The obstacle course ahead

The challenges that COVID-19 has brought to the fore, and the strategies to deal with them will vary based on the type of sports. For instance, while low- contact sports like tennis and gymnastics might see a quick resurgence, high contact, and team sports like wrestling, rugby, and football may take some time to get back in the arena. However, in either case, there will be some significant restrictions. For instance, training is currently a key challenge for sportspeople under lockdown. The social distancing norms and travel restrictions make it difficult for them to access world-class training facilities and in-person coaching. In sports like wrestling, where you need an opponent to train with, keeping in top form becomes doubly difficult.

When stadiums do open up, maintaining social distancing and adequate sanitization may remain a challenge in the years to come. And even then, it might be a while before audience confidence in large gatherings returns. After Covid-19, all professional sports have lost their attendees overnight. Sports events are often “super- spreader” events for infectious disease, making fans unwilling to assemble in large sports arenas in the near future. Indeed, a Champions League soccer match between Atalanta and Valencia on February 19, 2020, in Milan is being called “Game Zero” because it was played just two days before the first positive case of Covid-19 was confirmed in Italy. It is estimated that nearly 40,000 people in the stands exchanged the virus amongst them that day3.

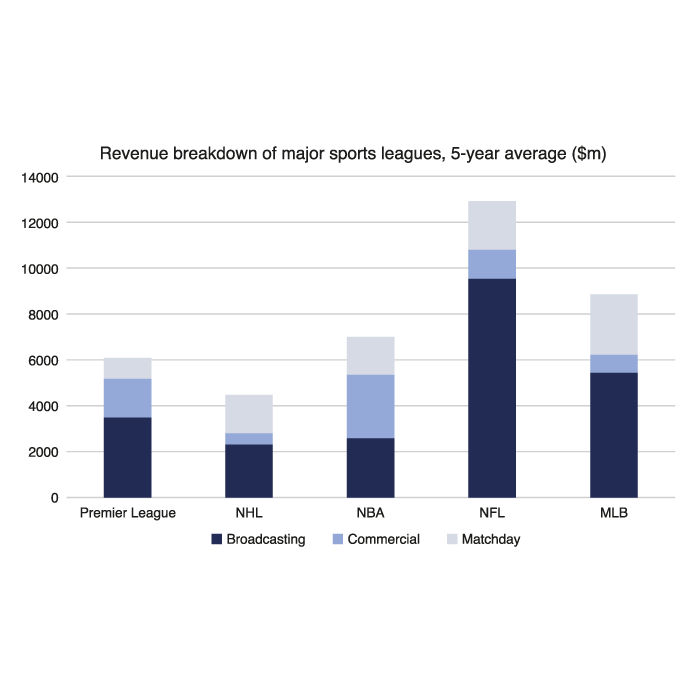

Another challenge for the industry is revenue generation. Closed borders and cancelled events have dealt a big blow to sponsorship and broadcasting opportunities as well as match- day income. Players wearing brand logos in the stadiums bring in sponsorship dollars and also create merchandizing opportunities. The NFL earned over $8.1 billion in national revenue (consisting of TV deals along with merchandising and licensing deals) in 20194. In the absence of new games, these opportunities may be lost.

These challenges pose key questions for the industry: What is the business model for sports when the crowds do not (or are not allowed) show up? Will players be as motivated to excel when there are no roaring crowds to cheer them on? What are the ways to make players perform in a zero- audience environment?

The new reality is a wakeup call for the industry to rethink their business models at the most fundamental level.

