TRANSFORM ASSET LIABILITY MANAGEMENT WITH FINACLE

Finacle Asset Liability Management is a comprehensive liquidity and interest rate risk management solution designed to deliver an enterprise-wide view of all on-balance sheet and off-balance sheet exposures, enabling banks and FIs manage their funding and liquidity decisions better.

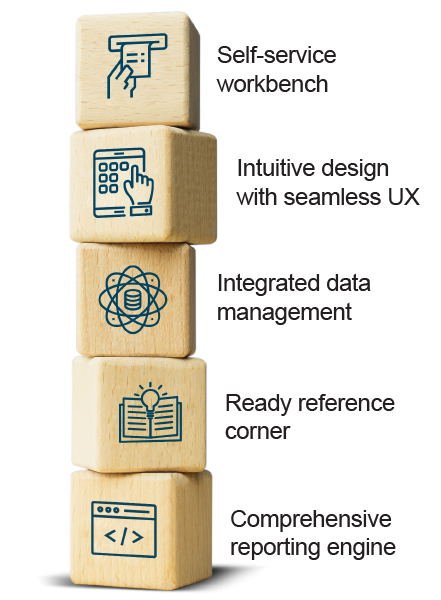

Built on an advanced architecture, the componentized solution with its robust functional capabilities, a self-service workbench, actionable insights and industry ready reporting engine, helps to elevate the asset liability management function in banks and FIs of all types and sizes, across regions and segments.

COMPREHENSIVE, INTEGRATED SOLUTION

Offers extensive capabilities to strengthen your asset liability management

ADVANCED ARCHITECTURE

Power your asset liability management with a

modern platform built for modularity, interoperability, and granularity

Cloud-ready

solution

Robust integration

capabilities

Integrated

data repository

Powerful

analytical models

Host

agnostic

“EdgeVerve’s Finacle Digital Banking Solution Suite supports retail, business, and corporate banking… The DBPP’s application architecture is state-of-the-art, supports a variety of application infrastructure stacks for on-premises deployments, and can run in the clouds of providers such as AWS, IBM, Microsoft Azure, and Oracle. The vendor’s cloud strategy goes beyond cloud based delivery models and also considers banking application ecosystems and platform-as-a-service plans, for example. Further strong points of the DBPP are its active ecosystem of system integrators and its support of APIs.”

– Forrester Wave™: Digital Banking Processing Platforms (Corporate Banking), Q3 2020

MANAGE REGULATORY AND INTERNAL GOVERNANCE REQUIREMENTS WITH AGILITY

With Finacle Asset Liability Management, banks get a robust platform to run agile ALM operations with speed and scale

DRIVE STRATEGIC MANAGEMENT

OF ASSETS AND LIABILITIES

Finacle offers a broad suite of capabilities to help banks go beyond basic compliance and reporting needs to meet the true strategic objectives of asset liability management.

Extensive stress testing capabilities supported

Interest rate stress test

Liquidity

stress test

Support for

back testing

Earnings at risk

& value at risk

BCBS recommended

stress scenarios

Economic value

of equity

ENHANCE RESILIENCE WITH

INTELLIGENT RISK MANAGEMENT

Finacle Asset Liability Management offers a wide array of intelligent risk management capabilities, helping banks strengthen their resilience to market volatility and economic turbulence

RELATED SOLUTIONS

Finacle Treasury

Finacle Treasury is a front-to-back, cross-asset, multi-entity enabled solution designed to accelerate treasury transformation journeys for universal banks, investment banks and asset

Finacle Corporate Banking Suite

Finacle Corporate Banking is a comprehensive solution suite built on an advanced architecture. The solution addresses the trade finance, lending, syndication, payments&#

Finacle Core Banking

The Finacle Core Banking solution provides banks a comprehensive set of capabilities, including flexible product factories, extensive parameterization, product bundling….

Ask for a Meeting

Thanks for your interest!

Our team will get in touch with you soon.