The Opportunity

The surging demand for swift, transparent cross-border transactions isn’t merely driven by ecommerce and retail remittances; it’s also fueled by corporations seeking efficient fund movements. Forbes projects the cross-border payments market to skyrocket to $250 trillion by 2027, propelled by robust trade, burgeoning travel and tourism, and steadfast G20 commitments.

- Cross-border e-comm will surpass $3.3 trillion by 2028 – Juniper

- 75% SMEs are planning to expand their international operations – Mastercard

- Cost of a $200 remittance is targeted to reach 3-5% – G20 commitment

- By 2030, the B2B cross-border payments market could reach $56.1 trillion – FXC

Seen together, these numbers paint a vivid picture of the opportunity for banks to become key players in this space.

Download the Report Ask for a Meeting

Top 3 issues Plaguing the Cross-border Payments Industry

![]()

High Cost

At 11.48%, banks are the priciest service providers

![]()

Long Settlement Times

Anywhere between real-time to upto a few days

![]()

Transparency

Swift surveyed 7000 consumers and small businesses and identified transparency as a crucial factor for low-value international payments

Outside of solving for these challenges, banks also need to stave off competition from fintechs, card networks, money transfer providers. Find out how

Real-time Payments Proving Pivotal

Real-time payments (RTP) could prove to be the silver bullet that banks could embrace to succeed.

2 primary models that bear critical significance

Bi-lateral cross-border payments

- Several countries are linking their RTP systems through bilateral agreements.

- Linking national fast-payment systems to reduce intermediaries and lower money transfer costs.

- APAC leading the market.

Multi-lateral cross-border payments

- A multilateral platform spans multiple jurisdictions as a cross-border payment system.

- Complement or replace traditional correspondent banking relationships.

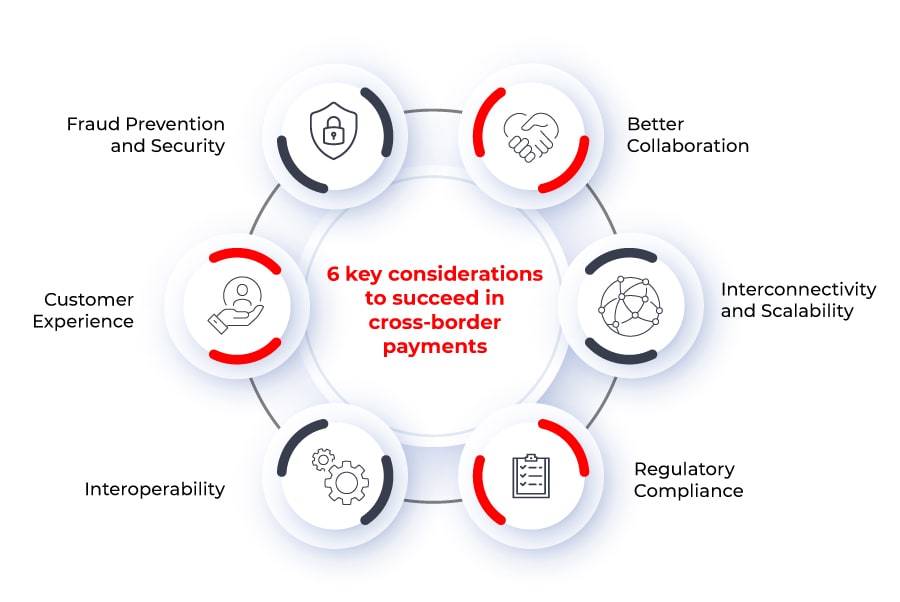

6 Key Considerations for Banks to Succeed in Cross-border Payments

Finacle Payments

The cross-border payments offering from Finacle Payments is a cloud native, microservices driven, highly available and scalable platform; and supports all models of cross-border RTP and has been developed inhouse. We have wide experience assisting banks in their cross-border payments journey.

- Successfully helped banks complete their cross-border payments through SWIFT on CBPR+ MX journey.

- As part of the bi-lateral cross-border payments infrastructure; Finacle Payments is live on rails such as Hong Kong cross-border and is ready for Australia NPP cross-border payment.