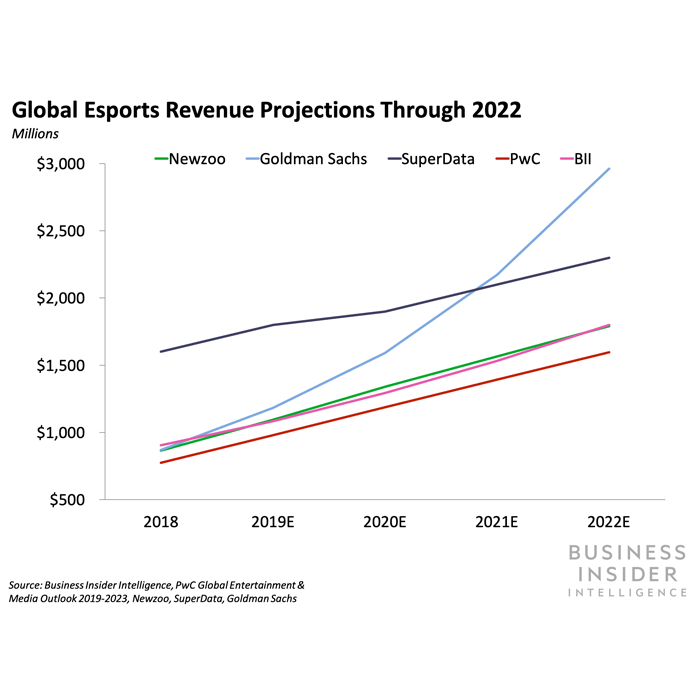

In the emerging world of eSports, the Intel Extreme Masters11 (IEM) is a series of tournaments held in countries around the world11. These Electronic Sports League (ESL) sanctioned events, sponsored by Intel, including StarCraft II, Counter-Strike: Global Offensive, Quake Live, League of Legends and Hearthstone. The 2017 IEM finals in Katowice, Poland, drew 46 million viewers. In the same year, the NFL’s Super Bowl drew 111 million viewers. Some companies are already transitioning to eSports and seeing great results. eNASCAR12 race stream where amateurs played against professionals on Amazon’s Twitch brought in almost 70,000 unique viewers with no notice and no advertising.

As necessity makes online gaming the new normal, technology will also be a critical element in keeping fans engaged in the virtual stadiums. The need is to move from a high-touch to low-touch customer experience – a shift that makes digital experience a vital move on the board. We may see an increased use of Artificial Intelligence (AI) to share insights on player performance and intelligent bots to have conversations with viewers in real-time. Technologies like Augmented and Virtual Reality (AR/VR) will give the viewers higher control on the gameplay and create more personalized and interactive experiences.

We could even see a complete robotization of sports with investments already pooling in for self-driving cars in auto racing and humanoid robot teams that could play in FIFA. CUE the basketball- playing robot can already shoot free throws with 100% accuracy topping the current NBA average of 77%3.

How sponsorship, broadcasting, and merchandizing opportunities evolve with these new models remains to be seen, however, one thing is clear – technology is set to play a major role in the sports industry.

Data: The key to performance

Powering all these technology use cases, and AI platforms is data. And the data we collect today will make the next innings for sports better prepared for managing any crisis.

Sports have multiple sources of data, such as social media, scoreboards, wearables, ticket sales, merchandise sales, loyalty programs, etc. Data solutions can unify this player, sport, and customer data into a single version of the truth. Available to AI-powered analytical tools, this data can become a goldmine of information for the industry for strategic decision making. For example, it can help with micro-segmentation of the audience and performance-based ranking of players to create advertising and game day strategies and measure their effectiveness. Actionable insights can also help drive dynamic pricing, contracts and sponsorship fee structures, and stadium and television rights20.

Even as the future of sports rests on data availability, the focus on analytics has often been after data is collected.A sound data collection strategy is almost non-existent. The industry needs to quickly set up processes to collect data for all transactions, without regard to how it will be used in the short term.

The next innings for sports

Digital technologies will be the cornerstone of the next innings for sports, and we will see a shift away from stadiums. The good news is that we are not on ground zero. Sports has already made forays into models like eSports, and now the efforts need to focus on making these models mainstream. Technology partnerships are forming and strengthening right now, and investments will only grow bigger.

The fact is that disruption breeds innovation. COVID-19 has fast-tracked the digital transformation of sports, and those who capitalize on it will come out champions. Are you ready to win the game?

References:

- https://www.bbc.com/sport/olympics/52670857

- https://www.insidesport.co/sports-business-to-lose-usd-61-6-billionin- 2020-reveals-two-circles-report/

- https://www.nbcuniversal.com/

- https://en.wikipedia.org/wiki/Intel_Extreme_Masters

- https://www.futurithmic.com/2020/03/03/5g-networks-will-changeesport- telco-playbook/

- https://cio.economictimes.indiatimes.com/news/strategy-andmanagement/ ai-the-holy-grail-for-the-enhanced-sports-viewingexperience- according-to-millennials/70175381