The insurance industry has traditionally been relatively slower in adopting newer, disruptive technology. However, the advent of Generative AI (Gen AI) is setting the stage for the industry by looking at new ways to handle the tasks of underwriting, selling, and servicing through digital channels. Given the pace at which we operate in an increasingly digitized world and the potential for cyber-attacks, establishing trust through digital mediums becomes paramount. In this article, we seek to examine how insurance companies can grow and retain their customer base while still trying to protect their privacy and provide the most relevant information.

A McKinsey survey of over 1300 business leaders and 3000 consumers indicates that growth and consumer expectations are largely achieved when there is trust established in products and experiences that leverage AI, digital technologies, and data. A benefit of organizations positioned to build digital trust is a likely annual growth rate of at least 10% on their top and bottom lines, as evidenced by the research.

1. Digital Trust: The catalyst for insurance innovation and growth

When it comes to human vs AI-powered interaction, we find that customers appear to have a higher degree of confidence in AI-powered products and services versus those that depend mostly on humans. This provides more confidence to customers that the companies they do business with protect their data.

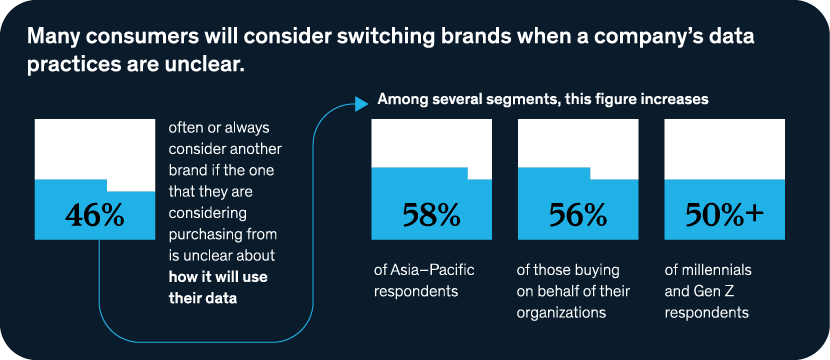

Extending this foundational principle of digital trust to the insurance industry, it becomes imperative for insurers to maintain an open line of communication with customers. This is typically achieved by having customers feel acknowledged, valued, and protected. Industry recognition is best achieved by a multitude of factors, including constant feedback, word-of-mouth recommendations, and an overall positive digital sentiment.

Digital trust: Why it matters for businesses | McKinsey.

2. Preserving Privacy in a Connected World: Your guide to digital security

We’re increasingly seeing instances of customers being inundated with various outreach mechanisms, such as online pop-ups, telemarketing calls, or other tactics like cyber phishing. This creates a situation where customers divulge personal information, and there is a growing risk of losing autonomy over their data each day.

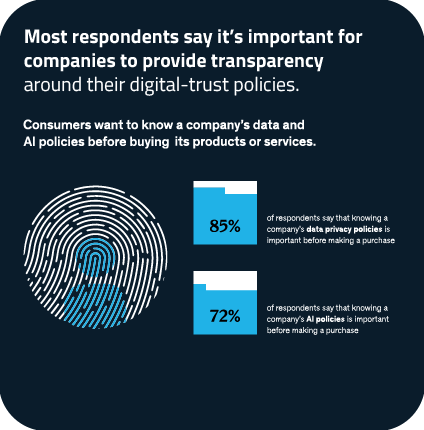

Given the nature of evolving and sensitive data privacy issues, Companies must demonstrate their support for the adoption of progressive and beneficial data privacy legislation by the publication of detailed research papers and reports in the public domain. This will go on to reassure customers that their data is being used for legitimate purposes and potentially thwart attempts by unwanted parties to gain access to valuable information.

Source: McKinsey

3. The Profound Impact of AI and Quantum Computing

The use of newer technologies and the rapid pace of adoption also bring with them new risks that need to be mitigated and managed. The combination of AI and Quantum Computing is posing unprecedented challenges in the way we look at cyber and privacy today. Quantum computing has the potential to not just magnify the current threats – together with AI; it has the potential to create an exponential increase in the frequency and severity of cyberattacks and breaches.

While these technologies are still in the early stages of adoption, insurance companies must think ahead and invest significantly in people and technology to take a lead position and develop quantum-safe algorithms to ensure data protection and arrest attacks and leaks in their footsteps.

The opportunity and the potential to transform insurance through Gen AI

Research from Bain & Company puts the size of the financial opportunity for the insurance industry from Gen AI to a staggering $50 billion, allowing for a combination of revenue boost and cost cuts. We look at four use cases briefly to help illustrate some of the potential benefits of Gen AI.

