The pandemic has thrown traditional Supply Chains into chaos. From the lack of workforce creating bottlenecks, increased wait time of shipping containers leading to shortages to them impacting the final price of the products, the Supply Chain process has seen it all. How can we unclog Supply Chain with the correct use of technology? What are the key steps to optimize costs and ensure timely delivery? Read on to know more.

Over 90% of the world trade moves on the water. And shipping has traditionally been plagued with supply-demand challenges for available capacity across routes. Container pile-ups have been known to create shipping traffic jams, a situation that has only worsened with the COVID-19 pandemic that threw traditional Supply Chains into chaos. While still recovering from the lockdown’s impact, CPG companies struggled to meet escalating consumer demands. Even as they shipped more to meet demand, region-specific issues like the drought in Taiwan, a devastating fire at Japan’s Renesas Electronics, and blockages in Suez Canal created fresh challenges.

These increasingly congested ports are costing businesses – according to McKinsey, shipping a container from China to Europe now costs up to six times more than it did at the start of 2019 . Add to that the losses from languishing cargo in yet unloaded ships, and it becomes a call for a detailed look into this crisis worsening every day.

What brought the industry to this point?

Several factors have converged to create the current crisis. For one, global trade has always been imbalanced. For example, more goods move from Asia to the U.S. than vice versa. This means that empty containers languish at U.S. ports, waiting for cargo to begin their journey back. North America alone faces a sizeable imbalance – i.e., for every 100 containers reaching the United States, only 40 are exported, and 60 out of every 100 containers keep on accumulating at the ports .

To this already skewed equation, the U.S. introduced a trade policy in 2018 and increased tariff rates under sections 232 and 301 . The consumer goods industry responded by shipping their products to the U.S. before the new tariff came into effect. The upsurge in imports immobilized the already struggling ports. Then came COVID-19 and took away a significant chunk of workforce available to handle this marine traffic. The non-availability of workers paralyzed the entire ocean Supply Chain while demand from consumers under lockdown continued to grow. In October 2021, marine container shipments from Asia to the U.S. hit a record high – up 23.3% Y-o-Y .

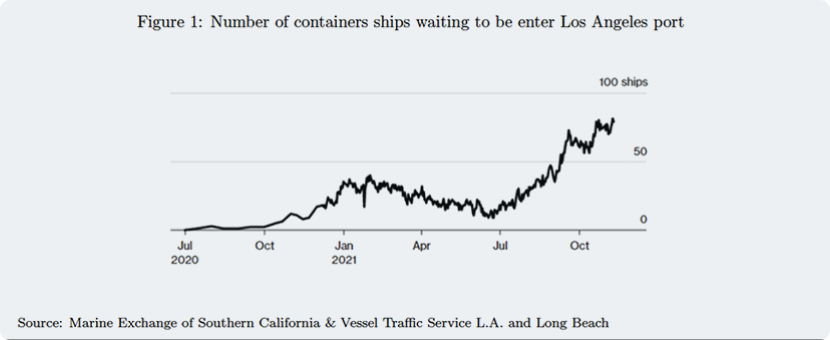

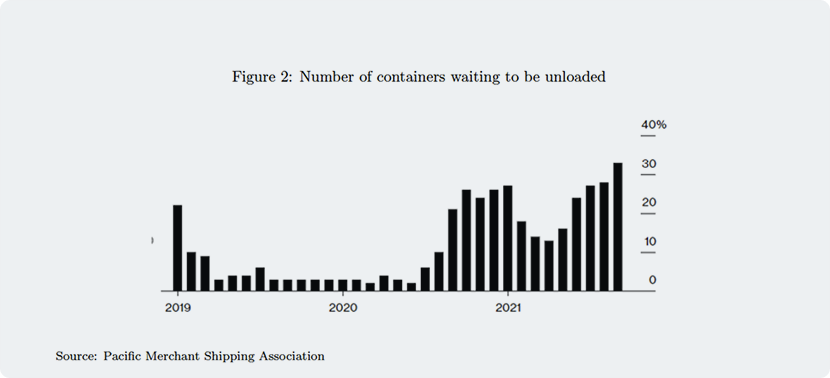

All this has led us to the situation depicted in the figures below. The number of ships waiting to enter ports is growing alarmingly. And even if they do manage to enter, they must wait a significant amount of time before they can unload their cargo.

Whose problem is it anyway?

