While Real-Time Payments (RTP) have a strong foothold in retail banking, their potential for enhancing competitiveness, revenue growth and customer experiences is heretofore under-utilized in Corporate Banking.

Recent forecasts and use cases show that Corporate RTP presents a relatively untapped opportunity for banks. To capitalize on this opportunity, banks need to urgently invest in RTP infrastructure and craft compelling propositions for their corporate clients.

Download the Report Ask for a Meeting

3 Reasons Why Banks Can’t Ignore the Corporate Banking RTP Opportunity:

According to an AFP survey of corporate treasury practitioners, within the next five years, 99% of corporations with USD 1 to 9.9 billion in annual revenues anticipate initiating RTP.

A recent study by PYMNTS.com showed that 86% of surveyed U.S. businesses in the USD 500 mn to USD 1 billion revenue range, utilize RTP.

According to a Deloitte forecast, RTP has the potential to substitute USD 18.9 trillion in ACH and check based B2B payments in the United States alone, by 2028.

6 Corporate RTP use Cases that Present Unique Opportunities for Your Bank:

Uncover the transformative potential of Corporate RTP through real-world examples.

- Business to Customer (B2C)

- Business to Business (B2B)

- Government to Business / Government to customer (G2B / G2C)

- Business to Government (B2G)

- Customer to Business (C2B)

- Customer to Government (C2G)

Finacle Payments gives banks an RTP platform, with agility and scalability, to respond swiftly to changing market needs.

Banks can deploy a comprehensive payments engine with rich business functionality that can be delivered on all channels. No matter how big or complex the business, Finacle can give it a firm foundation of functional capability, architecture, and delivery readiness.

Ask for a Meeting

Thanks for your interest!

Our team will get in touch with you soon.

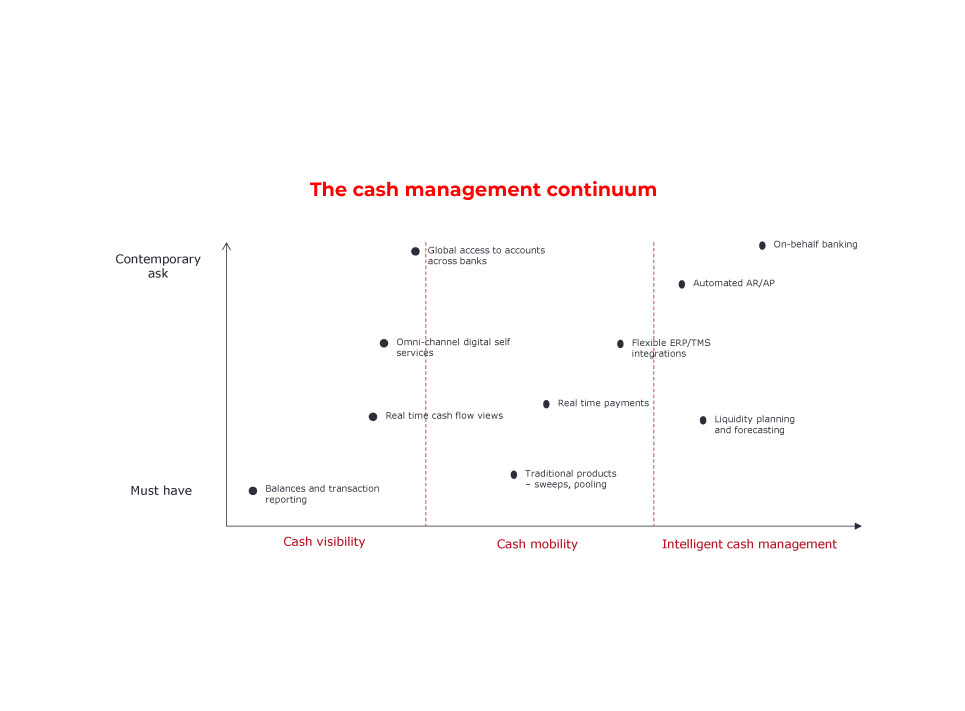

Reimagining Digital Cash Management: Banks' New Approach

To effectively deliver on their promise of comprehensively enabling corporate treasurers, banks need to offer innovative global cash and liquidity management solutions that provide the much-needed flexibility and self-serve capabilities that empower corporates to take control of their financial operations. Achieving this requires banks to fundamentally rethink digital cash management services along the three foundational pillars of cash visibility, mobility, and intelligent cash management. With this continumm-led approach to transforming their cash management offerings, banks will be able to drive continuous maturity and successfully respond to evolving client needs.

Transforming Your Cash Management Offerings with Finacle

Finacle serves as an invaluable business partner for banks, facilitating their journey of scaling the continuum of cash management. With its comprehensive and componentized suite of solutions, Finacle covers the entire gamut of cash management needs, providing banks with a powerful toolkit to meet the diverse requirements of their corporate clients. From liquidity planning and virtual account management to cash flow forecasting and digital engagement, Finacle’s range of offerings ensures that banks can offer holistic and tailored cash management solutions to their customers. This comprehensive suite empowers banks to enhance their value proposition, strengthen client relationships, and drive innovation in the dynamic landscape of cash management services.