Summary

While the financial industry has already started harvesting the benefits of robotic process automation, it is time that they take the next step — Intelligent Automation. Why you ask?

Intelligent Automation, as the name suggests, lends intelligence to bots, making them capable to make decisions, of course, under the guidance of human subject matter experts. The article explores everyday banking use cases like mortgage writing, KYC/AML, contract reviewing, and customer letter generation to explain why Intelligent Automation is not just a fad.

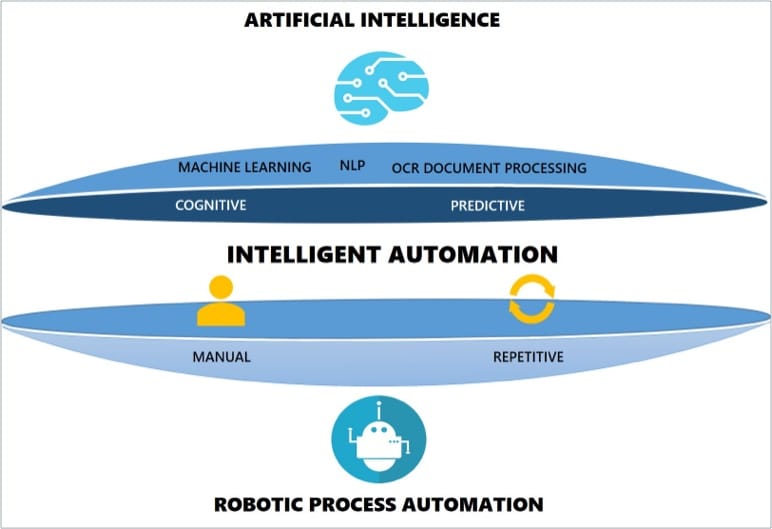

Digital is the buzzword shaping business across segments and geographies. As digital technologies gain prominence, including cloud, blockchain, IoT, the objective of these initiatives boils down to efficiency, cost savings, and customer empowerment. Automation forms the backbone of these digital themes, with the definition and scope of automation expanding over the last decade. In the Financial Services industry, automation is among the fundamental tenets and has grown enormously to embrace automation’s evolution as a key growth theme. Until recently, RPA (Robotic Process Automation) has emerged as a critical technology automating business processes that are manual, high volume, and repetitive. Nevertheless, any automation assessment also shows a good volume of processes that cannot be automated with RPA, simply because the process required some intelligence to make it work or the system had to deal with unstructured data like documents and emails. Intelligent Automation, one of the most disruptive technologies, is making rapid strides in the industry, automating processes that cannot be handled by RPA. Intelligent Automation blends RPA capabilities with Artificial Intelligence/Machine Learning technologies, making it the next logical step for banks to consider.

Decoding intelligent automation

Intelligent Automation combines the best of RPA and Artificial Intelligence capabilities to enable wider automation and improved efficiency.

A straightforward example would be any process that requires an incoming email to be parsed in order to determine the next course of action. Typically, such processes are excluded from RPA processes since it would require human intervention to read the email and then decide on the next step. This is where Intelligent Automation comes to the rescue. Since intelligence is built into the bots to parse email through AI capabilities like Natural Language Processing, it can read the email and decide on the next course of action. Essentially, Intelligent Automation is all about bringing more processes under automation, thereby enabling companies to navigate towards excellence.

Intelligent automation in banking — More than just a passing fad

The banking industry has evolved over a period of time, and the level of automation is expanding both in breadth and depth. The driving force behind such automation initiatives is not limited to cost reduction and operational efficiency. However, banks bring in the customer experience lever into such discussions, which is a significant step forward. The question is no longer around the $ saved or the % effort reduction, but the customer experience index.

Robotic Process Automation has undeniably changed the automation dynamics of the banking industry. One significant limitation of traditional RPA services is their ability to automate only tasks that are repetitive and well-defined. The banking industry has benefitted a great deal by adopting RPA since numerous processes within their landscape fit into what RPA can solve, viz., high volume, and repetitive tasks. Unfortunately, the banking industry is characterized by unstructured data and processes that require more than the ability to handle repetitive tasks.