1. Underwriting and Risk Management

Insurance underwriting can be a very complex effort, involving several different algorithms and pricing strategies tied to the need for an accurate assessment of risks and the need to understand customer needs very intricately. Generative AI can help underwriters conquer these challenges by automating each stage of risk assessment and providing accurate information when needed.

As insurers begin to leverage nascent technology like Gen AI, there’s a need to adopt a stance of deploying a responsible AI strategy that continually learns and evolves from iterative cycles of use cases, testing, and learning on the go. The result: better-informed decision making, and more time to spend with customers.

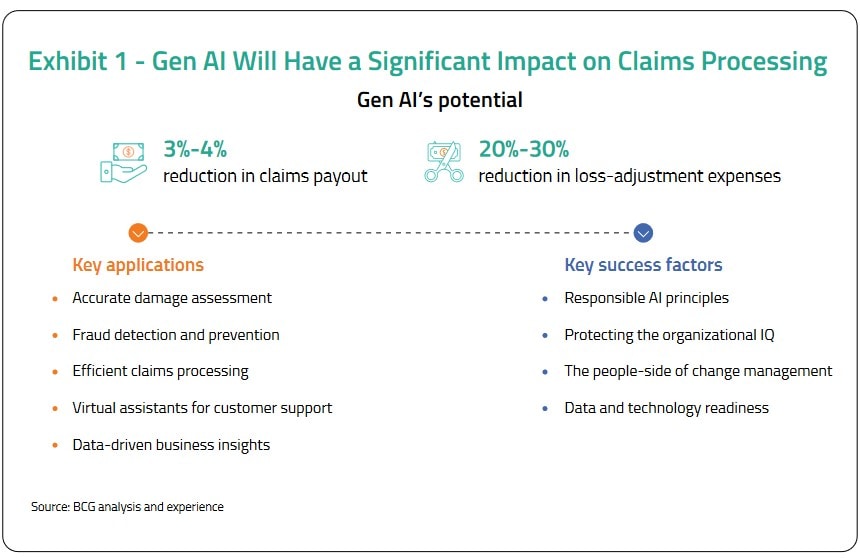

2. Claims Processing

Traditional claims processes have mostly been manual and people-driven. With Gen AI, these can be automated and accelerated – however, one needs to outweigh the benefits of greater efficiency and accuracy with the potential risks that come with deployment.

The wide-scale deployment of Gen AI may pose some risks and issues relating to data privacy and security. With the right deployment strategy and implementation, Gen AI could potentially create a game changer in the area of claims processing.

$50 billion opportunity emerges for insurers worldwide from generative AI’s potential to boost revenues and take out costs | Bain & Company

Insurance Claims Process is Changing due to Gen AI | BCG

3. Customer Experience

Gen AI is best being leveraged in the insurance industry to drive conversational interfaces; the technology is being used to improve the communication skills of chatbots and virtual agents.

- Gen AI-powered chatbots do more than just transactional interaction – they are better at conversation now and can help agents navigate and produce content faster. This will help answer more queries from customers, and the improvement can boost the support desk productivity by almost 40-60%.

- The chatbots can be available 24/7, ensuring agents can access assistance whenever they need it for service and sales support.

- Hyper-Personalization: The chatbots will be able to handle tailored conversations and provide contextualized offers more suited to individual customer needs.

Loved what you read?

Get practical thought leadership articles on AI and Automation delivered to your inbox

Loved what you read?

Get practical thought leadership articles on AI and Automation delivered to your inbox

4. Advanced Fraud Detective And Prevention (Anomaly Detection)

As is the case with any new technology, the use of gen AI may pose new fraud risks for insurers. Some of the risks include the possibility of hacking of devices and cameras, exploitation of software updates, hacking of various smart devices, etc., creating concerns around data privacy and security.

Insurers will need to improve their data security methods and tools to focus on these challenges. The development of a digital platform to detect, manage, and prevent fraud at the application and claims level could pave the way to shift to a smarter model when it comes to fraud.

In the case of advanced fraud detective and prevention, generative AI can identify unusual patterns, behaviors, claims, etc., and spot them ahead of time with behavioral analysis.

5. Riding the Waves of Change

It is the opportunity NOW for Insurance executives to plan and chart a course that can adapt with evolving technology. Gen AI is a hot boardroom topic today, and we must acknowledge that new models of Gen AI are being developed at breakneck speed. We need to find ways to amplify human potential by supporting global clients, unlocking values through the Gen AI platform, using cases relevant to the enterprise, and building the equation of trust through online interactions.

Disclaimer Any opinions, findings, and conclusions or recommendations expressed in this material are those of the author(s) and do not necessarily reflect the views of the respective institutions or funding agencies.