Last weekend I was looking for a fast broadband connectivity service for my home as my current service provider was unable to provide an upgrade in spite of multiple escalations. I found the answer in a new market entrant which offered the fastest, the cheapest and the most feature-rich service with the most convenient and fast onboarding process of less than 10 minutes. This was the experience I was looking for – completely personalized service, smooth and frictionless cross-channel onboarding process without any hassles.

I think for a truly engaging customer experience, the right product offered at the right moment and through the best channel creates a wow moment. This ensures a satisfied customer who can advocate and promote your product.

Today, customer experience is the most powerful force a business could use to win in the market. I believe in a customer-centric approach rather than a product-centric approach. Winning companies put their customers at the center, and this has time and again been proven by companies like Google in the search engine space, Apple in smartphone market, and Uber which has stunned the taxi-service market.

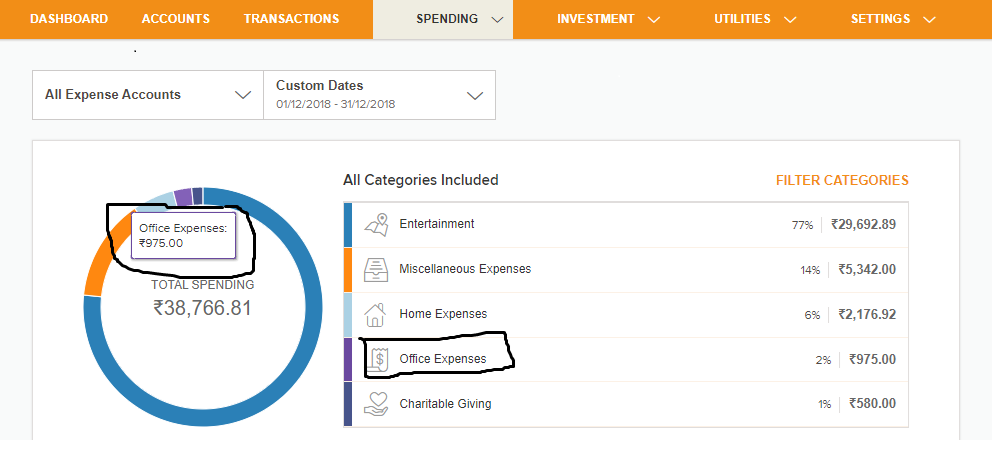

Creating a truly customer engagement experience is a necessity for any company today. If you achieve an engaging customer experience, you gain customer loyalty which can be a major competitive differentiator for your business instead of competing just on price. However, it is important for a company to understand any pain points and remove any systemic or process issues faced by customers while interacting with your company. In case of banking services, the gap in customer experience can be closed by introducing self-service application to address routine questions instead of making the customer wait in contact center queues. Also one can explore launching chat-bots to address customer questions. The main hurdle is to improve your customers’ chosen way of interacting with you.

With all this in mind, here are a few suggestions for anyone looking to develop a strategy for new business attitude called customer experience.

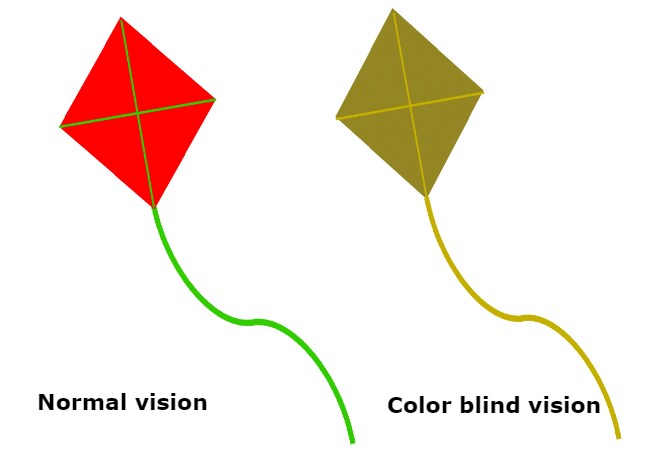

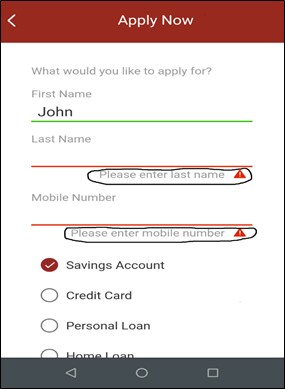

- Experience is always personal. So think carefully before introducing a new technology-driven feature or removing process steps, and understand how different customer segments will react to the variation. Not all customers have an up-to-date technology to take advantage of frictionless experience built around the latest mobile apps or devices. You have to offer contextual experiences on preferred channels to early adopters as well as other customers who could be fast-followers of technology or even laggards. You need to plan for training and support when introducing changes to ensure that there are no surprises.

- Just do it right. In the name of providing frictionless experience your organization should not move away from the customer. You may eliminate or automate some steps in the process but it should not distance a company from its customers by removing human touch. It is absolutely important to give an opportunity to your customers to interact with humans who understand their needs and can empathize with them. Automation is necessary but it should support human interaction. Human touch should not be removed completely.

- Be flexible. In any industry, you create ‘wow’ moments when you help people with uncommon requests, or surpass their expectations by going beyond the norm. It is important to not have rigid approaches which can work against employees and prevent them from using their own creativity to deliver the best service. You need to create an eco-system to allow your employees to do things differently when required.

If an organization wears an attitude of customer experience as a business strategy at all touch points, it can deliver wonders in customer service. To deliver the right experience, technology is an important enabler that companies can use to define flexible processes accurately and design services such that they are not devoid of a human touch.