Digital transformation allows some firms to realize better outcomes than their peers. Why are most healthcare organizations still far from achieving stages of digital maturity despite having embarked on the transformation journey? Likewise, how can Insurance companies contend with an evolving technology landscape and new disruptive distribution/service models? This article examines how pivoting to a platform-based strategy can help solve key issues plaguing efforts toward digital transformation and help balance business objectives with superior customer experience.

Digital transformation is reshaping industries, driven by the need to improve efficiency, customer experience, and adaptability in a rapidly evolving market. Organizations in the Healthcare and Insurance sector are being challenged like never before. They must adapt to new digital capabilities in an increasingly Brittle, Anxious, Non-Linear, and Incomprehensible (BANI) environment. The current business landscape is fraught with multiple issues relating to skilled workforce shortage, dependence on legacy technologies, newer players in the space, supply chain issues, and a recessionary situation overall.

The changing nature of the business and the emergence of increasingly savvy customers calls for organizations to make a paradigm shift in their efforts for digital transformation and pivot towards a platform approach – this will serve as a solution by the leverage of AI and automation, among other things like digital operating models and help develop compelling customer insights and translate business objectives to tangible value.

Healthcare Sector Priorities

A recent EdgeVerve-commissioned Forrester study conducted interviews with business and IT decision-makers from Healthcare firms responsible for their business, IT, supply chain, and process automation strategy to explore the effectiveness of digital transformation initiatives and outline the top priorities to be addressed. Interestingly enough, the IT team focused on driving the transformation towards operational resilience while the Business focused on digitizing for the customer. Bridging these gaps to drive business and IT connectivity is, therefore, a core part of the transformation agenda today that a platform-based strategy would help to achieve.

- https://www.edgeverve.com/ai-first-platform/forrester-edgeverve-thought-leadership-paper/healthcare/

- Reimagine Growth with A Platform Centric Digital Strategy – An EdgeVerve commissioned Forrester Study

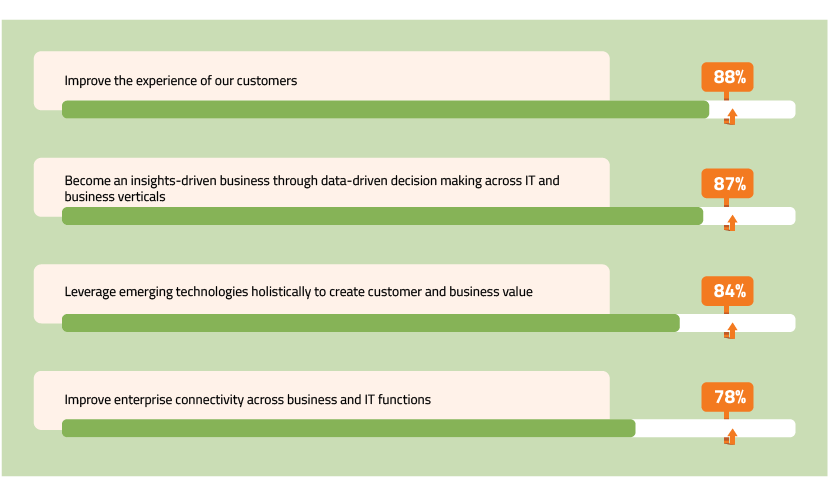

- Customer Experience (CX): 88% of healthcare decision-makers viewed this as the most critical, making it a top priority to improve CX. Improving CX is a top priority, with 88% of healthcare decision-makers viewing it as critical. This involves leveraging technology to create personalized, seamless experiences for patients and healthcare providers.

- Data-Driven Decision-Making: The ability to steer towards becoming an insights-driven business is essential, with 87% of respondents emphasizing the need for data-driven decision-making across IT and business functions.

- Enterprise Connectivity: This is the most critical of them all, integrating data, infrastructure, and applications to create a cohesive ecosystem. Operational efficiency improvements and achievement of business outcomes are a direct benefit. Enhancing connectivity across business and IT functions is crucial for improving operational efficiency and achieving business outcomes.

Insurance Sector Priorities

- Operational Efficiency: The insurance industry is about reducing costs and improving productivity. Streamlining operations through automation and AI is a key focus, achieved by automating claims processing and enhancing underwriting with data analytics.

- Customer Retention: Customers are increasingly becoming more aware of the many players in the Insurance marketplace, necessitating the focus on prioritizing CX to drive customer retention and satisfaction. This also calls for increased innovation and the need to provide products and services quickly and effectively to help maintain competitive differentiation.

- Risk Management: The insurance business is all about risk; insurers are able to make informed underwriting decisions by leveraging AI for predictive analytics and risk assessment, with an effort to have plans tailored to individual requirements.

