Loxon IFRS Provision Calculation Engine

A comprehensive solution for automatic calculation of impairment, Expected Credit Loss as per IFRS 9 regulations and country specifics, and the related risk (PD, LGD, etc.) and accounting (amortised cost, fair value, effective interest rate) figures.

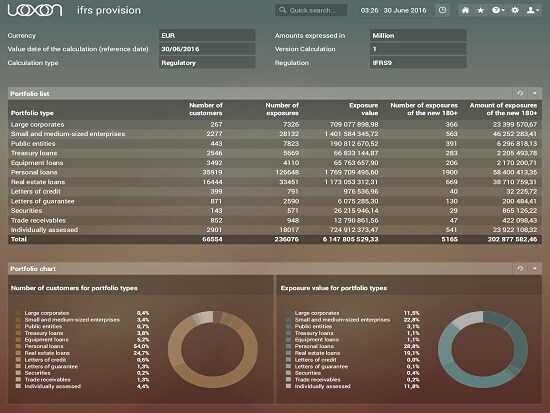

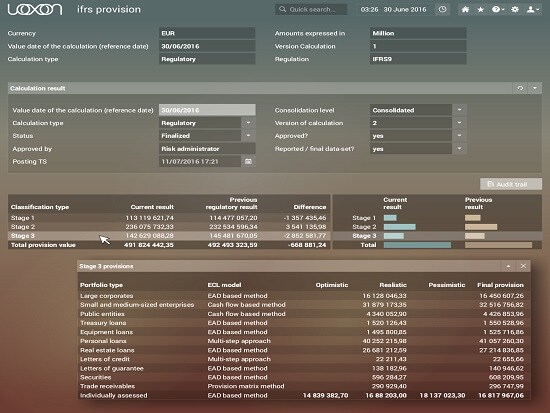

App Screens

Features

Full coverage of IFRS9 for conventional and Islamic banks

Covering the full IFRS9 accounting area, including SPPI test, IFRS 9 measurement & classification (Amortized cost, FVTPL, FVTOCI), Effective interest/profit rate (EIR/EPR), Amortized cost and Fair value calculation under IASB, AAOIFI and country regulations

Full coverage of IFRS 9 risk & provision requirements

Covering the full IFRS9 area, including IFRS 9 stage classification, 12-month and lifetime PD and LGD calculation, macroeconomic adjustment, provision calculation on single entity and on consolidated basis compliant with IASB, AAOIFI and country regulations

Comprehensive data management, reporting, disclosures

Comprehensive data management with end-to-end visualization. Wide range of reporting coverage, including built-in management, drill-down and analytical reports, trend analysis, IFRS 9 movement reports and coverage for IFRS 7 and IFRS 9 disclosures

Benefits

Perfect insight into the logic of the system and not a black box

Experience in risk management, IFRS implementations in EMEA

Calculate impairment using standard IFRS methodologies

Full control over your impairment calculation processes

Execute forecasts and simulations

Optimize Expected Credit Loss with state of the art methods

Reconcile all data with GL on granular and aggregate levels