Simility

Simility provides an end-to-end adaptive fraud prevention platform that has the ability to take virtually unlimited structured data feeds from across the enterprise and use advanced machine learning and data visualization techniques to detect fraud.

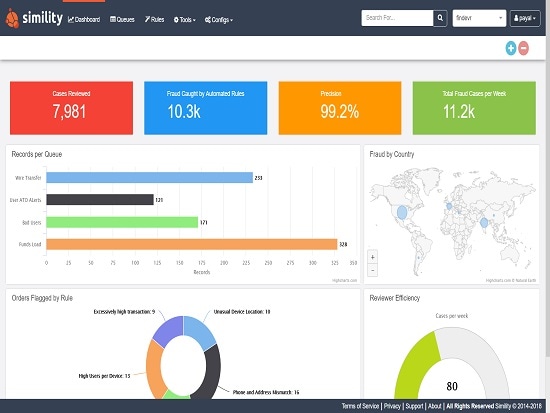

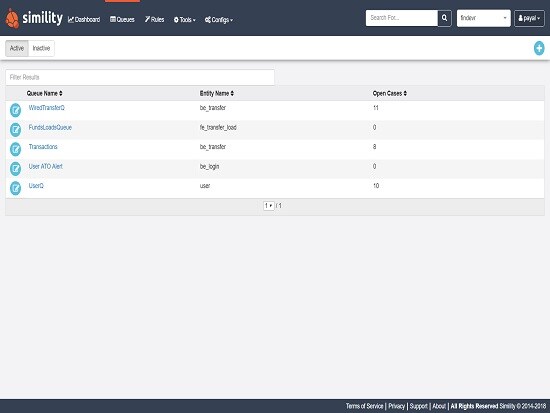

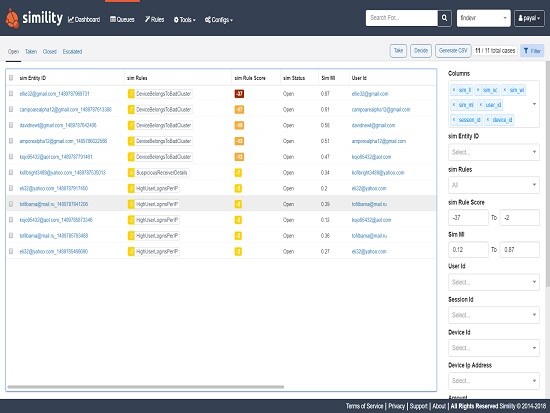

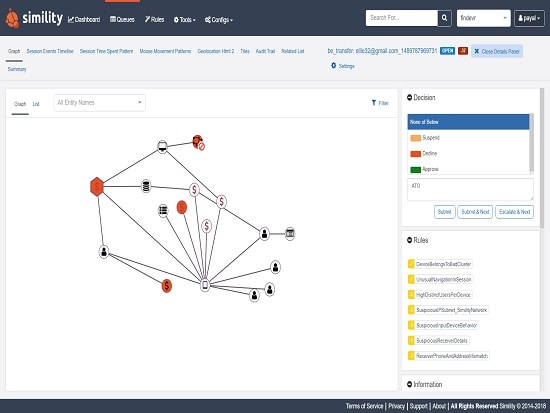

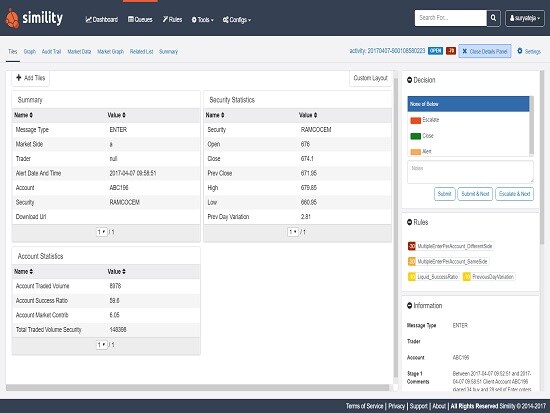

App Screens

Watch & Learn

Simility Adaptive Fraud Prevention Overview

Features

Device Fingerprinting & Behavioral Biometrics

Simility’s device fingerprinting technology predicts device risk based on attributes instead of a blacklist of devices. The behavioral biometrics correlates typing speeds, scrolling speed, preferred visit times, top cities, countries, devices, credit card numbers and nature of transactions for fraud prevention

Advanced Analytics & Machine Learning

The fraud detection technology is equipped with big data analytics to analyze huge data sets and identify specific fraud patterns or irregularities across customer and business data. The robust machine learning system can learn rapidly as frauds are tagged, constantly learning and self-calibrating as fraud trends change

Powerful Link Analysis with Intuitive Workbench

Simility combines behavioral biometrics and third-party feeds with machine learning, alongside rules-based fraud prevention to provide a precise, unified fraud decision interface. Sophisticated data visualization through the intuitive workbench helps to learn the telltale signs of fraud that are unique to each website

Benefits

Adaptive fraud prevention and risk management

Quickly adapt to changing fraud attacks by easily updating rules and ML models AND know impact of changes before adopting them

Easy to add any feed, within hours, without engineering

Fast response time and enterprise scalability

Deploy in days to weeks, not months to years

Intuitive UI

Designed from the beginning for a lower TCO