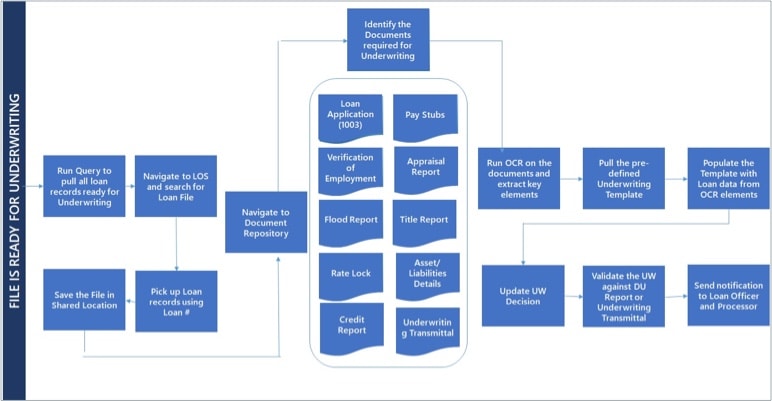

Banks have already begun adopting Intelligent Automation, and here are few use cases where Intelligent Automation could accelerate the automation journey.

Unlocking the transformative potential of intelligent automation in banking — A deep dive into the use cases:

Loved what you read?

Get 15 practical thought leadership articles on AI and Automation delivered to your inbox

Loved what you read?

Get 15 practical thought leadership articles on AI and Automation delivered to your inbox

Three ways financial services organizations can overcome the obstacles:

-

-

Process discovery:

The automation journey in most organizations starts with process discovery — automation experts observe and record the process, review automation feasibility, and then identify use cases that could benefit from automation. The prioritization of use cases is predominantly based on FTE/Cost reduction, but banks are now factoring in business benefits and customer experience scores too. Process discovery exercises are time-consuming, leading to wrong use cases being picked or the right use cases missed out. The way forward for banks is to adopt Process discovery tools offered by most or all of the Intelligent Automation vendors. These tools are essentially bots that run on the employee machines in a non-intrusive way, monitoring and gathering keystrokes/tasks data, which are then analyzed using machine learning algorithms to identify automation use cases. These tools also offer insights on the benefits of automation and accelerate the time to implement the automation since the data gathered as part of process discovery can be used to generate the automation workflow relatively faster.

-

Data quality issues:

No discussion around AI and ML is complete without concerns about data quality. Even the best of AI/ML initiatives can fail if a stronger dataset does not back them. Since Intelligent Automation is about bots that learn from data, the same concern echoes here.

When there is a general tendency to blame it on the data quality for any failure, it boils down to two specific perspectives:- Is the dataset reflective of the data in the real world?

- Is the data comprehensive enough to conform to the problem that

is being solved?

The first is more of a technology play, whereas the second is more of an SME/Domain knowledge play. Major banks have begun technology initiatives like a data lake that could help alleviate some of the concerns around data quality. Although, there is no one size fits all approach that can solve all the data quality issues. But more critical is also the domain/SME knowledge that is important to figure out the kind of data that would supply meaningful insights to solve the problem.

-

-

Technology implementation:

Sometimes, banks struggle to answer two key questions around Intelligent Automation — When and How. Budgets and other priorities influence the timing, but it is safe for banks to get started on the journey considering the value it brings to the table. With a tougher regulatory environment, fierce competition, and increased expectation from Gen Y customers driving the demand, banks cannot handle the current pace of manual driven process that is fraught with delays and disappointments. What’s needed is a strategic Intelligent Automation initiative, which includes establishing a CoE driven by an enterprise-wide initiative led by domain SMEs, data scientists, RPA developers, and leaders that come together in an agile way.

What lies on the next horizon?

Banks have adopted RPA to automate the repetitive manual process, and it is time for banks to embark on the Intelligent Automation journey. In traditional RPA, we often start with a large % of exceptions, but continuous monitoring and fine-tuning the process flow over time leads to improved results. But then, quantifying the success factors and projected business benefits is relatively difficult in Intelligent Automation (AI/ML/RPA) use cases, as the success is largely dependent on the accuracy and availability of data over a period of time. Process definition and modeling could be straight forward, but the underlying data used in training the bots should reflect real-time data to make things work. Hence it’s critical to have a mindset to test, learn and experiment; even if there are initial failures, it is important to pick up the learnings and move ahead. Successful Intelligent Automation journey would go a long way not just in regular automation KPIs like FTE reduction, cost benefits, but also improve the end-user experience.