Unlock New Dimensions for Your Bank

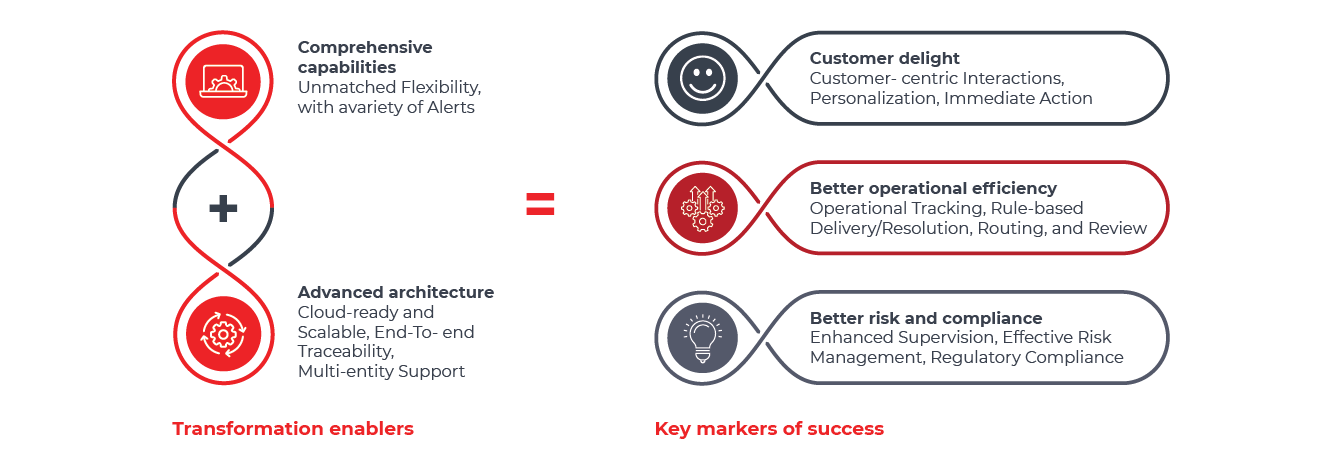

Built on advanced architecture the Finacle Bancassurance solution provides a range of features to enhance bancassurance operations.. It facilitates the processing of multiple insurance products, ensuring tailored suitability for customers, and streamlines commission processing.

With the flexibility to seamlessly integrate with any ecosystem application and insurance provider, Finacle Bancassurance enables banks to achieve operational efficiency. It provides a robust platform for navigating the complexities of the insurance landscape. This solution is crucial for banks looking to expand their service portfolio, delivering an enhanced customer experience through seamless and customer-focused interactions.

Feature-rich Solution

Built on the principles of interoperability and openness for collaboration.

The solution empowers banks to provide multi-channel alerts to customers about transactions and events recorded by the bank’s diverse business systems. It can provide alerts for the bank’s internal users as well.

The key features of the solution are –

![]()

Multiproduct definition

Define a variety of products, including life, non-life, white-labeled, unit-linked, and loan-linked.

![]()

Product suitability

Configure rules for suggesting tailored products to customers.

![]()

Premium rule maintenance

Define and maintain premium rules based on parameters like age and income range.

![]()

End-to-end transaction processing

Process Policy Initiation, renewals, and premium collection comprehensively featuring various premium types like basic, Loading, Rider, and Top-up.

![]()

Policy servicing support

Provide comprehensive policy servicing throughout the insurance life cycle, covering claims, Surrender, market-linked policy servicing, and assignments.

![]()

Commission processing

Calculate and reconcile premium level, policy, and bank-level commissions, including clawbacks.

![]()

Reconciliation capabilities

Facilitate reconciliation of transactions and commissions.

![]()

Policy maintenance

Maintain regular policy updates and premium schedules from the Insurer.

We continually strive to curate a wide range of wealth management products and services for our valued customers. This partnership with Infosys Finacle will help customers access a very diverse set of insurance products with great convenience.

Abdullah Tamman Al Mashani

Deputy General Manager – Institutional Sales and Product Development, Bank Muscat.

Advanced Architecture Powering Finacle Bancassurance

Flexible Adoption - A cloud-native solution can be installed independently either on-premises or over the cloud.

Core agnostic - the solution can work seamlessly with Finacle as well as other core banking, channel, and CRM applications.

Scalability - Proven for high availability and performance, powers horizontal, vertical, and functional scaling.

