The Dynamic World of Corporate Cash Management

Cash management complexities are on the rise today. Amidst the backdrop of a continuously shifting operating landscape, corporate treasurers are confronted with a complex array of challenges in cash management, ranging from heightened inflationary pressures and geopolitical volatility to the nuanced intricacies of sustainable finance. Coupled with the perpetual flux of business dynamics, which includes rapid shifts like the rise of instant payments, adoption of open banking frameworks, and stringent regulatory demands, along with the digital revolution in cash management, the task of devising innovative strategies appears dauntingly complex.

To empower corporate treasurers and drive superior treasury outcomes, banks must arm them with the necessary tools to navigate the intricacies of daily treasury operations while enabling delivery of strategic value through robust technology foundations.

Download the Report Ask for a Meeting

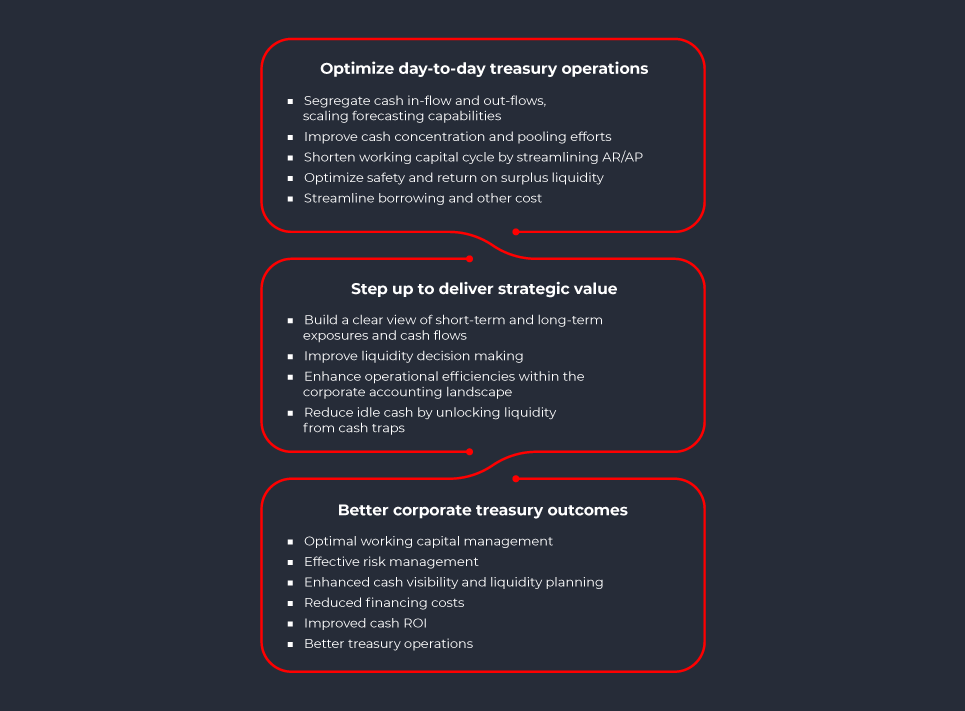

A Potent Formula for Banks to Drive Better Corporate Treasury Outcomes

Optimize day-to-day treasury operations

- Segregate cash in-flow and out-flows, scaling forecasting capabilities

- Improve cash concentration and pooling efforts

- Shorten working capital cycle by streamlining AR/AP

- Optimize safety and return on surplus liquidity

- Streamline borrowing and other cost

Step up to deliver strategic value

- Build a clear view of short-term and long-term exposures and cash flows

- Improve liquidity decision making

- Enhance operational efficiencies within the corporate accounting landscape

- Reduce idle cash by unlocking liquidity from cash traps

Better corporate treasury outcomes

- Optimal working capital management

- Effective risk management

- Enhanced cash visibility and liquidity planning

- Reduced financing costs

- Improved cash ROI

- Better treasury operations