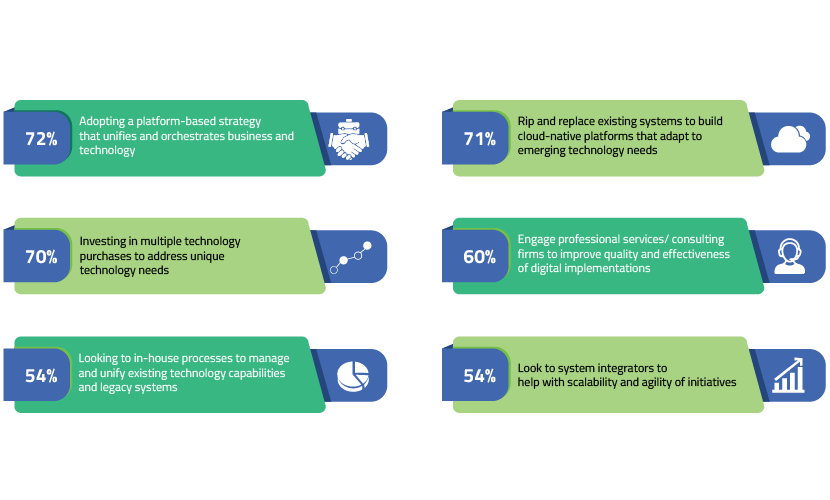

It’s increasingly evident that most healthcare decision-makers rely on a platform-based strategy that unifies business and technology to help accelerate the efforts at digital transformation and create some tangible impact. True transformation by way of improved patient experience and clinician productivity is best achieved by having the organizations leverage emerging technology, innovation, asset management, and smart ways to interpret and integrate data. Organizations that can scale the platform and partner approach can accelerate business results and better adapt to changing conditions in an uncertain market.

Key findings from the EdgeVerve commissioned Forrester study (Figure 3):

- Healthcare decision-makers believe that a platform-based strategy remains a priority to accelerate their organization’s digital efforts.

- A partner ecosystem helps Healthcare firms bridge the knowledge and capability gap.

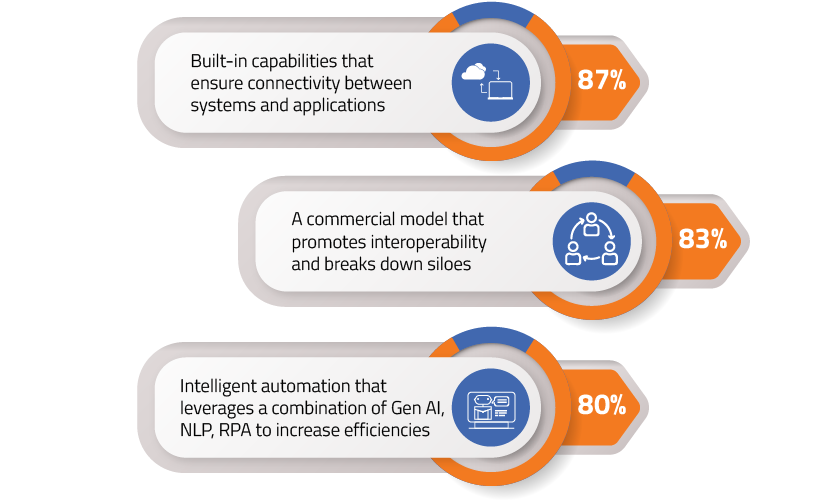

- Healthcare firms rank connectivity, operational efficiencies, and customer value as top priorities in platforms.

AI-powered Claims Processing

Forrester’s research found that a top American insurer had projected $500 million in run-rate cost savings by 2023 from its investments in robotics, machine learning, and other AI technologies to develop insights into underwriting and claims while improving efficiencies. The healthcare and insurance sectors are in a pivotal position to leverage AI for claims processing by automating manual tasks, reducing errors, and speeding up the reimbursement process. AI technologies such as natural language processing (and machine learning can analyze unstructured data, detect fraudulent claims, and predict potential issues before they occur. This not only improves efficiency but also enhances the accuracy and timeliness of claims processing, leading to better financial outcomes and customer satisfaction.

Loved what you read?

Get practical thought leadership articles on AI and Automation delivered to your inbox

Loved what you read?

Get practical thought leadership articles on AI and Automation delivered to your inbox

How to Develop a Platform-Centric Digital Strategy for Maximum Impact

Healthcare and Insurance leaders must seize the moment and use the opportunity before themselves to focus on the reinvention of their organizations and smartly integrate data, asset management, innovation, and the use of emerging technology to improve the customer experience for their clients and productivity for their workforce.

Recommendations:

- Drive a customer-centric tech strategy by building connectivity.Align business and IT stakeholders early on to focus on transformation priorities while enabling a connected enterprise with the tools, systems, and metrics all factored into the planning.

- Remove traditional barriers with end-to-end capabilities.

Do away with siloes and workflow inefficiencies to focus on true end-to-end capabilities. - Set priorities for leveraging AI and automation capabilities to drive employee outcomes. Using automation for application processing helps reduce process time, increases employee productivity, and drives a customer-centric strategy.

- Embrace emerging technologies with clearly defined use cases.

Identifying the right set of use cases and capabilities is important to leverage emerging tech to help achieve business success. - Optimize partner ecosystems to drive accountability and efficiency.

Leverage a platform strategy that enables you to capture value through efficiencies, insights, and growth from business, IT & partner ecosystems.

Our leanings demonstrate that firms need to tap into a future-fit platform strategy to be successful in their digital transformation, allowing for connectivity within and outside the organization. This allows for a true integration of the experiences of customers, employees, partners, and societies with the many back-end systems, technology, and processes of an organization.

Disclaimer Any opinions, findings, and conclusions or recommendations expressed in this material are those of the author(s) and do not necessarily reflect the views of the respective institutions or funding agencies