While at one glance, it looks like a problem for the shipping industry, the real challenge here is for the consumer goods players. The pandemic has forced them to take a more active role in their end-to-end Supply Chains, and many of them have taken steps to resolve the current crisis. Amazon, for example, made their containers to avoid container shortages and the hustle to return empty containers quickly. They exponentially increased their workforce and number of warehouses to unload goods rapidly. And they leased long-haul plans to ship smaller volumes faster. While these initiatives helped them continue their product movements uninterrupted, ensuring timely delivery and minimum stockouts, they were drastic and cost-intensive. Not everyone in the CPG industry could (or should) do what Amazon did. What then is the alternative?

Some firms are switching to using smaller ports to avoid congestion at the bigger ones. While this affords them the flexibility of loading and unloading, the cost of using these ports is much higher. Small ports accommodate smaller ships, increasing shipping costs per item and carbon emissions. Like Home Depot and Walmart, others are going the collaboration route for port resources, personnel, capacity, and distribution networks.

There are other proposals, such as fining companies for keeping the empty containers on the port property for a long duration and keeping the ports open 24*7 to accelerate the loading and unloading of vessels. These are, however, short-term efforts towards a structural Supply Chain problem that needs a broader, long-term intervention.

Unclogging Supply Chains with technology

Information is essential to minimize congestion at the ports and get traffic moving smoothly. Suppose all players involved in the logistics could get a view of how many ships are awaiting entry, how many of them need to be unloaded, what is the workforce available, what is the warehouse capacity, what is the last mile transport availability, what cargo needs to be shipped out, etc.. In that case, shipping could be planned much better.

This information exists in bits and pieces and manual paper trails, but there is no comprehensive single-view. To get a single source of truth, we need to start looking at shipping less as an isolated activity and more as an integrated part of larger CPG Supply Chains. Every aspect of shipping needs to be digitized. The data is made available in one single format into a typical data frame that could be utilized for analytics-led decision making—effectively creating a connected network of every activity and building transparency into the system.

Once this information is available, companies can use intelligent digital solutions to maximize resource efficiency. It is then that technology can offer insights such as which warehouse to use to minimize transport time and get maximum capacity, which shipping route to take to avoid congestions and balance container supply and demand, which alternative port is available that can handle the size of the ship, etc.

-

-

Digital payment solutions for complex shipping contracts

Currently, there are complex mechanisms at play when it comes to containers carrying high-value items, precious goods, or restricted goods. These require multiple physical inspections and heavy paperwork before payments can be made. Digital solutions to expedite these services would decrease the idle time of ships at the ports and eventually increase port utilization.

-

-

-

Digital route planning and cost-effective lane solutions

Currently, ships wait 6-7 weeks before getting a chance to unload. Technology-enabled dynamic route planning and lane selection solutions could result in cost-effective route selection, provide continuous route traffic and port congestion updates, and dynamically offer route change options to nearby ports.

-

-

-

Paperless transactions and data integration

Shipping is still dependent on a lot of paperwork – a state that increases chances of errors, data loss, and duplication of processes. Digitizing processes could eliminate manual intervention and make the flow of information more accurate and on-demand. This can reduce the processing time of the ships at the port, thus reducing the operating cost and idle time.

-

Loved what you read?

Get practical thought leadership articles on AI and Automation delivered to your inbox

Loved what you read?

Get practical thought leadership articles on AI and Automation delivered to your inbox

The future of shipping is connected.

Everyone part of the shipping value chain knows the importance of automated solutions. They’ve taken steps to adopt Automation in their existing operations. The challenge is that these solutions remain in siloes obstructing the free flow of information. While deploying Automation is excellent, it’s time for the industry players to think about the whole Supply Chain, partner integrations, and how data availability can improve overall outcomes for their business. As we prepare for the inevitable global Supply Chain redesign, only the connected will come out winners in our post-pandemic reality’s dynamically changing environment and consumption pattern.

Disclaimer Any opinions, findings, and conclusions or recommendations expressed in this material are those of the author(s) and do not necessarily reflect the views of the respective institutions or funding agencies

- Perrins, W. “Rebuilding In The Face of Adversity” Research Report COMMITTEE: Economic and Environmental QUESTION OF: The Environmental Hazards Presented by Trading Activities in Key Strategic Waterways.

- https://www.mckinsey.com/industries/travel-logistics-and-infrastructure/our-insights/whats-going-on-with-shipping-rates

- https://www.hillebrand.com/media/publication/where-are-all-the-containers-the-global-shortage-explained

- https://www.usitc.gov/research_and_analysis/trade_shifts_2018/

special_topic.htm - https://asia.nikkei.com/Business/Markets/Commodities/Container-shortage-in-Asia-pushes-up-shipping-costs