Seamless integration - The solution capabilities are exposed through APIs to enable banks to connect and co-innovate with customers, insurance providers, partners, and the extended ecosystem.

Multi-entity - The application is built to support multiple entities, languages, and currencies, and comes ready with geographical best practices.

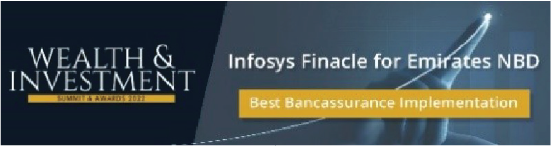

Emirates NBD partnered with over 15 insurance providers to enhance its wealth management services. Leveraging Finacle Bancassurance bank aims to efficiently manage and optimize the insurance portfolios of its affluent clients, across conventional and Islamic banking.

Discover how Emirates NBD elevated customer satisfaction by reimaging connventional and Islamic insurance operations with Finacle Bancassurance.

Explore the Advantage: Unveiling Key Benefits

Empowering you to do more.

![]()

Seamless Operations Integration:

- Elevate operational efficiency with a unified bancassurance solution.

- Ensure seamless integration with insurance companies for a cohesive approach and streamlined workflows.

![]()

Revenue Maximization:

- Implement accurate revenue accrual mechanisms, including provisions for clawbacks, to eliminate potential leakage.

- Safeguard revenue integrity through robust commission reconciliation features.

![]()

Customer-Centric Servicing:

- Enrich customer satisfaction through efficient and customer-centric servicing tailored to their insurance policies.

- Provide real-time access to updated policy information, enhancing transparency and responsiveness.

![]()

Strategic Sales Management:

- Implement sophisticated product suitability checks to ensure tailored offerings for customers.

- Empower sales teams with advanced tools and simulators, facilitating more effective and informed conversations.

Industry Recognition

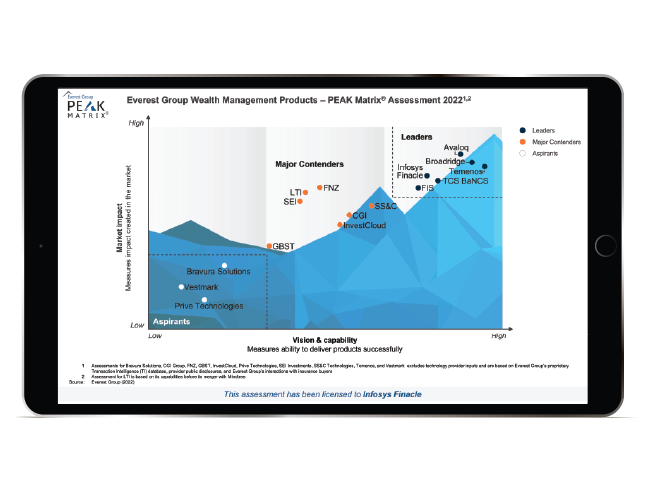

Everest Group PEAK Matrix® for Wealth Management Products Provider 2023

Read this report to learn why Infosys Finacle is rated a Leader among 16 wealth platform providers. Get detailed insights on the capabilities and strengths of the Finacle Wealth Management Solution and why top banks like DBS and Axis Bank trust us to drive their success.

Kriti Gupta, Practice Director, Everest Group – “Dedicated focus on enabling technology capability via detailed dashboards, client portal, analytics processing, and 360-degree view of customers along with well-established presence in Asia and the Middle East, have helped Infosys Finacle secure a positioning as a Leader in Everest Group’s Wealth Management Products PEAK Matrix® Assessment 2023.”

ESG conscious lending to retail and corporate customers that aligns with sustainable development goals

Driving ESG influence in the bank’s ecosystem, incentivizing stakeholders, vendors, partners and customers to be more ESG-conscious

Related Resources

Finacle Wealth Management

Finacle Wealth Management is a comprehensive solution that offers a full spectrum of wealth products, enhances customer experience, improves the productivity of financial advi...

Reimagined Wealth Management: Why is It Needed For All Your Customers

Over the past few years, with technological advancements, wealth management has undergone a paradigm-shifting change. ...

The Six Tenets for Success in Digital Wealth Management Transformation

In the past, technology transformation in the Wealth Management industry has been largely focused on serving the Mass Affluent seg...

DBS – Getting Ready to Conquer Asia’s Wealth

With Finacle Wealth Management Solution, DBS Bank has the flexibility to tailor solutions and create new products for emerging customer segments. ...