Download case study

Digital-first World

Over the years, Bank Sohar has grown on various balance sheet parameters and has been among the most customer-centric banks in Oman. This has made it the fourth largest bank in Oman within a decade. However, maintaining this value proposition and enabling business growth in the digital age required the bank to reinvent itself as a digital organization.

Bank Sohar decided to upgrade to the latest version of Finacle Core Banking Solution to build a robust, scalable and flexible platform for its digital transformation. This has enabled it to deliver frictionless experience and innovative products to its digital-native customers.

When Bank Sohar first implemented Finacle during the launch of the bank, it created a record of sorts by completing the implementation in 56 days. This time was no different with the bank and Infosys Finacle team ensuring an equally smooth implementation.

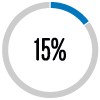

Increase in new customer acquisition

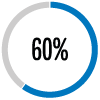

Reduction in Time to Market

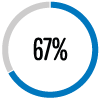

Functionality, ensuring seamless operations

Increase in average transactions processed per day

Increase in transaction peak load capacity

“We were looking to build a robust technology foundation in line with our vision to be the best digital bank in the region. We decided to upgrade to the latest version of Finacle Core Banking Solution as the solution would help us in accelerating our speed of innovation, provide extensive automation and help us deliver intuitive & inspiring customer experiences. Finacle has been a reliable partner over the years, and this time again, the team has helped us in ensuring a smooth technology transformation.”

Ahmed Al Musalmi

CEO, Bank Sohar

The Insight Edge

In the digital world, having access to actionable insights will be a key differentiator. Bank Sohar realized that implementing an advanced analytics solution will enable it to engage better with customers, generate new streams of revenue and remain profitable.

The bank was marred by manual data extraction and analysis which served as a major bottleneck in offering the right products and services to the customers at the right time.

With the new embedded analytics platform, Bank Sohar eliminated the manual process and has become more customer-centric with the ability to capture deeper consumer analytics.

Increase in alternate revenues and fees from up-sell, cross-sell opportunities

Right selling by capitalizing on behavior analytics of the customer data

Introduction of contemporary products and services as per various customer segments

Reduction in overall time taken across processes

Reduction in human resource utilization across effected processes

“Bank Sohar embarked on a journey to transform its technology in line with the bank’s vision and strategy to become a digitalized bank & one of the most valuable assets for a digital bank is analytics & insights. The ability to quickly capture and convert data into actionable insights will be key to success. Implementation of Finacle Analytics Solution empowers all our bank employees and management with the right insights to have more contextual engagements with our customers.”

Mujahid Said Al-Zadjali

Deputy General Manager – IT & Alternate Channels, Bank Sohar

For any further queries kindly reach out to Contact@edgeverve.com

For any further queries kindly reach out to Contact@edgeverve.com