Summary

The pandemic indicated that supply chain strategies today must include execution, not just planning to drive business resilience. Transitioning from linear value chains to a highly connected value network will emerge as the new norm, a true game-changer. What lies at the heart of today’s enterprise is the power of connected intelligence to rethink the global supply chain. Read on.

In the wake of a Black Swan event, it is easy to recommend the virtue of being prescient. Nowhere has this convenience been more evident than in recommendations for supply chain resilience after the disruptions of COVID-19. The industry has said enough about what could have been and used it to inform what we should do now. The reality, however, is that the occurrence of an unexpected event lowers the likelihood of an exact repetition soon. Equally important is the collective belief we all now have in the importance of preparedness and agility. No forecast can predict every potential hindrance or opportunity.

In the supply chain context, demand forecasting based on historical sales data is no different. We can always prepare for something we’re expecting, but we can’t expect everything that will happen. To drive business resilience and genuine value, supply chain strategy today must extend to include execution, not just planning. How can we do that? Before we talk about the solution, it is essential to delineate the challenges.

Business Challenges, Unprecedented

This past year was different for two reasons. First, usual disruptions involve either a supply shock or a demand shock, and rarely both simultaneously. Second, these interruptions are often limited to a country or a vertical and not spread across the entire global supply chain in varying degrees of intensity. Even with natural disasters, the disruption applies to a warehouse, factory, or a few nodes in the supply chain. The pandemic has substantially expanded the horizons of risk and has shown us that even the best-laid plans can fail for a variety of reasons.

-

Fragmentation of Demand Signals

The number of new products being introduced in the market has gone up exponentially. Most verticals in the consumer goods space might see a new product launched every week – a unique flavor, a new color, or a new style. Many of these new products may not be on the market for very long. They may be seasonal or limited edition or event-driven items. This sheer variety of products makes it difficult to predict or forecast which variant will sell and in what quantities. Compounding the product proliferation is the explosion in online sales, primarily because of the pandemic, causing further fragmentation of demand. Traditional demand clusters like retail stores have suddenly become less important since the end consumer could be anywhere in the world. The result – existing forecasting frameworks found themselves inadequate to address the situation.

-

Inventory Deployment

A typical e-commerce transaction can result in one of two options – consumer selecting home delivery or pick up in a store. Consider the pick-up in-store example, which is very common, at least in the Western markets. It is possible in these cases that items may not be available in the store of consumer’s choice, but elsewhere in the retailer network. Expecting a consumer to go store-hopping is a sure-shot recipe for disaster. Retailers must orchestrate timely inventory transfer to the store of consumer choice to enhance experience. The same would be true for home-delivery orders where retailers have started repurposing their stores as front-line warehouses. Committing inventories to a store and then having to pull it back for an online order turns out to be expensive, especially in the fashion segment.

-

Hierarchical Value Chains

Traditional supply chains are inherently rigid, oftentimes driven by the territorial nature of the business. Value chain partners typically roll up to designated suppliers, thereby limiting flexibility in sourcing their needs.

The early phase of the pandemic saw China closed off to the world, crippling supply chains everywhere. Enterprises now understand that supply-side signals matter just as much as demand signals. Companies are currently looking for intelligence that allows them to see disruptions to the supply partner ecosystem as they occur, ensuring that they can create resilience with alternate sources of supply.

-

Systemic Silos

ERP systems, while standardizing processes within an enterprise, track a company’s direct customers or vendors and rarely beyond. With every business having its own ERP, data islands have become inevitable, requiring significant integration cost and effort to drive any meaningful collaboration between partners.

-

Externality of Data

Nearly three-quarters of critically relevant data required for planning sits outside an enterprise. Mismatching partner master data hierarchies and latency in acquisition make it extremely hard to aggregate information and contextualize it for timely decision making.

A New Paradigm in Business

We see an opportunity for transformation. Supply chain planning is moving from shipment-based forecasting to demand-based forecasting, and manufacturers are now looking for near real-time demand signals. Supporting this trend is the willingness of retailers and channel partners to share point of sale information at granularities and frequency like never before. This ability to sense and respond as events unfold is no longer a pilot or candidate for experimentation but a business imperative. Successful initiatives have resulted in a 15-20% improvement in forecast accuracies.

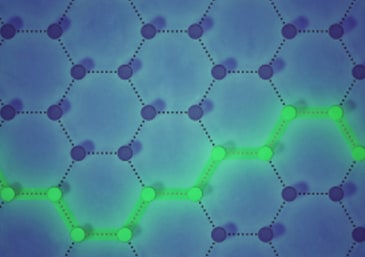

Our viewpoint is that a similar effort is needed in supply chain execution to bridge the gap left by forecast errors. The current business architecture in most manufacturing value chains is too rigid and driven by territorial considerations. With the advances in cloud, mobile, and network technologies, access to information should no longer be limited by traditional boundaries established during the analog era. While physical goods flow will still experience well-known real-world friction, the ability for value chain players to digitally connect with each other in a non-hierarchical manner becomes a business imperative. We believe the industry will transition from operating in a linear value chain to a highly connected value network going forward. Such networks will trend towards a common goal of matching supply with demand regardless of the size of the participant or the origin of such demand (akin to ride-hailing services in passenger transportation). It wouldn’t be surprising to see a billion-dollar corporation digitally connected to a mom-and-pop store either to drive direct marketing messages, receive feedback on new product launches, or even to recruit them to provide last mile delivery services.

What’s in it for me?

A multi-enterprise business network makes peers of all value chain players regardless of their size and location. It recognizes the fact that in the business of trading, no entity could be permanently tagged a customer or a vendor; rather, such designation is limited to the context of a transaction. Consequently, for one looking to buy, the network offers a choice of products and vendors like in an online marketplace. For a seller, it is all about the ease of customer discovery. For a marketer, the power of disintermediation had never come this close to reality. And, for a manufacturer, the ability to track and trace products and orders, rebalance inventories across the entire network are examples of benefits that no longer remain a pipe dream.

Technology Considerations

By definition, multi-enterprise business networks are founded on cloud infrastructure and could be public or private in their participation. A key tenet to success lies in the ability of the network to drive inter-operability versus integration. This calls for common data architecture and seamless integration without compromising the privacy of data that participants place on the network. Ensuring the uniqueness of participant, product, and location identification is a lynchpin of a network’s success. At the same time, the network must not require participants to give up their systems of record which would be an extremely difficult change management to drive. The networks are logical clusters of businesses that organize themselves using any attribute(s) of participant businesses serving a shared purpose.

Driving the Future of Business

This networked approach to supply chain management is critical to better execution. Through the power of connected intelligence, a network inherently builds resilience in its participants’ supply and demand functions. It democratizes access to data and technology, brings consumer-like user experiences in business, and enables them to interoperate in real-time like never before. There will be innumerable use cases that deliver exponentially higher value leveraging data from the entire ecosystem. It has the power to transcend B2C or B2B, Demand or Supply, Product or Services in ways that will make us wonder how we ever lived with such silos for decades!

Loved what you read?

Get 10 practical thought leadership articles on AI and Automation delivered to your inbox

Loved what you read?

Get 10 practical thought leadership articles on AI and Automation delivered to your inbox