- Supports infrastructure for other bi-lateral models such as UPI-PayNow, PromptPay-DuitNow etc.

- Multilateral cross-border networks like SEPA Credit Transfers, SEPA Direct Debits, SEPA Instant, Target 2, TIPS implemented for clients.

- Infrastructure can support cross-border frameworks such as GCC BUNA, BIS Nexus, Visa B2B, Visa Direct, Mastercard Send, Partior, Ripple etc.

Ask for a Meeting

Thanks for your interest!

Our team will get in touch with you soon.

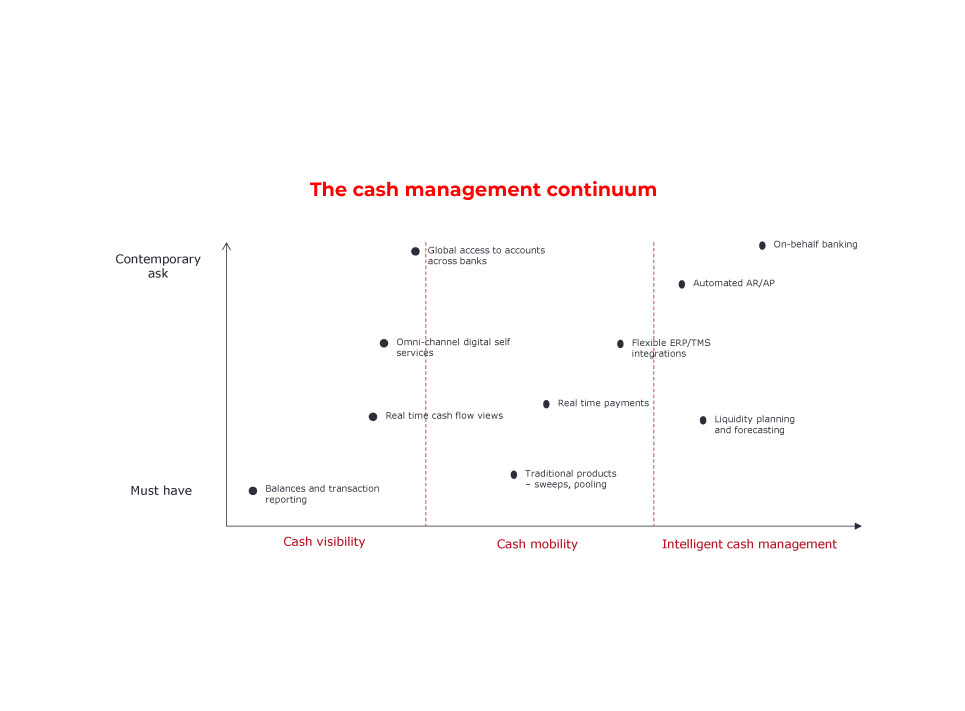

Reimagining Digital Cash Management: Banks' New Approach

To effectively deliver on their promise of comprehensively enabling corporate treasurers, banks need to offer innovative global cash and liquidity management solutions that provide the much-needed flexibility and self-serve capabilities that empower corporates to take control of their financial operations. Achieving this requires banks to fundamentally rethink digital cash management services along the three foundational pillars of cash visibility, mobility, and intelligent cash management. With this continumm-led approach to transforming their cash management offerings, banks will be able to drive continuous maturity and successfully respond to evolving client needs.

Transforming Your Cash Management Offerings with Finacle

Finacle serves as an invaluable business partner for banks, facilitating their journey of scaling the continuum of cash management. With its comprehensive and componentized suite of solutions, Finacle covers the entire gamut of cash management needs, providing banks with a powerful toolkit to meet the diverse requirements of their corporate clients. From liquidity planning and virtual account management to cash flow forecasting and digital engagement, Finacle’s range of offerings ensures that banks can offer holistic and tailored cash management solutions to their customers. This comprehensive suite empowers banks to enhance their value proposition, strengthen client relationships, and drive innovation in the dynamic landscape of cash management services.