> Blogs > Low code/ no code helps banks innovate faster and better

Low code/ no code helps banks innovate faster and better

Today’s customers have high expectations from their digital banking experiences, which have undergone a complete change over the last few years. Entire customer journeys have gone digital, and an increasing number of banking interactions are being processed straight through to create seamless user experiences.

To meet these ever-evolving expectation, banks are constantly striving to transform the underlying systems, employ a variety of new age digital solutions and leverage ecosystem innovations. While doing so, ‘speed’ often becomes a prime consideration. Fortunately, rapid evolutions in technology is letting banks transform and deliver faster than ever. One of the biggest evolutions is the emergence of no code / low code platforms. The traditional method of application development requires programmers with deep technical knowledge to write huge volumes of complex code. But a low code/ no code tool offers visual interfaces and graphics to define data, logic, flows, forms, and other application elements, without actually writing any code. Also, there are pre-built reusable components that the users can simply drag and drop.

By auto-generating the required code, the low code / no code tools drastically reduce the time needed for creating an application and following from that, the time for taking new products and experiences to market. Also, because many of these tools come with capabilities such as security readiness, extensibility, cloud readiness, easy maintainability, and internationalization features, it further reduces the need for development and customization, thus reducing bank’s total cost of ownership.

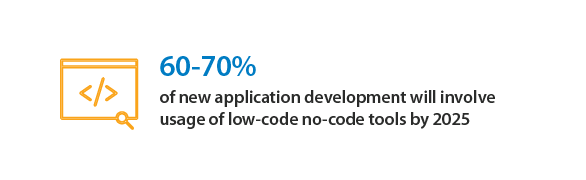

In a dynamic environment where agility is critical, the importance of low code/ no code tools cannot be overstated. Rapid adoption of low code/ no code is only going to accelerate in coming years.

sridhar-guturi

Product Manager, Infosys Finacle

Sridhar Guturi, in his role as Product Manager, Infosys Finacle, drives product innovations and market strategies for Finacle suite of products. He has worked with banks and financial institutions around the world and keeps deep interests in analyzing emerging banking trends and evolving regulatory changes. He has to his credit, multiple publications in digital and print media on various topics related to banking, technology and compliance

More blogs from sridhar-guturi >