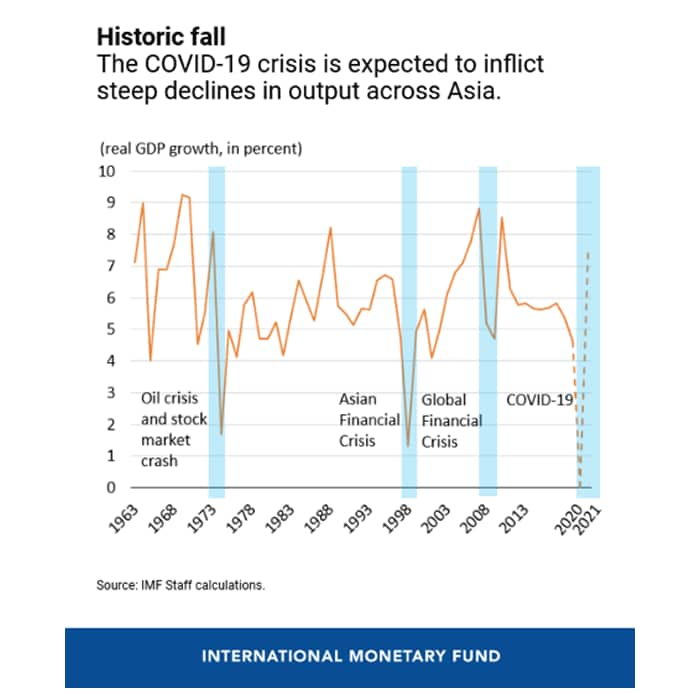

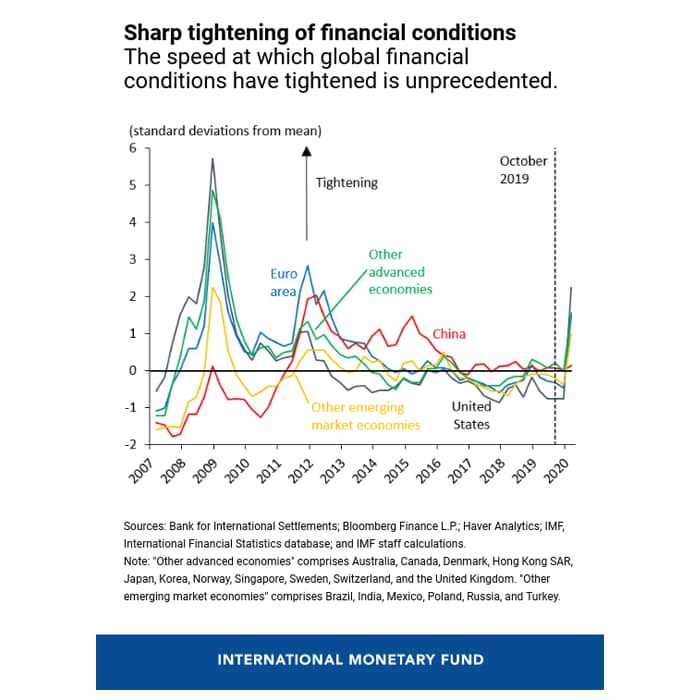

These are challenging times, much worse than the 2008 crisis. The impact of COVID-19 has brought the world to a standstill. While the aftermath appears similar in both cases, the reality is different. The 2008 economic crisis was a slow event which built up over a period of time. The current scenario is an unforeseen event where immediate global lockdowns have created a dip in the economy

Unlike the banking collapse of 2008, the 2020 pandemic has muted demand impacting consumption of goods and services across industries. We’ve seen small businesses shutting down and an increase in layoffs. This can have a potential bearing on an individual’s cash flow and the ability to pay off their dues.

While the primary focus of governments across the globe is to protect the health and safety of citizens, they are also taking steps to safeguard the interest of the consumer. CARES Act in the US covers direct payments to families impacted by the pandemic, benefits to unemployed individuals, and grants for businesses that have suffered.

Governments across the globe have also stepped by providing short term moratoriums and payment breaks to their citizens.

Impact of COVID on the banking system

With growing job losses, slower demand and sales, and declining revenues, borrowers and banking customers will soon start seeking extended financial assistance. This will further stress bank assets and might require extreme measures for recovery. As a result, banks and financial institutions are going to face multifold challenges in short to mid-term basis as below:

- Increase in losses due to sudden spike in delinquencies and loan defaults

- Revenue compression impacted by an individual’s ability to borrow further in these challenging times

- Cost optimization in every department without impacting the output

Challenging times ahead for debt collections

The collections teams within banks are facing a different challenge altogether. Federal and state agencies in different countries have implemented restrictions on debt collection in the short term. Once COVID-19 deferral ends, banks are expecting delinquencies to rise and will need to handle the situation with the available workforce.

Borrowers with no history in delinquencies will start entering collections bucket due to COVID-19. It will be essential to identify these customers from perennial defaulters and treat them separately.

Post moratorium, contact centers will have their hands full with an increase in outbound call volumes. Collections manager will have the task of managing the workloads for their teams.

Collections team have been leveraging risk models in the past to identify the risk of their delinquent borrowers and suitably define contact strategies. There is a high chance that these models will under- estimate the actual defaults and banks relying on such models could face higher losses.

Why current banking risk models are not enough

Banks use risk models to predict and identify the risk of a customer.

Traditional risk models have been built on historical data to predict a borrower’s propensity to pay. Risk modelers typically use historical data to build these models. While these models have been performing strongly in a steady economy, they could perform poorly in the current crisis due to the following reasons:

With the current risk model failing, banks are looking for other avenues to help predict customer risk more efficiently.

What banks need to do

While the nature of the current crisis is different from 2008, banks can draw similarities in terms of the failures and misses and learn from the past to plot a more pro-active path to recovery. Collection and risk managers will need to come up with intuitive solutions in short to near term as below:

New approaches in the new normal

Correct identification of customer risk today requires an evaluation of a large number of traditional and non-traditional user attributes.

Traditional risk models are incapable of sifting through the gigabytes of unstructured data to extract customers’ behavioral profiles.

Advanced text analytics and machine learning techniques are highly effective in evaluating and quantifying qualitative aspects. AI models with the right set of data can quickly provide a granular view of customer risk against traditional models. These models can be built, tested, and tuned to help portfolio managers devise and test strategies quickly.

Swift assignment of appropriate programs to assist the borrowers in this time of need will enable lenders to build a strong and lasting bond with their customers. And isn’t that what business is all about!