprehensive, Suite

![]()

Advanced architecture

![]()

Simplified transformation

FUTURE-PROOF YOUR BUSINESS WITH A COMPREHENSIVE SUITE

Finacle Trade Finance Solution Suite offers a wide array of trade and supply chain finance products along with a host of digital capabilities to automate the end-to-end business lifecycle. The suite also offers a blockchain-based solution to power inter-organization automation and drive ecosystem innovations. The solution offers the freedom to choose tailored products that match your bank’s business priorities, and the flexibility to decide when to deploy or upgrade a particular product.

![]()

Finacle Trade Finance

Bank guarantee | Remittances | Documentary credits | Buyer’s credit | Forward contracts | Documentary collections | Pre-shipment credit

![]()

Finacle Supply Chain Finance

Factoring | Reverse factoring | Payable finance | Account payables | Invoice discounting

![]()

Finacle Trade Connect

Letters of credit | Bank guarantee | Bill collection | C2C transactions (domestic) | Avalisation of bill of exchange | Forfaiting | Pre-shipment finance | Import bill finance | Open account | Invoice financing | Factoring | Reverse factoring

ADVANCED ARCHITECTURE

Finacle Trade Finance Solution Suite is built on an advanced architecture and enables banks to transform trade finance business with agility and flexibility.

![]()

Cloud-ready

![]()

SOA-based open solution

![]()

Declarative and RESTful APIs

![]()

Multi-platform

![]()

Configurability, localization and extensibility

![]()

Host-agnostic and interoperable

![]()

CI/CD and DevOps automation

![]()

Industry standards compliant

![]()

Multi* capabilities

![]()

Robust security framework

![]()

Truly 24×7 & real-time processing

Infosys Finacle positioned as a Leader in The Forrester Wave™: Digital Banking Processing Platforms for Corporate Banking, Q3 2022

EdgeVerve (Finacle) brings APIs, integration, and application ecosystems to corporate banking. The strategy is strong on future plans for enhancing existing cloud-based offerings. The DBPP has differentiating business banking features such as preintegration of small business solutions for accounting and analytics via upSWOT. The DBPP offers strong integration capabilities including event streaming and has integrated with multiple third-party digital front-end solutions in the 12 months prior to this evaluation. Reference customers report a high degree of satisfaction with the vendor’s delivery and support, available APIs, out-of-the-box security functions, and willingness to deliver in DevOps environments. EdgeVerve (Finacle) is a good shortlist candidate for banks that look for a well-designed modern architecture and that want to collaborate with a vendor using agile approaches

– Forrester Wave™: Digital Banking Processing Platforms for Corporate Banking, Q3 2022

SIMPLIFIED TRANSFORMATION

Experience agile, risk-mitigated modernization

Whether it is a big bang switchover, progressive deployment, or complete overhaul, Finacle helps your bank transform at its own pace by simplifying transformation and minimizing risks.

- Reference bank models offering geo-specific parameterization to roll out products in line with local requirements

- Progressive deployment and upgrades to enable flexible modernization milestones and reduce transformation risks

- Agile delivery to facilitate quick deployment of products

- Choice of Global & Local SI partners for harnessing region-specific knowhow in the space of trade finance transformation

- Strong in-house consulting team to help deconstruct trade finance value chain, build inimitable transformation strategies, accelerate adoption, and drive value creation at scale

Simplified and risk-mitigated transformations

![]()

Reference bank

Global best practices + innovations + localized solution

Coverage for local products – parameterization for geo-specifc innovations

Interface configuration for connectivity with local systems, third party agencies

![]()

Phased transformation

Progressive modernization

A phase-wise approach

Business priority mapping and value realization

![]()

Agile delivery

SAFe Agile Practice

CI-CD, end to end release automation

Progressive launches

Reference bank

Phased transformation

Agile delivery